An Advance Beneficiary Notice of Noncoverage (ABN) is a liability waiver form that is given when a healthcare provider or medical supply company thinks or knows Medicare will not cover something. An ABN will explain: the goods or services that Medicare will not cover the estimated cost of each item and service that Medicare will not cover

Does Medicare require an ABN?

The key here is that Medicare typically covers the service. Items statutorily excluded from Medicare coverage (i.e., never covered) do not require issuance of an ABN because Medicare, like other carriers, expects its beneficiaries to understand the benefits and limitations of their particular plan.

What happens if a doctor does not have an ABN?

If the practice does not have a signed ABN from the patient and Medicare denies the service, the charge must be written off and the patient cannot be billed for it. The only exception is for statutorily excluded services (those that Medicare never covers like cosmetic surgery and complete physicals for example).

What is an ABN and why do I need one?

An ABN gives you the opportunity to accept or refuse the items or services and protects you from unexpected financial liability in cases where Medicare denies payment. It also offers you the right to appeal Medicare's decision.

What doesn't Medicare cover?

Medicare doesn't cover everything. Even if Medicare covers a service or item, you generally have to pay your Deductible , Coinsurance, and Copayment . Find out if Medicare covers a test, item, or service you need.

What does an ABN cover?

An ABN gives you the opportunity to accept or refuse the items or services and protects you from unexpected financial liability in cases where Medicare denies payment. It also offers you the right to appeal Medicare's decision.

What is the purpose of the ABN under Medicare?

This notice is called an “Advance Beneficiary Notice of Noncoverage” (ABN). The ABN lists the items or services that Medicare isn't expected to pay for, along with an estimate of the costs for the items and services and the reasons why Medicare may not pay.

Are ABNs used for Medicare Part D?

The ABN is given to beneficiaries enrolled in the Medicare Fee-For-Service (FFS) program. It is not used for items or services provided under the Medicare Advantage (MA) Program or for prescription drugs provided under the Medicare Prescription Drug Program (Part D).

When should an ABN not be issued?

If the provider does not have a reasonable belief that the service or item that is normally payable will be denied than an ABN is prohibited from being issued. Other circumstances were you are prohibited from issuing an ABN include: To make a beneficiary liable for Medically Unlikely Edit (MUE) denials.

What can I use an ABN for?

You can use an ABN to:identify your business to others when ordering and invoicing.avoid pay as you go (PAYG) tax on payments you get.claim goods and services tax (GST) credits.claim energy grants credits.get an Australian domain name.

Why is getting an ABN so important?

Why is using an Medicare Advance Beneficiary Notice of Noncoverage (The ABN) so important? An ABN is important because it allows a provider to administer a service to a Medicare patient that may not be covered by Medicare.

Are ABNs valid for Medicare Advantage plans?

ABNs aren't valid for Medicare Advantage members. Providers should be aware that an Advance Beneficiary Notice of Noncoverage (ABN) is not a valid form of denial notice for a Medicare Advantage member.

What is ABNs?

An Advance Beneficiary Notice (ABN), also known as a waiver of liability, is a notice a provider should give you before you receive a service if, based on Medicare coverage rules, your provider has reason to believe Medicare will not pay for the service.

Who uses the Advance beneficiary Notice of Non Coverage?

The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers (including independent laboratories, home health agencies, and hospices), physicians, practitioners, and suppliers to Original Medicare (fee for service - FFS) beneficiaries in situations where Medicare payment is expected to be ...

What is not a mandatory reason for issuing an ABN?

[14] Hospice providers are not required to issue an ABN unless they administer services billable to hospice, and (a) the beneficiary is not determined to be terminally ill, (b) separately billed specific items are not medically necessary, or (c) the level of hospice care for terminal illness and/or related conditions ...

What document must be provided to Medicare patients when Medicare is unlikely to cover a service?

What document must be provided to Medicare patients when Medicare is unlikely to cover a service? Must be given a copy of the Medicare Advance Beneficiary Notice (ABN).

Is ABN for Medicare Part A or B?

Medicare Advantage is offered by commercial insurance carriers, who receive compensation from the federal government, to provide all Part A and B benefits to enrollees. Therefore, an ABN is used for services rendered to Original Medicare FFS (Part A and Part B) enrollees.

What Is A Medicare Waiver/Advance Beneficiary Notice (ABN)?

An ABN is a written notice from Medicare (standard government form CMS-R-131), given to you before receiving certain items or services, notifying y...

If I Receive An ABN Form, What Are My Options?

You have the option to receive the items or services or to refuse them. In either case, you should choose one option on the form by checking the bo...

What If I Refuse to Sign An ABN, but I Want The Items Or Services Anyway?

If you refuse to sign, one of two actions will take place: 1. Mayo Clinic may decide not to provide the items or services. 2. A second person will...

When I Am Liable For Payment Because I Signed An ABN, How Much Can I Be charged?

When you sign an ABN and become liable for payment, you will have to pay for the item or service yourself, either out of pocket or by some other in...

Why Do I Routinely Receive An ABN For Certain Items Or Services?

Certain items or services that are covered by Medicare are only covered up to a certain number of times within a specified amount of time. Examples...

Do Abns Mean That Medicare Is Reducing Coverage?

No. ABNs do not operate to reduce coverage at all. Only if and when Medicare does deny the claim, do you become liable for paying personally for th...

Who Do I Contact If I Have More Questions About My Medicare Coverage?

For more information about your Medicare coverage, please contact Medicare directly: 1. Phone: 800-633-4227 (toll-free) 2. Website: www.medicare.go...

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What is an ABN waiver?

What is a Medicare waiver/Advance Beneficiary Notice (ABN)? An ABN is a written notice from Medicare (standard government form CMS-R-131), given to you before receiving certain items or services, notifying you: Medicare may deny payment for that specific procedure or treatment.

What to do if you choose not to receive Medicare?

If you choose NOT to receive the items or services: You must check "OPTION 2". Sign and date the form. Your claim will not be sent to Medicare. Although Medicare may not pay for your items or services, there may be good reasons for your physician recommending them. You should notify your doctor of your refusal.

What happens if you refuse to sign a contract with Mayo Clinic?

If you refuse to sign, one of two actions will take place: Mayo Clinic may decide not to provide the items or services. A second person will witness your refusal to sign the agreement, and you will receive the items or services.

What happens if Medicare denies you a claim?

The claim will be sent to Medicare. You may be billed while Medicare is making its decision. If Medicare does pay, you will be refunded any payments that are due to you. If Medicare denies payment, you will be personally responsible for full payment.

Do you have to pay for an ABN?

When you sign an ABN and become liable for payment, you will have to pay for the item or service yourself, either out of pocket or by some other insurance coverage that you may have in addition to Medicare. Medicare fee schedule amounts and balance billing limits do not apply.

Does Medicare apply to Mayo Clinic?

Medicare fee schedule amounts and balance billing limits do not apply. The amount of the bill is a matter between you and Mayo Clinic. If this is a concern for you, you may want to ask for a cost estimate before you sign the ABN.

Can Medicare deny payment?

Medicare may deny payment for that specific procedure or treatment. You will be personally responsible for full payment if Medicare denies payment. An ABN gives you the opportunity to accept or refuse the items or services and protects you from unexpected financial liability in cases where Medicare denies payment.

How long is a Medicare extended treatment notice valid?

A single notice for an extended course of treatment is only valid for 1 year. If the extended course of treatment continues after 1 year, issue a new notice.

How long does it take for Medicare to refund a claim?

Medicare considers refunds timely within 30 days after you get the Remittance Advice from Medicare or within 15 days after a determination on an appeal if you or the beneficiary file an appeal.

Is an ABN valid for Medicare?

An ABN is valid if beneficiaries understand the meaning of the notice. Where an exception applies, beneficiaries have no financial liability to a non-contract supplier furnishing an item included in the Competitive Bidding Program unless they sign an ABN indicating Medicare will not pay for the item because they got it from a non-contract supplier and they agree to accept financial liability.

Does Medicare cover frequency limits?

Some Medicare-covered services have frequency limits. Medicare only pays for a certain quantity of a specific item or service in each period for a diagnosis. If you believe an item or service may exceed frequency limits, issue the notice before furnishing the item or service to the beneficiary.

What is an ABN form?

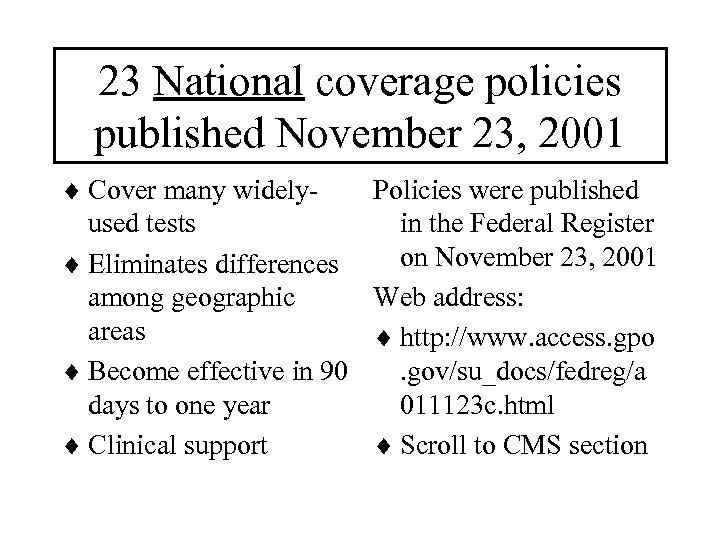

The Advance Beneficiary Notice of Non-coverage (ABN), Form CMS-R-131 helps Medicare Fee-For-Service (FFS) beneficiaries make informed decisions about items and services Medicare usually covers but may not cover because they are medically unnecessary. If Medicare denies coverage and the provider did not give the beneficiary an ABN, the provider or supplier may be financially liable.

How long is an ABN valid?

An ABN is valid if you: Use the most recent version of it. Use a single ABN for an extended course of treatment for no longer than 1 year. Complete the entire form.

What happens if a Medicaid beneficiary denies a claim?

If the beneficiary has full Medicaid coverage and Medicaid denies the claim (or will not pay because the provider does not participate in Medicaid), the ABN could allow the provider to shift financial liability to the beneficiary per Medicare policy, subject to any state laws that limit beneficiary liability.

What happens if Medicare denies coverage?

If Medicare denies coverage and the provider did not give the beneficiary an ABN, the provider or supplier may be financially liable. When Medicare coverage denial is expected, all health care providers and suppliers must issue an ABN in order to transfer financial liability to the beneficiary, including:

What is the meaning of "you" on an ABN?

On the ABN form, the term “you” refers to the beneficiary who signs the ABN. In the ABN interactive tutorial instructions, “you” refers to the provider issuing the form. If you reproduce the ABN form, remove the letters before issuing it to the beneficiary. Go to the ABN Interactive Tutorial. ABN FORM TUTORIAL.

What to do if a beneficiary refuses to sign an ABN?

If the beneficiary or the beneficiary’s representative refuses to choose an option or sign the ABN, you should annotate the original copy indicating the refusal to choose an option or sign the ABN. You may list any witnesses to the refusal, although Medicare does not require a witness.

Do you need an ABN for Medicare Advantage?

The beneficiary wants the item or service before Medicare gets the advance coverage determination. Do not use an ABN for items and services you furnish under Medicare Advantage (Part C) or the Medicare Prescription Drug Benefit (Part D). Medicare does not require you to notify the beneficiary before you furnish items or services ...

When Does Medicare Issue An Advance Beneficiary Notice?

The Centers of Medicare & Medicaid Services (CMS) issues advance beneficiary notices to make you aware when you may be personally responsible for paying for a medical service.

How Long Is an Advance Beneficiary Notice (ABN) in Effect?

An ABN remains in effect after valid delivery if there haven’t been any changes to the care described in the original notice and no changes to your health status that would require a change in the subsequent treatment for your non-covered condition.

What Should I Do If I Receive an Advance Beneficiary Notice?

If you receive an ABN, you have three options in terms of how you can respond.

Compare Medigap plans in your area

Lisa Eramo is an independent health care writer whose work appears in the Journal of the American Health Information Management Association, Healthcare Financial Management Association, For The Record Magazine, Medical Economics, Medscape and more.

What is an ABN for Medicare?

If a Medicare patient wishes to receive services that may not be considered medically reasonable and necessary, or you feel Medicare may deny the service for another reason, you should obtain the patient’s signature on an Advance Beneficiary Notice (ABN).

Why is it important to use ABNs?

It is important to code all services provided, even if you think Medicare will not cover the services. Medicare has strict rules when billing for covered and non-covered services on the same date.

What are non covered services?

Medicare Non-covered Services. There are two main categories of services which a physician may not be paid by Medicare: Services not deemed medically reasonable and necessary. Non-covered services. In some instances, Medicare rules allow a physician to bill the patient for services in these categories. Understanding these rules and how ...

When Medicare or another payer designates a service as “bundled,” does it make separate payment for the pieces of the

When Medicare or another payer designates a service as “bundled,” it does not make separate payment for the pieces of the bundled service and does not permit you to bill the patient for it since the payer considers payment to already be included in payment for another service that it does cover. Coordination of Benefits.

Is it reasonable to ask for a service from Medicare?

Medically Reasonable and Necessary. A patient may ask for a service that Medicare does not consider medically reasonable and necessary under the circumstances. For instance, the patient wants the service more frequently than Medicare allows or for a diagnosis that Medicare does not cover.

Do commercial insurance companies have similar coverage guidelines?

Commercial insurance companies and some Medicaid payers will have similar types of information about their coverage guidelines on their websites. Stay up-to-date on these policies for your local payers to ensure claims are processed as medically reasonable and necessary.

Can you bill for a non-covered medical visit?

For instance, in the case of a medically-necessary visit on the same occasion as a preventiv e medicine visit, you may bill for the non-covered (carved-out) preventive visit, but must subtract your charge for the covered service from your charge for the non-covered service.

Why do I not need an ABN for Medicare?

Items statutorily excluded from Medicare coverage (i.e., never covered) do not require issuance of an ABN because Medicare, like other carriers, expects its beneficiaries to understand the benefits and limitations of their particular plan. Examples of statutorily excluded services include: Long-term (custodial) care.

What to include in a Medicare ABN?

A. Notifier – Must include the name, address, and telephone number of the person at the practice issuing the ABN.#N#B. Patient’s name – It must be the patient’s name according to their Medicare card.#N#C. Identification (ID) number – The ID number used to link the claim with the patient, usually the patient’s medical record or account number. It cannot be the patient’s Medicare number or Social Security number.#N#D. Item, service, laboratory test, test, procedure, care, or equipment.#N#E. Reason Medicare may not pay – Include a patient-friendly description of why Medicare may not cover the service.#N#F. Estimated cost – Reasonable estimated cost of all the items and services listed in part D.#N#(see G below)#N#H. Additional information#N#Note: If the billing and notifying entities are not the same, the additional information section (H) should indicate who the patient should contact for questions.

What is blanket ABN?

This process is called issuing blanket ABNs, and may cause Medicare to invalidate all issued ABNs from the practice, including those that may have been appropriate. Practices that issue ABNs correctly have one thing in common: a process for identifying potential denied services prior to delivering them.

What is an ABN?

If your organization treats Medicare patients, the Advance Beneficiary Notice of Non-coverage (ABN) is worth every penny it could save your physicians. The ABN safeguards your right to collect on non-covered services (other than statutorily excluded services) from patients. With all the money ABNs help practices to recoup, ...

Why is acupuncture not covered by Medicare?

Acupuncture. Hearing aids and exams for fitting them. Routine foot care. The most common reasons Medicare denies a service ordinarily covered are: Service is deemed experimental, investigational, or considered “research only” in this case. Service is not indicated for the diagnosis and/or treatment in this case.

Does Medicare cover skin tag removal?

The patient’s request to remove it creates a Medicare coverage limitation because Medicare does not cover benign lesion removal (including skin tag removal) for purely cosmetic purposes.

Why does Medicare not cover ABN?

The typical reasons that Medicare will not cover certain services and that would be applicable are: Statutorily Excluded service/procedure (non-covered service) Frequency Limitations. Not Medically Necessary. Statutorily Excluded items are services that Medicare will never cover, such as (not a complete list):

What happens if a physician does not have an ABN?

If the practice does not have a signed ABN from the patient and Medicare denies the service, the charge must be written off and the patient cannot be billed for it. The only exception is for statutorily excluded services (those that Medicare never covers like cosmetic surgery and complete physicals for example).

What happens if a physician is denied Medicare?

The current ABN form with instructions can be found here. If a service is denied by Medicare and the physician does not have a signed ABN prior to the service being rendered, the service can not be billed to the patient and will need to be written off.

What is not medically necessary?

Services that are not considered Medically Necessary are those that do not have a covered diagnosis code based on Local Coverage Determinations (LCD). One example is for excision of a lesion. If the lesion is being removed because the patient just doesn’t like how it looks, that is considered cosmetic surgery.

How often do you need to have an ABN for a pap?

If the patient fits Medicare’s guidelines for “high risk” they are allowed to have the pap every 12 months and no ABN is required.

When to use ABN?

This is typically used when there is a secondary payer that requires the Medicare denial before they pay benefits. The use of the ABN is often misunderstood; however, it is the only way a patient can be informed about their financial responsibility prior to agreeing to a service being rendered.

Is an ABN required for Medicare?

A rule of thumb in trying to discern the necessity of ABNs is to ask yourself if there may be some times that the service isn’t covered by Medicare. The times the service isn’t covered, an ABN is required. To illustrate this point, here are two examples: EKGs are covered for certain cardiac and respiratory conditions.