Can I still enroll in Medicare Plan F?

People who became eligible for Medicare before 2020: You can still enroll in Plan F, even if you've never had this particular plan before. Or enter your zip code below to request a free Medicare quote. John is 73, and he has end-stage renal disease (ESRD).

What does plan F of Medicare cover?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion.

How do I get Medigap plan F coverage?

To get Part F or Plan F coverage, or any other kind of MedSup coverage, you have to go through an insurance company that is licensed in your state to sell these policies. Will Medigap Plan F cover both me and my spouse? MedSup policies cover only one person, so you and your spouse each have to buy your own Part F plan.

Can I buy Medicare Plan F for my spouse?

Covers one person: You can only buy a Medicare Supplement policy for yourself. Your spouse would have to buy his or her own policy to get Medicare Plan F coverage. No networks: You can use your Plan F or Plan F+ coverage nationwide at any provider that accepts Medicare.

Can you get Plan F in 2021?

Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of $2,370 for 2021 before the plan pays anything. This amount can go up each year. High-deductible policies have lower premiums, but if you need to use your benefits, you may have higher out-of-pocket costs.

Who qualifies for Medicare Plan F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

Can I enroll in a plan F?

Plan F is still available for people who were eligible for Medicare before January 1st, 2020. However, anyone who became eligible for Medicare on or after Jan 1, 2020 can no longer enroll in Plan F.

Is Plan F still available in 2022?

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Can I switch from plan N to plan F?

Medicare Supplement Plan N's coverage is very similar to Plan F's, and you can use your Plan N anywhere that you can use your Plan F.

Can I get Medicare Plan F in 2020?

As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

How much does AARP plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

What is the difference between Medigap plan F and plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is plan G cheaper than plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

What is the cost for Medicare Plan F in 2022?

The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year. Here is how the average estimated premiums of Plan F compare with that of other Medicare Supplement Insurance plans in 2022.

What does Medicare Supplement Plan F cover?

MedSup Plan F pays for 100% of the following: Medicare Part A deductible. Medicare Part B deductible. Part A coinsurance and hospital costs up to a...

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if the...

How does Medicare Part F compare to other MedSup plans?

The only way MedSup Plan F differs from Plan G is that Plan F pays your Medicare Part B deductible while Plan G does not. All other benefits are th...

What Does Medicare Supplement Plan F Pay For?

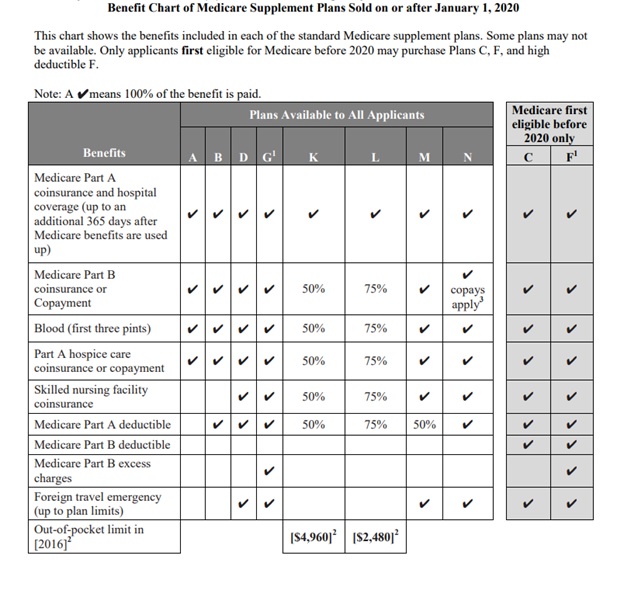

Medicare Supplement Plan F is the only plan that covers all Medicare Supplement insurance benefits . The following are the benefits available with Medicare Supplement plans. “Yes” means that Plan F covers 100% of this benefit.

How much does Medicare cover after 90 days?

Yes. If you’re admitted to the hospital for more than 90 days, you pay $682 in coinsurance for each “ lifetime reserve ” coverage day you have.

What is the high deductible plan for Medicare?

High-deductible Plan F: The high-deductible version of Medicare Plan F has a lower monthly premium and higher out-of-pocket expenses. You pay for Medicare-covered costs up to the $2,340 ($2,370 in 2021) before the plan begins to pay for anything.

What does "no" mean in Medicare Supplement?

Sections with “No” means the plan does not cover that benefit. You will notice that Plan C and Plan G are the most similar to Medicare Supplement Plan F in terms of the level of coverage available. The only differences are: Plan C does not cover Part B excess charge while Plan F covers at 100%.

How much is SNF coinsurance?

This benefit helps pay the coinsurance amount for days 21-100 of SNF care, which is $170.50 per day for each benefit period. The plan pays your Part A hospital insurance deductible, which is $1,364 in 2019 for each benefit period. This plan covers the annual Part B medical insurance deductible, which is $185 in 2019.

What is the 20% Medicare benefit?

This benefit helps pay your share of the cost for covered medical services, which is usually 20% of the Medicare-approved amount.

When will Medicare end?

Print October 28, 2020. New enrollment for Medicare Supplement Plan F for qualified individuals ended on December 31, 2019. But if you’re currently enrolled in Plan F, you have the opportunity to keep your plan or you can compare your options and change plans.

Who Can Enroll in Medicare Plan F?

To enroll in Plan F, you must first have Medicare Part A and Part B. You must also be eligible for Medicare prior to 2020.

What is a Medigap Plan F?

Medigap Plan F. Medigap Plan F is the most comprehensive Medigap plan, covering 100% of your cost-sharing. Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs, including deductibles, coinsurance, and copayments. However, it is not available to everyone who is eligible for Medicare.

How Much Does Medicare Plan F Cost in 2022?

The average cost of Medigap Plan F is around $130-$230 per month . There are many factors that impact the premium price.

Why is Medicare Plan F Being Discontinued?

Plan C and Plan F are no longer available to newer beneficiaries. CMS discontinued all first-dollar coverage plans.

What is the Difference Between Medicare Plan F and Plan G?

The only difference between Plan F and Plan G is that you’ll have to pay the Part B deductible. Yet, the lower premium with Plan G is often worth it.

What is a plan F?

Plan F is the Medigap plan that covers EVERY gap Medicare leaves the beneficiary to pay. Once enrolled in this policy, you’ll have $0 cost-sharing and will only be responsible for your monthly premium.

What factors affect Medicare Supplement premiums?

A major factor that influences your monthly Medicare Supplement premium rates is the plan you select. With more benefits come higher monthly premiums. Thus, since Plan F offers the most comprehensive benefits, premium prices tend to be higher.

Who should enroll in Medicare Plan F? Or why should someone enroll in Plan F?

If you would like to deal with as few out-of-pocket healthcare costs as possible while enrolled in Original Medicare, Plan F probably is the Medicare Supplement policy for you.

When can I enroll in a Medicare Supplement Plan F plan?

You should be able to buy a Part F plan whenever you want if you’re enrolled in Medicare Part A and Part B in some form or fashion. (In other words, a Medicare Advantage plan counts.) Or you should be able to buy it whenever you want as long as:

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage .

What does Medicare Supplement Plan F cover?

You’ve already heard a few times that Plan F offers more comprehensive coverage than any other Medicare Supplement policy. But what does that mean?

How does Medicare Part F compare to other MedSup plans?

So, let’s focus on how it compares to another popular Medicare Supplement policy, which some call Medicare Part G.

How does Medicare Plan F work?

The main thing you need to know about how this and all other Medicare Supplement plans work is that you have to be enrolled in Original Medicare, or Medicare Parts A and B, before Part F kicks in and starts filling your Medicare payment gaps.

How can I lower the costs associated with my Medicare Part F plan?

One way to lower what you pay for Medicare Supplement Part F is to move to an area where this kind of coverage costs less than it does where you live now.

How to enroll in Medicare Plan F?

To enroll in Medicare Plan F, a person must determine whether they are eligible and whether it is available in their area. They can use the Medicare Plan Finder or contact the State Health Insurance Assistance Program (SHIP) or State Insurance Department.

When will everyone be eligible for Medicare Plan F?

A person may not qualify for a Medigap policy after the Open Enrollment Period. Before January 1, 2020, everyone was eligible for Medicare Plan F.

How much does Medicare cost if you have worked for 10 years?

If a person has worked and paid Medicare taxes for between 7.5 and 10 years, the premium is $252 per month.

What is Medicare Plan F?

These can include deductibles, copayments, and coinsurance. Medicare Plan F is a Medigap policy. These policies help people pay some of the extra expenses of Medicare Part A and Part B. Together, Medicare Part A and Part B are called Original Medicare. Part A covers hospital expenses, and Part B covers other medical expenses.

Does Medicare plan F have the same benefits?

Private insurance companies offer the insurance plans. All Medicare Plan F plans offer the same benefits, but not all plans cost the same amount. Each insurance company can set its premiums and may provide more benefits. Not all insurance companies offer Medigap policies in every state.

Does Medicare Plan F cover Part B?

As Medicare Plan F covers the Medicare Part B deductible , it is not available to people who have only become eligible for Medicare after this date. In this article, learn more about Medicare Plan F, including who is eligible, what it covers, the costs, and how to enroll.

Is Medicare Plan F deductible higher?

If more benefits become added to the policy, its cost may be higher. Some states offer high deductible Medicare Plan F policies. People can use the Medicare Plan Finder to find the average cost of Medicare Plan F policies in their zip code.

When will Medigap Plan F be available?

As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

What is a Medigap Plan F?

Medigap Plan F is a comprehensive Medigap plan that helps cover your Medicare Part A and Part B deductibles, copayments, and coinsurance. Medigap Plan F is beneficial for low-income beneficiaries who require frequent medical care, or for anyone looking to pay as little out-of-pocket as possible for medical services.

How much is a Medigap Plan F deductible?

With this plan, you’ll owe an annual deductible of $2,370 before Medigap pays out, but the monthly premiums are usually much less expensive. High-deductible Medigap Plan F is a great option for people who prefer to pay the lowest monthly premium possible for this coverage.

What is a Plan F policy?

Plan F covers copays and coinsurance associated with Medicare parts A and B. If you have a Plan F policy, you won’t be responsible for these costs.

How long does it take to enroll in Medigap?

If you are planning to enroll in Medigap, there are certain enrollment periods that you should take note of: Medigap open enrollment runs 6 months from the month you turn 65 years old and enroll in Medicare Part B.

What are the different Medicare options?

The different Medicare options to cover your basic healthcare needs include Part A, Part B, Part C, and Part D.

Does Medigap have a yearly deductible?

Each Medigap plan has its own monthly premium. This cost will vary depending on the plan you choose and company you purchase your plan through. Yearly deductible. While Medigap Plan F itself does not have a yearly deductible, both Medicare Part A and Part B do. However, unlike some of the other options offered, ...

What is the difference between Medicare Supplement Plan G and Plan F?

It includes the same benefits as Plan F. The only difference is it doesn’t pay Part B deductibles .

Why is Plan F going away?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees. But even if you’re unable to get a plan ...

Why Get Medicare Supplement Insurance?

Original Medicare includes Part A for hospitalization and Part B for regular medical insurance. You’re eligible to enroll in both Part A and Part B starting three months before your 65th birthday. But even if you sign up for Original Medicare, this federal health insurance program doesn’t cover all medical expenses.

Which Medicare Supplement Plan is the most popular?

According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, it’s the most popular plan among those eligible for Medicare.

Does Medicare cover medical expenses?

But even if you sign up for Original Medicare, this federal health insurance program doesn’t cover all medical expenses. With Original Medicare, you’re still responsible for copayments, deductibles, and coinsurance.

Is Medicare going away?

Medicare Plan F is the most comprehensive Medicare Supplement plan, but starting in 2020 the plan will not be available to everyone en rolled in Original Medicare. By Valencia Higuera. Last Updated: July 8, 2020.

Why Is Plan F Not Taking New Enrollees?

Specifically, MACRA prevents insurance companies from offering plans that cover the Part B deductible to newly eligible beneficiaries after 2020.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G: Plan G has become increasingly popular for several reasons. First of all , it covers all of the gaps in Medicare that Plan F covers, with the sole exception of the annual Medicare Part B deductible ($198 in 2020). Medicare Supplement Plan N: Under Plan N, which tends to have lower monthly premiums than Plan G, ...

How much does Plan N cost?

Plan N will bill a $20 copay for office visits and a $50 copay for emergency room visits that don’t lead to hospital admission. Like Plan G, it does not cover the annual Medicare Part B deductible ($198 in 2020). This is a good replacement for high-deductible Plan F.

Can you switch Medigap plans without medical underwriting?

Note, also, that some states will allow you to switch Medigap plans without medical underwriting.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

Is Plan C available for 2020?

Plan C is not available to new Medicare enrollees as of January 1, 2020. You may still be eligible to enroll if you were eligible before 2020, but did not join a plan. If you already have Plan C, you can keep your plan.

Is Plan G a comprehensive plan?

In that case, you may want to consider joining Plan G. It’s a comprehensive plan, covering many of the costs associated with Original Medicare. Original Medicare is a fee-for- service health insurance program available to Americans aged 65 and older and some individuals with disabilities.