Once you are entitled to Medicare you are no longer allowed to continue on the employer ‘s group health plan (COBRA). If you have a spouse or any dependents, they may take advantage of COBRA for 36 months, but you will not. You are not able to have both Medicare and COBRA.

What happens to Cobra when you enroll in Medicare?

If your employees are already enrolled in COBRA when they age into Medicare, they should enroll in Medicare to avoid late fees. Their COBRA coverage may end at this time. If your employees have Medicare first and then become eligible for COBRA, they may decide to keep both coverage types.

Do spouses and dependents qualify for Cobra if they have Medicare?

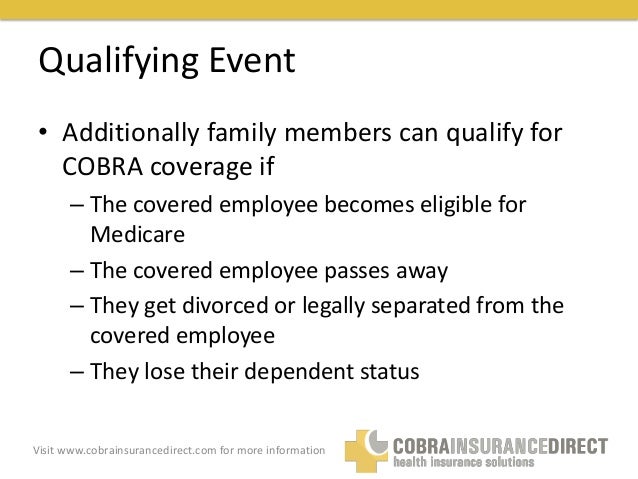

Some people may decide to keep their COBRA coverage along with Medicare in order to retain additional benefits offered through the employer’s health plan. Do spouses and dependents qualify for COBRA if they lose coverage when an employee ages into Medicare? Yes. Employee enrollment in Medicare is considered a qualifying event under COBRA.

Does Cobra cover employers with less than 20 employees?

In general, COBRA only applies to employers with 20 or more employees. However, some states require insurers covering employers with fewer than 20 employees to let you keep your coverage for a limited time.

Is Cobra more expensive than Medicare?

If the added surcharges for parts A or B apply to you, COBRA might actually be less expensive than Medicare. For example, if your income as an individual is greater than $500,000 or $750,000 as a married couple, you’ll pay the maximum $504.90 a month for Part B coverage.

Can my spouse go on COBRA If I go on Medicare?

Your spouse and dependents may keep COBRA for up to 36 months, regardless of whether you enroll in Medicare during that time. You may be able to keep COBRA coverage for services that Medicare does not cover.

Can you be on Medicare and COBRA at the same time?

If you become eligible and enroll in Medicare before COBRA, the good news is that you can have both. Taking COBRA is optional, and depending on your situation, you may or may not want to. If you do decide to take COBRA, do not drop your Medicare plan.

What happens to my dependents when I go on Medicare?

Medicare is individual insurance, not family insurance, and coverage usually does not include spouses and children. Unlike other types of insurance, Medicare is not offered to your family or dependents once you enroll. To get Medicare, each person must qualify on their own.

How does COBRA and Medicare work together?

If your Medicare benefits (Part A or Part B) become effective on or before the day you elect COBRA coverage, you can continue COBRA coverage as well as having Medicare. This is true even if your Part A benefits begin before you elect COBRA but you don't sign up for Part B until later.

Is COBRA primary or secondary to Medicare?

COBRA is always secondary to Medicare. This means that it only pays after Medicare pays. If you do not enroll in Medicare when you become eligible for it, it will be as if you have no insurance. If you have Medicare first and then become eligible for COBRA, you can enroll in COBRA.

Is Medicare entitlement A COBRA qualifying event?

Medicare entitlement of the employee is listed as a COBRA qualifying event; however, it is rarely a qualifying event. In situations where it is a qualifying event, it is only a qualifying event for the spouse or children that are covered under the group health plan.

Can you claim someone as a dependent if they are on Medicare?

No. Medicare does not provide coverage for dependents. Dependents must be individually eligible in order to have Medicare coverage. This provision, therefore, does not apply to Medicare.

Who can be dependent on Medicare?

Medicare is individual insurance and does not provide coverage for your spouse or children. Medicare is federal health insurance for individuals age 65 and older and younger people who have a disability or end-stage renal disease (ESRD). Your spouse or children must qualify on their own to receive Medicare coverage.

What is a Medicare Dependent plan?

The Medicare-Dependent, Small Rural Hospital (MDH) program was established by Congress in 1990 with the intent of supporting small rural hospitals for which Medicare patients make up a significant percentage of inpatient days or discharges.

What happens if I turn 65 while on COBRA?

The risks in electing COBRA at 65 or older include missing Medicare Part B enrollment deadlines and paying premium penalties, having a gap in medical coverage and being responsible for large medical bills you didn't anticipate.

Is COBRA creditable coverage for Medicare Part B?

Is COBRA creditable coverage for Medicare Part B? COBRA is NOT creditable coverage for Part B. If you delay enrollment, you'll face lifetime penalties.

Can you drop a dependent from COBRA?

(When a triggering event results in a loss of coverage, it is called a COBRA “qualifying event.”) But an employee might drop a spouse or dependent from coverage for other reasons—for example, because the spouse or dependent has enrolled in another employer's health plan.

What happens if you enroll in Cobra?

This means that if your employees enroll in COBRA instead of Medicare, once COBRA coverage ends, they will have to wait until the next annual enrollment period to enroll in Medicare, and they will have to pay late penalties. The late penalties are not minor, either. For Medicare Part B, for example, the monthly premium goes up 10 percent ...

What is the cobra law?

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, is a federal law that requires employers to offer health care continuation to covered employees, their spouses and their dependents after a qualifying event. Enrollees can be required to pay 102 percent of premium costs, which includes the full premium and a 2 percent administrative fee.

How much does Medicare Part B premium go up?

For Medicare Part B, for example, the monthly premium goes up 10 percent for every 12-month period enrollment was delayed. Enrollees have to pay this penalty for the rest of their lives. If your employees are trying to decide between COBRA and Medicare, make sure they understand that they must enroll in Medicare if they want to avoid expensive ...

How to contact CMS about Medicare?

Your employees can contact the CMS Benefits Coordination & Recovery Center at 1-855-798-2627 with questions about Medicare and COBRA. As always, do your best!

Is Medicare the primary insurance?

If someone is enrolled in both COBRA and Medicare, Medicare is the primary insurance. In other words, Medicare pays first, and COBRA may pay some of the costs not covered by Medicare.

Is Medicare a qualifying event?

Yes. Employee enrollment in Medicare is considered a qualifying event under COBRA. Imagine this scenario: One of your employees turns 65 and ages into Medicare, but he’s not ready to retire yet. He keeps working. Now he has two health plan options: his group health plan and Medicare.

Is Cobra confusing?

COBRA administration can be confusing in the best of times. When you add complicating factors, it can seem downright baffling. Take COBRA and Medicare. Dealing with one can be a challenge – but what if your employees are dealing with both? Here’s how COBRA and Medicare interact.

How long do you have to take Cobra after leaving a job?

Once you leave your job, you have at least 60 days to decide whether to take COBRA coverage. If you’re not already enrolled in Medicare Part B, you’ll have 8 months after leaving your job to enroll. You can use this window of time to weigh your options.

How long can you keep Cobra insurance?

Under COBRA, you’re able to stay with your former employer’s health plan, even if you’re no longer employed. You can keep COBRA coverage for 18 or 36 months, depending on your situation.

How much is Medicare Part B in 2021?

Medicare Part B is medical coverage, and most people pay the standard premium amount for it. In 2021, this amount is $148.50. So, for most people, Medicare will be less expensive unless their COBRA coverage has a premium that’s lower than $148.50.

When does Cobra end?

So, if you leave your job at age 64 and enroll in COBRA, your COBRA coverage will end when you turn 65 years old and enroll in Medicare.

How long can you keep your cobra?

COBRA allows you to keep your former employer’s health insurance plan for up to 36 months after you leave a job.

What are the two types of reimbursement for healthcare professinoal?

If you have more than one type of insurance coverage, the reimbursement to healthcare professinoal is divided into two types: primary and secondary. This is based on which insurance pays first and which pays second.

Does Cobra include Medicare?

Your COBRA plan will likely include coverage for medications but you’ll be responsible for paying the entire premium amount. Medicare Part D plans are available at a wide variety of premiums. You can choose a plan that fits your needs and budget.

What is Cobra coverage?

This section provides information about COBRA continuation coverage requirements that apply to state and local government employers that maintain group health plan coverage for their employees. Group health plan coverage for state and local government employees is sometimes referred to as “public sector” COBRA to distinguish it from the requirements that apply to private employers. The landmark COBRA continuation coverage provisions became law in 1986. The law amended the Employee Retirement Income Security Act of 1974 (ERISA), the Internal Revenue Code and the Public Health Service Act (PHS Act) to provide continuation of employer-sponsored group health plan coverage that is terminated for specified reasons. CMS has jurisdiction to interpret and administer the COBRA law as it applies to state and local government (public sector) employers and their group health plans. Individuals who believe their COBRA rights are being violated have a private right of action. The COBRA law only applies to group health plans maintained by employers with 20 or more employees in the prior year. In addition, the law does not apply to plans sponsored by the governments of the District of Columbia or any territory or possession of the United States, certain church-related organizations, or the federal government. (The Federal Employees Health Benefit Program is subject to generally similar requirements to provide temporary continuation of coverage (TCC) under the Federal Employees Health Benefits Amendments Act of 1988.)

What is the burden of Cobra?

The law plainly places the burden of informing individuals of their COBRA rights on group health plans sponsored by state or local government employers. (Either the employer or plan administrator must provide an initial notice of COBRA rights when an individual commences coverage under the plan and again following a COBRA qualifying event.) A notice of COBRA "rights" must address all of the requirements for which an individual is responsible in order to elect and maintain COBRA continuation coverage for the maximum period. A plan cannot hold an individual responsible for COBRA-related requirements when the plan fails to meet its statutory obligation to inform an individual of those requirements.

What is Section 3001 of ARRA?

Specific Provisions: Section 3001 of ARRA provides a subsidy to all involuntarily terminated workers and their dependents covering 65 percent of the cost of COBRA premiums under ERISA and the PHS Act; continuation coverage for federal employees; and State continuation coverage premiums, if the state continuation coverage is comparable to COBRA. Originally, premium assistance under ARRA was available if the employee became eligible for continuation coverage as the result of an involuntary termination that occurred during the period from September 1, 2008 through December 31, 2009 and the employee or family member elected continuation coverage.

How long does it take to notify Cobra of a disability?

The plan cannot require an individual who receives a disability determination under the Social Security Act before experiencing a COBRA qualifying event that is the covered employee's termination, or reduction of hours, of employment to notify the plan of the determination within 60 days of the determination because that requirement expressly applies to a "qualified beneficiary." An individual whose disability determination is issued before the COBRA qualifying event is not a "qualified beneficiary" at the time the disability determination is issued.

What are the second qualifying events for Medicare?

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.

What is a qualified beneficiary?

Qualified beneficiaries are generally entitled to continue the same coverage they had immediately before the qualifying event, under the same rules. For example, changes in the benefits that apply to active employees will apply, as well as catastrophic and other benefit limits.

How long is a premium due for a health insurance plan?

After you make the initial premium payment, subsequent premiums (usually paid on a monthly basis) are considered to be timely if made by the date due or within a grace period of 30 days after the date due (or longer period as applies to or under the plan). Payment is considered to be made on the date it is sent to the plan.

What is a cobra?

COBRA identifies seven events as qualifying events that trigger an obligation to offer COBRA coverage if they would result in a loss of group health plan coverage. An employee’s Medicare entitlement is one of these seven events. If an employee would lose group health plan coverage due to his or her Medicare entitlement, a group health plan would be required to offer COBRA coverage to the employee’s covered spouse and dependent children. A covered employee is entitled to Medicare when he or she is eligible for Medicare and actually enrolled in the Medicare program.

How long does a spouse have to be on Cobra?

If the employee’s Medicare entitlement begins on the same day that the employee terminates employment or retires, the employee’s covered spouse and dependents are not eligible for this extension and their maximum COBRA period would remain at 18 months.

How long does Medicare coverage last for a second qualifying event?

In order for a second qualifying event to extend the maximum coverage period to 36 months, the second qualifying event must be an event that would have resulted in a loss of coverage under the health plan, in the absence of the first qualifying event. According to Internal Revenue Service (IRS) Revenue Ruling 2004-22, an employee’s Medicare entitlement is not a second qualifying event for a qualified beneficiary unless the Medicare entitlement itself would have caused a loss of coverage for the qualified beneficiary under the group health plan.

What is the primary payer for Medicare?

A “primary payer” pays what it owes on benefit claims first, up to the limits of its coverage. The “secondary payer” only pays if there are covered costs that the primary payer did not cover. The following chart addresses Medicare’s coordination of benefits rules for COBRA coverage:

When does an employee have to be entitled to Medicare?

An employee must be entitled to Medicare before his or her termination or retirement date in order for this special extension of COBRA coverage to apply to the employee’s covered spouse and dependents.

Is Medicare a COBRA?

An employee’s entitlement to Medicare is a COBRA qualifying event ONLY IF it would result in the loss of group health plan coverage. Most group health plans that are subject to COBRA are prohibited from terminating an employee’s group health coverage due to the employee’s Medicare entitlement. This prohibition comes from the MSP law, which bars most group health plans from “taking into account” a current employee’s (or family member’s) Medicare entitlement.

Can you get Cobra if you have Medicare?

A qualified beneficiary who becomes entitled to Medicare before electing COBRA is still eligible for COBRA. But, COBRA coverage may be terminated early if a qualified beneficiary becomes entitled to Medicare after electing COBRA.

How long is Cobra coverage?

In certain circumstances, if a disabled individual and non-disabled family members are qualified beneficiaries, they are eligible for up to an 11-month extension of COBRA continuation coverage, for a total of 29 months. The criteria for this 11-month disability extension is a complex area of COBRA law. We provide general information below, but if you have any questions regarding your disability and public sector COBRA, we encourage you to email us at [email protected].

What is a Cobra notice?

A notice of COBRA rights generally includes the following information: A written explanation of the procedures for electing COBRA, The date by which the election must be made, How to notify the plan administrator of the election, The date COBRA coverage will begin, The maximum period of continuation coverage, The monthly premium amount,

How long does it take to get a Cobra notice?

Separate requirements apply to the employer and the group health plan administrator. An employer that is subject to COBRA requirements is required to notify its group health plan administrator within 30 days after an employee’s employment is terminated, or employment hours are reduced. Within 14 days of that notification, the plan administrator is required to notify the individual of his or her COBRA rights. If the employer also is the plan administrator and issues COBRA notices directly, the employer has the entire 44-day period in which to issue a COBRA election notice.

How long do you have to notify Cobra?

Qualified beneficiaries must be given an election period of at least 60 days during which each qualified beneficiary may choose whether to elect COBRA coverage.

What is the COBRA requirement?

Title XXII of the Public Health Service (PHS) Act, 42 U.S.C. §§ 300bb-1 through 300bb-8, applies COBRA requirements to group health plans that are sponsored by state or local government employers. It is sometimes referred to as “public sector” COBRA to distinguish it from the ERISA and Internal Revenue Code requirements ...

How long does an employer have to issue a Cobra election notice?

If the employer also is the plan administrator and issues COBRA notices directly, the employer has the entire 44-day period in which to issue a COBRA election notice.

How long does a dependent have to notify the employer of a qualifying event?

If you become divorced or legally separated from the covered employee, or if a dependent child no longer meets the requirement to be a covered dependent (usually by reaching a specified age), the covered employee or qualified beneficiary is responsible for notifying the plan administrator of the qualifying event within 60 days after the date of the qualifying event .

What is COBRA group health plan?

Under COBRA, group health plans must provide covered employees and their families with specific notices explaining their COBRA rights. Plans must also have procedures for how COBRA continuation coverage is offered, how qualified beneficiaries may elect continuation coverage, and when it can be terminated.

Who administers Cobra?

COBRA continuation coverage laws are administered by several agencies. The Departments of Labor and the Treasury have jurisdiction over private-sector group health plans. The Department of Health and Human Services administers the continuation coverage law as it applies to state and local government health plans.

How to contact COBRA?

Or contact the Employee Benefits Security Administration electronically or call toll free 1-866-444-3272.

How long can you extend Medicare coverage?

An 18-month extension may be available to a qualified beneficiary while receiving an 18-month maximum period of continuation coverage (giving a total maximum period of 36 months of continuation coverage) if the qualified beneficiary experiences a second qualifying event, for example, death of a covered employee, divorce or legal separation of the covered employee and spouse, Medicare entitlement (in certain circumstances), or loss of dependent child status under the plan. The second event can be a second qualifying event only if it would have caused the qualified beneficiary to lose coverage under the plan in the absence of the first qualifying event.

What is continuation coverage?

The continuation coverage must be identi cal to the coverage currently available under the plan to similarly situated active employees and their families. (Generally, this is the same coverage that you had immediately before the qualifying event.) You must receive the same benefits, choices, and services that a similarly situated participant or beneficiary currently receives under the plan, such as the right during an open enrollment season to choose among available coverage options. You are also subject to the same rules and limits that would apply to a similarly situated participant or beneficiary, such as co-payment requirements, deductibles, and coverage limits. The plan’s rules for filing benefit claims and appealing any claims denials also apply.

How long does Cobra coverage last?

COBRA requires that continuation coverage extend from the date of the qualifying event for a limited period of 18 or 36 months. The length of time for which continuation coverage must be made available (the “maximum period” of continuation coverage) depends on the type of qualifying event. A plan, however, may provide longer periods of coverage beyond the maximum period required by law.

What is group health coverage?

group health plan must offer continuation coverage if a qualifying event occurs. The employer, employee or beneficiary must notify the group health plan of the qualifying event, and the plan is not required to act until it receives an appropriate notice. Who must give notice depends on the type of qualifying event.

How long is John eligible for Cobra?

John is eligible for 18 months of COBRA coverage.

What happens if you terminate Cobra?

If COBRA is terminated early because of entitlement to Medicare, employer’s must send an early termination notice to the qualified beneficiary who is affected.

How long is Cobra coverage for spouse?

If coverage for the retiree is terminated as a result of their Medicare entitlement, the covered spouse and children would be eligible for up to 36 months of COBRA coverage on the retiree plan.

How long does a spouse have to be on Cobra?

he/she retires) or experiences a reduction in hours shortly after becoming entitled to Medicare, the covered spouse and children are eligible for 36 months of COBRA coverage less the number of months the employee has been entitled to Medicare (but not less than 18 months of coverage). This is best illustrated with an example:

How long does Cobra last?

Generally, termination of employment or reduction in hours results in a maximum COBRA coverage period of 18 months for those covered on the group health plan at the time of the event, but there are special rules when either event occurs shortly after an employee becomes entitled to Medicare. These rules extend the maximum coverage period ...

When does John retire from XYZ?

John becomes entitled to Medicare on July 1st. John and Jill also remain covered under the group health plan offered by XYZ Company. On January 1st (6 months later), John retires and therefore John and Jill both experience a termination of employment qualifying event. John is eligible for 18 months of COBRA coverage.

Does XYZ Company offer Cobra to Jill?

Does XYZ Company have to offer COBRA to Jill? No. John voluntarily dropped coverage under the group health plan. XYZ Company did not, and is prohibited from, changing John’s eligibility for coverage under the group health plan because he enrolled in Medicare.

How much do dependents pay for Cobra?

They will have the same benefits as they had before you dropped out of the plan. If your employer has 20 or more employees and is subject to Federal COBRA laws, your dependents will pay 102 percent of the total cost of their coverage If your employer is subject to California laws and has between 2 to 19 employees your dependents will be able to continue their coverage under Cal-COBRA, but they must pay 110 percent of the monthly insurance cost.

Can dependents continue Medicare without employer?

What this means is that if you, the employee, choose to enroll in Medicare and terminate your employer-sponsored plan , then any dependents enrolled in the company plan will be able to continue their coverage without you.

Is Cobra based on age?

Here is an interesting twist on the cost of COBRA or Cal-COBRA: the premium for your dependents is based on the age of the spouse or child who continues on the plan. So, if your spouse is much younger, and your group health plan uses age bands to set the monthly premium, your spouse’s coverage may be significantly less expensive than the premium for you as an employee at age 64 or 65. You’ll need to speak with the person in your company who handles the benefits to get the answer to this question.

Who administers Cobra?

The Departments of Labor and Treasury have jurisdiction over private-sector group health plans. The Department of Health and Human Services administers the continuation coverage law as it applies to state and local governmental health plans.

How long do you have to be covered by Cobra?

Your COBRA rights must be described in the plan's Summary Plan Description (SPD), which you should receive within 90 days after you first become a participant in the plan. In addition, group health plans must give each employee and spouse who becomes covered under the plan a general notice describing COBRA rights, also provided within the first 90 days of coverage.

What is FMLA coverage?

The Family and Medical Leave Act (FMLA) requires an employer to maintain coverage under any group health plan for an employee on FMLA leave under the same conditions coverage would have been provided if the employee had continued working. Coverage provided under the FMLA is not COBRA coverage, and taking FMLA leave is not a qualifying event under COBRA. A COBRA qualifying event may occur, however, when an employer's obligation to maintain health benefits under FMLA ceases, such as when an employee taking FMLA leave decides not to return to work and notifies an employer of his or her intent not to return to work. Further information on the FMLA is available on the Website of the U. S. Department of Labor's Wage and Hour Division at dol.gov/whd or by calling toll-free 1-866-487-9243.

How long can a spouse continue Cobra?

A covered employee's spouse who would lose coverage due to a divorce may elect continuation coverage under the plan for a maximum of 36 months. A qualified beneficiary must notify the plan administrator of a qualifying event within 60 days after divorce or legal separation. After being notified of a divorce, the plan administrator must give notice, generally within 14 days, to the qualified beneficiary of the right to elect COBRA continuation coverage.

What is continuation coverage?

If you elect continuation coverage, the coverage you are given must be identical to the coverage currently available under the plan to similarly situated active employees and their families (generally, this is the same coverage that you had immediately before the qualifying event). You will also be entitled, while receiving continuation coverage, to the same benefits, choices, and services that a similarly situated participant or beneficiary is currently receiving under the plan, such as the right during open enrollment season to choose among available coverage options. You will also be subject to the same rules and limits that would apply to a similarly situated participant or beneficiary, such as co-payment requirements, deductibles, and coverage limits. The plan's rules for filing benefit claims and appealing any claims denials also apply.

What is the law for cobra?

The law generally applies to all group health plans maintained by private-sector employers with 20 or more employees, or by state or local governments. The law does not apply to plans sponsored by the Federal Government or by churches and certain church-related organizations. In addition, many states have laws similar to COBRA, including those that apply to health insurers of employers with less than 20 employees (sometimes called mini-COBRA). Check with your state insurance commissioner's office to see if such coverage is available to you.

Can you use the Health Coverage Tax Credit for Cobra?

The Health Coverage Tax Credit (HCTC), while available, may be used to pay for specified types of health insurance coverage ( including COBRA continuation coverage).

Table of Contents

Background

- This section provides information about COBRA continuation coverage requirements that apply to state and local government employers that maintain group health plan coverage for their employees. Group health plan coverage for state and local government employees is sometimes referred to as “public sector” COBRA to distinguish it from the requirements that apply to private …

Premium Assistance

- In General.Despite the fact that COBRA and State "mini-COBRA" laws may make continuation coverage available to employees who lose their jobs, as well as their dependents (qualified beneficiaries), many unemployed individuals and family members cannot afford the cost of the continuation coverage. These individuals may qualify for a subsidy under the...

Covered Benefits

- Federal COBRA requirements only apply to employment-related group health plan coverage. They do not apply to individual or association health insurance policies, and they do not apply to any non-health benefits through the employer, such as life insurance. Qualified beneficiaries are generally entitled to continue the same coverage they had immediately before the qualifying eve…

Periods of Coverage

- In most cases, COBRA coverage for the covered employee lasts a maximum of 18 months. However, the following exceptions apply: 29-Month Period (Disability Extension):Special rules apply for certain disabled individuals and family members. If a qualified beneficiary is determined to be entitled to disability benefits under Titles II or XVI of the Social Security Act, and is disable…

Shortened Periods of Coverage

- Continuation coverage generally begins on the date of the qualifying event and ends at the end of the maximum period. However, a period of coverage may end earlier if: 1. an individual does not pay premiums on a timely basis. 2. the employer ceases to maintain any group health plan. 3. after the COBRA election, an individual obtains coverage with another employer group health pla…

Notices Required of Qualified Beneficiaries

- An employee or qualified beneficiary must notify the plan administrator of a qualifying event within 60 days after divorce (or legal separation if that results in loss of plan coverage) or a child's ceasing to be covered as a dependent under the plan's rules. Also, a qualified beneficiary must notify the plan administrator within 60 days of those events when they occur during the initial 1…

Paying For Coverage

- Group health coverage for COBRA participants is usually more expensive than health coverage for active employees, since usually the employer pays a part of the premium for active employees while COBRA participants generally pay the entire premium themselves. COBRA coverage may be less expensive, though, than individual health coverage. Premiums for COBRA continuation cove…

Other Coverage Considerations

- In deciding whether to elect COBRA continuation coverage, you should consider all your health care options. 1. For instance, one option that may be available is "special enrollment" in a group health plan sponsored by a spouse's employer, if enrollment is requested within 30 days of loss of your health coverage. (If you decide to elect COBRA coverage under your plan, special enrollmen…

Contact Information

- If you are unable to find the COBRA-related information you are looking for on this Website, you may e-mail us at [email protected]. Below are other sources of information about continuation coverage benefits, and subsidies and other rights under ARRA. 1. Centers for Medicare & Medicaid Services (CMS). For assistance with questions regarding premium assistance for conti…