Will Medicare run out of money in 2026?

Putting aside that noise, however, here is the utterly unsurprising takeaway: Medicare is rapidly running out of money to cover program costs. According to the Medicare Trustees, the Medicare Trust Fund, which covers hospital services, will be exhausted in 2026, and incoming revenues have long been insufficient to cover expenditures.

When will Medicare become insolvent?

Medicare will become insolvent in 2026, U.S. government says Social Security is expected to become insolvent in 2034 — no change from the projection last year. (Patrick Semansky / Associated Press)

Will Medicare be around when I retire?

Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like Coinsurance and deductibles. Sometimes retiree coverage includes extra benefits, like coverage for extra days in the hospital.

When will Medicare run out?

You could quickly run out of money in retirement if you need long-term care ... When you're in retirement, compare Medicare options to make sure you get the right plan for your needs. It can be worth spending more on the premium for a comprehensive ...

What year is Medicare going to run out?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

Is Medicare going to collapse?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

Is Medicare and Social Security going broke?

WASHINGTON — A stronger-than-expected economic recovery from the pandemic has pushed back the go-broke dates for Social Security and Medicare, but officials warn that the current economic turbulence is putting additional pressures on the bedrock retirement programs.

What will happen to Medicare in the future?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

Is Medicare going away in 2026?

According to a new report from Medicare's board of trustees, Medicare's insurance trust fund that pays hospitals is expected to run out of money in 2026 (the same projection as last year). The report states that in 2020, Medicare covered 62.6 million people, 54.1 million aged 65 and older, and 8.5 million disabled.

What would happen if Medicare ended?

Payroll taxes would fall 10 percent, wages would go up 11 percent and output per capita would jump 14.5 percent. Capital per capita would soar nearly 38 percent as consumers accumulated more assets, an almost ninefold increase compared to eliminating Medicare alone.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Will Social Security exist in 30 years?

According to the 2022 annual report of the Social Security Board of Trustees, the surplus in the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2035. That's one year later than the trustees projected in their 2021 report.

Will Social Security be cut?

However, the recent 2021 Social Security Trustees report finds that in 2034, retirees will start receiving a reduced benefit if Congress doesn't fix funding issues for the social program. In other words, Social Security will exist after 2034, but retirees will only receive 78% of their full benefit starting then.

What is the future of Social Security and Medicare?

In 2021 and all later years, Social Security (the combination of retirement and disability programs) will spend more than it takes in and by 2034, the combined Social Security Trust Funds are projected to be exhausted. Medicare's Hospital Insurance (HI) Trust Fund will be depleted even sooner — in 2026.

Is the future of Social Security at risk?

Introduction. As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.

What are two major problems with respect to the future of Medicare?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries.

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

Why is there a doctor shortage?

As it stands, there is already an impending doctor shortage because of limited Medicare funding to support physician training. Decrease Medicare fraud, waste, and abuse. Private insurance companies run Medicare Advantage and Part D plans.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's Covid-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

When will the Congressional Budget Office deplete?

Last September, the Congressional Budget Office (CBO) forecast depletion in 2024. In February 2021, the CBO pushed back that date to 2026 due to improved prospects for stronger economic growth and higher employment rates.

Is Medicare insolvency a new issue?

Medicare Insolvency Issues Aren't New. The Medicare Hospital Insurance Trust Fund has actually confronted the risk of insolvency since Medicare began in 1965 because of its dependence on payroll taxes (much like Social Security).

Why did Medicare repeal the Independent Payment Advisory Board?

Policymakers also repealed the Independent Payment Advisory Board, which was projected to help slow Medicare’s cost growth. And the Administration has failed to address excessive Medicare Advantage payments due to insurance company assessments of their beneficiaries that make them appear less healthy than they are.

Why does Medicare pay the benefits owed?

Trustees’ reports have been projecting impending insolvency for over four decades, but Medicare has always paid the benefits owed because Presidents and Congresses have taken steps to keep spending and resources in balance in the near term.

How much is Medicare payroll tax?

This means that Congress could close the projected funding gap by raising the Medicare payroll tax — now 1.45 percent each for employers and employees — to about 1.9 percent, or by enacting an equivalent mix of program cuts and tax increases.

What will Medicare be in 2040?

Total Medicare spending is projected to grow from 3.7 percent of gross domestic product (GDP) today to 5.9 percent in 2040. Medicare has been the leader in reforming the health care payment system to improve efficiency and has outperformed private health insurance in holding down the growth of health costs.

Can SMI go bankrupt?

The SMI trust fund always has sufficient financing to cover Part B and Part D costs, because the beneficiary premiums and general revenue contributions are specifically set at levels to assure this is the case. SMI cannot go “bankrupt.”. The short-term outlook for the HI trust fund is unchanged from last year.

Will Medicare run out of money in 2026?

This shortfall will need to be closed through raising revenues, slowing the growth in costs, or most likely both. But the Medicare hospital insurance program will not run out of all financial resources and cease to operate after 2026, as the “bankruptcy” term may suggest.

Is Medicare a major change?

In contrast to Social Security, which has had no major changes in law since 1983, the rapid evolution of the health care system has required frequent adjustments to Medicare, a pattern that is certain to continue.

When will Medicare run out of money?

The report from program trustees says Medicare will become insolvent in 2026 — three years earlier than previously forecast.

When will Medicare become insolvent?

Medicare will become insolvent in 2026, U.S. government says. Social Security is expected to become insolvent in 2034 — no change from the projection last year. Copy Link URL Copied! Medicare will run out of money sooner than expected, and Social Security’s financial problems can’t be ignored either, the government said Tuesday in ...

What does Medicare mean for nursing homes?

For Medicare, it could mean that hospitals, nursing homes and other providers of medical care would be paid only part of their agreed-upon fees. Medicare’s problems are widely seen as more difficult to solve. It’s not just the growing number of beneficiaries as the baby boom generation continues moving into retirement.

How many people are on Medicare?

Medicare provides health insurance for about 60 million people, most of whom are age 65 or older. Together the two programs have been credited with dramatically reducing poverty among older people and extending life expectancy for Americans.

When will Social Security become insolvent?

The report says Social Security will become insolvent in 2034 — no change from the projection last year. The warning serves as a reminder of major issues left to languish while Washington plunges deeper into partisan strife. Because of the deterioration in Medicare’s finances, officials said the Trump administration will be required by law ...

Who is involved in the annual Medicare report?

The Cabinet secretaries for Treasury, Health and Human Services, and Labor usually participate in the annual release of the report on Social Security and Medicare, along with the Social Security commissioner, and take questions from reporters. None of those top officials was present Tuesday; an aide cited scheduling conflicts.

Is Medicare on track to meet its obligations?

“The programs remain secure,” Mnuchin said. Medicare “is on track to meet its obligations to beneficiaries well into the next decade.”. “However, certain long-term issues persist,” the statement added.

When will Medicare run out of money?

When will America’s Medicare Hospital Insurance (HI) trust fund run out of money to pay all of the promised Medicare benefits? According to the latest report by the Medicare Trustees, without any changes, the fund will be insolvent in 2026—three years earlier than they projected last year. With just two exceptions, the Medicare hospital program has ...

How many times has Medicare been raised?

In fact, Congress has raised the Medicare payroll tax (now 2.9 percent of wages) ten times since the inception of the program in 1966.

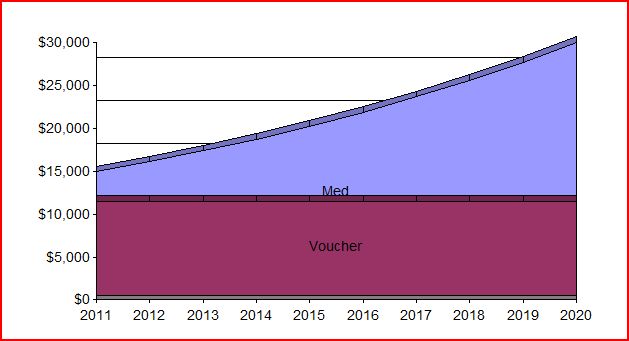

How much will Medicare cost in 2027?

CBO recently reported that Medicare spending will double, from last year’s $708 billion to $1.4 trillion by 2027. That growth will make Medicare the biggest driver of federal health care spending, dwarfing Medicaid, Obamacare subsidies, and outlays for the Children’s Health Insurance Program (CHIP).

What percentage of GDP will Medicare be in 2042?

Furthermore, the Trustees estimate that Medicare spending, currently at 3.7 percent of the Gross Domestic Product (GDP), will rise to 5.9 percent of GDP by 2042. In fact, a more realistic alternative scenario projects that spending to reach 6.2 percent of GDP by 2042. In short, Medicare spending will grow faster than workers’ wages, ...

What age can you get Medicare?

Congress could also gradually raise the normal age of Medicare eligibility to sixty-eight.

Can Medicare expand its defined contribution financing system?

For the longer term, Congress, building on the success of the Medicare Advantage and Medicare drug programs, could expand the defined contribution financing system ("premium support") to the entire Medicare program.

Does Medicare have a substantial effect on the federal debt?

In this connection, the Medicare Payment Advisory Commission (the panel that advises Congress on Medicare reimbursement) recently observed, "With their reliance on general tax dollars and deficit spending, Medicare and other major federal health care programs have a substantial effect on the federal debt.".

How long was the Obama administration's Medicare shortfall?

The Obama Administration oversaw a $2.4 trillion cash shortfall over 8 years (2009-2016). The fiscal reality is that continuing the previous administration’s Medicare policies and leaving Medicare unchanged all but guarantees bankruptcy.

How much is Medicare's cash deficit?

· In 2019, the Medicare Part A (hospitals) cash deficit was $43.2 billion. · To balance, payroll taxes would need to increase from 1.45 percent to 1.7 percent.

How much is Medicare cash shortfall?

Medicare’s Annual Cash Shortfall in 2019 was $396 billion; Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and. Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

What do you need to know about Medicare and Social Security?

What You Need to Know About the Medicare and Social Security Trustees Reports includes one-pagers and relevant statistics on: The solvency of Medicare; The president’s stewardship of Medicare; The solvency of the Social Security Trust Fund; The solvency of the Social Security Disability Insurance (DI) program; and.

How much did Social Security spend in 2019?

Social Security’s Contribution to the Debt in 2019. · In 2019, Social Security spent $1,059.3 billion but only collected $981 billion in non-interest income. · This year is the 10th in a row that Social Security has been in cash deficit, with the program running a cumulative deficit of $615.6 billion since 2010.

Is Medicare a red ink source?

Medicare’s True Contribution to the National Debt. · America’s fiscal trajectory is unsustainable, and Medicare is the primary source of red ink. · Medicare’s cash shortfall is responsible for one-third of the federal debt. Continuing with the Medicare status quo is unacceptable.

Is Medicare going bankrupt?

This annual report delivered yet another reminder to the American public that Medicare is undeniably going bankrupt. The report estimates that the Medicare Hospital Insurance Trust Fund will be bankrupt by 2026.