Types of Medicare coverage in Connecticut Original Medicare, Part A and Part B, is offered and administered by the federal government. Medicare Part A provides inpatient hospital care while Part B covers physician visits, medical supplies, and medically necessary durable medical equipment.

What are the different types of Medicare plans in Connecticut?

Sep 16, 2018 · Original Medicare, Part A and Part B, is offered and administered by the federal government. Medicare Part A provides inpatient hospital care while Part B covers physician …

Do you qualify for Medicare savings programs in Connecticut?

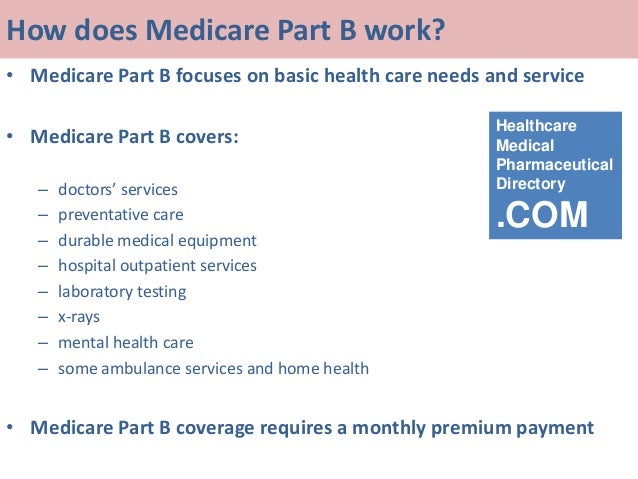

Sep 11, 2014 · Medicare Part B helps cover medically-necessary services like doctors’ services and tests, outpatient care, home health services, durable medical equipment, and other medical …

What does Medicare Part B cover?

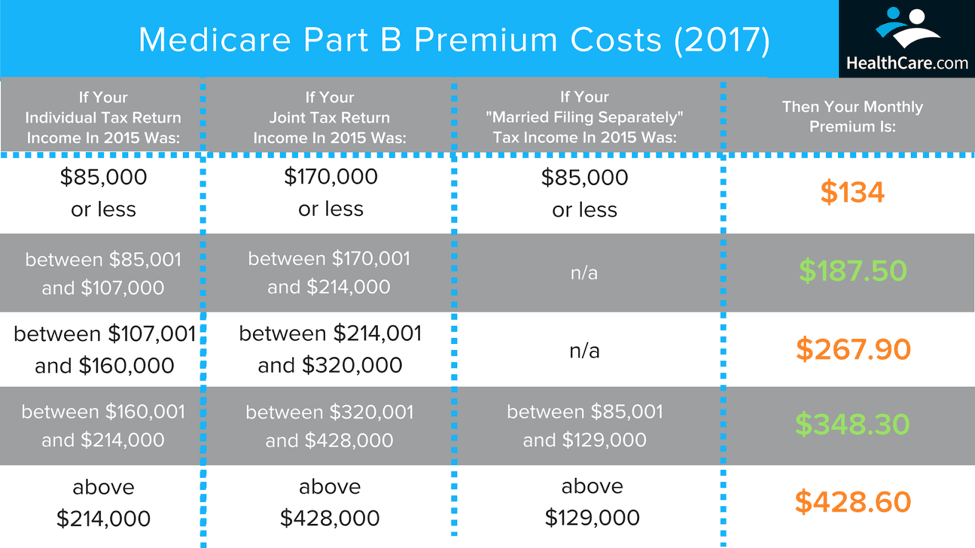

Apr 16, 2021 · The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your …

What services are covered under Part B?

Excess Part B charges (some plans) Foreign travel emergency costs (some plans) Covers: All Original Medicare services (Part A hospital and Part B medical insurance) Often, Part D …

What does CT Husky D cover?

What services are usually provided under Part B of Medicare?

- Services from doctors and other health care providers.

- Outpatient care.

- Home health care.

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many preventive services (like screenings, shots or vaccines, and yearly “Wellness” visits)

What does Medicare Plan B offer?

Is Medicare Part B an HMO?

You must have both Parts A and B to join a Medicare HMO. Generally you will continue paying your Medicare Part B premium, though some HMOs will pay part of this premium. Some HMOs may charge an additional premium, on top of your Part B premium.

Which of the following is not covered by Medicare Part B?

Does Medicare Part B pay for prescriptions?

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is Medicare type C?

Will Medicaid pay for my Medicare Part B premium?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What is the difference between HMO and health insurance?

What is an EPO plan vs HMO?

About Medicare in Connecticut

Medicare beneficiaries in Connecticut may choose to enroll in Original Medicare, Part A and Part B, and enhance that coverage with a Medicare Presc...

Types of Medicare Coverage in Connecticut

Original Medicare, Part A and Part B, is offered and administered by the federal government. Medicare Part A provides inpatient hospital care while...

Local Resources For Medicare in Connecticut

Medicare Savings Programs in Connecticut: If your income is below the state-established limit, then you may qualify for additional Medicare savings...

How to Apply For Medicare in Connecticut

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years.In Connecticut,...

Does Connecticut have Medicare?

About Medicare in Connecticut. Medicare beneficiaries in Connecticut may choose to enroll in Original Medicare, Part A and Part B, and enhance that coverage with a Medicare Prescription Drug Plan and/or Medicare Supplement insurance. Alternatively, they may decide to receive all of their benefits through a Medicare Advantage plan.

How long do you have to be a resident to qualify for medicare in Connecticut?

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years. In Connecticut, those who receive benefits through Social Security or the Railroad Retirement Board may be automatically enrolled in Original Medicare, Part A and Part B a few months prior to reaching age 65. ...

How many Medigap policies are there in Connecticut?

Most states, including Connecticut, offer up to 10 standardized Medigap policy options, each labeled with a letter. All plans of the same letter offer the same benefits, no matter which insurance company offers the plan.

What is Medicare Part D?

Plan cost and availability may vary by county. Medicare Part D is prescription drug coverage for beneficiaries looking to have their prescription medications covered. One option is to get this coverage through a stand-alone Medicare Prescription Drug Plan, which works alongside Original Medicare, Part A and Part B.

What is Medicare Supplement Insurance?

Medicare Supplement insurance, also called Medigap, covers “gaps” in Original Medicare coverage such as deductibles, copayments, coinsurance, and other out-of-pocket costs, such as emergency overseas health coverage. Most states, including Connecticut, offer up to 10 standardized Medigap policy options, each labeled with a letter.

How long do you have to be on Medicare to get a disability?

People with disabilities are eligible to enroll before age 65 and are enrolled once they have received Social Security disability benefits (or certain Railroad Retirement Board disability benefits) for 24 months straight; those who are eligible for Medicare due to disability are automatically enrolled in the 25 th month.

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much is the 2021 Medicare premium?

The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Keep reading for answers to all your questions about Medicare in Connecticut

Reviewed by: Malinda Cannon, Licensed Insurance Agent. Written by: Bryan Strickland.

Key Takeaways

Original Medicare Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). in Connecticut is an option at age 65.

Who is Eligible for Medicare in CT?

If you’re a U.S. citizen and are age 65 or older, you qualify for Medicare in Connecticut. It’s as simple as that.

What is the Income Limit for Medicaid in Connecticut?

Each state has its own plan for administering Medicaid, a federal/state program founded alongside Medicare in 1965 that helps those facing a financial need and/or disability regardless of age. The state of Connecticut calls its Medicaid services HUSKY Health. Each program within HUSKY Health has its own income limits for eligibility.

Do Seniors Have to Pay for Medicare?

Seniors aren’t required to enroll in Medicare. But typically, it does make sense to enroll in Part A at age 65 because most people don’t have to pay for coverage, and sometimes it makes sense to enroll in Part B at age 65 to avoid having to pay more in the future.

What are the Different Medicare Plans Available?

In the case of Original Medicare in Connecticut, there’s only one plan — Parts A and B, which does open the option to add Part D and Medigap coverage from private insurance companies.

What is the Best Medicare Advantage Plan in CT?

Medicare Advantage and Original Medicare have different coverage areas and costs. While Original Medicare can be used nationwide, Medicare Advantage is usually limited to a network of providers in your area. The limited network allows Medicare Advantage in Connecticut to often offer more affordable options.

Can you choose Medicare Advantage in Connecticut?

In Connecticut, you can only choose between Medicare Advantage Plans that are offered in your county. Fortunately, every county in the state has a broad choice of plans so you can select one to suit your health care needs and budget.

How many Medicare Advantage Plans are there in Connecticut?

Many plans also provide prescription drug coverage, or Medicare Part D. In 2019, there were 28 Medicare Advantage Plans available in Connecticut. 34% of the total Medicare population in Connecticut was enrolled in Medicare Advantage Plans as of 2018. In 2018, Original Medicare spent an average of $10,729 per beneficiary in Connecticut, ...

How many types of Medicare are there in Connecticut?

There are four main types of plans available through the Connecticut Medicare Advantage program. Each type of plan has different levels of coverage, premiums, and restrictions. At a minimum, each one must offer the same coverage as Original Medicare, although many include prescription drug coverage and various other benefits.

What is HMO in Medicare?

Health Maintenance Organizations (HMO) HMOs are typically the least expensive type of Medicare Advantage Plan available. However, these plans also have more restrictions. You must use the HMO’s in-network health care providers and choose a primary care physician.

What is the least expensive Medicare Advantage Plan?

You must use the HMO’s in-network health care providers and choose a primary care physician. You also need to get a referral from your PCP to see a specialist. Many Medicare Advantage HMO plans include extra benefits, such as vision and dental coverage, hearing care and fitness programs. Some HMO plans also provide prescription drug coverage, while others require you to pay the premium for Medicare Part B.

What is Medicare Advantage PPO?

Medicare Advantage PPOs give you greater flexibility about your health care choices compared to HMOs. You won’t need to choose a primary care physician or obtain a referral from your PCP to see a specialist. You can use the Medicare Advantage PPO’s in-network providers to save money on your health care costs. You can see out-of-network providers when you want, although you may pay higher fees to do so. Many PPO plans offer prescription drug coverage and most offer benefits similar to HMO plans.

What is a SNP plan?

Special Needs Plans (SNP) These plans are designed for specific groups with certain conditions in common, such as individuals eligible for Medicare and Medicaid or living in an institutional nursing home setting, or those suffering from AIDS, cancer, or End-Stage Renal Disease (ESRD) or other chronic conditions.

What is Medicare Part B?

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider (i.e. vaccines, injections, infusions, nebulizers, etc.), or through medical equipment at home. Examples of drugs covered under Medicare Part B include: 1 Injections for osteoporosis 2 Some transplant medications 3 Immunosuppressants 4 End-stage renal disease (ESRD) medications 5 Flu, pneumonia, and Hepatitis B shots

What does Part B cover?

This part pays for things like doctor visits, lab tests, and home health care. Part B also covers certain medications and durable medical equipment like diabetic test strips, nebulizers, and wheelchairs. You can get your Part B medical coverage through your former employer, through a standalone plan, or directly from Medicare.

What items are covered by Medicare Part B and not Part D?

Items that may be covered by Medicare Part B, and not Part D: Certain medications (commonly referred to as Part B drugs) Durable medical equipment (wheelchairs, diabetic test strips, nebulizers, etc.) Specialty pharmacy. Mail-order pharmacy.

What is Part B insurance?

Part B is your medical coverage. This part pays for things like doctor visits, lab tests, and home health care. Part B also covers certain medications and durable medical equipment like diabetic test strips, nebulizers, and wheelchairs. You can get your Part B medical coverage through your former employer, through a standalone plan, ...

Can a pharmacy bill Medicare?

Many retail pharmacies cannot bill a medical plan for Medicare medical prescriptions (commonly referred to as Part B drugs) or medical equipment. If you need Part B drugs or medical equipment, ask if your pharmacy is able to bill your medical plan directly. Or, consider using these types of specialty service providers:

Does Medicare cover osteoporosis?

Some transplant medications. Immunosuppressants. End-stage renal disease (ESRD) medications. Flu, pneumonia, and Hepatitis B shots. Medicare Part D may cover medications that aren’t covered under Part B, and vice versa. When you choose a Medicare plan, make sure it will cover your current medications.

Does Medicare cover B or D?

Medicare Part D may cover medications that aren’t covered under Part B, and vice versa. When you choose a Medicare plan, make sure it will cover your current medications.

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Does Medigap Plan A include the same benefits as Medigap Plan A?

In other words, Medigap Plan A sold by one company will include the same essential benefits as Medigap Plan A sold by any other insurance company. Their costs and the availability of the types of plans, however, may vary.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is coinsurance in Medicare?

The amount you must pay for health care or prescriptions before Original Medicare, your pre scription drug plan, or your other insurance begins to pay. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%). apply.

Does Medicare pay for chronic care?

Chronic care management services. Medicare may pay for a health care provider’s help to manage chronic conditions if you have 2 or more serious chronic conditions that are expected to last at least a year.

Does Medicare pay monthly fees?

Your costs in Original Medicare. You may pay a monthly fee, and the Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. and.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. and. coinsurance. An amount you may be required to pay as your share of the cost for services after you pay any deductibles.

Do you have to pay a monthly fee for Medicare?

You may pay a monthly fee, and the Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. and. coinsurance.