Full Answer

Is anthem a Medicare plan?

Anthem offers varied Medicare Advantage plans, including HMOs, PPOs, and two Special Needs Plans (SNPs). All plans come with affordable premiums and extra services. If an Anthem plan is available in your area, you have access to at least one plan that includes drug coverage and at least one zero premium plan.

Which providers accept anthem Medicare plans?

- General doctors

- Specialists

- Dentists

- Hospitals

- Pharmacies and pharmacists

- Clinics

- Therapists

- Dialysis centers

- Durable medical equipment (DME) suppliers

- Rehabilitation facilities

Does anthem pay for treatment?

Treatment: Yes, effective April 1, 2020, through January 31, 2021, Anthem and its delegated entities waived cost shares for members undergoing treatment related to a COVID-19 diagnosis. Anthem will reimburse healthcare providers according to standard reimbursement rates, depending on provider participation and benefit plan, for fully insured, individual, Medicaid and Medicare members.

What states have Anthem Insurance?

- Anthem acquires Blue Cross Blue Shield of Maine.

- WellPoint Health Networks acquires Rush Prudential Health Plans of Illinois.

- WellPoint Health Networks acquires the Texas based mail service pharmacy fulfillment center of RxAmerica.

What is Anthem Part D?

Medicare Part D is a standalone health insurance plan from a private insurer like Anthem that provides outpatient prescription drug benefits that can save you money.

What is Medicare Part D?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

What items are covered under Medicare Part D?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Is Medicare Part D needed?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is not covered in Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.

What is the difference between Medicare Part B and Part D?

Medicare Part D pays for most at-home medications, while Medicare Part B generally pays for drugs that a person receives at a doctor's office, hospital, or infusion center. Part B also pays for additional services, such as doctor's visits and some medical procedures.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Are you automatically enrolled in Medicare Part D?

Enrollment in a Part D prescription drug plan is not automatic, and you still need to take steps to sign up for a plan if you want one. Part D late penalties could apply if you sign up too late. If you want a Medicare Advantage plan instead, you need to be proactive. Pay attention to the Medicare calendar.

What is the maximum out of pocket for Medicare Part D?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

Can I cancel my Part D plan anytime?

A. You can quit Part D during the annual open enrollment period (which is for enrolling and disenrolling) that runs from October 15 to December 7.

Are Medicare Part D Plans All The Same?

While prescription drug plans provide at least the standard level of coverage as it is defined by Medicare, they have the option to offer different combinations of coverage and cost sharing.

What Prescription Medications Are Covered?

Every Medicare Part D plan covers different types of medications. If you use prescription drugs to manage a health condition like high blood pressure or diabetes, make sure your plan covers the medications you need most.

What Medications Are Not Covered By Medicare Part D?

Medicare does not allow Part D insurers to cover certain types of drugs. These include:

Does A Medicare Part D Plan Have Any Restrictions On Coverage?

Check to see if a plan has certain restrictions on the medicines you need, such as prior authorization and step therapy. Prior authorization requires your doctor to get permission from the insurer to prescribe certain medications. Then, the drug will be covered if your insurer pre-approves the medicine.

What Is The Average Cost Of A Medicare Part D Plan?

Once you’ve found plans that cover the medications you use, compare the costs of those medicines. The price of prescription drugs often varies from plan to plan.

What Other Medicare Part D Costs Should You Know About?

Look at the copays, coinsurance, monthly premiums, and deductibles across different plans, in addition to ensuring your medications are covered. You may want the lowest annual cost not only for premiums, but also for your estimated annual out-of-pocket costs.

Will Your Medications Be Covered In The Donut Hole Coverage Gap?

Most drug plans currently have a coverage gap, also called a “donut hole.” It sets a temporary limit on what your plan will pay for medications.

Medicare Part D Premiums And Deductibles

Most Part D plans have deductibles, premiums and/or copays or coinsurance for which you are responsible. Each year, the government sets a maximum limit on annual deductibles.

Medicare Part D Copay And Coinsurance Options

Your copay is a set amount you pay for prescriptions when you pick them up at the pharmacy. Generic medications often cost less than brand-name prescription drugs, and you'll want that option in a Part D plan.

Drug Tiers And Medicare Part D Costs

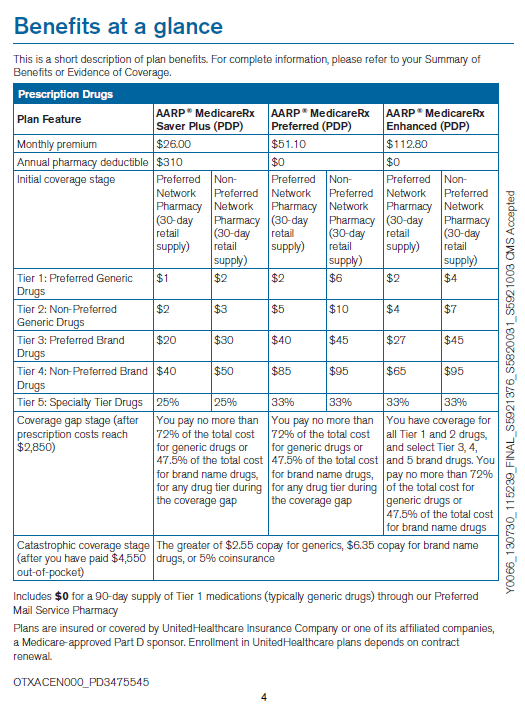

Every drug on a drug list is in a cost-sharing tier. What you pay for your prescription depends, in part, on which tier your drug is in. Your prescription may fall under different drug tiers depending on its availability in generic or brand form, as well as the associated cost. Each drug tier has a set copay or coinsurance cost.

What Is A Medicare Part D Coverage Gap (Donut Hole)?

Most drug plans currently have a coverage gap, also called a “donut hole.” It sets a temporary limit on what your plan will pay for medications. Check to see if your medications will still be covered during the coverage gap or if your Part D plan has added benefits in the gap. The Medicare Part D 2021 limit is $4,130.

Avoiding The Medicare Part D Penalty

If you don’t sign up for a Part D plan when you’re first eligible, or you’ve gone 63 days or more without creditable drug coverage after your IEP, you’ll pay a monthly late enrollment Medicare Part D penalty while you have Part D coverage. While the fee is typically only a few dollars each month, it can add up over time.

Getting Help With Medicare Part D Costs

Costs for Medicare Part D can vary, and for those who need help, there is assistance available. Extra Help is a federal program that helps with Medicare Part D costs. Depending on your financial situation, it can pay for some or all of your prescription drug coverage.

Other Ways To Pay For Medicare Part D Costs

When researching your Part D plans, look at everything you pay for Medicare. For example, you may find that a Medicare Advantage plan or Part C can help you save. Many Medicare Advantage plans include prescription drug coverage as well as other benefits that give you bundled savings.

What pharmacies accept Anthem prescription drug coverage?

There are over 68,000 pharmacies nationwide that are part of the Anthem network. 2

The benefits of Anthem Medicare Part D coverage

Original Medicare (Part A and Part B) doesn’t cover prescription medications. The out-of-pocket costs of paying for prescription drugs can be high, which can be daunting for the majority of older Americans who need prescription drugs.

Most Anthem Medicare Advantage Plans cover prescription drugs

Medicare Advantage plans – such as the plans available from Anthem – provide the same benefits as Original Medicare and (often) prescription drug coverage, combined into one convenient plan.

What is Medicare Part D?

As a California resident, you can save on medications with a Medicare Part D prescription drug plan (PDP) from Anthem Blue Cross. With copays as low as $1 at preferred pharmacies in our network, you can purchase a standalone PDP to enhance Original Medicare, which doesn’t cover prescription medications.

Medicare Part D Plan Options

Anthem offers Medicare Part D plans with excellent coverage and low or no deductibles.

Medicare Part D Costs

The cost of your Medicare prescription drug coverage can depend on your income and the type of plan you purchase. People with higher incomes may pay slightly more in premiums. The Medicare Part D coverage gap is another important factor in understanding your costs. Find out more in our detailed article on Medicare Part D costs.

Understanding Part D Drug Coverage

Here are some common terms you may run into when comparing Medicare Part D plans.

Medication Therapy Management (MTM)

The Medication Therapy Management program helps members with multiple health conditions understand and use their medications safely. The program is designed to help you and your doctor ensure the medications you take are working together to improve your health.

Attend a Free Medicare Event

Sign up for a free Medicare event to learn how Anthem Medicare plans help cover costs that Original Medicare doesn’t. You can attend a virtual Medicare webinar. Or, if you prefer, come to a live seminar in your area where a Medicare licensed agent will be present to answer your questions.

Who might want an Anthem Part D plan?

Kroger, Walmart, and Rite Aid customers: These preferred pharmacies offer Anthem’s lowest copayments.

Anthem Part D prescription drug plans

When we sampled Anthem’s Medicare Part D prescription drug coverage, we found the company offers three Part D plans. Many other companies offer three or more plans, so Anthem is right up there in terms of choices.

Anthem Part D sample plans

Input your drugs into Anthem’s drug formulary tool to find out which tiers they fall into.

Anthem Blue MedicareRx Standard (PDP)

In the location we sampled (Manchester, New Hampshire), this plan comes with a $400 deductible. For Tiers 2 through 5, you’ll need to pay the full $400 before your benefits kick in, whereas Tier 1 drugs are immediately covered. Once you reach the deductible, you could pay just $3 for a 30-day supply of Tier 2 prescriptions.

Anthem Blue Cross MedicareRx Plus (PDP)

This plan comes with a $0 deductible, so you’ll start saving on your prescriptions immediately. That's a relief for a lot of people, since it eliminates having to shell out more money for medications at the beginning of each year.

Anthem MediBlue Rx Enhanced (PDP)

Although the deductible for this plan is $300, it doesn't apply to Tier 1 and Tier 2 drugs. Once that deductible is met, Anthem covers a higher portion of Tier 3, 4, and 5 drugs than its two other plans. Additionally, out of the three plans we sampled, this one had the lowest premium by thirty dollars.

Bottom Line: High-rated plans, limited by location

Pay close attention to which tiers your medications fall in to save the most with Anthem.