How much will Medicare spending increase by 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

What will Medicare spending look like in 2051?

In fact, Medicare spending is projected to rise from 4 percent of GDP in 2020 (payments were boosted in 2020 because of programs to accelerate and advance payments to providers during the pandemic) to about 6 percent of GDP by 2051.

How much will Medicare benefit from payroll tax revenue in 2026?

The actuaries estimate that Medicare will be able to cover 89 percent of Part A costs from payroll tax revenue in 2026.

What percentage of the US population is covered by Medicare?

In 2019, Medicare provided benefits to 19 percent of the population. 2 Medicare spending is a major driver of long-term federal spending and is projected to double from 3 percent of GDP in fiscal year 2019 to 6 percent in fiscal year 2049 due to the retirement of the baby-boom generation and the rapid growth of per capita healthcare costs.

What percentage of GDP goes to Medicare?

Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

Does Medicare affect GDP?

Total spending for Medicare is projected to increase to 8 percent of GDP by 2035 and to 15 percent by 2080. Total spending for Medicaid is projected to increase to 5 percent of GDP by 2035 and to 7 percent by 2080.

What percentage of GDP is healthcare 2021?

18.5 percentFor all of 2021, healthcare spending accounted for 18.5 percent of gross domestic product (GDP) including federal expenditures, and would have accounted for 18.1 percent, excluding federal support.

What percentage is Medicare of the federal budget?

12 percentMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How does Medicare affect the economy?

In addition to financing crucial health care services for millions of Americans, Medicare benefits the broader economy. The funds disbursed by the program support the employment of millions of workers, and the salaries paid to those workers generate billions of dollars of tax revenue.

How does Medicare Effect economy?

Medicare for All could decrease inefficient “job lock” and boost small business creation and voluntary self-employment. Making health insurance universal and delinked from employment widens the range of economic options for workers and leads to better matches between workers' skills and interests and their jobs.

How much GDP does the US spend on healthcare?

19%In 2020, the U.S. spent 19% of its GDP on health consumption (up from 17% in 2019), whereas the next-highest comparable country (the United Kingdom) devoted 13% of its GDP to health spending (up from 10% in 2019).

What percent of hospital revenue is from Medicare?

The percentage of the total payor mix from private/self-pay increased from 66.5% in 2018 to 67.4% in 2020. The Medicare percentage decreased from 21.8% to 20.5%.

How much is the healthcare industry worth 2021?

US$2709.9 billionThe health care industry in the U.S. places priority in the areas of medical technology, research, and innovation. In 2021, the estimated industry revenue of the industry was US$2709.9 billion.

What is the projected percentage of the GDP that will be spent on federal health programs in 2029?

20.1 percentDemographics, Health Costs Drive Modest Rise in Total Program Spending. Federal program spending is expected to rise from 19.0 percent of GDP in 2019 to 20.1 percent in 2029.

What are the 5 largest federal expenses?

Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

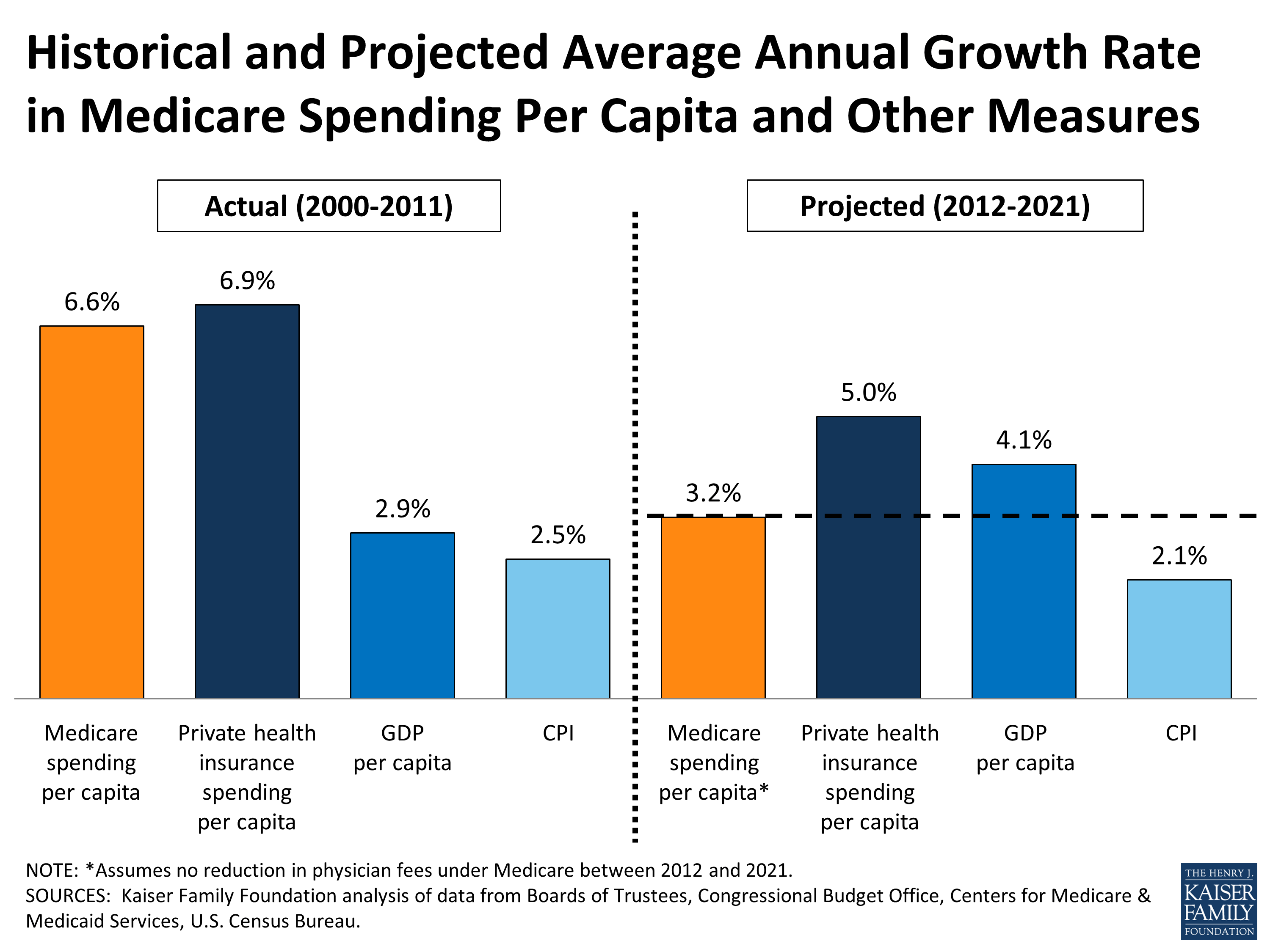

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

When will Medicare be depleted?

In the 2019 Medicare Trustees report, the actuaries projected that the Part A trust fund will be depleted in 2026, the same year as their 2018 projection and three years earlier than their 2017 projection (Figure 8).

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

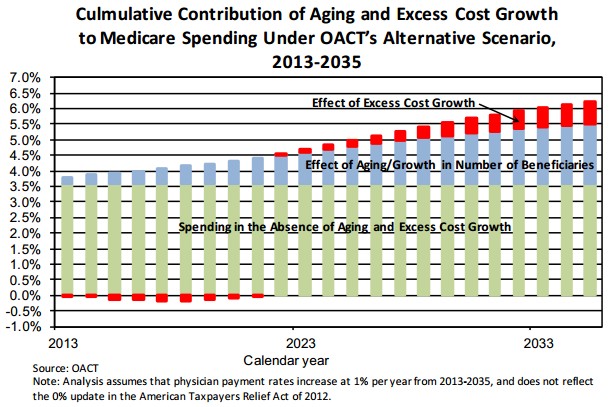

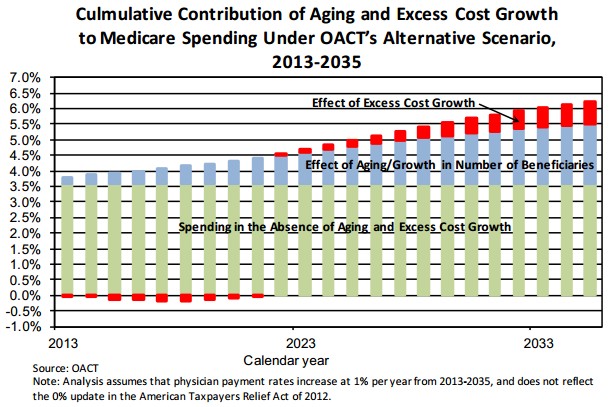

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

Why is telehealth important?

Almost overnight, telehealth became more of a necessity than a luxury , as a way to minimize potential exposure to COVID-19, ensure patient access to care and allow providers a pathway to recoup valuable revenue from flatlining in-person visits.

How much will Medicare cost in 2040?

Total Medicare spending is expected to balloon to 5.9% of the GDP by 2040, and 6.5% by 2094, according to the Medicare Board of Trustees. The program, which covers roughly 62 million Americans, is currently at 3.9% of the GDP, spending $796 billion last year.

Will Medicare run out?

To date, lawmakers have not allowed the Medicare Part A trust fund to run out, and since it's hard to project healthcare cost growth, these projections aren't set in stone. But if reality follows the board's estimates, it will significantly strain the economy, Medicare beneficiaries and the federal budget.

What percentage of GDP will Medicare be in 2035?

Total spending for Medicare is projected to increase to 8 percent of GDP by 2035 and to 15 percent by 2080. Total spending for Medicaid is projected to increase to 5 percent of GDP by 2035 and to 7 percent by 2080. Overview of the U.S. Health Care System. A combination of private and public sources finances health care in the United States.

What percentage of the federal budget will be spent on Medicare and Medicaid in 2035?

As a share of GDP, federal spending for Medicare and Medicaid will grow from 5 percent in 2009 to 10 percent in 2035 and to 17 percent in 2080.

What percentage of GDP was spent on health care in 2007?

1. National health expenditures in 2007 totaled 16.2 percent of GDP. However, the concept of “total spending for health care” used in this report comprises spending for health services and supplies as defined in the national health expenditure accounts maintained by the Centers for Medicare and Medicaid Services.

What was the total amount of Medicaid spending in 2008?

In fiscal year 2008, those offsetting receipts from premiums and states’ payments equaled 0.5 percent of GDP.) Between fiscal years 1975 and 2008, total spending for Medicaid, including spending by the states, increased from 0.8 percent of GDP to 2.5 percent .

What is the long term outlook for Medicare?

The Long-Term Outlook for Medicare, Medicaid, and Total Health Care Spending. Spending for health care in the United States has been growing faster than the economy for many years, posing a challenge not only for the federal government’s two major health insurance programs, Medicare and Medicaid, but also for the private sector.

How many people are covered by Medicare?

Overview of the Medicare Program. Medicare provides federal health insurance for 45 million people who are elderly or disabled (the elderly make up about 85 percent of enrollees) or who have end-stage renal disease or amyotrophic lateral sclerosis (also known as Lou Gehrig’s disease).

When did Medicare start paying for admissions?

Most notably, in 1983 , Medicare implemented a prospective payment system under which hospitals are paid a predetermined rate for each admission, an approach that has reduced some of the program’s costs. Long-Term Projections of Spending for Medicare and Medicaid.

How many people will be uninsured by the repeal of the Affordable Care Act?

That repeal is projected to result in a net increase in the number of uninsured Americans by 1.3 million, to 31.2 million in 2019.

How much healthcare is expected to be in 2019?

Still, 90.6% of Americans are expected to have coverage in 2019, down from 90.9% last year. Overall price inflation for healthcare goods and services is expected to average 2.5% over the next decade, compared with 1.1% for 2014 to 2017.

Why is the 2018 Medicaid spending rate lowered?

Sean Keehan, one of the authors, said the 2018 projected spending growth was lowered in the new report due to slower-than-expected Medicaid enrollment and spending increases, smaller out-of-pocket spending hikes, and a more sluggish jump in prescription drug costs.

How much will healthcare spending increase in the next decade?

Healthcare spending growth will rise at an annual average of 5.5% over the next decade, slightly faster than in the past few years, due to the aging of the baby boomers and healthcare price growth, the CMS Office of the Actuary projects.

Is Medicare spending going to grow?

Medicare spending is expected to grow faster than Medicaid or private insurance spending due to the aging of the large Baby Boom population into the program, peaking this year. That will produce a 7.4% average annual Medicare spending growth rate over the next decade, compared with 5.5% for Medicaid and 4.8% for private insurance.

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What was the per person spending for 2014?

In 2014, per person spending for male children (0-18) was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males. For further detail see health expenditures by age in downloads below.

How much did Medicaid spend in 2019?

Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE. Private health insurance spending grew 3.7% to $1,195.1 billion in 2019, or 31 percent of total NHE. Out of pocket spending grew 4.6% to $406.5 billion in 2019, or 11 percent of total NHE.

How much did hospital expenditures grow in 2019?

Hospital expenditures grew 6.2% to $1,192.0 billion in 2019, faster than the 4.2% growth in 2018. Physician and clinical services expenditures grew 4.6% to $772.1 billion in 2019, a faster growth than the 4.0% in 2018. Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018.

How much did prescription drug spending increase in 2019?

Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018. The largest shares of total health spending were sponsored by the federal government (29.0 percent) and the households (28.4 percent). The private business share of health spending accounted for 19.1 percent of total health care spending, ...

How much did Utah spend on health care in 2014?

In 2014, per capita personal health care spending ranged from $5,982 in Utah to $11,064 in Alaska. Per capita spending in Alaska was 38 percent higher than the national average ($8,045) while spending in Utah was about 26 percent lower; they have been the lowest and highest, respectively, since 2012.

Which region has the lowest health care spending per capita?

In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita ($6,814 and $6,978, respectively) with average spending roughly 15 percent lower than the national average.

How much did the NHE increase in 2019?

NHE grew 4.6% to $3.8 trillion in 2019, or $11,582 per person, and accounted for 17.7% of Gross Domestic Product (GDP). Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

What will be the GDP growth rate in 2060?

By 2060, GDP rises by 16 percent with premium financing, falls by 3 percent with payroll tax financing, and falls by 15 percent with deficit financing. Premium financing, therefore, produces a GDP that is over a third (36 percent) larger than deficit financing by 2060.

How much will the M4A premium grow in 2060?

We project that financing M4A with a premium that is independent of a worker’s labor income would grow the economy by almost 16 percent by 2060 through a combination of cost savings and productivity increases.

Why are insurance premiums not eliminated?

Insurance premiums fall the most under payroll tax and deficit financing, since M4A is financed without additional premiums; however, the premiums are not completely eliminated because workers still pay the same premiums as retirees, which are lower than the actuarial value of the benefits. Figure 5.

How does M4A affect wages?

Given competitive labor markets, replacing employer-based health benefits with M4A raises worker wages by the pre-tax amount of employer-subsidized health benefits under current law. M4A also expands the tax base by removing the (employer and employee) exemption of health benefits.

How does M4A improve life expectancy?

By 2060, we project that M4A improves life expectancy by 1.8 years, grows the population size by almost 3 percent. M4A also increases worker productivity through improved health, before macroeconomic feedback effects. However, the macroeconomic performance depends critically on how M4A is financed.

How do wages change?

Wages and Output per Hour: Changes in worker wages occur from four different sources, the first one being purely mechanical in nature, and the rest being “real” in nature: 1 Competitive labor markets: wages increase through competitive micro-economic labor markets, as employer-based health benefits are eliminated, forcing up wages. However, this effect is “mechanical” in nature and does not correspond to any improvement in the actual well-being (“welfare”) of workers. 2 “Fiscal externalities:” The first mechanical effect, though, produces indirect real effects though other tax channels, as more of a worker’s reported compensation is now subject to income and payroll taxation. Holding all other factors fixed, this additional revenue reduces deficits, increasing national saving and the capital stock, in turn boosting wages. 3 Improved health: As noted earlier, improvements in health effectively increase the productivity of workers, raising their wages. 4 Macroeconomics: Wages will rise if the capital stock grows faster than labor supply, as labor becomes a more scarce factor of production.

What happens if a worker's total value falls below $13,000?

However, firms face real wage rigidity: if a worker’s total value (“marginal product”) falls below approximately $13,000 (the minimum wage) the household is compensated only with wages. The worker can still purchase insurance but the value of the tax exemption is, therefore, lost.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Summary

Health

Cost

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future inc...

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…