How early should you sign up for Medicare?

If you’re under 65 years old, you might be eligible for Medicare:

- If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board (RRB) for at least 24 months in a row

- If you have amyotrophic lateral sclerosis (ALS, also called Lou Gehrig’s disease)

- If you have end-stage renal disease (ESRD). ...

What age can you start getting Medicare?

You qualify for full Medicare benefits under age 65 if:

- You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or

- You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or

- You have Lou Gehrig’s disease, also known as amyotrophic lateral sclerosis (ALS), which qualifies you immediately; or

When is the best time to sign up for Medicare?

Situations that don’t qualify for a Special Enrollment Period:

- Your COBRA coverage or retiree coverage ends. If you miss your 8-month window when you stopped working, you’ll have to wait until the next General Enrollment Period to sign up.

- You have or lose your Marketplace coverage.

- You have End-Stage Renal Disease (ESRD). Learn more about Medicare coverage for ESRD.

What is the last day to sign up for Medicare?

The annual open enrollment period for Medicare coverage ends today, Tuesday, Dec. 7. This means if you have not already signed up, or are already signed up and simply want to make changes, today is your last chance to do so. See: Retirement: Medicare Part B Will Rise 14.5% Next Year — More Than Double the Estimate

When should a person enroll in Medicare Part A?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you sign up for Medicare, stop your Marketplace coverage so it ends when your Medicare coverage starts.

Does Medicare Part A start automatically at age 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can I get Medicare Part A at 62?

The typical Medicare age requirement is 65, or younger if you qualify for disability benefits. In addition to meeting the age requirement of 65, you must also be a U.S. citizen or legal permanent resident before you are eligible for Medicare.

What part of Medicare is required at 65?

You should enroll in Part A and Part B when you turn 65. In this case, Medicare pays before your employer insurance. This means that Medicare is the primary payer for your health coverage.

Does Medicare Part A start automatically?

You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you're automatically enrolled, you'll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How do I retire at 62 with health insurance?

If you retire at 62, you'll need to make sure you can afford health insurance until age 65 when your Medicare benefits begin. 5 (If you have a disability, you can qualify early.) With the Affordable Care Act, you are guaranteed to get coverage even if you have a pre-existing condition.

Can I get AARP health insurance at 62?

Full AARP membership is available to anyone age 50 and over.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

What does Medicare Part A pay for?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift...

What if I’m Not Automatically Enrolled at 65?

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medic...

How Much Does Medicare Cost at Age 65?

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsu...

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and olde...

Can a 55-Year-Old Get Medicare?

While 65 has always been Medicare’s magic number, there are a few situations where the Medicare age limit doesn’t apply, and you may be able to get...

Key Takeaways

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Full Retirement Age by Year - What to Know

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

How old do you have to be to get Medicare?

Age is one of the ways to get Medicare but not the only requirement. The basic eligibility today is at age 65. That is the beginning, and the other parts are just as important to getting Medicare coverage. One must know whether the Medicare is Part A only; if costs is a consideration, then one needs to know whether it is premium-free ...

When is the best time to sign up for Medicare?

The Medicare eligibility by age begins at age 65 with a signup window that begins three months before the birthday month. The window closes three months after the Birthday month. This seven-month period is the above-described Initial Enrollment Period. It is the best time to sign-up for Medicare.

What is Medicare Part A?

Just the essentials... Medicare Part A is Hospital Insurance for older Americans. Eligibility on the basis of age comes at age 65. Some disabilities qualify for eligibility under age 65. Persons with ALS or End Stage Renal Disease are eligible at any age. The Medicare.gov website provides information and access to the online sign-up portals.

How much is Medicare Part A 2020?

In 2020, the Part A premium was $458 per month.

Why are prescription drugs important to Medicare?

Prescription drugs are a vital part f outpatient care. Doctors use powerful drugs to heal ad to control disease and other medical conditions. The costs of prescription drugs can make Medical care unattainable for millions of older Americans.

What are the two major features of Medicare eligibility?

Age and disability are the two major features of Medicare eligibility. These are the main factors that determine when one can get Medicare. They also determine the costs and other advantages such as late fees and timely coverage.

What is the premium for 40 covered quarters?

The full benefits of 40 covered quarters is that the Part A premium is zero ; this is the premium-free Medicare. By contrast, a person that has 30 covered quarters would have to pay $252.00 per month.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

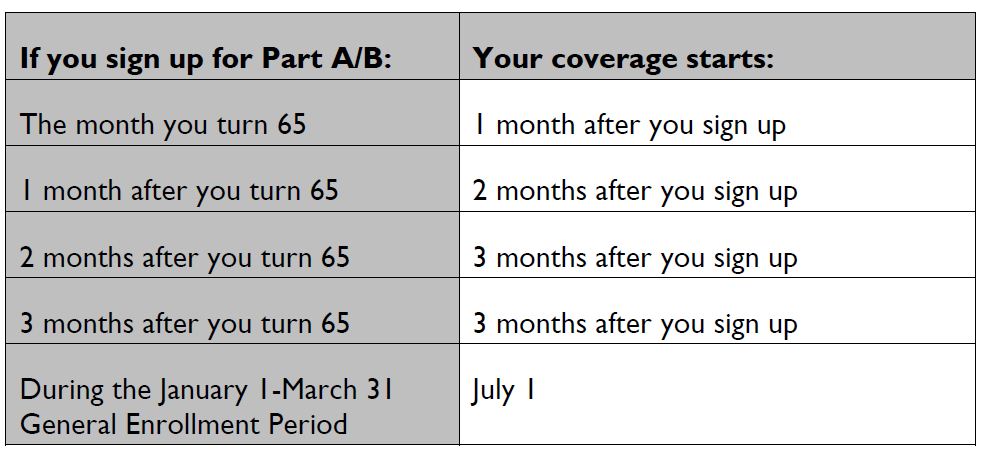

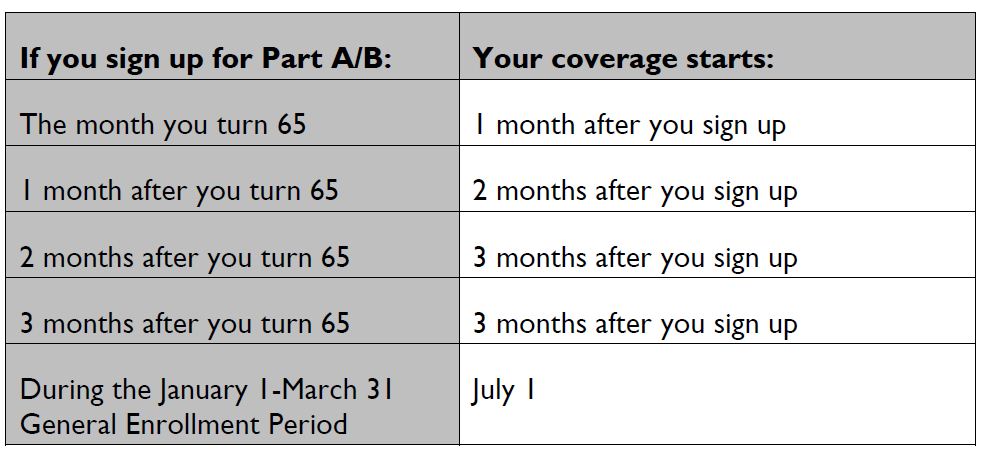

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.