State Medicaid agencies have legal obligations to pay Medicare cost-sharing for most "dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance. Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1]

Who pays Medicare cost-sharing for dual eligibility?

State Medicaid agencies have legal obligations to pay Medicare cost-sharing for most "dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance. Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1]

What is a dually eligible Medicare beneficiary?

“Dually eligible beneficiaries” generally describes beneficiaries enrolled in Medicare and Medicaid. The term includes beneficiaries enrolled in Medicare Part A and/or Part B and getting full Medicaid benefits and/or assistance with Medicare premiums or cost sharing through the Medicare Savings Program (MSP):

What happens to dually eligible beneficiaries if there is no cost-sharing payment?

To the extent they are unwilling to serve dually eligible beneficiaries if there is small or no cost-sharing payment from their state, dually eligible beneficiaries will have greater difficulty getting access to needed health care. Advocates can work with their states to increase the state’s cost-sharing payment to the full Medicare rate.

What are the state's obligations to dual eligibility eligible for Medicaid?

For non-QMB dual eligibles, [3] the state's obligation, according to guidance issued by CMS in 2007, is to pay up to the Medicaid rate for Medicaid services "rendered by Medicaid providers" in excess of any third-party liability (such as that of traditional Medicare or an MA plan). [4]

What does it mean if a Medicare patient is dual eligible?

Dually eligible beneficiaries are people enrolled in both Medicare and Medicaid who are eligible by virtue of their age or disability and low incomes.

What plan provides both Medicare and Medicaid coverage to certain eligible beneficiaries?

Some people qualify for both Medicare and Medicaid and are called “dual eligibles.” If you have Medicare and full Medicaid coverage, most of your health care costs are likely covered. You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan.

What is a partial dual eligible?

These enrollees are commonly broken into two groups: full-benefit dual-eligibles – who have Medicare but also receive benefits under Medicaid. partial duals – who have Medicare but qualify to have Medicaid help pay for expenses such as Medicare premiums and/or cost-sharing.

Do beneficiaries under Original Medicare have cost sharing?

Medicare benefits include substantial cost-sharing as well as no limit on out-of-pocket costs for covered services. For example, beneficiaries pay $1,300 each time they are hospitalized and pay 20 percent of bills for physician care. Beneficiaries also pay a premium for Part B medical services of $1,600 a year.

What crossover plan provides Medicare and Medicaid?

Health Insurance Chapter 14, 15QuestionAnswerA denial of otherwise covered services that were found to be not "reasonable and necessary"medical necessity denialA plan that provides both medicare and medicaid coverage to certain eligible beneficiariesmedicare-medicaid crossover38 more rows

Can you have Medicare and Medicaid at the same time?

Yes. A person can be eligible for both Medicaid and Medicare and receive benefits from both programs at the same time.

What is United Healthcare Dual Complete?

A UnitedHealthcare Dual Complete plan is a DSNP that provides health benefits for people who are “dually-eligible,” meaning they qualify for both Medicare and Medicaid. Who qualifies? Anyone who meets the eligibility criteria for both Medicare and Medicaid is qualified to enroll in a DSNP.

What is a dual SNP plan?

Dual Eligible Special Needs Plans (D-SNPs) enroll individuals who are entitled to both Medicare (title XVIII) and medical assistance from a state plan under Medicaid (title XIX). States cover some Medicare costs, depending on the state and the individual's eligibility.

Which is the special group that requires states to pay Medicare Part B premiums for individuals with incomes between 100 and 120 percent of the federal poverty level?

New legislation required state Medicaid programs to cover premiums of the new Specified Low-Income Medicare Beneficiary (SLMB) eligibility group – those eligible for Medicare with incomes between 100 and 120 percent of the federal poverty level.

What is Medicare cost sharing?

The share of costs covered by your insurance that you pay out of your own pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn't include premiums, balance billing amounts for non-network providers, or the cost of non-covered services.

Can you have Medicare and Medicare Advantage at the same time?

In most cases, yes. If you're planning to join a PPO and you want Medicare drug coverage (Part D), you must join a PPO plan that offers Medicare drug coverage. If you join a PPO plan without drug coverage, you can't join a separate Medicare drug plan.

What does QMB mean on Medicare?

Qualified Medicare BeneficiarySPOTLIGHT & RELEASES. The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

What is dual eligible?

Definition: Dual Eligible. To be considered dually eligible, persons must be enrolled in Medicare Part A, which is hospital insurance, and / or Medicare Part B, which is medical insurance. As an alternative to Original Medicare (Part A and Part B), persons may opt for Medicare Part C, which is also known as Medicare Advantage.

What is Medicare and Medicaid?

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

How old do you have to be to qualify for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old. For persons who are disabled or have been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis), there is no age requirement. Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.

How to apply for medicaid?

How to Apply. To apply for Medicare, contact your local Social Security Administration (SSA) office. To apply for Medicaid, contact your state’s Medicaid agency. Learn about the long-term care Medicaid application process. Prior to applying, one may wish to take a non-binding Medicaid eligibility test.

Does Medicare cover out-of-pocket expenses?

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid does cover some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.

What is cost sharing in Medicaid?

Cost Sharing. States have the option to charge premiums and to establish out of pocket spending (cost sharing) requirements for Medicaid enrollees. Out of pocket costs may include copayments, coinsurance, deductibles, and other similar charges.

Can you charge out of pocket for coinsurance?

Certain vulnerable groups, such as children and pregnant women, are exempt from most out of pocket costs and copayments and coinsurance cannot be charged for certain services.

Does Medicaid cover out of pocket charges?

Prescription Drugs. Medicaid rules give states the ability to use out of pocket charges to promote the most cost-effective use of prescription drugs. To encourage the use of lower-cost drugs, states may establish different copayments for generic versus brand-name drugs or for drugs included on a preferred drug list.

Can you get higher copayments for emergency services?

States have the option to impose higher copayments when people visit a hospital emergency department for non-emergency services . This copayment is limited to non-emergency services, as emergency services are exempted from all out of pocket charges. For people with incomes above 150% FPL, such copayments may be established up to the state's cost for the service, but certain conditions must be met.

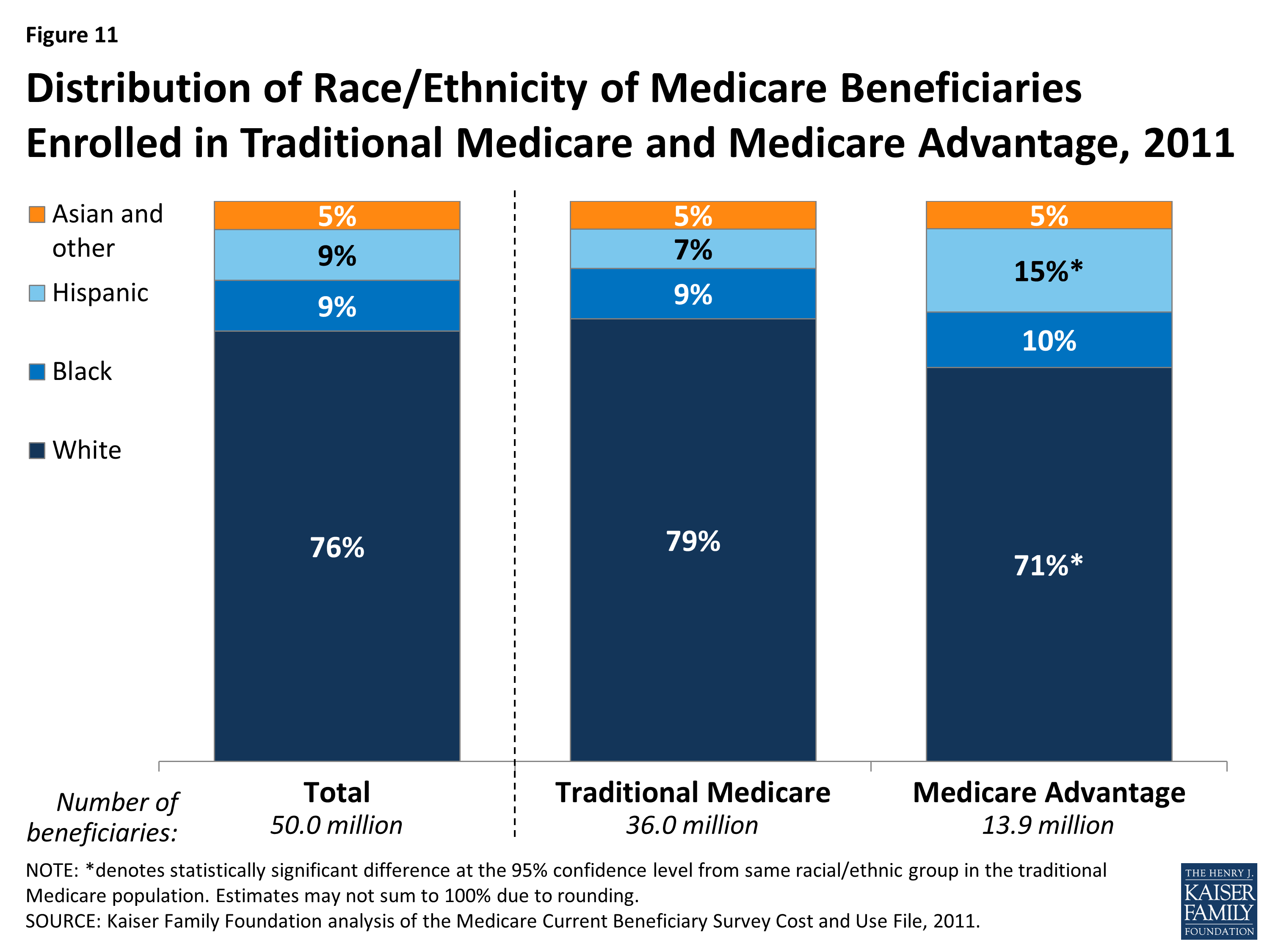

How many people are dually eligible for medicaid?

In 2018, there were 12.2 million individuals simultaneously enrolled in Medicare and Medicaid.1 These dually eligible individuals experience high rates of chronic illness, with many having long-term care needs and social risk factors. Forty-one percent of dually eligible individuals have at least one mental health diagnosis, 49 percent receive long-term care services and supports (LTSS), and 60 percent have multiple chronic conditions.2,3 Eighteen percent of dually eligible individuals report that they have “poor” health status, compared to six percent of other Medicare beneficiaries.4

What is a full benefit dually eligible person?

Full-benefit dually eligible individuals are Medicare beneficiaries who qualify for the full package of Medicaid benefits. They often separately qualify for assistance with Medicare premiums and cost-sharing through the Medicare Savings Programs (MSPs). Partial-benefit dually eligible individuals are enrolled only in Medicare and an MSP.

What is MMCO9?

The role of MMCO9 is to bring together Medicare and Medicaid in order to more effectively integrate benefits and improve the coordination between the federal government and states to enhance access to quality services for individuals who are enrolled in both programs.

What is Medicaid coverage?

Medicaid provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicaid is a state-based program that is funded jointly by states and the federal government. Within broad national guidelines established by federal statutes, regulations, and policies, each state has the flexibility to:

Can you be dually enrolled in Medicare and Medicaid?

These individuals may either be enrolled first in Medicare and then qualify for Medicaid, or vice versa.

Can QDWIs get Medicare Part A?

QDWIs have income that does not exceed 200% of the FPL, resources that do not exceed two times the SSI resource standard, and are not otherwise eligible for Medicaid. Medicaid pays the Medicare Part A premiums only.