How long do I need to keep records for Medicare?

Georgetown University 2005 AZ – Overview 1 1. OVERVIEW

How long should I Save my medical payment records?

How long do medical records, including radiographs, need to be maintained? | Arizona State Veterinary Medical Examining Board How long do medical records, including radiographs, need to be maintained? Medical records, including radiographs, need to be kept 3-years past the last date of service, even if the animal is deceased. Related Terms:

What medical records do you have to keep?

May 30, 2019 · One suggestion, storage space permitting, is to save medical payment records for three to six years as you would tax deduction records. That way, if you need to refer back to them, they are there. You also might keep these medical records if you claimed them as a deduction on your taxes. The records can also provide you with a medical history.

How long should I keep my tax records?

The Centers for Medicare & Medicaid Services (CMS) requires records of providers submitting cost reports to be retained in their original or legally reproduced form for a period of at least 5 years after the closure of the cost report. CMS requires Medicare managed care program providers to retain records for 10 years.

How long do medical records have to be kept in Arizona?

6 yearsHOW LONG DOES MY PROVIDER HAVE TO KEEP MY MEDICAL RECORD? Generally, Arizona law requires health care providers to keep the medical records of adult patients for at least 6 years after the last date the patient received medical care from that provider.

How long are Medicare records kept?

seven yearsOther requirements to retain records Doctors must keep all documents related to a claim under Medicare for at least two years from the date the service was provided. By keeping records for seven years you will also satisfy this requirement.Aug 13, 2019

How long does Arizona State require records of patients be kept before they are destroyed?

Arizona Adult patients 6 years after the last date of services from the provider. 6 years after the last date of services from the provider, or until patient reaches the age of 21 whichever is longer.

How long should Medicare claims be retained for?

Thus, Medicaid and Medicare providers are advised to maintain their records for a minimum of 10 years in order to avoid potential liability and ensure they can properly defend themselves against all False Claims Act whistleblower cases.

Should health information be kept indefinitely and why?

When hospitals retain information indefinitely, they run the risk of exposing personal health and other information over an extended period of time, she says. Hospitals must ensure they can maintain the integrity of the record over a potentially long period of time, Fox says.Jun 18, 2012

How long are medical records kept Australia?

7 yearsIf your doctor has retired or died For example, in the ACT, NSW and Victoria, privacy law requires a health service provider to keep records for 7 years or, in the case of a child, until the child turns 25.

How long do medical notes need to be kept for?

Minimum lengths of retention of hospital records 20 years or 8 years after the patient has died. 20 years after date of last contact between the patient and the mental health provider. Or 3 years after the death of the patient if sooner and the patient died while in the care of the organisation.Feb 24, 2022

How long should the medical records of minors be retained Why?

For example, a physician in California is only required by law to retain a minor's record until the patient reaches age nineteen (19). If the patient was age fourteen (14) at the date of the last treatment, they would reach the age at which their record is required by law to be retained after only five years.Dec 14, 2018

How long should medical records be retained quizlet?

According to federal and state laws, medical records should be kept at least two to seven years.

How long should you keep records?

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.Feb 25, 2022

Is there any reason to keep Medicare summary notices?

Medicare generally recommends that you keep notices for 1 to 3 years. It's extremely unusual that Medicare would follow up on anything older than that. In any case, Medicare ought to have copies of your records. Tax purposes are generally a good index for document retention.

What is the timely filing limit for Medicare secondary claims?

12 monthsQuestion: What is the filing limit for Medicare Secondary Payer (MSP) claims? Answer: The timely filing requirement for primary or secondary claims is one calendar year (12 months) from the date of service.Jan 4, 2021

How long do doctors keep patient records?

Holding On to Medical Records at Home. Most doctors keep patient records for about seven years. That is due to national standards, but laws often change by state. If you are covered by Medicare, your doctor might keep records for ten years. There are strict privacy laws regarding patient records.

How long do you keep medical bills?

They might also appear on your online insurance account. Keep the physical copies, and make duplicates if you need them. File these away for one year. You can keep them for a little longer if it gives you peace of mind.

How to keep track of medical bills?

Keeping Track of Medical Bills and Receipts at Home 1 Some costs, like the nurses and technicians, are included in the daily room rate. This might be applicable if you stayed in the hospital for a few weeks. Some attending doctors aren’t included in that rate, though. They will bill you separately because they aren’t employed by the hospital. 2 Keep all these individual bills for one year. If you receive duplicates—such as charges that are mentioned twice on different statements—toss those. 3 You might want to invest in a shredder. One of the main reasons that people save bills is out of concern, and don’t want to be caught without the documents they need. But experts recommend trashing them anyway. If someone breaks into your home, they can access information to commit identity fraud. In addition, if you don’t dispose of them properly, you’re putting yourself at a similar risk.

What happens if someone breaks into your home?

If someone breaks into your home, they can access information to commit identity fraud. In addition, if you don’t dispose of them properly, you’re putting yourself at a similar risk. If you’re still struggling to stay organized, here are some tips. Set up a time and date to review your files.

What happens if you switch jobs?

If you switch jobs, your primary doctor might change, too. This can happen even if your providers are within the insurance network. In general, you should keep a file of all your doctors’ contact information. If you only saw them for a common cold and a broken arm, it might not be strictly necessary.

How long do you need to keep medical records?

For instance, many states mandate that healthcare providers hold onto records from adult patients for seven years.

Why should you keep records longer?

Keeping records for longer than you should increases your risk for data breaches and HIPAA violations. However, getting rid of them too soon can make it harder to provide the best care. By following federal and state laws, you’ll improve your patient care and protect their data.

Why is it important to keep medical records?

Keeping them for the right length of time will prevent legal issues and help you access the information you need to help your patients.

Where should paper records be stored?

Paper records should be stored in a locked area that only staff can access. Electronic records are a bit trickier to store. Safeguards need to be put in place to protect data but allow staff access to essential information. You need a secure network to store and transmit your data.

Is JotForm HIPAA compliant?

JotForm offers HIPAA-compliant online forms. Whether you want to streamline your information gathering or increase your telehealth options, our forms can help you keep your patients’ medical records safe. This article is originally published on May 13, 2020, and updated on Jul 09, 2021.

Is medical information valuable?

However, this medical information isn’t just useful for healthcare employees. It’s also valuable to hackers. Holding onto medical records for longer than you need puts your patients’ data at risk. A medical record or data breach can lead to huge legal problems.

What is Medicaid in Arizona?

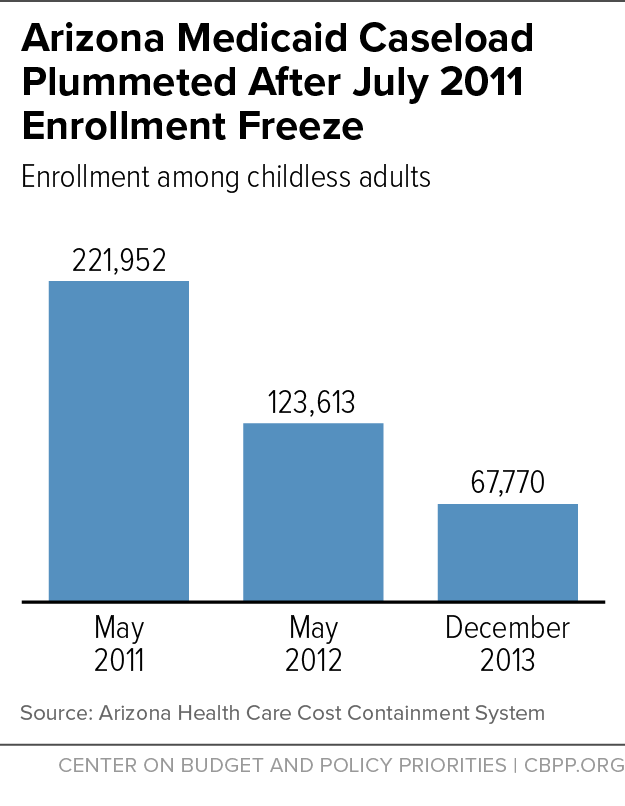

In Arizona, Medicaid is called the Arizona Health Care Cost Containment System (AHCCCS), and the program that provides long term care for the aged, blind, and disabled is called the Arizona Long Term Care System (ALTCS). Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages.

What is ALTCS in Arizona?

Arizona LTC Services (ALTCS) – This is an AZ general Medicaid program for those with long term care needs. The ALTCS program, sometimes called the Elderly and Physical Disability (EPD) program, will pay for nursing home care, but also for some care in beneficiaries’ homes, adult foster care homes, or in assisted living residences. 2.

What are countable assets?

Countable assets include cash, stocks, bonds, investments, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility purposes, there are many assets that are considered exempt (non-countable).

Can I get Medicaid for long term care?

In order to be eligible for long-term care Medicaid, an applicant must have a need for such care. For nursing home care, an applicant must require a nursing home level of care, and for home and community based services, an applicant must be at risk of institutionalization (i.e. nursing home).

Is Medicaid a federal or state program?

Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. However, this page is focused on Medicaid eligibility, specifically for Arizona residents, aged 65 and over, with a focus on long term care, whether that be at home, in a nursing home, or in an assisted living facility.

Keep until warranty expires or can no longer return or exchange

Sales Receipts (Unless needed for tax purposes and then keep for 3 years)

What to keep for 1 month

ATM Printouts (When you balance your checkbook each month throw out the ATM receipts)

What to keep for 1 year

Paycheck Stubs (You can get rid of once you have compared to your W2 & annual social security statement)

What to keep for 3 years

Income Tax Returns (Please keep in mind that you can be audited by the IRS for no reason up to three years after you filed a tax return. If you omit 25% of your gross income that goes up to 6 years and if you don't file a tax return at all, there is no statute of limitations.)