How to enroll in Medicare if you are turning 65?

Feb 01, 2021 · Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But it’s important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

Is it mandatory to sign up for Medicare?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later. When the employer-tied coverage ends, you’re entitled to a special enrollment period of …

What age can you take Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer. If you have COBRA coverage: Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B late enrollment penalty. If you have COBRA before signing up for Medicare, …

What is the age for Medicare eligibility?

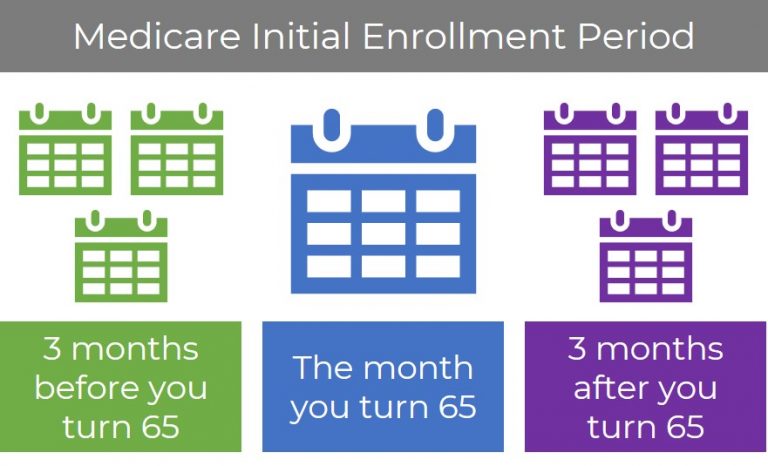

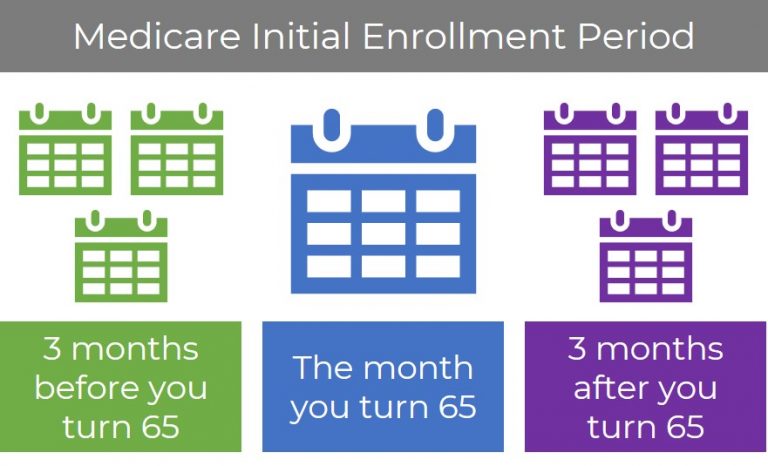

Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties that could prove quite costly over the course of retirement.

Can I decline Medicare at 65?

What if I don't want Medicare?

What happens if I opt out of Medicare Part B?

How do I decline Medicare Part B?

What parts of Medicare are mandatory?

Can you collect Social Security without Medicare?

Can I get Medicare Part B for free?

Do you have to enroll in Medicare Part B every year?

How much do they take out of Social Security for Medicare?

Can I opt out of Medicare Part A?

When do you sign up for Medicare at 65?

When you near your 65th birthday, you will enter what is called your Initial Enrollment Period (IEP). This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

Why don't people sign up for Medicare at 65?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Is it mandatory to sign up for Medicare at 65?

Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But it’s important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

Does Medicare cover health insurance?

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance – including health insurance provided by employers or unions – and won’t prevent you from enrolling.

Does Medicare have a late enrollment penalty?

Medicare Part D, which provides coverage for prescription medications, is optional but can also come with a late enrollment penalty if you don’t sign up when you’re supposed to. This penalty is a little more complex to calculate but remains in place for as long as you have Part D coverage. The Part D late enrollment penalty applies if you experience a stretch of at least 63 consecutive days without creditable drug coverage following your IEP and then later enroll in a Part D plan.

What happens if you don't sign up for Medicare?

Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage. It’s therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability.

How many employees do you need to be to receive Medicare?

The law requires a large employer — one with at least 20 employees — to offer you (and your spouse) the same benefits that it offers to younger employees (and their spouses). It is entirely your choice (not the employer’s) whether to: accept the employer health plan and delay Medicare enrollment.

How long can you delay Medicare?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later. When the employer-tied coverage ends, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare.

Is Medicare Part B primary or group?

If you enroll in both the group plan and Medicare Part B, be aware of the consequences. In this situation, the employer plan is always primary, meaning that it settles medical bills first and Medicare only pays for services that it covers but the employer plan doesn’t.

Can you delay Medicare enrollment?

You can’t delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA — by definition, these do not count as active employment. Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer.

Can you sell a Medigap policy?

Insurance companies are prohibited from refusing to sell you a Medigap policy or charge higher premiums based on your health or preexisting medical conditions, if you buy the policy within six months of enrolling in Part B. Outside of that six-month window, except in very limited circumstances, they can do both.

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

How long do you have to sign up for a Part B plan?

Sign up during those eight months, and you won’t have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if you’re delaying Part B enrollment because you’re covered under your spouse’s employer-sponsored plan, assuming their employer has at least 20 employees.

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

What do you need to know about Medicare at 65?

Most who have to get Medicare at age 65 will get Part A (hospital coverage), Part B (medical coverage) and some form of prescription drug coverage (Part D) – through either a stand-alone Part D plan or a Medicare Advantage plan.

When do you have to enroll in Medicare if you are 65?

If you’re approaching age 65 and (1) are not going to keep working, (2) you have employer coverage from an employer with fewer than 20 employees, or (3) your spouse’s employer requires you to get Medicare to stay on their health plan, then you need to enroll during what’s known as your Medicare Initial Enrollment Period (IEP).

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does Medicare Advantage last?

The Special Enrollment Period lasts 8 months, but you only get the first two months to enroll in a Medicare Advantage or Part D plan.

What is the milestone of your 65th birthday?

Published by: Medicare Made Clear. The popular perception is that your 65th birthday marks the milestone in your life when you get to walk out the office, kick back and reap the fruits of your labor as you enjoy sunsets from your porch. For some, that perception is becoming a thing of the past. Nowadays, many people turning 65 ...

Why enroll in the first two months of insurance?

Another good reason to enroll in the first two months is that it can take some time for plans to process your application. Make your decisions and enroll early to avoid a lapse in coverage.

Why do people work after 65?

Some do it for financial reasons and others continue to work simply because they enjoy it .

What is the age limit for Medicare?

The standard eligibility age for Medicare in the United States is 65. However, many people don't know if they need to sign up for Medicare if they already have other health insurance coverage, such as through a job, a spouse's employer, from their former employer, or through COBRA.

How long do you have to sign up for Medicare if you are still working?

Once the employment or your employer-based health coverage ends, you'll have eight months to sign up for Medicare Part B ...

What happens if you don't sign up for Medicare Part B?

If one of these situations applies to you and you don't sign up for Medicare Part B during your initial enrollment period, you could face permanently higher premiums when you do. The Motley Fool has a disclosure policy. Prev. 1. 2. 3.

How much does Medicare Part B cost?

On the other hand, Medicare Part B has a monthly premium you'll have to pay ($134 per month for most new beneficiaries in 2018), which is why it can make sense to delay signing up if it's not going to be your primary insurance.

Can Medicare be a primary payer?

Depending on the type of insurance you have (group coverage, retiree coverage, COBRA, marketplace coverage, etc.), Medicare can either be the primary or the seconda ry payer. If Medicare would be a secondary payer to your current insurance, you can delay signing up for Medicare Part B.

Does Medicare pay for seniors who don't have other insurance?

How Medicare works with your other insurance. When you have more than one insurance provider, there are certain rules that determine who pays what it owes first and who pays based on the remaining balance. For seniors who don't have other insurance, Medicare is obviously the primary payer.

Do you have to get Medicare if you are retired?

Retired service members must get Medicare Part B when eligible in order to keep their TRICARE coverage. (Note: If you're still on active duty, you don't have to enroll in Medicare until after you retire.) You have veterans' benefits. You have coverage through the healthcare marketplace or have other private insurance.

What happens if you don't sign up for Medicare?

Therefore, if you are required to sign up for Medicare but don’t, you’ll essentially be left with little or no health coverage.

How long do you have to sign up for Medicare?

At that point, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare without risking late penalties. If the employer has 20 or more employees, the law stipulates that those 65 and older (and their spouses) must be offered exactly the same health benefits that are offered to younger employees ...

How long can you delay Medicare enrollment?

En español | If you’re over 65 and receive coverage under a group health plan provided by an employer for which you or your spouse actively works, you have the right to delay Medicare enrollment until the job ends or the coverage ends — whichever occurs first. At that point, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare without risking late penalties.