Yes, different secondary insurance policies can be used as payments to cover out-of-pocket expenses, including deductibles. Depending on the insurance provider, there are two types of policies that do this – those that give you a lump-sum payment and those that work with your primary insurance provider to reduce the cost of your deductible.

Does Medigap cover deductibles?

Mar 11, 2020 · A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms. When Medicare coordinates benefits with other health insurance coverage providers, there are a variety of factors that play into ...

Does Medicare automatically Bill secondary insurance?

The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay. If the insurance company doesn't pay the. claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional …

How does Medicare pay as secondary?

Jun 14, 2021 · If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If …

Does Medi-Cal ever pay secondary if Medicare is primary?

Jan 06, 2022 · In situations where Medicare is a secondary payer, it will still cover all the same things as a primary payer situation—they’ll just be second-in-line for coverage after the primary payer takes care of as much as they can. The primary payer may not cover some things that Medicare does, and vice versa, so it’s especially nice to have both sources to cover healthcare …

Does Medicare secondary pay deductible?

What does Medicare pay when it is secondary?

Do secondary insurances have deductibles?

Does Medicare accept secondary paper claims?

How do you know if Medicare is primary or secondary?

Does Medicare pay first or second?

How do deductibles work with two insurances?

How do deductibles work when you have two insurances?

Do you have to pay a deductible with Medicare?

How do I submit a secondary claim to Medicare?

How is Medicare secondary payment calculated?

When would a biller most likely submit a claim to secondary insurance?

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

Is Medicare the primary payer?

Medicare remains the primary payer for beneficiaries who are not covered by other types of health insurance or coverage. Medicare is also the primary payer in certain instances, provided several conditions are met.

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

What is ESRD in Medicare?

End-Stage Renal Disease (ESRD): Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD. Individual has ESRD, is covered by a Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA plan) ...

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a multi-employer plan have?

At least one or more of the other employers has 20 or more employees.

Does Medicare cover other insurance?

Medicare can work with other insurance plans to cover your healthcare needs. When you use Medicare and another insurance plan together, each insurance covers part of the cost of your service. The insurance that pays first is called the primary payer. The insurance that picks up the remaining cost is the secondary payer.

How much does Medicare Part B cover?

If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost.

Does Medicare cover dental visits?

If you have a health plan from your employer, you might have benefits not offered by Medicare. This can include dental visits, eye exams, fitness programs, and more. Secondary payer plans often come with their own monthly premium. You’ll pay this amount in addition to the standard Part B premium.

Is Medicare Part A the primary payer?

Secondary payers are also useful if you have a long hospital or nursing facility stay. Medicare Part A will be your primary payer in this case.

What is primary payer?

A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments. When you become eligible for Medicare, you can still use other insurance plans to lower your costs and get access to more services. Medicare will normally act as a primary payer and cover most ...

How long can you keep Cobra insurance?

COBRA allows you to keep employer-sponsored health coverage after you leave a job. You can choose to keep your COBRA coverage for up to 36 months alongside Medicare to help cover expenses. In most instances, Medicare will be the primary payer when you use it alongside COBRA.

Is FEHB a primary or secondary payer?

Coverage is also available to spouses and dependents. While you’re working, your FEHB plan will be the primary payer and Medicare will pay second. Once you retire, you can keep your FEHB and use it alongside Medicare. Medicare will become your primary payer, and your FEHB plan will be the secondary payer.

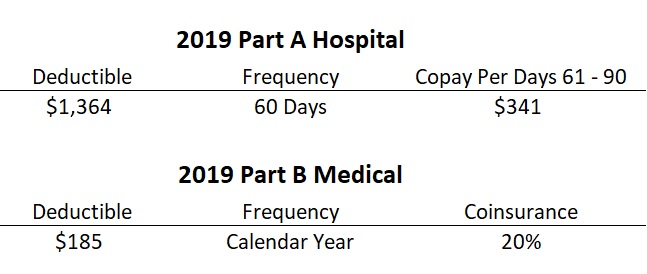

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is the coinsurance amount for Medicare?

The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example. Say your treatment cost you $80.

What is Medicare Supplement?

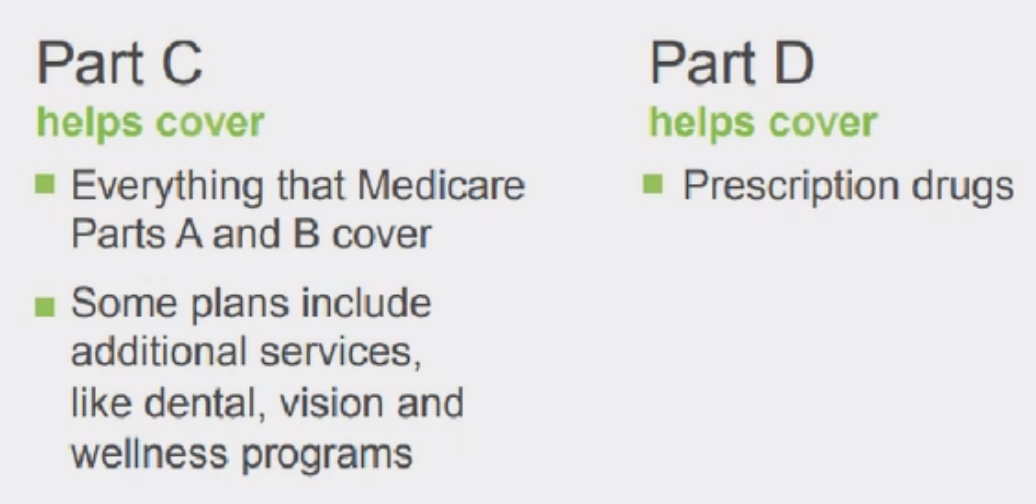

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

Is Medicare a secondary payer?

Medicare benefits are secondary payer to “large group health plans” (LGHP) for individuals under age 65 entitled to Medicare on the basis of disability and whose LGHP coverage is based on the individual’s current employment status or the current employment status of a family member. Under the law, a LGHP may not "take into account" that such an individual is eligible for, or receives, Medicare benefits based on disability. The instructions in §10.1 and throughout this manual that are applicable to GHPs are also applicable to LGHPs in processing claims where Medicare is secondary payer for disabled individuals. Where those sections refer to a GHP of 20 or more employees, substitute the term "large group health plan" as defined in §20, to apply them to disabled individuals.

What is the prohibition on Medicare?

An employer or other entity is prohibited from offering Medicare beneficiaries financial or other benefits as incentives not to enroll in or to terminate enrollment in a GHP or LGHP that is or would be primary to Medicare. This prohibition precludes the offering of benefits to Medicare beneficiaries that are alternatives to the employer's primary plan (e.g., prescription drugs) unless the beneficiary has primary coverage other than Medicare. An example would be primary plan coverage through his/her own or a spouse's employer. This rule applies even if the payments or benefits are offered to all other individuals who are eligible for coverage under the plan. It is a violation of the Medicare law every time a prohibited offer is made regardless of whether it is oral or in writing. Any entity that violates the prohibition is subject to a civil money penalty of up to $5,000 for each violation.

Does GHP take into account Medicare?

GHP may not take into account that an individual is eligible for or entitled to Medicare benefits on the basis of ESRD during a coordination period described in Chapter 2,

What is the right to collect double damages?

Section 1862(b)(3)(A) of the Act provides that any claimant (including a beneficiary, provider, physician, or supplier) has the right to take legal action against, and to collect double damages from a GHP, that fails to pay primary benefits for services covered by the GHP. Any claimant, also, has the right to take legal action against, and to collect double damages from, a no-fault or liability insurer that fails to pay primary benefits for services covered by the no-fault or liability insurer where required to do so under §1862(b) of the Act.

Is a member of a religious order considered to have current employment status with the religious order?

member of a religious order whose members are required to take a vow of poverty is not considered to have current employment status with the religious order if the services he/she performs as a member of the order are considered employment by the order for Social Security purposes only. This is because the religious order elected Social Security coverage for its members under section 3121(r) of the Internal Revenue Member of Religious Order Code. Thus, Medicare is primary payer to any group health coverage provided by the religious order.

What is a senior federal judge?

Senior Federal judges are retired judges of the U.S. court system and the Tax Court. They may continue to adjudicate cases, but they are entitled to full salary as a retirement benefit whether or not they perform judicial services for the Government. By law, the remuneration they receive as senior judges is not considered wages for Social Security retirement offset purposes. Since they are considered retired for Social Security purposes, they are not considered to have current employment status for purposes of the working aged and disability provisions.

Is a director of a corporation considered self employed?

Directors of corporations (i.e., persons serving on a Board of Directors of a corporation who are not officers of the corporation) are self-employed. (Officers of a corporation are employees.) Directors who receive remuneration for serving on a board are considered to have current employment status. Remuneration may be of a monetary or nonmonetary nature. Benefits, including health benefits that a corporation provides to a board member, are considered remuneration if they are subject to FICA taxes under the IRC.

Is Medicare primary or secondary?

In this case it typically is primary and Medicare secondary. But many retirees are able to maintain their coverage and it becomes secondary to Medicare. Often the coverage rules are the same, and it will cover items and services not covered by Medicare, but still within its own coverage rules.

Does Medigap cover Medicare?

The charges must also be covered by the Medigap plan and not subject to deductibles, etc. Medigap plans, however, often do cover services that Medicare does not include.

Does Medicare cover hospice?

Continue Reading. If Medicare is your secondary coverage, Part A will pay for in patient care in the hospital or skilled nursing facility. It will cover hospice, home health care and inpatient care in a religious nonmedical health care institution. It covers charges not paid by your primary (like your deductible and your co-insurance amounts).

Does Medicare pay for custodial care?

It does not pay for “custodial” care as previously discussed.

What does Part B pay for?

If you also have Part B (most people do and you pay for this coverage as a monthly premium, but most people don't pay for Part A) it will pay for doctors and healthcare providers office services, various screenings, ambulance services, alcohol misuse screening and counseli. Continue Reading.