When you have a Medicare Supplement (Medigap) plan, you are no longer responsible for all of the costs Original Medicare leaves behind. However, if you do not enroll when you first become eligible, you could be denied Medicare Supplement coverage. Many health-related pre-existing conditions can result in a denied Medicare Supplement plan.

What to do if Medicare denies your medical claim?

You can also take other actions to help you accomplish this:

- Reread your plan rules to ensure you are properly following them.

- Gather as much support as you can from providers or other key medical personnel to back up your claim.

- Fill out each form as carefully and exactly as possible. If necessary, ask another person to help you with your claim.

Are people denied Medicare and why?

Though Medicare is designed to give seniors and certain disabled individuals the most unobstructed access to healthcare possible, there are some rare circumstances that may unfortunately lead to a Medicare claim denial. When a Medicare claim is denied, you will receive a letter notifying you that a specific service or item is not covered or no longer covered. This can also happen if you are already receiving care but have exhausted your benefits.

What can you do if your Medicaid application is denied?

- Affordable Care Act (ACA) Subsidized Plans After Medicaid. Special Enrollment Status: If you lose your Medicaid health coverage, a Special Enrollment Period (SEP) opens up for you.

- Short-Term Health Coverage After Medicaid. ...

- Reapply for Medicaid. ...

- Review Your Options and Stay Covered. ...

Can secondary insurance pay claims that are denied by Medicare?

That depends on your contract with the other insurance company and why Medicare denied the claim. Your secondary insurance might be an employer-sponsored plan or Medicaid. It's quite common for those to pay for things that Medicare does not cover.

Can Medicare Supplement plans deny for pre-existing conditions?

Summary: A Medicare Supplement insurance plan may not deny coverage because of a pre-existing condition. However, a Medicare Supplement plan may deny you coverage for being under 65. A health problem you had diagnosed or treated before enrolling in a Medicare Supplement plan is a pre-existing condition.

Is there a waiting period for pre-existing conditions with Medicare?

For up to six months after your Medicare Supplement plan begins, your new plan can choose not to cover its portion of payments for preexisting conditions that were treated or diagnosed within six months of the start of the policy.

What is a Medicare denial?

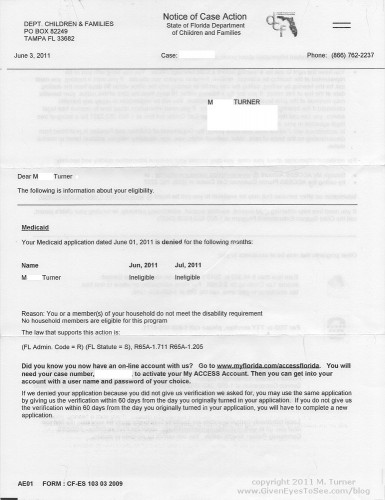

Medicare may send a Notice of Denial of Medical Coverage or Integrated Denial Notice (IDN) to those who have either Medicare Advantage or Medicaid. It tells someone that Medicare will no longer offer coverage, or that they will only cover a previously authorized treatment at a reduced level.

What would disqualify someone from Medicare?

those with a felony conviction within the past ten years that is considered detrimental to Medicare or its beneficiaries, e.g., crimes against a person (murder, rape, assault), financial crimes (embezzlement, tax evasion), malpractice felonies, or felonies involving drug abuse or trafficking.

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

What is a 12 month pre-existing condition limitation?

The time period during which a health plan won't pay for care relating to a pre-existing condition. Under a job-based plan, this cannot exceed 12 months for a regular enrollee or 18 months for a late-enrollee.

What percentage of Medicare claims are denied?

The amount of denied spending resulting from coverage policies between 2014 to 2019 was $416 million, or about $60 in denied spending per beneficiary. 2. Nearly one-third of Medicare beneficiaries, 31.7 percent, received one or more denied service per year.

Why would Medicare deny a procedure?

There are certain services and procedures that Medicare only covers if the patient has a certain diagnosis. If the doctor's billing staff codes the procedure correctly, but fails to give Medicare the correct coding information for the diagnosis, Medicare may deny the claim.

Why are my Medicare claims being denied?

A claim that is denied contains information that was complete and valid enough to process the claim but was not paid or applied to the beneficiary's deductible and coinsurance because of Medicare policies or issues with the information that was provided.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

You may not be guaranteed Medigap coverage

Lora Shinn has been writing about personal finance for more than 12 years. Her articles have also been published by CNN Money, U.S. News & World Report, and Bankrate, among others.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance or Medigap is sold by private insurance companies. You must be enrolled in both Parts A and B to be eligible for a policy. It’s not an option if you have a Medicare Advantage plan, and coverage is for one person only (spouses need to purchase Medigap separately).

Can You Be Denied Medigap Coverage?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

Denial of Medigap Policy Renewal

In most cases your renewal is considered guaranteed and cannot be dropped, however there are certain circumstances when the insurance company can decide not to renew your Medigap policy:

How Do You Get Medigap Coverage?

The best time to get Medigap coverage is during your once-per-lifetime Medigap open enrollment period. This period lasts for six months, beginning the first month you are enrolled in Medicare Part B and are at least 65. 10

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

Medigap and Medicare Advantage

If you have a Medicare Advantage (MA) plan, it’s illegal for an insurance company to sell you a Medigap policy. But if you switch to MA after you’ve purchased a Medigap policy, you’ll probably want to drop your policy since you can’t use it to supplement your MA plan.

How to change your insurance plan?

There are a few options for you to change your plan: 1 You could contact each one and read their underwriting guide to see if you qualify. Most people don’t find underwriting guides to be the most exciting reading material 2 Call one company at a time and apply, until you are accepted. It sure seems like there are better things to do each day then call 1-800 numbers 3 Contact an independent agent that represents multiple companies and let them work on your behalf (after all the help is free)

What happens if you don't fall into one of the first two buckets?

If you don’t fall into one of those first two buckets then you will need to pass an underwriting review. Which means you could potentially be denied for coverage. Or your premium could be higher due to your health history.

Can insurance companies ask for health questions?

Insurance companies are not allowed to ask any health questions for your Medicare supplement policy during this window. That means they cannot charge you a different premium due to your health history. And they also cannot deny you based of your health history.

Can a Medicare supplement be denied by one company?

So just because you have been denied by one company does not mean all companies will deny your Medicare supplement application. It’s helpful to speak with an independent agent that can help you with multiple carriers so they can help you find a company that is likely to accept your application.

How long does Medicare Advantage have to appeal?

Medicare Advantage beneficiaries have 60 days from the date of the denial notice to file an appeal. Following your appeal, the plan must make a decision in the following 30 days if you have not already received the service in question.

What is Medicare Advantage?

A Medicare Advantage plan is offered by a private insurer that is required to offer the same coverage as Original Medicare, but typically offers more. The extra coverage usually includes dental, vision, and drug coverage.

Can a denial notice be unclear?

While it is not uncommon for the denial notice to be unclear or even have incorrect information listed, it is important to stay on top of it. Even if you are unsure, follow the instructions that are listed on the denial notice in order to file an appeal.

Can a patient appeal a denial?

Most patients who receive a denial do not appeal it. These denials are likely to cause more problems further down the path for the patients and providers. When a provider is denied payment, they are more likely to turn down other services as well.

What happens if Medicare denies coverage?

If you feel that Medicare made an error in denying coverage, you have the right to appeal the decision. Examples of when you might wish to appeal include a denied claim for a service, prescription drug, test, or procedure that you believe was medically necessary.

Why did I receive a denial letter from Medicare?

Example of these reasons include: You received services that your plan doesn’t consider medically necessary. You have a Medicare Advantage (Part C) plan, and you went outside the provider network to receive care.

What is an integrated denial notice?

Notice of Denial of Medical Coverage (Integrated Denial Notice) This notice is for Medicare Advantage and Medicaid beneficiaries, which is why it’s called an Integrated Denial Notice. It may deny coverage in whole or in part or notify you that Medicare is discontinuing or reducing a previously authorized treatment course. Tip.

How to avoid denial of coverage?

In the future, you can avoid denial of coverage by requesting a preauthorization from your insurance company or Medicare.

How long does it take to get an appeal from Medicare Advantage?

your Medicare Advantage plan must notify you of its appeals process; you can also apply for an expedited review if you need an answer faster than 30–60 days. forward to level 2 appeals; level 3 appeals and higher are handled via the Office of Medicare Hearings and Appeals.

What are some examples of Medicare denied services?

This notice is given when Medicare has denied services under Part B. Examples of possible denied services and items include some types of therapy, medical supplies, and laboratory tests that are not deemed medically necessary.

What is a denial letter?

A denial letter will usually include information on how to appeal a decision. Appealing the decision as quickly as possible and with as many supporting details as possible can help overturn the decision.

How long before Medicare coverage ends?

As early as 60 calendar days before the date your coverage will end. No later than 63 calendar days after your coverage ends. Call the Medicare SELECT insurer for more information about your options. Find the phone number for the Medicare SELECT company.

How long after Medicare coverage ends can you start Medigap?

No later than 63 calendar days after your coverage ends. Medigap coverage can't start until your Medicare Advantage Plan coverage ends. You have Original Medicare and an employer group health plan (including retiree or COBRA coverage) or union coverage that pays after Medicare pays and that plan is ending.

How long does Medigap coverage last?

No later than 63 calendar days after your coverage ends. note: Your rights may last for an extra 12 months under certain circumstances. Your Medigap insurance company goes bankrupt and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own. You have the right to buy:

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How long do your rights last on Medicare?

Your rights may last for an extra 12 months under certain circumstances. You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you’ve been in the plan less than a year, and you want to switch back. (Trial Right) You have the right to buy:

When will Medicare plan C and F be available?

However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to buy Plan C or Plan F.

Does Medicare cover prescriptions?

If you’re enrolled in a Medicare Advantage Plan: Most Medicare services are covered through the plan. Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. and still buy a Medigap policy if you change your mind. You have a guaranteed issue right (which means an insurance company ...

What to do if Medicare denial is not correct?

However, if you think the stated reasons are not correct, call the plan immediately at the number given on the denial notice and explain why. If that doesn’t resolve the issue, call Medicare at 1-800-633-4227 and say you wish to discuss it with someone at your Medicare regional office.

What to do if your pharmacy enrollment is delayed?

If your enrollment is delayed beyond the time when your coverage should begin, the plan must cover your drugs while the issue is being resolved. In the meantime, you can use a copy of your enrollment form or the plan’s acknowledgment letter as proof of coverage at the pharmacy.

Can you be refused Medicare?

You cannot be refused Medicare prescription drug coverage because of the state of your health, no matter how many medications you take or have taken in the past, or how expensive they are. Nor can you be asked to pay more than other people because of your medical history. There are no preexisting conditions in Part D.

Can ESRD patients join Medicare?

ESRD patients—usually defined as those undergoing dialysis or needing a kidney transplant—cannot join an MA plan. They can still get coverage under traditional Medicare and a separate stand-alone drug plan.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

Does Medicare pay for group health insurance?

Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You'll have to pay any costs Medicare or the group health plan doesn't cover.

Do employers have to offer health insurance to employees over 65?

Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65. If the employer offers coverage to spouses, they must offer the same coverage to spouses 65 and older that they offer to spouses under 65.