What age do people become eligible for Medicare benefits?

3 rows · Feb 15, 2022 · In many cases you cannot get Medicare at age 62 or younger. However, there are a few exceptions, ...

What is the earliest age you can get Medicare?

Key Takeaways The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in... These days, fewer people are automatically enrolled in Medicare at age 65 because they draw Social Security …

Will I be automatically enrolled in Medicare at 65?

Dec 21, 2021 · Key Takeaways Medicare is the U.S. national health insurance program for those 65 and older or with qualifying disabilities. You may be able to keep your private health insurance if you work past the age of 65, but conditions—such as making... Stay-at-home parents with no work history may still be ...

Will Congress lower Medicare age?

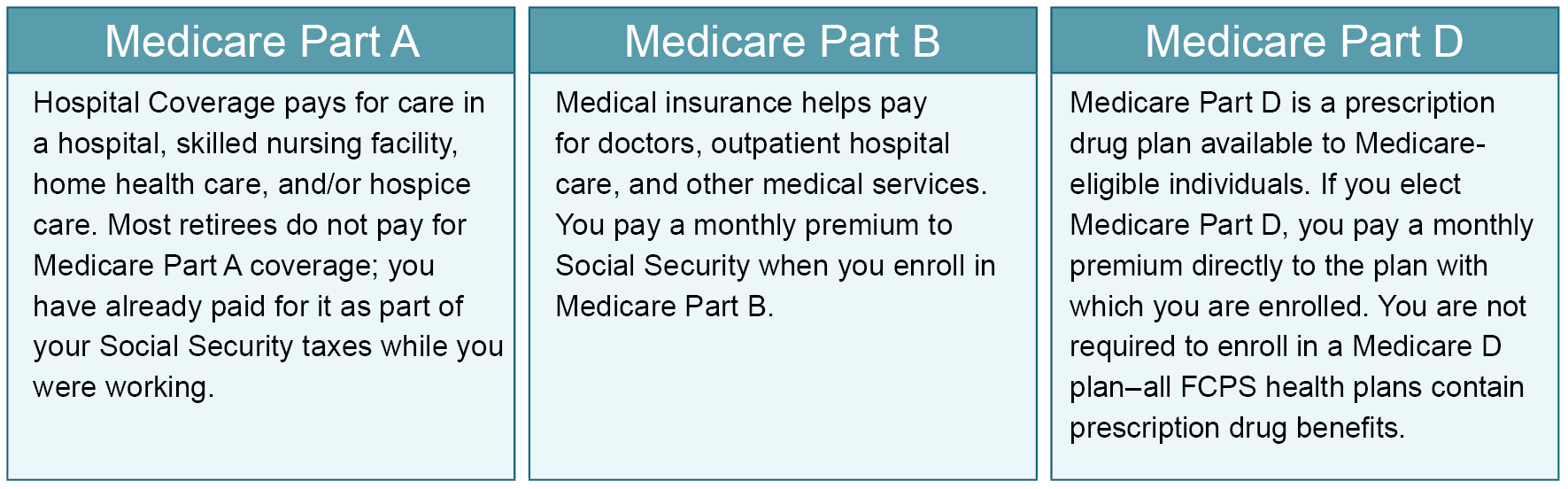

You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board. You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them. You or your spouse had Medicare-covered ...

Do you get Medicare at age 62?

Generally speaking, no. You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

What is the earliest age you can get Medicare?

age 65Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down.

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.Feb 15, 2022

Is Medicare age changing to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Is it better to take SS at 62 or 66?

There is no definitive answer to when you should collect Social Security benefits, and taking them as soon as you hit the early retirement age of 62 might be the best financial move.5 days ago

What is full retirement age?

Full retirement age is the age when you can start receiving your full retirement benefit amount. The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960, until it reaches 67.

How soon before you turn 65 should you apply for Social Security?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

How much Social Security will I get at the age of 65?

approximately $33,773 per yearIf you start collecting your benefits at age 65 you could receive approximately $33,773 per year or $2,814 per month. This is 44.7% of your final year's income of $75,629. This is only an estimate. Actual benefits depend on work history and the complete compensation rules used by Social Security.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

Key Takeaways

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Full Retirement Age by Year - What to Know

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

Can I get Medicare if I work past 65?

national health insurance program for those 65 and older or for those with qualifying disabilities. You may be able to keep your private health insurance if you work past the age of 65, but conditions—such as making Medicare your primary coverage— often apply.

Can I file for Medicare if I work beyond 65?

If you continue to work beyond age 65, things get a bit more complicated. 7 You will have to file for Medicare, but you may be able to keep your company’s health insurance policy as your primary insurer. Or, your company-sponsored insurance plan might force you to make Medicare primary, or other conditions may apply to you.

Can I get Medicare if I'm divorced?

If you’re divorced and don't qualify for Medicare under your own work record, you may qualify based on your ex-spouse's record as long as your marriage lasted at least ten years and you are currently single. 10.

Can I still get Medicare if I didn't withhold Social Security?

If you paid into a retirement system that didn’t withhold Social Security or Medicare premiums, you’re probably still eligible for Medicare— either through your retirement system or through your spouse.

Can I still get Medicare at 65?

You can still receive Medicare benefits at age 65 based on your spouse's work record. If your spouse has the required 40 credits and you’ve been married for at least one continuous year, you qualify for benefits. 89.

What is the eligibility age for Medicare?

What is the Medicare eligibility age? The eligibility age for Medicare is 65 years old for most people. This applies whether or not you’re still working at the time of your 65th birthday. The age when you retire does not factor into Medicare eligibility.

What age do you have to be to qualify for Medicare?

Medicare eligibility requirements. To qualify for Medicare under any circumstances, including reaching age 65 and those outlined above, you’ll need to meet the following eligibility requirements: U.S. citizenship. You must be a citizen, or you must have been a legal resident for a minimum of 5 years. Address. You must have a stable U.S. address.

How long do you have to be on Medicare to get Social Security?

Social Security disability. If you’re under age 65 and have been receiving Social Security disability benefits for 24 months, you qualify for Medicare. You can enroll in your 22nd month of receiving these benefits, and your coverage will begin in your 25th month of receiving them. If you’re entitled to monthly benefits based on an occupational ...

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes.

Requirements To Purchase Part B

Medicare Part B is also known as medical insurance. Part B helps to pay for the basic medical costs you have, such as doctor visits, preventive care and basic medical treatments. If you are a non-citizen, you can purchase Medicare Part B under specific conditions. You are required to be 65 years of age or older.

Medical Conditions And Disabilities

If you have certain disabilities, you may be eligible for premium-free Medicare Part A benefits even if youre under 65 years old.

What If I Have Non

If you have non-retiree health insurance through your or your spouseâs employer when you become eligible, youâll have to choose if you want to enroll in Medicare Parts A, B, and/or D. Ultimately, this decision depends on the type of health coverage you or your spouse currently have and the size of your or your spouseâs employer.

When Can Veterans Enroll In Medicare

Like other Americans, veterans become eligible for Medicare at age 65. The best time to sign up is during your initial enrollment period. That begins 3 months before the first day of your birthday month and lasts for 7 months.

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Medicare Other Insurance And How We Can Help

Did you know you can enroll in Medicare even if you have other kinds of insurance such as Medicaid, VA benefits, and employer-sponsored health insurance? That said, some of these types of insurance work better with Medicare than others. In some cases, they may affect your ability to enroll in Medicare.

Reasons You Can Lose Your Medicare Benefits

A few scenarios can cause a beneficiary to lose Medicare benefits. The way you became eligible for Original Medicare plays a major role in how benefits can be taken away. If any of the following apply to you, you could be at risk of losing your Medicare coverage.

Not Paying Your Monthly Premiums

It is essential to pay your Medicare premiums on time. If you don’t, you could potentially lose your Medicare benefits. For Medicare Part A (if you do not qualify to receive it premium-free) and Part B, beneficiaries receive two additional bills before their coverage is terminated.

SSDI Benefits Ending

If you receive Medicare benefits before age 65 due to Social Security Disability, your Medicare benefits may not last until you’re 65. SSDI is a federal program that assists Americans with disabilities. Individuals who stop receiving SSDI benefits can continue Medicare coverage for 93 months.

Your Medicare Plan Is Discontinued or You Move

If you relocate to a new address and have a Medicare Advantage or Medicare Part D plan, you could lose Medicare coverage. These plan types are available through private insurance companies and don’t provide the same coverage throughout the country.

Providing Misleading Information or Medicare Fraud

When applying for Medicare, you should never lie or attempt to mislead. Doing so can lead to the cancelation of your coverage, or in extreme cases, jail time. This can be something as small as intentionally answering a health question incorrectly on an application or as big as Medicare money laundering.

How Long Do Medicare Benefits Last?

For those under 65 who are eligible due to disability, Medicare benefits can last anywhere from one year to the rest of your life. The extent of your coverage depends on your situation. However, for those who age into Medicare at 65, benefits last a lifetime.

What age can you collect a $1000 survivor benefit?

Generally, if the person who died was receiving reduced benefits, we base the survivors benefit on that amount. Year of Birth 1. Full (survivors) Retirement Age 2. At age 62 a $1000 survivors benefit would be reduced to 3. Months between age 60 and full retirement age.

When can a widow receive Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month ...

What are the pros and cons of taking survivors benefits before retirement age?

Pros And Cons. There are disadvantages and advantages to taking survivors benefits before full retirement age. The advantage is that the survivor collects benefits for a longer period of time. The disadvantage is that the survivors benefit may be reduced.

How much is the 62 survivors benefit?

It includes examples of the age 62 survivors benefit based on an estimated monthly benefit of $1000 at full retirement age . If the worker started receiving retirement benefits before their full retirement age, we cannot pay the full retirement age benefit amount on their record. Generally, if the person who died was receiving reduced benefits, ...

Can you use the retirement estimate to determine the amount of a spouse's retirement benefits?

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker's yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.