What happens to the ACA subsidy when one person goes on Medicare?

Can you have Medicare and ACA at the same time?

Can only one spouse get Obamacare?

What happens to spouse when on Medicare?

Can I choose Obamacare instead of Medicare?

Can you keep Obamacare after age 65?

How does marriage affect ObamaCare?

What is considered income for ObamaCare subsidies 2021?

| Household size | 100% of Federal Poverty level (2021) | 400% of Federal Poverty Level (2021) |

|---|---|---|

| 1 | $12,880 | $51,520 |

| 2 | $17,420 | $69,680 |

| 3 | $21,960 | $87,840 |

| 4 | $26,500 | $106,000 |

Can a married couple have two health insurance?

Can my wife go on Medicare when I retire?

Is my spouse covered under my Medicare plan?

When can a spouse claim spousal benefits?

The premium changes can be counter-intuitive

Louise Norris has been a licensed health insurance agent since 2003 after graduating magna cum laude from Colorado State with a BS in psychology.

Changes in ACA Subsidies Can Be Confusing

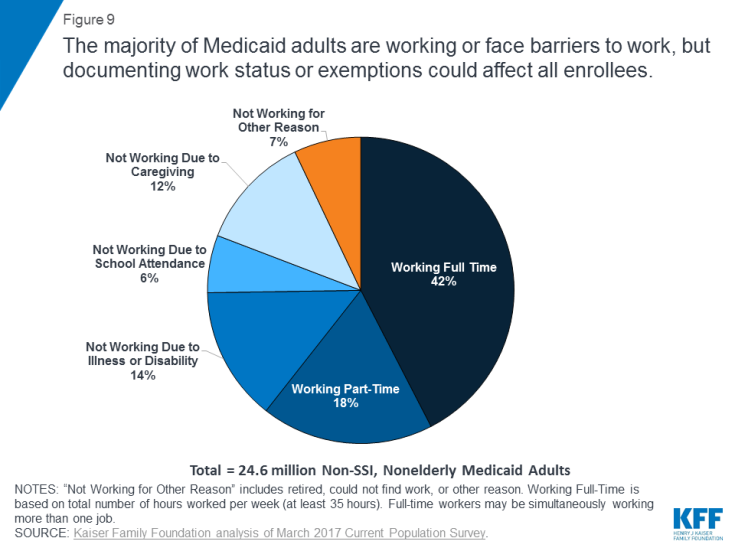

In some circumstances, the interaction between income, family size, and exchange enrollment creates results that can be counter-intuitive—things like a decrease in after-subsidy premiums when you add a new baby to the plan, or no change in after-subsidy premiums when one family member switches to other coverage, like Medicare.

Spouse Moving Onto Medicare

Javier and Pauline Gutierrez are 60 and 64, respectively. They both have coverage in the exchange under the benchmark plan in their area, and their household income is $50,000. Using the U.S. average costs, their subsidy in 2021 is $1,782 per month.

Adding Your Spouse to Your Plan

Amy is 51 and Bill is 53. Amy has had her own health insurance from her employer.

Adding a Child

In 2013, the federal government finalized rules for setting rates in the new ACA-compliant insurance market. The final rule states that for a single household, no more than three children under the age of 21 will be counted for the purpose of determining the family's premium. 6

Seek Help If You Have Questions

If you have questions about how your premiums will change based on various life changes, you can use a subsidy calculator, or reach out to the exchange in your state for help.

When do you have to apply for Medicare?

When you turn 65, you will have to apply for Medicare if you are eligible for it. “You have a seven-month period enrollment period — three months before the month you turn 65 to three months after the month,” he said. “Once your Medicare Part A coverage starts, you will no longer get premium credit through the ACA.

How much is the FPL for 2020?

The FPL amount varies depending on the size of your family, he said. “For example, for 2020 the FPL in most states for an individual is $12,760, while it is $17,240 for a family of two,” he said. “If your income is between 100% and 400% of the FPL, you will be eligible for the premium credit.”.

Is Medicare fully funded?

While Part A of Medicare, which covers hospital expenses, is fully funded by worker payroll taxes, the other parts of Medicare are not fully covered. In fact, taxpayers foot the bill for about 75 percent of Part B expenses and a hefty share of Part D drug expenses and Medicare Advantage plans as well.

How long does it take to get Medicare after a disability?

This normally takes at least two years after disability payments have begun. And being entitled to Medicare at any age because of a disability is normally a helpful benefit. However, Stuart did not have to accept Part B, and it appears he did not.

How many years do you have to work to get Social Security?

The exception is for older persons who do not qualify for premium-free Part A coverage. To qualify, they need to have worked at least 40 quarters (10 years) at jobs where they paid Social Security payroll taxes. Or they need to be married or have been married to someone who worked that many quarters.

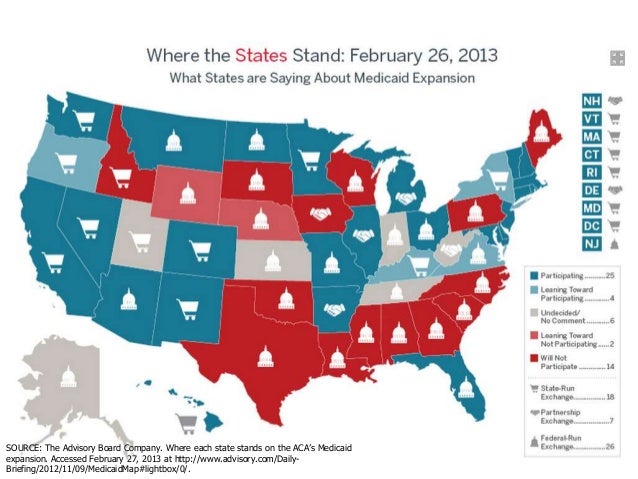

Is Kaiser Family Foundation biased?

Trying to get an impartial assessment of the issues is hard. The Kaiser Family Foundation certainly is biased to the extent it generally supports more health benefits for people. But its arguments are fact-based and very useful. (Source: Kaiser Family Foundation.)

What happens if you don't enroll in Medicare at 65?

Even worse, if you fail to enroll in Medicare at age 65 because you choose to keep your Obamacare plan instead, you will later owe a Part B late enrollment penalty that will stay with you for as long as you remain enrolled in Medicare. It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65).

How long do you have to wait to cancel ACA?

Don’t be tempted to gamble with your health by cancelling your ACA plan early. If you have more than a 63-day window between when your ACA plan ends and your Medicare begins, then when you enroll in a Medigap plan, they can impose a waiting period for pre-existing conditions.

Does Medicare cover spouse?

Medicare will only cover you, not your spouse or children if they are not eligible on their own. This is where problems begin, especially when a working spouse is older than a non-working spouse. Say the working spouse turns 65, retires, and claims Medicare. The other spouse is only 61.

How long do you have to work to qualify for Medicare?

First, it is important to know how eligibility for Medicare works. Most Medicare beneficiaries have worked and paid Medicare payroll taxes for at least 10 years to qualify for premium-free Medicare Part A as well as Part B coverage. If you have not worked for 10 years but your spouse has, you are allowed to claim benefits on their record. Medicare benefits cannot start earlier than when you turn 65, unless you are disabled, have ALS, or have end-stage renal disease. Medicare will only cover you, not your spouse or children if they are not eligible on their own.

What is Cobra insurance?

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, is a law that gives workers and families that lose employer health coverage the right to maintain the coverage by paying the full premiums. If a company has more than 20 employees, it is required to offer COBRA benefits. COBRA allows coverage for 18 months, sometimes longer, ...

How long does a spouse have to be on Cobra?

If a company has more than 20 employees, it is required to offer COBRA benefits. COBRA allows coverage for 18 months, sometimes longer, so if the working spouse can wait to retire until 18 months before the younger spouses 65th birthday, this would work out nicely.

How long does Cobra last?

If a company has more than 20 employees, it is required to offer COBRA benefits. COBRA allows coverage for 18 months, sometimes longer, so if the working spouse can wait to retire until 18 months before the younger spouses 65th birthday, this would work out nicely. One caveat to this is that the premiums are going to be much higher than ...

What is Obamacare subsidy?

A few more quick facts about Obamacare subsidies: The subsidies are tax credits, which means you can opt to pay full price for your coverage (purchased through the exchange in your state) each month, and then get your tax credit when you file your tax return.

Will the American Rescue Plan increase in 2021?

Enrollment has increased in 2021, and more people are eligible for subsidies now that the American Rescue Plan has temporarily eliminated the “subsidy cliff.”. Yet about two-thirds of uninsured Americans haven’t checked recently to see if they’re eligible for financial assistance with their health insurance costs.

What happens if you enroll in Medicare after the initial enrollment period?

Also, if you enroll in Medicare after your Initial Enrollment Period, you may have to pay a late enrollment penalty. It’s important to coordinate the date your Marketplace coverage ends with the effective date of your Medicare enrollment, to make sure you don’t have a break in coverage.

When do you sign up for Medicare?

For most people, this is 3 months before, the month of, and 3 months after their 65th birthday. It’s important to sign up for Medicare when you’re first eligible because once your Medicare Part A coverage starts, you’ll have to pay full price for a Marketplace plan.

Why is it important to sign up for Medicare?

It’s important to sign up for Medicare when you’re first eligible because once your Medicare Part A coverage starts, you’ll have to pay full price for a Marketplace plan. This means you’ll no longer be eligible to use any premium tax credit or help with costs you might have been getting with your Marketplace plan.

How long does it take to sign up for Medicare?

Once Medicare eligibility begins, you’ll have a 7 month Initial Enrollment Period to sign up. For most people, this is 3 months before, the month of, and 3 months after their 65th birthday. It’s important to sign up for Medicare when you’re first eligible because once your Medicare Part A coverage starts, you’ll have to pay full price ...

When does Medicare enrollment end?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday.

When does Medicare Part B start?

In addition, you can enroll in Medicare Part B (and Part A if you have to pay a premium for it) only during the Medicare general enrollment period (from January 1 to March 31 each year). Coverage doesn’t start until July of that year. This may create a gap in your coverage.

When does Medicare pay late enrollment penalty?

If you enroll in Medicare after your Initial Enrollment Period ends, you may have to pay a Part B late enrollment penalty for as long as you have Medicare. In addition, you can enroll in Medicare Part B (and Part A if you have to pay a premium for it) only during the Medicare general enrollment period (from January 1 to March 31 each year).