not present

| Medicare | |

| i) Acquisition/Administration/Overhead C ... | $5,168 |

| ii) Acquisition/Administration/Overhead ... | 9,837 |

| iii) Total of i and ii | 15,006 |

Full Answer

How much does Medicare spend on administrative expenses?

Medicare’s administrative costs were $8 billion in 2011, or 1.4 percent of total Medicare spending of $549 billion that year. Those figures come from the latest annual report of the Medicare trustees, prepared by OACT (Office of the Actuary within …

What is a Medicare Administrative Contractor (MAC)?

contractor shall submit an estimate of administrative costs that are anticipated for the ensuing FY. Predicate the annual budget on the budget and performance requirements (BPRs) issued by CMS and on its previous Medicare cost and productivity experience. It shall consider unusual or non-recurring type activities that could be part of the ...

What is an annual cost report for Medicare?

9 rows · Medicare an inherent advantageon administrative costs. Medicare calculates administrative ...

How much does Medicare spend on Medicare Advantage plans?

The combined administrative expenses of the intermediaries and Government for Medicare ranged from 4.6 percent to 5.2 percent of ex- penditures from fiscal years 1967 to 1973. The 1967 administrative cost data, however, include some start-up costs incurred in 1965 and 1966.

What are healthcare administrative costs?

Excess Administrative Spending in Healthcare: Significant Savings Possible. Administrative spending refers to the costs incurred by insurers, hospitals, doctors' offices and other entities to conduct the business side of healthcare.

Does CMS administer the Medicare program?

The Centers for Medicare and Medicaid Services (CMS) is the U.S. federal agency that works with state governments to manage the Medicare program, and administer Medicaid and the Children's Health Insurance program.

Why are administrative costs in healthcare so high?

Because there are multiple insurers seeking competitive advantage, these activities are difficult to standardize. Similarly, efforts to control prices create administrative costs. These are in part related to negotiation, and those costs expand as the effects of the negotiations ripple through the system.Oct 20, 2021

How can healthcare administrative costs be reduced?

Here are eight ways that health insurers and hospitals can put the squeeze on administrative costs.Simplify provider engagement. ... Re-evaluate major expenses. ... Determine if historical processes are obsolete. ... Adopt common technology platforms. ... Measure performance and improve quality outcomes.More items...•Oct 14, 2019

What is the CMS Administration?

Administrator. Chiquita Brooks-LaSure is the Administrator for the Centers for Medicare and Medicaid Services (CMS), where she will oversee programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the HealthCare.gov health insurance marketplace.

What does CMS mean in Medicare?

Centers for Medicare & Medicaid ServicesHome - Centers for Medicare & Medicaid Services | CMS.

What are administrative costs in healthcare quizlet?

Administrative costs are charges associated with management of the financing, insurance, delivery, and payment functions of health care.

Who pays the most for health insurance coverage?

Employers pay 83% of health insurance for single coverage On average, employers paid 83% of the premium, or $6,200 a year. Employees paid the remaining 17%, or $1,270 a year.Sep 24, 2021

What country has the best healthcare system?

South KoreaCountries With The Best Health Care Systems, 2021RankCountryHealth Care Index (Overall)1South Korea78.722Taiwan77.73Denmark74.114Austria71.3251 more rows•Apr 27, 2021

What percentage of Medicare is administrative expenditure?

The latest trustees’ report indicates Medicare’s administrative expenditures are 1 percent of total Medicare spending, while the latest NHEA indicates the figure is 6 percent. The debate about Medicare’s administrative expenditures, which emerged several years ago, reflects widespread confusion about these data. Critics of Medicare argue that the official reports on Medicare’s overhead ignore or hide numerous types of administrative spending, such as the cost of collecting taxes and Part B premiums. Defenders of Medicare claim the official statistics are accurate. But participants on both sides of this debate fail to cite the official documents and do not analyze CMS’s methodology. This article examines controversy over the methodology CMS uses to calculate the trustees’ and NHEA’s measures and the sources of confusion and ignorance about them. It concludes with a discussion of how the two measures should be used.

What is CMS in Medicare?

The Centers for Medicare and Medicaid Services (CMS) annually publishes two measures of Medicare’s administrative expenditures. One of these appears in the reports of the Medicare Boards of Trustees and the other in the National Health Expenditure Accounts (NHEA).

What is the FAR for administrative costs?

Costs will be allocated separately by program management (PM) and Medicare integrity program (MIP) functions and activities.

What is the 5 digit code for Medicare?

5-digit code identifying each activity. A listing of codes is available within CAFM II. The first digit of an activity code identifies the activity as a PM activity (odd numbers) or a MIP activity (even numbers). The second digit identifies the Medicare function, e.g., claims processing, appeals, etc. The last three digits refer to the specific activity or project within each function.

What is the receiving contractor in a subcontract?

The receiving contractor includes the estimated costs, furnished by the servicing contractor, as a subcontract cost and identifies the servicing contractor in the Remarks section of that Activity Form.

What is MSP in CMS?

The MSP function includes the costs and workload(s) for recovery activities related to working aged; disabled; ESRD; workers' compensation; auto/liability/no fault; and other activities related to MSP and identified by CMS.

What is MR in insurance?

MR is the efforts taken to prevent, identify, and address claim errors made by providers including manual or automated review of claims to ensure that payments are made for services that are covered and correctly coded. (For further information see the Program Integrity Manual)

What is integrated operations in Medicare?

Integrated operations generally include receiving, screening, determination of amount of payment, and portions of the keypunching and data processing functions. The contractor shall analyze integrated operations carefully in order to identify any functions that are not required under title XVIII but have been superimposed on the normal title XVIII claims process. For example, special coding required by the State agency, additional key punching and data processing necessary as a result of this coding, preparation of a separate check, and other similar activities are extra, identifiable functions not required in the title XVIII claims process and are not reimbursable by Medicare. State agencies are responsible for administrative costs of all extra, identifiable functions that the contractor performs while processing combined claims.

What is the title XVIII?

This chapter sets forth the financial policies and principles used by Medicare contractors furnishing title XVIII claims information for complementary health insurance or Federal grants-in-aid program purposes and for integrating the Medicare program with these programs.

What percentage of Medicare claims are administrative costs?

One of the most common, and least challenged, assertions in the debate over U.S. health care policy is that Medicare administrative costs are about 2 percent of claims costs, while private insurance companies’ administrative costs are in the 20 to 25 percent range.

Is Medicare more efficient than private insurance?

One of the most common, and least challenged, assertions in the debate over U.S. health care policy is that Medicare is much more efficient than the private sector. Critics of the private sector health insurance industry like to boast that Medicare administrative costs are about 2 percent of claims costs, while private insurance companies’ administrative costs are in the 20 to 25 percent range — or more.1 That assertion is nearly always followed by a policy recommendation: Switch everyone to a government-financed health care system — or just put everyone in Medicare — and the country will save so much in administrative costs that it can cover all of the 46 million uninsured with no additional health care spending.2 Sound too good to be true? It is.

Is Medicare administrative cost hidden?

The primary problem is that private sector insurers must track and divulge their administrative costs, while most of Medicare’s administrative costs are hidden or completely ignored by the complex and bureaucratic reporting and tracking systems used by the government.

Is Medicare getting more efficient?

Is Medicare Getting More “Efficient”? Based on Tables 1 and 2, one can see that the administrative cost figure for Medicare has been decreasing and is estimated to continue downward — making Medicare look as if it is getting even more “efficient” as time passes. Higher costs in early years were partly due to startup program costs — which private insurers also have — but the primary reason for the decrease is clearly the acceleration in Medicare benefits (averaging about 8 percent growth per year) versus the estimated increase in program administrative costs (abut 3 percent per year). Using Table 2 as a basis, even with the unreported costs (see Table 1, Medicare ii), Medicare over time looks better and better relative to the private market because private administrative costs will likely remain roughly the same as a percentage of claims. Why are benefits growing faster than administrative costs? There are least two reasons: increased economies of scale and the high, and growing, cost of treating seniors. Private Sector Economies of Scale. Certainly one reason for Medicare’s declining percentage of administrative costs is greater economies of scale, but the private sector also can achieve economies of scale. Large employers have lower administrative cost ratios than small employers, and not much more than Medicare.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

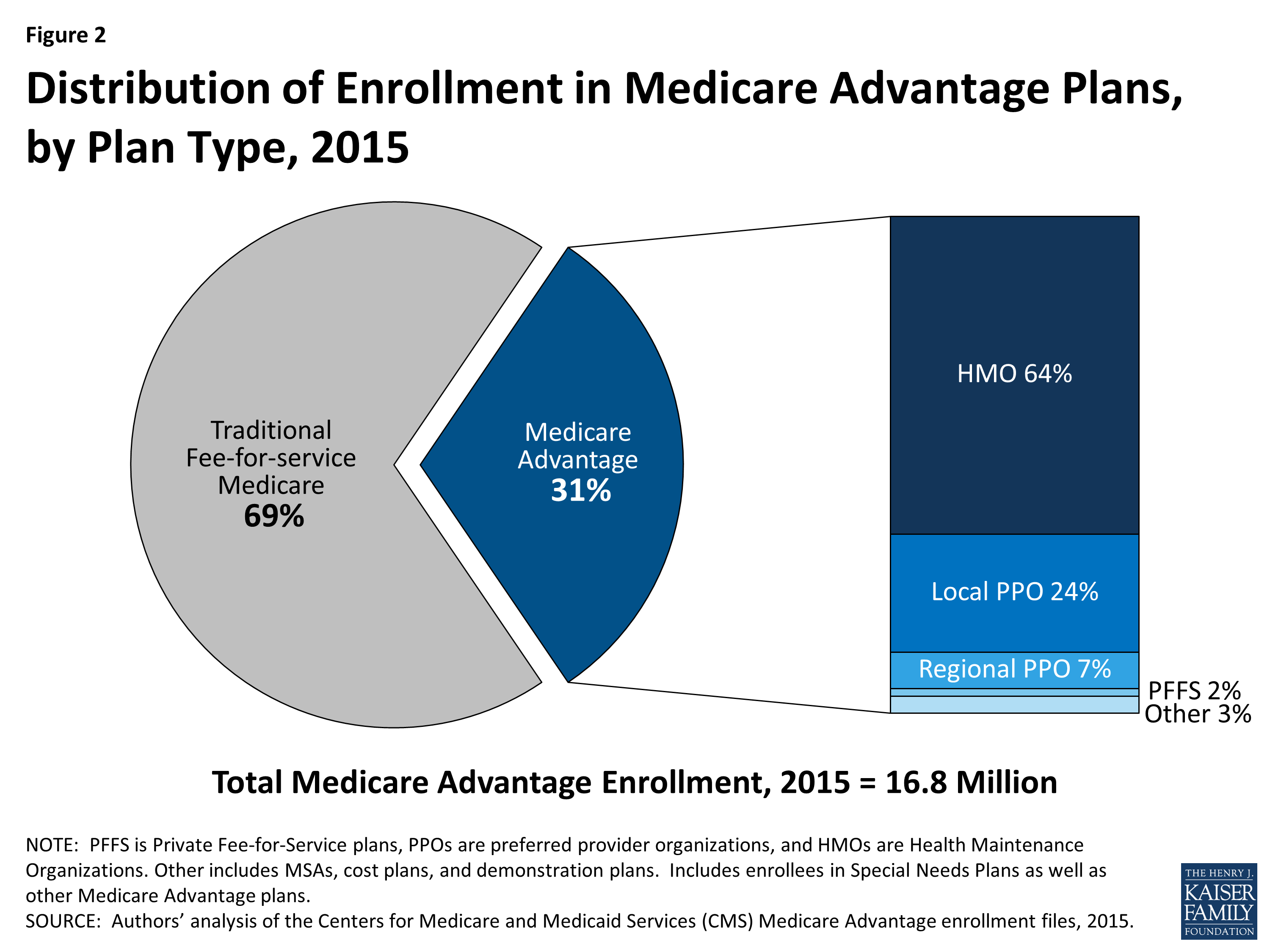

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

What is administrative expense?

Administrative expenses are all the expenses incurred in providing a service, excluding the cost of the service itself. In health insurance, administrative expenses are all the expenses not spent directly on health care. Often referred to as “overhead” or “bureaucracy,” they include all the costs of administering an insurance plan or program, including marketing, collecting premiums, billing, and actuarial consulting, as well as salaries, rent, taxes, fees, and other expenses. But how the government measures administrative expenses for the Medicare program differs significantly from the insurance industry definition.

What is Medicare ABD compared to?

In this section, we compare the public Medicare ABD with the private Medicare Part C data without delving into the differences in coverages. For public Medicare, the annual MBT reports produced by CMS are compared with the health insurers’ fully insured data. 2,3

How long did Medicare lose?

The public Medicare program suffered losses in 11 years during 2002-2018, whereas private insurers’ Medicare remained solvent with about an 85% loss ratio. Conclusions: Comparisons of the systems in the United States would benefit from expanding the focus beyond incomparable administrative expenses.

Is there a comparison between Medicare ABD and private insurance?

The scant academic literature on administrative expenses for health care coverage reinforces our main argument that the data sources are incompatible. In addition, there is no recent comparison of broad income and benefits trends between the governmental Medicare ABD and private insurance (Medicare Part C). The literature usually makes such comparisons for specific medical conditions, rather than for comprehensive coverage, and is not cited here. The most applicable research for comprehensive coverage is the comparison of Boccuti and Moon, who found for the period 1970-2000 that “Medicare can be counted on to control per enrollee spending growth over time, more than private insurers can” and that the benefits growth of the Medicare Part C of private insurance was higher than that of governmental Medicare. 4 They used governmental resources, not health insurers’ data directly. Our current recent data, from private insurers, show the reverse of Boccuti and Moon: Benefits growth of Medicare ABD exceeds that of private Medicare Part C.

Is administrative expense reconcilable?

First, administrative expenses are defined and calculated differently under the public Medicare and private insurance systems. These differences are not reconcilable. Second, administrative expenses are a flawed, narrow measure and are only a part of the larger context of income, benefits, losses/gains, and loss ratios.

What is Medicaid Administrative Claiming?

Title XIX of the Social Security Act (the Act) authorizes federal grants to states for a proportion of expenditures for medical assistance under an approved Medicaid state plan, and for expenditures necessary for administration of the state plan.

When did CMS provide FFP?

On July 13, 2015, CMS provided responses to general questions received on the subject of claiming Federal Financial Participation (FFP) for Medicaid administrative services. In order for Medicaid administrative expenditures to be claimed for federal matching funds, the following requirements must be met:

What is federal matching?

Federal matching funds under Medicaid are available for the cost of administrative activities that directly support efforts to identify and enroll potential eligibles into Medicaid and that directly support the provision of medical services covered under the state Medicaid plan.

Can Medicaid costs supplant funding?

Costs may not supplant funding obligations from other federal sources. Costs must be supported by adequate source documentation. For guidance on specific Medicaid administrative funding and claiming topics, please refer to the list below.

HCRIS Data Disclaimer

- The Centers for Medicare & Medicaid Services (CMS) has made a reasonable effort to ensure that the provided data/records/reports are up-to-date, accurate, complete, and comprehensive at the time of disclosure. This information reflects data as reported to the Healthcare Cost Report I…

New Cost Report Data Available

- * Due to being replaced by newer forms and an absence of updates, the HOSPICE-1999, SNF-1996 and RNL-1994 data files will no longer be updated.

Frequently Asked Questions

- There is a document available at the bottom of this page, the HCRIS FAQ, which answers some questions about HCRIS, the data files, and the cost reporting process.

Technical Assistance

- Free assistance to academic, government and non-profit researchers interested in using HCRIS data is available at : ResDAC, the Research Data Assistance Center.

Freedom of Information Act

- Individual cost reports may be requested from the Medicare Administrative contractors via the Freedom of Information Act (FOIA). For more information on this process, visit the FOIApage. Organization of data files: For the Hospital Form 2552-1996, Hospital Form 2552-2010 , SNF Form 2540-1996, SNF Form 2540-2010, HHA Form 1728-1994 and HHA Form 1728-2020 cost reports…