When can you change your Medicare supplement plan?

Aug 20, 2021 · You can change your Medicare Supplement Plan at any time. However, if you have health issues that could cause a rate increase of denial of coverage, you should not change your Medicare Supplement plan outside of your open enrollment period unless you qualify for special enrollment with guaranteed issue rights.

What changes are expected for Medicare supplement?

Aug 09, 2018 · Medicare beneficiaries can make changes to parts of their Medicare coverage – including their Medicare Advantage (Part C) and Prescription Drug Plans (Part D) – during Medicare’s Annual Enrollment Period (AEP) which takes place every year from October 15th to December 7th. However, Medicare Supplement Insurance (Medigap) plans are not part of this …

How can I Change my Medicare supplement plan?

Oct 16, 2020 · You can switch from Medicare Advantage to Medigap (Medicare Supplement insurance) and maintain your guaranteed-issue rights only if you signed up for Medicare Advantage during your Initial...

How often can I change Medicare supplement plan?

Feb 02, 2022 · When you switch Medicare Supplement Insurance plans, you generally are allowed 30 days to decide to keep it or not. This 30-day “free look” period starts when your new Medicare Supplement plan takes effect. To qualify, you need to pay the premiums for both your new plan and your old plan for one month.

Do Medicare Supplement plans automatically update when Medicare changes?

Fortunately, you will be able to stay with your plan as long as you like in most cases. This is called “guarantee renewable.” Medicare Supplement insurance plans renew automatically when you make your premium payment.

How often can you change your Medicare Supplement?

Is there a time limit or deadline for changing Medicare supplement plans? No there is not. Once your six-month open enrollment period has expired, you can change anytime. However, there's generally no reason to change unless you've had a rate increase and are shopping for a lower rate.

Can you change Medigap policies without medical underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Can you have two Medicare Supplement plans?

En español | By law, Medigap insurers aren't allowed to sell more than one Medigap plan to the same person.

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

When can I switch to a Medigap plan?

The best time for you to sign up for a Medicare Supplement plan, also called Medigap, is when you turn 65 and are covered under Medicare Part B. This six-month period, known as your Medigap Open Enrollment Period, typically starts on your 65th birthday if you're already enrolled in Part B.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

When can you change Medicare Supplement Plans?

You can change your Medicare Supplement Plan at any time. However, if you have health issues that could cause a rate increase of denial of coverage...

What is the Medicare free look period?

Most companies will allow you a free-look period for thirty days when you can examine and use your plan. If you find your plan unsatisfactory, you...

Can Medicare Supplement Insurance plan be Cancelled?

Generally, no. Your insurance company cannot cancel your Medicare Supplement insurance plans unless you don't make your premium payments or the ins...

Can I change my Medicare Part D plan anytime?

You can change from your current Part D plan to a different one during the Medicare open enrollment period, which runs from October 15 to December...

Why are the Medigap rules changing in Idaho?

Senate Bill 1143, signed by Governor Little on April 22, 2021, revised key provisions of Medicare Supplement policy eligibility and rating. The Dep...

What is community rating?

Community rating is a rating method for Medigap insurance that assigns a single rate to all ages and classes of individuals in the group, regardles...

I don’t have a Medicare Supplement policy. Can I get one on my birthday?

It depends. While the birthday rule only applies to people with Medicare Supplement policies, there may be other guaranteed issue rights available...

I’m on Medicare under age 65. Can my premium be higher than the premium charged for over age 65?

People eligible for Medicare for reasons other than age may be charged up to 150% more than people eligible for Medicare based on age. When benefic...

I have a Medicare Supplement policy and I want to change plans/companies. What are my options?

The rule allows you to leave your policy and purchase a new policy of similar or lesser coverage. For example, if you have a Plan G, you may purcha...

I have a Medicare Supplement policy and I’m happy with my plan. Do I need to do anything?

If you have a Medicare Supplement policy you do not need to do anything. Your policy is guaranteed renewable. Even if the plan is issue-age rated (...

I have a Medicare Supplement policy. How do these changes affect me?

These changes do not affect current policyholders. Your policy is guaranteed renewable. Even if the plan is issue-age rated (most common rating in...

I have a Medicare Advantage plan. How do these changes affect me?

These changes do not affect people with Medicare Advantage plans.

I have a Medicare Supplement policy and I heard my rates are going to increase. Is that true?

Not because of this law change. Medicare Supplement policy premiums typically change annually due to the increasing cost of medical care, and that...

How are Medicare Supplement policy premiums determined?

Companies submit their premium rates to the DOI for review. Factors that may affect premiums include your age when you took out the policy (if issu...

What is Medicare Supplement Insurance?

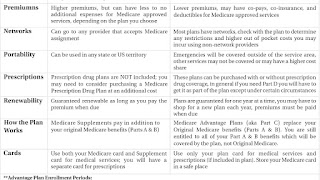

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

What happens if a Medigap policy goes bankrupt?

Your Medigap insurance company goes bankrupt and you lose your coverage , or your Medigap policy coverage otherwise ends through no fault of your own. You leave a Medicare Advantage plan or drop a Medigap policy because the company hasn’t followed the rules, or it misled you.

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

When can I switch from Medicare Advantage to Medigap?

You can switch from Medicare Advantage to Medigap (Medicare Supplement insurance) and maintain your guaranteed-issue rights only if you signed up for Medicare Advantage during your Initial Enrollment Period — the seven months before, during, and after you become eligible for Medicare at age 65.

What is Medicare Supplement?

Medicare Supplement ( or Medigap) insurance provides coverage for copayments, coinsurance, deductibles, and other expenses not covered by Original Medicare ( Medicare Part A hospital insurance and Medicare Part B medical insurance). Medicare Supplement policies are provided by private insurance companies that contract with the federal government.

How long does it take to switch Medigap to another?

Regardless of your circumstances, if you switch from one Medigap policy to another, you will get a 30-day “free look” period to explore a new plan before you drop your existing plan. During this time, you will need to pay the premiums for both policies.

When is the best time to enroll in Medigap?

Ultimately, the best time to enroll in a Medigap plan is during your Open Enrollment Period, which is the seven-month time frame before and after you first become eligible for Medicare at age 65. You may find some exceptions to this, though.

How long do you have to have a medical underwriting process before you can get a new insurance?

If you’ve had your policy for less than six months and you have a preexisting health condition, you can apply for a new policy anytime within the first six months of coverage. After that time, the insurance provider will likely need to complete a medical underwriting process before selling you a different plan.

When can I remove my Medicare Advantage plan?

Outside of this time frame, you can remove a Medicare Advantage plan only during the Fall Open Enrollment Period, from October 15 to December 7 each year , and only if you are switching back to Original Medicare. You may also be able to add a Medigap policy during this time.

Can I change my Medigap plan?

You can change a Medigap plan at any time. Depending on risks associated with your past or current health conditions, if you apply outside of your Initial Enrollment Period window, which begins when you first become eligible for Medicare, the insurance provider could charge a higher premium or deny your application altogether.

What happens if you don't change your Medicare Supplement?

If you don't change Medicare Supplement insurance plans during your Medigap Open Enrollment Period, your insurer can force you to undergo medical underwriting, and they can now assess your health history during the application process and can turn you down if it chooses.

When do insurance companies send out notices of changes to Medicare?

Every September, insurance companies must send out a Medicare Annual Notice of Change (ANOC) letter to Medicare beneficiaries. This letter tells you of any changes to your rates. If your rates go up, you may want to consider looking for a new policy.

How to avoid medical underwriting?

The main way to avoid medical underwriting is if you have a Medicare Supplement insurance guaranteed-issue right. Some guaranteed-issue rights occur when: Your Medigap insurance company went bankrupt or ended your policy through no fault of your own.

What is a Medicare Supplement Plan?

Medigap plans are designed to fill those gaps by supplementing your Original Medicare coverage to pay for certain out-of-pocket costs. A Medicare Supplement plan may pay your coinsurance or copayments from Medicare Part A and Part B.

What to do if you are unhappy with your Medicare Supplement?

If you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter. Call to speak with a licensed insurance agent who can help you compare Medicare Supplement plans in your area. They can help you change plans once you find the best plan for your needs.

How long do you have to keep Medicare Supplement?

The Medicare Supplement “Free Look” Period. When you switch Medicare Supplement Insurance plans, you generally are allowed 30 days to decide to keep it or not. This 30-day “free look” period starts when your new Medicare Supplement plan takes effect.

How long does it take to enroll in Medigap?

If you do consider enrolling in a Medigap plan Medigap plans, you should try to apply for a plan during your 6-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period is a 6-month period that starts the day you are both 65 years old and enrolled in Medicare Part B.

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

What happens if you have original Medicare and Supplemental?

You have Original Medicare and supplemental coverage through an employer group health plan, and that coverage is ending. Your current insurance company went bankrupt, or your coverage ends through no fault of your own. Your current insurer misled you or broke the law.

How long is the free look period for Medicare Supplement?

What is the Medicare Supplement Free Look Period? Medigap plans come with a 30-day “ free look ” period. You can keep your old plan for 30 days after your new one starts. If you decide you liked the old one better, you can switch back and cancel the new one.

What does it mean when an insurance application is medically underwritten?

This means the insurance company will use the applicants’ age and health history to decide if they will cover them, and what the premiums will cost. Therefore, a new policy may cost more than your old one. Always remember, a quote is only a quote, it’s not a final offer.

Can you cancel your insurance until you are approved?

Always remember, a quote is only a quote, it’s not a final offer. Don’t cancel coverage until you are approved for new coverage, this will prevent any possible lapses in coverage. Any good insurance agent will tell you to keep your old coverage until your new coverage goes into effect.

Can you change your Medigap plan in 2021?

Updated on March 18, 2021. When considering changing Medigap plans, there are a few things you should know before you leap for change. First, changing Medigap policies can be difficult if you don’t have an insurance agent in your corner. Agents can help you along the way; additionally, they’re a great resource for all beneficiaries.

Can you change supplements on Medicare without underwriting?

This means an insurance company can’t turn you down or charge you more if you have a pre-existing health condition . As a Medicare beneficiary, you can change supplements at any time.

Can you change your plan?

You can always change your plan. Recipients are never locked in for a certain amount of time. But if you do change it, you could face some restrictions that didn’t apply when you originally signed up.

What are the changes to Medicare?

What Are the Medicare Changes for 2021? 1 Medicare premiums and deductibles have increased across the various plans. 2 The “donut hole” in Medicare Part D was eliminated in 2020. 3 Changes have been made to Medicare coverage to respond to COVID-19.

What is Medicare Supplement?

Medicare supplement, or Medigap, plans are Medicare plans that help you pay for a portion of your Medicare costs. These supplements can help offset the costs of premiums and deductibles for your Medicare coverage. Plans are sold by private companies, so rates vary. In 2021, under Plan G, Medicare covers its share of costs, ...

How much is Medicare Part A deductible in 2021?

This deductible covers an individual benefit period, which lasts 60 days from the first day of hospital or care facility admission. The deductible for each benefit period in 2021 is $1,484 — $76 more than in 2020.

How much is coinsurance for Medicare Part A?

For hospitalization, this means Medicare Part A will charge participants a coinsurance of $371 per day for days 61 through 90 — up from $352 in 2020. Beyond 90 days, you must pay a rate of $742 per day for lifetime reserve days — up from $704 in 2020. For admissions to skilled nursing facilities, the daily coinsurance for days 21 ...

What is the deductible for Medicare 2021?

In 2021, under Plan G, Medicare covers its share of costs, and then you pay out-of-pocket until you have reached a $2,370 deductible. At that point, Plan G will pay for the remainder of costs.

How much will Medicare cost in 2021?

Premium. Most people with Medicare Part B pay a premium for this plan, and the base cost in 2021 is $148.50 per month for individuals who make less than $88,000 per year or couples who make less than $176,000 per year. Premium costs increase incrementally based on income.

How many people will be on medicare in 2020?

In 2020, about 62.8 million people were enrolled in Medicare. It’s up to the Centers for Medicare & Medicaid (CMS), a division of the U.S. Department of Health and Human Services, to keep the needs of enrollees and the cost of the program in check as laid out in the Social Security Act.