Full Answer

How much of the federal budget is spent on Medicare and health 2015?

20 percentMedicare spending, which represented 20 percent of national total health care spending in 2015, grew 4.5 percent to $646.2 billion, slightly slower than the 4.8 percent growth in 2014 even as the leading edge of the baby boom generation joined Medicare.

What was the cost of Medicare Part B in 2015?

$104.90 per monthHow much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums.

How much did the US spend on Medicare in 2016?

$672.1 billionMedicare spending, at $672.1 billion, accounted for 20.1 percent of total health spending and Medicaid spending, at $565.5 billion, made up 16.9 percent.

How much do Americans pay into Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

How much did Medicare cost in 2008?

$96.40The standard Medicare Part B monthly premium will be $96.40 in 2008, an increase of $2.90, or 3.1 percent, from the $93.50 Part B premium for 2007.

How much did the US spend on healthcare in 2019?

How much does the federal government spend on health care? The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1).

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

How much has Covid cost the US government?

How is total COVID-19 spending categorized?AgencyTotal Budgetary ResourcesTotal OutlaysDepartment of Labor$726,058,979,281$673,702,382,650Department of Health and Human Services$484,524,400,000$279,893,610,481Department of Education$308,328,604,971$127,408,234,7359 more rows

How much have I paid into Social Security so far?

Go to www.ssa.gov/mystatement/ and open an account with Social Security to view your statement. (You can no longer request a printed statement either using Form SSA 7004.)

Do Americans pay Medicare tax?

Almost every employee in the United States — whether they work for an American or foreign employer — pays Medicare taxes. All employers in the U.S. must also match the amount of Medicare taxes their employees pay — with certain limitations on additional Medicare taxes for high earners.

How much does the Affordable Care Act cost taxpayers?

According to the Joint Committee on Taxation, about 73 million taxpayers earning less than $200,000 will see their taxes rise as a result of various Obamacare provisions. The CBO originally estimated that Obamacare would cost $940 billion over ten years. That cost has now been increased to $1.683 trillion.

How much is Medicare Part B in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

How much is Medicare Advantage going up?

The average premium for a Medicare Advantage plan is going up by about 9.5%, to $33.90 per month (you’re still on the hook for Part B premiums). However, premiums will remain the same for about 61% of people if they elect to stay with the same Medicare Advantage plan.

How long can you open enrollment for Medicare Supplement?

Medicare supplement policies don’t have an annual open-enrollment period; you can buy them anytime. But you usually can be rejected or charged more because of your health if you get the policy more than six months after signing up for Medicare Part B.

How much was Medicare paid in 2015?

Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes. Of this amount, $211.9 billion came from wage income. The remaining $30 billion or so came from other sources that don't impact the average American, such as the 0.9% additional Medicare tax I mentioned earlier.

How many people paid Medicare taxes in 2015?

So, let's see how much the average American pays in Medicare taxes. According to the Bureau of Labor Statistics, there were about 137.9 million American workers in mid-2015, if you include part-time employees.

What is the Medicare tax rate?

Image source: Getty Images. On the other hand, the Medicare tax rate of 1.45% is assessed on all wage income. Employers pay an equal amount, for a total rate of 2.9%. And although it doesn't affect the average American worker, in the interest of being complete, there's an additional Medicare tax that high earners are required to pay.

How much is Medicare deficit?

According to the Medicare Trustees Report, the 75-year deficit is projected to be equivalent to 0.73% of taxable payroll. This means that by raising the current 2.9% Medicare tax rate to 3.63% (1.815% for employees), the program would maintain its solvency for at least another 75 years.

Is Medicare taxing in 2028?

However, there's a strong possibility that the Medicare tax rate will be increased in the not-too-distant future. It's no secret that Medicare isn' t in the best financial shape, and at the current rate, the program will be out of money in 2028.

Is Medicare based on income?

Of the three wage-based types of tax American workers pay, Medicare is perhaps the most straightforward and easy to calculate. Federal and state income taxes are based on a set of marginal tax brackets, and Social Security tax is only assessed on income below a certain threshold that changes annually.

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

What is Medicare inpatient?

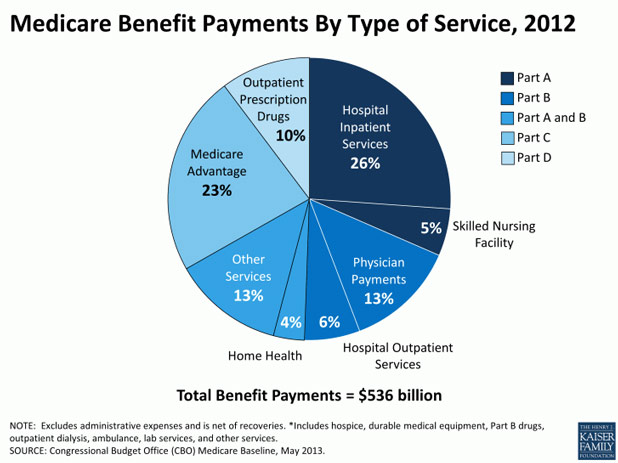

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

What percentage of Medicare enrollees are poor?

It is estimated that about 25 percent of Medicare enrollees are in fair/poor health. But there are lots of questions about who should pay for or help with elderly care long-term. In a recent survey of U.S. adults, about half of the respondents said that health insurance companies should pay for elderly care.

What is Medicare 2020?

Get in touch with us now. , Oct 9, 2020. Medicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2019, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year. As of 2018, California, Florida, and Texas had the largest number ...

Is Medicare a poor program?

Despite a majority of the Medicare enrollees being above the federal poverty line, there are still several programs in place to help cover the costs of healthcare for the elderly. Opinions on elderly care in the U.S. It is estimated that about 25 percent of Medicare enrollees are in fair/poor health.

How much does the government spend on Medicare?

The government currently spends more than $10,000 per Medicare beneficiary every year, with costs spiking in an enrollee's last years of life. "From the government’s perspective, they will spend, on average, nearly $450,000 for the new age 65 Medicare beneficiary during their expected lifetime," actuaries at the Health Care Cost Institute reported ...

How many people will be Medicare eligible by 2035?

The CBO projects that 80 million Americans will be Medicare-eligible by 2035, if current trends hold. Some analysts have a name for the wave of change that's coming — they call it the "silver tsunami.". And it has huge ramifications for the rest of our economy, and especially for the health care industry.

How long will Medicare enrollment continue?

That's a record surge in Medicare enrollment, and it's expected to continue for the next 15 years, as the Baby Boomers age into their golden years. It also means that the total number of Medicare beneficiaries is expected to double within the next twenty years.

How much has the number of home health jobs grown in the past decade?

In the past decade, the number of all U.S. jobs has grown by 6% — but the number of home health jobs has grown by 60%, as more aging Americans with chronic illness need support and care.