Who is eligible for Medicare?

You are typically eligible for Medicare when you turn 65 if you are a U.S. citizen or permanent legal resident. You can become eligible at a younge...

When are you eligible for Medicare?

You have a window to enroll in Medicare that begins three months before the month of your 65th birthday and ends three months after. You may be aut...

Does income affect eligibility for Medicare?

Income does not affect your eligibility for Medicare but may impact how much you pay for it. Your Part B premium, which is typically $170.10 in 202...

Is Medicare enrollment automatic at age 65?

Medicare enrollment is automatic only if you are already receiving Social Security benefits. If you have not received Social Security benefits, you...

Do I have to sign up for Medicare when I turn 65?

If you have health insurance through your or your spouse’s employer, you may not have to enroll in Medicare when you turn 65.If the employer has 20...

What happens if I miss my Medicare enrollment?

If you miss your initial or special enrollment periods, you can still enroll in Medicare during the next open enrollment period. But you may incur...

When will I get my Medicare card?

If you actively enroll, you will get your Medicare card about three weeks after you sign up. If you are already receiving Social Security benefits...

When is the Medicare open enrollment period?

The Medicare open enrollment period is Oct. 15 to Dec. 7 each year. You will be able to enroll in Medicare coverage during that time if you didn't...

How old do you have to be to get Medicare?

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

How long do you have to work to pay Medicare?

You or your spouse worked long enough (40 quarters or 10 years) while paying Medicare taxes. You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security. Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked.

What happens if you refuse Medicare Part B?

If you refuse it, you don’t lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll . You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

Do you pay Medicare Part B monthly?

Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked. Read more about the Part A and Part B premiums.

Who is Medicare eligible?

The simplest category of Medicare eligible individuals includes most senior citizens. Any individual 65 years of age or older who is a United States citizen and paid into the Medicare system through their payroll taxes is Medicare eligible. Married individuals who did not pay into the system through taxes are still eligible ...

How many seniors are eligible for Medicare?

The system provides insurance coverage to roughly 45 million Americans, 38 million of whom are senior citizens over the age of 65. Medicare eligibility is not restricted to senior citizens however; in fact not even all senior citizens are eligible for Medicare.

How long is the waiting period for Medicare?

Those who are receiving Social Security disability benefits due to an illness or disability are eligible to receive Medicare but there is a two year waiting period. The Medicare program provides eligible individuals with many benefits despite some drawbacks.

How many people are covered by Medicare?

The system provides insurance coverage to roughly 45 million Americans, 38 million of whom are senior citizens over the age of 65.

Who is eligible for Medicare if they are 65?

Individuals who are 65 years of age or older, but only paid into Medicare through taxes for less than 10 years, are still eligible for Medicare but must pay a monthly premium for Part A. Individuals in this group will pay less of a premium than those who never paid into the Medicare system. Certain groups of individuals born outside ...

Can an alien collect Medicare?

Certain groups of individuals born outside of the United States can be eligible for Medicare coverage. No illegal aliens are allowed to collect Medicare benefits. Those who are legal aliens in the United States and have lived in the country for at least five years continuously may be Medicare eligible but need to contact a local Medicare office for specific eligibility information as it can vary from person to person.

Is there a waiting period for Medicare for elderly?

Also, individuals who are suffering from Lou Gehrig’s Disease (also known as ALS) are eligible for Medicare coverage. For these individuals, there is no waiting period; they become Medicare eligible as soon as they are diagnosed with their disease.

How to qualify for Medicare premium free?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits. The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years. Most individuals pay the full FICA tax so the QCs they earn can be used to meet the requirements for both monthly Social Security benefits and premium-free Part A.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

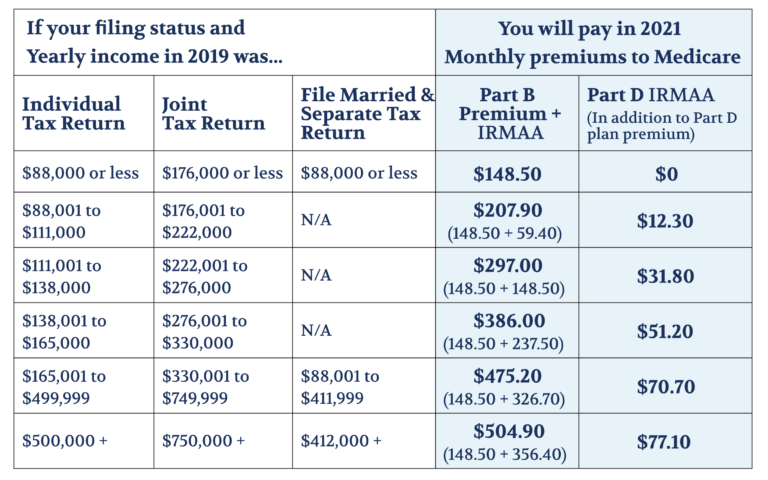

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

When do you have to apply for Medicare if you are already on Social Security?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B. People living in Puerto Rico who are eligible for automatic enrollment are only enrolled in premium-free Part A.

When does Medicare start if you have an IEP?

Coverage begins based on when you enroll during the IEP. If a person enrolls in the first 3 months of the IEP, coverage begins the first month the person is eligible for Medicare. If a person enrolls in any other month of the IEP, coverage will be delayed. Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months.

What age do you have to be to get Medicare?

The age of eligibility for full Social Security benefits is gradually increasing from 65 to 67, thus an increasing number of people will need to enroll in Medicare at age 65 without also registering for Social Security benefits. Here’s how to do it:

When does Medicare start?

Medicare eligibility for Social Security and Railroad Retirement beneficiaries begins on the first day of the first month in which the individual attains age 65. This is also the date upon which individuals not otherwise eligible for Medicare are entitled and may purchase coverage.

What happens if you don't enroll in Medicare?

There can be serious implication for individuals who fail to enroll in Medicare during their proper enrollment period. There is the surcharge of 10% per year assessed on the Part B premium for each year that an individual fails to enroll. What can be more serious, is that failure to enroll during the initial or special enrollment period will result in the individual not being allowed to enroll in Medicare Part B until the general enrollment period during the first three months of each year. Coverage for Part B benefits then would not begin until July of that year. As a result, there may be several months when an individual, having no Part B Medicare coverage, may be vulnerable to costly out-of-pocket medical expenses. It is important to note that an individual entitled to Social Security or Railroad Retirement benefits may enroll in Part A at any time and receive up to 6 months retroactive coverage without penalty. It is only Part B coverage which is subject to enrollment period restrictions and to a surcharge. An exception to this is those individuals not entitled to Part A coverage but who elect to pay the premium and participate voluntarily. They will be subject to the enrollment restrictions and the surcharge.

How long do you have to enroll in Medicare for railroad retirement?

Railroad Retirement beneficiaries should contact the Railroad Retirement Board to enroll. An individual may make application to enroll in Medicare three months prior to the first month in which they would be eligible for benefits and for three months after their first month of eligibility. This period is referred to as the “initial enrollment ...

How to appeal Medicare denied?

When a person’s enrollment rights have been prejudiced because of the action , inaction , misrepresentation or error on the part of the federal government she cannot be penalized or caused hardship. If an individual can demonstrate this to be the case, the decision to deny Medicare eligibility or coverage, or the imposition of a penalty surcharge, may be reversed. Appeals are handled by the local Social Security office. It is important if you feel you are being unfairly denied Medicare coverage that you insist on your right to an appeal.

How long does it take to get a Medicare card?

Four to six weeks after the receipt of your documentation, you will receive your Medicare card and handbook in the mail.

When do you get Medicare for a railroad disability?

Individuals receiving Social Security or Railroad Retirement disability benefits become eligible for Medicare coverage in the 25th month of receiving those benefits. Individuals who have end stage renal disease usually become eligible on the first day of the third month of a course of renal dialysis treatments.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What is covered by Medicare?

Coverage includes certain hospital, nursing home, home health, physician, and community-based services. The health care services do not have to be related to the individual’s disability in order to be covered.

How long can disabled people receive Medicare?

Even after the eight-and-one-half year period of extended Medicare coverage has ended, working individuals with disabilities can continue to receive benefits as long as the individual remains medically disabled. At this point the individual – who must be under age 65 – will have to pay the premium for Part A as well as the premium for Part B. The amount of the Part A premium will depend on the number of quarters of work in which the individual or his spouse have paid into Social Security. Individuals whose income is low, and who have resources under $4,000 ($6,000 for a couple), can get help with payment of these premiums under a state run buy-in program for Qualified Disabled and Working Individuals.

What are the requirements for Medicare for ESRD?

The requirements for Medicare eligibility for people with ESRD and ALS are: ALS – Immediately upon collecting Social Security Disability benefits. People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B.

How long do you have to wait to collect Medicare?

There is a five month waiting period after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits. People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare.

How long does SSDI last?

This new period of eligibility can continue for as long as 93 months after the trial work period has ended, for a total of eight-and-one-half years including the 9 month trial work period. During this time, though SSDI cash benefits may cease, the beneficiary pays no premium for the hospital insurance portion of Medicare (Part A). Premiums are due for the supplemental medical insurance portion (Part B). If the individual’s employer has more than 100 employees, it is required to offer health insurance to individuals and spouses with disabilities, and Medicare will be the secondary payer. For smaller employers who offer health insurance to persons with disabilities, Medicare will remain the primary payer.

How long does Medicare coverage last?

Medicare eligibility for working people with disabilities falls into three distinct time frames. The first is the trial work period, which extends for 9 months after a disabled individual obtains a job.

How long do you have to wait to collect Social Security?

There is a five month waiting period after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits. People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare.

Who is eligible for Medicare Part A?

Contractors. A spouse of a deceased, retired, or disabled individual who was or is eligible for Medicare benefits: Is eligible for Medicare coverage. Medicare Part A provides coverage for all of the following services EXCEPT: Inpatient physician services.

How old do you have to be to qualify for Medicare?

Individuals age 65 and older qualify for Medicare if they have paid FICA taxes for at least:

What is Medicare Advantage?

Medicare Advantage (MA) Medicare prescription drug coverage is offered through: Medicare Part D. The role of the Centers for Medicare and Medicaid Services (CMS) includes all of the following EXCEPT: Paying claims for Medicare.

How long does Medicare cover skilled nursing?

For each benefit period, a Medicare Part A beneficiary will receive coverage for how many days of skilled nursing care? 100 days.