Some qualified Obamacare marketplace plan members may qualify for federal subsidies to help pay some of their health care costs, such as premiums and deductibles. Plan selection Medicare Medicare Part A and Part B are available throughout the U.S. and U.S. territories.

How is Obamacare paid for?

The health reform law known as Obamacare (officially the Affordable Care Act) is paid for with a combination of cuts in government spending and new revenue from several sources, including tax increases.

Is Medicare Part of the ACA (Obamacare)?

ACA (ObamaCare) cut overpayment to hospitals and other wasteful Medicare spending to give seniors better benefits and to ensure the future of Medicare for years to come. Is Medicare Part of the ACA (ObamaCare)? ObamaCare makes some changes to Medicare (discussed below), but the ACA (ObamaCare) doesn’t replace Medicare.

How does Obamacare affect Medicare?

Obamacare works on the premise that those who can afford a greater share of healthcare’s financial burden will do so through higher premiums. In general, Medicare remains largely unaffected by this premise. However, there are always exceptions to the rule.

What is the difference between Obamacare and Original Medicare?

There is no one type of policy that is considered “Obamacare.” Under Obamacare, private insurance companies compete for business by offering affordable plans with different levels of coverage. Unlike Obamacare, coverage under Original Medicare is provided specifically by the federal government.

Does Obamacare work with Medicare?

Obamacare's expanded Medicare preventive coverage applies to all Medicare beneficiaries, whether they have Original Medicare or a Medicare Advantage plan.

How did Obamacare affect Medicare?

The ACA made myriad changes to Medicare. Some changes improved the program's benefits. Others reduced Medicare payments to health care providers and private plans and extended the financial viability of the program. Still others provided incentives and created programs to encourage the system to provide better care.

How is Obamacare different from Medicare?

Main Differences Between Medicare and the ACA (Obamacare) In the simplest terms, the main difference between understanding Medicare and Obamacare is that Obamacare refers to private health plans available through the Health Insurance Marketplace while Original Medicare is provided through the federal government.

How does Obamacare get paid for?

To help offset the cost of the law, the ACA contains a revenue-raising provision that would place an excise tax on high-cost insurance plans, beginning in 2018. Most Americans receive health insurance through their employer and the cost of employer-sponsored health insurance is currently excluded from taxation.

Can I stay on Obamacare instead of Medicare?

A: The law allows you to keep your plan if you want, instead of signing up for Medicare, but there are good reasons why you shouldn't. If you bought a Marketplace plan, the chances are very high that you do not have employer-based health care coverage.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is eligible for ObamaCare?

You are currently living in the United States. You are a US citizen or legal resident. You are not currently incarcerated. Your income is no more than 400% (or 500% in 2021 and 2022) of the FPL.

Is Medicare Advantage the same as ObamaCare?

Medicare isn't part of the Affordable Care Act (ObamaCare) neither is supplemental Medigap insurance nor Medicare Advantage plans. You won't shop for your coverage through the marketplace. Instead, you'll want to follow the instructions under the “how to sign up for Medicare Advantage” section below.

Can you get ObamaCare if you are retired?

If you retire before you're 65 and lose your job-based health plan when you do, you can use the Health Insurance Marketplace® to buy a plan. Losing health coverage qualifies you for a Special Enrollment Period. This means you can enroll in a health plan even if it's outside the annual Open Enrollment Period.

What's the problem with Obamacare?

The ACA has been highly controversial, despite the positive outcomes. Conservatives objected to the tax increases and higher insurance premiums needed to pay for Obamacare. Some people in the healthcare industry are critical of the additional workload and costs placed on medical providers.

Is Obamacare free?

If you're unemployed you may be able to get an affordable health insurance plan through the Marketplace, with savings based on your income and household size. You may also qualify for free or low-cost coverage through Medicaid or the Children's Health Insurance Program (CHIP).

Does Social Security count as income for Obamacare?

Yes, Social Security benefits are counted as income in determining eligibility for premium tax credits in the Marketplace.

Medicare and The Healthcare Marketplace

Confusion abounds when it comes to Obamacare. One of the things people fear most is that their insurance will change drastically if they enroll in...

Does Your Medicare Coverage Meet The Affordable Care Act’S Individual Mandate?

Under the ACA, every eligible American citizen needs to obtain health insurance or face a penalty fine issued by the IRS during their annual taxes....

Essential Healthcare Benefits For All Americans

One of the biggest concerns among Medicare beneficiaries is that Obamacare will alter their existing coverage, so that they won’t enjoy the same be...

The New Standard of Care For Seniors

In many ways, the Affordable Care Act improves the standard of care that those with insurance receive. And, it helps to prevent the spread of disea...

Medicare Part D: Closing The Gap of Prescription Drug Coverage

If you have Medicare Part D prescription coverage, then you may be familiar with the concept of the coverage gap or “donut hole.” The coverage gap...

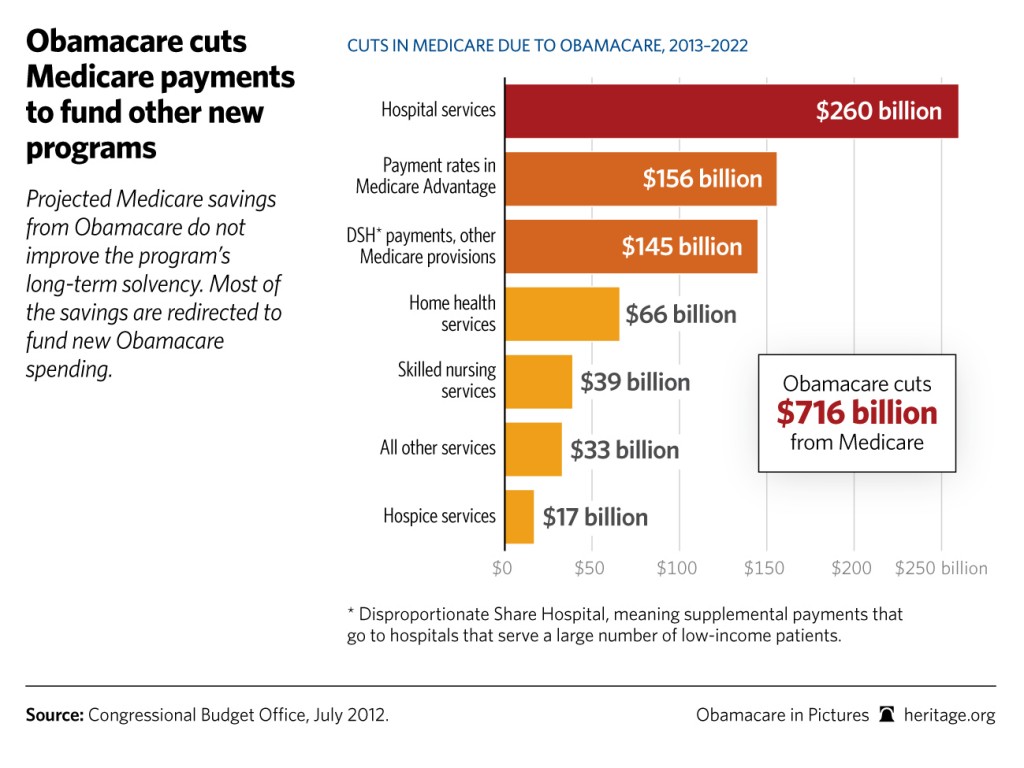

Medicare Budget Cuts Under The Affordable Care Act

For some people, the idea that the Affordable Care Act will be cutting approximately $716 billion from Medicare is frightening. The number can seem...

Changes to Medicare Premiums and Payments

We mentioned above that some people will have to pay a higher premium for Medicare coverage under the guidelines of the ACA. Obamacare works on the...

Medicare and Obamacare – Our Conclusion

There do seem to be many changes coming to Medicare as a result of the Affordable Care Act. However, these changes are aimed at improving the syste...

What does the ACA do to improve Medicare?

Here are some things that the program does to improve Medicare: • The ACA (ObamaCare) closes the “donut hole” that was causing Seniors not to be able to afford their prescriptions. (The Medicare ‘donut hole’ is the Part D drug coverage limit where seniors must start paying out of pocket for their prescriptions.

What are the Medicare cuts?

The Medicare cuts contained in the law were aimed at improving care by limiting fraud, waste, and abuse. The money saved from those cuts has been reinvested in Medicare and the ACA to improve care for seniors.

How much did Obamacare cut in 2022?

ObamaCare Medicare Cuts, Changes in Medicare Spending. Over the ten year period between 2013 and 2022, ObamaCare will cut Medicare by $716 billion and spend nearly that much trying to reform it. In fact, all money cut from Medicare must be used to increase Medicare solvency, improve its services, or reduce premiums.

How much will Medicare penalties increase over the next two years?

ACA (ObamaCare) Medicare penalties and rewards will rise over the next two years to a total of 2%.

What is the ACA tax increase?

The ACA (ObamaCare) Medicare Tax Increase. The ACA (ObamaCare) implements a Medicare tax part A increase of .9% for businesses making over $250,000 in profit and employees earning over $200,000 to help pay for the improvements to Medicare.

What is the discount for Medicare Part D?

This means there’s a temporary limit on what the drug plan will cover for drugs. Seniors in the Medicare Part D “donut hole” can now get a 50% discount when buying Part D-covered brand-name prescription drugs and a 14% discount on generic drugs covered by Part D.

When did Medicare stop giving donuts?

This reform has been planned to become stronger every year. It increases coverage and closes the donut hole until it disappeared in 2020.

How does Obamacare help people?

In many ways, the Affordable Care Act improves the standard of care that those with insurance receive. And, it helps to prevent the spread of diseases and other medical conditions to people without insurance. Medicare beneficiaries, in particular, gain valuable advantages, like being able to afford brand name prescription drugs or getting yearly colonoscopies to detect early forms of cancer. Obamacare seeks to help people stay healthier for longer by making better coverage an affordable option; this goal extends to Medicare beneficiaries. And despite the emphasis on better medical treatments and prevention, the new standard of healthcare doesn’t affect how you sign up for or receive your Medicare benefits.

What are the benefits of Medicare under the ACA?

One of the benefits included under minimum essential coverage is the ability to see your doctor for yearly screenings and wellness checkups.

What is a Medicare Part D coverage gap?

If you have Medicare Part D prescription coverage, then you may be familiar with the concept of the coverage gap or “donut hole.” The coverage gap happens when a person reaches the limit for covered prescriptions, but has to wait until he gets to the other side of the “donut” or coverage period to get covered prescriptions again.

Is Demetrius a Medicare beneficiary?

As a Medicare beneficiary for the last five years, Demetrius is already familiar with what Medicare covers and how his medical claims get filed. Demetrius is fairly healthy, but he does need to visit the doctor more frequently than some men his age, because he has a family history of diabetes and stroke.

Does Obamacare affect Medicare?

One of the biggest concerns among Medicare beneficiaries is that Obamacare will alter their existing coverage, so that they won’t enjoy the same benefits as before. In reality, the Affordable Care Act seeks to strengthen health insurance across the board, including Medicare.

When did the Affordable Care Act change?

The Affordable Care Act (ACA), also known as Obamacare, made significant changes to the healthcare industry in the United States starting in 2010. Several of these changes centered on the social insurance policy of Medicare, including the way that Medicare is administered and distributed. Sorting through Medicare policies can be challenging enough, ...

Will Medicare premiums rise?

However, Medicare premiums are not expected to rise significantly as a result of the Affordable Care Act. You will probably find that you pay the same amount for your health insurance as you did prior to the implementation of Obamacare. As mentioned above, we’ll discuss the change in premiums in a later section.

Medicare Advantage Rates

Aside from traditional Medicare, seniors have the option to enroll in a Medicare Advantage plan. Since the passage of the ACA in 2010, membership in [hnd word=”Medicare Advantage”] has increased by 42 percent, reflecting the popularity of MA plans among Medicare beneficiaries.

Long-term Benefits for Beneficiaries

If you’re wondering whether your Medicare plan qualifies as minimum essential coverage under the law, then don’t worry. Medicare Part A counts as minimum coverage, so you won’t have to enroll in any additional insurance to meet the law’s requirement. However, Part B alone does not count as minimum coverage.

Questions About Obamacare And Its Effect on Medicare

Obamacare seeks to reform the healthcare industry in America by providing better coverage and legal protections to millions of citizens, but the goal of the Affordable Care Act can sometimes get lost in translation when it comes to programs like Medicare.

Medicare Funding and Cost Distribution

Before we go over the changes to Medicare, we’ll take a brief look at Medicare as it exists right now in the United States. For starters, you might be interested in knowing how Medicare gets funded and who operates the program. The U.S.

Wasteful Medicare Spending Comes To An End

What happens to the $716 billion savings that are taken from wasteful Medicare spending? In essence, the money will be redistributed back into the program to help fund various aspects of Medicare. From Advantage plans to prescription drug costs, the redistributed funds will help offset the cost of care for senior citizens in America.

Improvements To Medicare Under Obamacare

You may have been given bad information when it comes to the impact of the Affordable Care Act on Medicare, and we want to highlight some of the positives of Obamacare in relation to your current or future coverage. For one thing, Obamacare does not replace Medicare at all.

Does Obamacare Impact Medicare Part C?

Many people have expressed concern about Medicare Part C, also known as Medicare Advantage. Medicare Part C is an alternative to traditional or “original medicare” and in a short period of time, approximately less than ten years, medicare part C has become the primary preferred way that anyone over the age of 65 manages their healthcare benefits.

When does Medicare end?

For example, if Medicare will begin May 1, you will want your Marketplace coverage to end April 30. To make this transition, it's important to cancel your Marketplace policy at least 15 days before you want the coverage to end and to specify that you want it terminated on the final day of the month. (Medicare coverage always begins on the first day ...

What is a small employer in Medicare?

But under Medicare rules, a small employer is one that has fewer than 20 employees. Larger employers are subject to laws that are designed to protect older workers — for example, by requiring these employers to offer to employees who are 65 and older exactly the same health benefits as they offer to younger workers.

How to contact Medicare and Medicaid?

Or go online to ssa.gov. Centers for Medicare & Medicaid Services at 800-633-4227 (TYY: 877-486-2048) for issues on Medicare coverage, Medicare Advantage plans and Part D drug plans. Or go online to medicare.gov.

How long does it take to sign up for Medicare after it ends?

Throughout the time that you have this insurance, and for up to eight months after it ends, you'll be entitled to a special enrollment period (SEP) to sign up for Medicare without incurring any late penalties. This is also true if your health insurance comes from your spouse's employer through SHOP.

Can you sell insurance before Medicare?

Insurance companies in the Marketplace are banned from knowingly selling new policies to people enrolled in any part of Medicare. However, if you're enrolled in a Marketplace plan before becoming eligible for Medicare, your plan cannot reduce or terminate your coverage unless you request it.

Is Medicare automatic?

You should know that this transition is not automatic. People approaching Medicare age will receive no official notification about how to make the change or when to do it. It's a new scenario ripe for mistakes, some of which can be costly for consumers. Medicare recently announced that it has begun sending notices to people who are both enrolled in ...

How is Obamacare paid for?

The health reform law known as Obamacare (officially the Affordable Care Act) is paid for with a combination of cuts in government spending and new revenue from several sources, including tax increases.

How much tax do you pay for Obamacare?

High-income taxpayers also help pay for Obamacare. The health law requires workers to pay a tax equal to 0.9% of their wages over $200,000 if single or $250,000 if married filing jointly to finance Medicare’s hospital insurance. It also imposes a 3.8% surtax on various forms of investment income for taxpayers whose modified adjusted gross income is ...

How does Obamacare raise taxes?

The law raises revenue by imposing tax penalties on people who don’t have health insurance ($43 billion by 2025) and employers that don’t offer coverage to their workers ($167 billion), among other things. High-income taxpayers also help pay for Obamacare.

How much will Medicare cut in 2025?

On the spending side, cuts in Medicare payment rates and reductions in payments to the Medicare Advantage program will trim spending by more than $700 billion by 2025, according to the Congressional Budget Office’s most recent estimate.

When does Medicare subsidy end?

If you enroll in Medicare during the final three months of your initial enrollment period, your premium subsidy will likely end before your Part B coverage begins, although your Part A coverage should be backdated to the month you turned 65.

When will Medicare be sent to you?

Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, includes the month you turn 65, and then continues for another three months. (Note that you’ll need to enroll during the months prior to your birth month in order to have coverage that takes effect the month you turn 65.

What happens if you don't sign up for Medicare?

And if you keep your individual market exchange plan and don’t sign up for Medicare when you first become eligible, you’ll have to pay higher Medicare Part B premiums for the rest of your life, once you do enroll in Medicare, due to the late enrollment penalty.

How long does it take to get Medicare if you are not receiving Social Security?

If you’re not yet receiving Social Security or Railroad Retirement benefits, you’ll have a seven-month window during which you can enroll in Medicare, which you’ll do through the Social Security Administration. Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, ...

When does Medicare coverage take effect?

If you complete the enrollment process during the three months prior to your 65th birthday, your Medicare coverage takes effect the first of the month you turn 65 ( unless your birthday is the first of the month ). Your premium subsidy eligibility continues through the last day of the month prior to the month you turn 65.

When will Medicare be enrolled in Social Security?

Here are the details: If you’re already receiving retirement benefits from Social Security or the Railroad Retirement Board, you’ll automatically be enrolled in Medicare with an effective date of the first of the month that you turn 65. As is the case for people who enroll prior to the month they turn 65, premium subsidy eligibility ends on ...

When will Medicare be sent out to my 65 year old?

If you’re already receiving Social Security or Railroad Retirement benefits, the government will automatically enroll you in Medicare Part A the month you turn 65, with your Medicare card arriving in the mail about three months before you turn 65. If you’re not yet receiving Social Security or Railroad Retirement benefits, ...

What is Obamacare?

Obamacare's primary intention is to give all Americans the ability to purchase affordable health insurance. There are several different parts to the law that each affected a different aspect of health insurance access. Here are some of the more well-known: 1 Individual Mandate#N#One of the most-talked-about aspects of the ACA was its provision stating that everyone is required to have health insurance. Those who do not have health insurance face a tax penalty. 2 Coverage of Pre-Existing Conditions#N#Another one of the biggest changes ACA made was to prohibit insurance companies from denying someone coverage or charging them more because of a pre-existing condition. And because as many as 1 in 2 Americans have some type of pre-existing condition, this provision has been one of the law’s more popular. 3 Health Insurance Subsidies#N#Under Obamacare, people who qualify for financial assistance are eligible for health insurance tax credits to help offset the cost of their insurance. 4 Exchanges#N#Exchanges, or online marketplaces for health insurance, are how people are supposed to purchase affordable insurance policies under the ACA. Private health insurance companies offer policies in the marketplace and compete for the business of shoppers. Any legal citizen can purchase insurance from the exchanges, but not everyone qualifies for the low-income subsidies.

What are the health insurance subsidies under Obamacare?

Under Obamacare, people who qualify for financial assistance are eligible for health insurance tax credits to help offset the cost of their insurance. Exchanges. Exchanges, or online marketplaces for health insurance, are how people are supposed to purchase affordable insurance policies under the ACA.

What changes did the ACA make to the health insurance industry?

Another one of the biggest changes ACA made was to prohibit insurance companies from denying someone coverage or charging them more because of a pre-existing condition. And because as many as 1 in 2 Americans have some type of pre-existing condition, this provision has been one of the law’s more popular. Health Insurance Subsidies.

What is Medicare for people over 65?

Medicare is a federal health insurance program for Americans over age 65 and certain people under age 65 who have qualifying conditions or disabilities. "Obamacare" is a nickname for the Patient Protection and Affordable Care Act of 2010 (also known as the ACA).

What is Obamacare's primary intention?

Obamacare's primary intention is to give all Americans the ability to purchase affordable health insurance. There are several different parts to the law that each affected a different aspect of health insurance access. Here are some of the more well-known: Individual Mandate.

When was Medicare first created?

Medicare was first created in 1965 and now provides health coverage to more than 55 million Americans . Medicare Part A and Part B (Original Medicare) pay for some of the costs associated with hospital and physician services. Medicare Part A covers hospital services, including inpatient hospital stays, care in a skilled nursing facility ...

Does Medicare cover out of pocket costs?

Original Medicare requires some out-of-pocket costs, including deductibles, copa yments, coinsurance and other fees. Many Medicare beneficiaries purchase a Medicare Supplement Insurance plan (also called Medigap) to help cover some of these costs. Medigap plans are sold by private insurance companies, but their basic benefits are standardized by ...

Medicare and Hospital Costs: Medicare Networks, Medicare Assignment, Balance Billing, and Other Factors Related to Hospital Costs

On this page, we discuss Medicare networks, Medicare assignment, balance billing, and the way hospital costs vary within a hospital (such as in the ER).

Hospital Costs and Balance Billing

Medicare has agreements with hospitals to accept a set fee for particular services. Like other insurance companies, Medicare negotiates discounted fees for items and services with hospitals. These are called insurer-negotiated discounts.

What is Balance Billing?

You can get unexpected medical bills when you use the services of a healthcare provider who is not in your network and does not accept Medicare assignment.

How do Hospitals Bill?

In 1985, Medicare changed its hospital reimbursement formula to the charge master, a list of agreed prices that is still used to determine hospital payments for items and services. There is a lack of transparency in hospital billing, and patients have little knowledge of or control over costs.

Medicare and the States

Medicare is a Federal Program but States Regulate Hospital Billing. That means hospitals bill differently according to each state’s laws.

Am I a Qualified Medicare Beneficiary?

If you have Medicare and your income is at or below 100% of the Federal Poverty Level (FPL) or whatever income level is set by your state, you are a Qualified Medicare Beneficiary (QMB). If you are a QMB and have limited resources, you are not responsible for Medicare co-payments or cost sharing. [5]

What About Emergency Room Charges?

Tim Xu et al just published their May 30, 2017 study, Variation in Emergency Department vs Internal Medicine Excess Charges in the United States. [6] They examined charges within the same hospital vs. the amount Medicare was willing to pay.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.