Medicare is always primary if it’s your only form of coverage. When you introduce another form of coverage into the picture, there’s predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Full Answer

What is coordination of benefits?

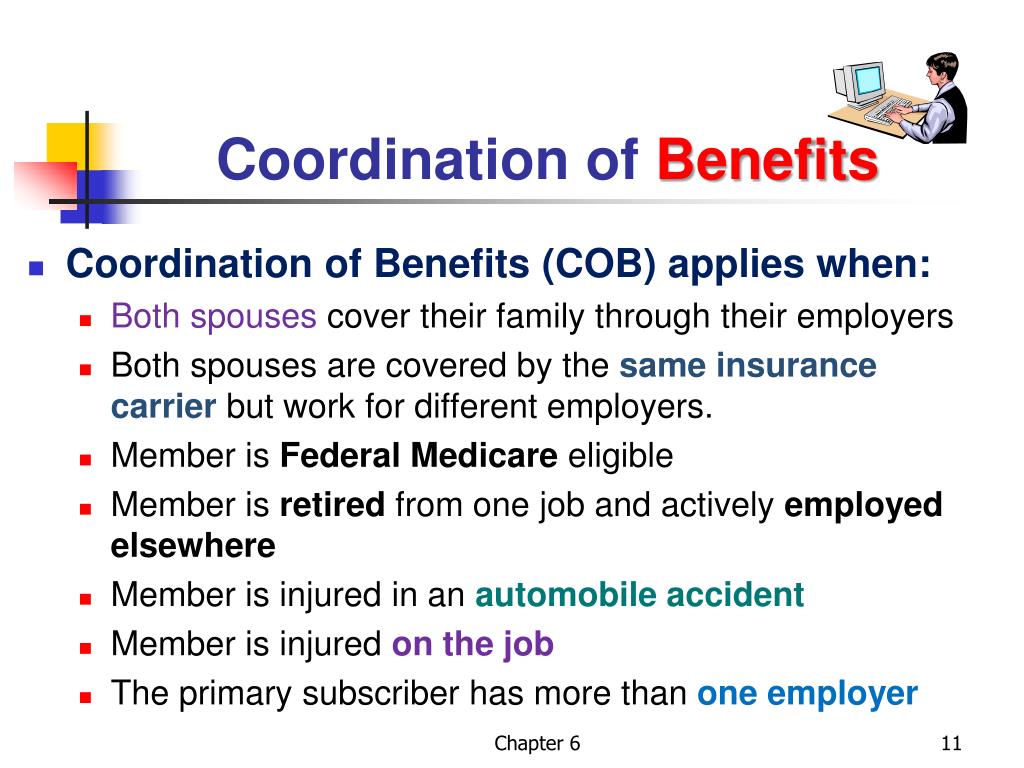

Coordination of Benefits (COB) is when two insurance plans work together to pay claims for the same person. This occurs when you or your dependents are covered for benefits under more than one insurance plan.

How does Medicare coordinate benefits?

They can, for example, design benefits to target people with chronic conditions or in ways that take into account socioeconomic factors. One of those possible value-based offerings is hospice benefits, which have traditionally fallen outside of Medicare Advantage. This year, 13 MA organizations are offering hospice benefits.

How do coordination of benefits work?

Terminology

- Primary insurer – your own insurance provider

- Secondary insurer – your spouse’s insurance

- Dependant – the party listed under your insurance plan as your dependant

How does coordination of benefits work in health insurance?

Key takeaways

- When someone is covered by more than one benefits plan, the plans work together to pay any claims.

- There are several scenarios to determine which plan pays first.

- The reimbursement under both plans won’t be more than 100% of the original claim amount.

Who is responsible for coordination of benefits?

Who is responsible for coordination of benefits? The health insurance plans handle the COB. The health plans use a framework to figure out which plan pays first — and that they don't pay more than 100% of the medical bill combined. The plan type guides a COB.

Who determines if Medicare is primary?

Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second. If this is your situation, it's important to enroll in both parts of Original Medicare when you are first eligible for coverage at age 65.

How do you determine which insurance is primary and which is secondary?

The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer. The secondary payer only pays if there are costs the primary insurer didn't cover.

How do you know if Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Which insurance is primary when you have two?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

How does it work when you have two health insurance policies?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

How do you make Medicare primary?

Making Medicare Primary. If you're in a situation where you have Medicare and some other health coverage, you can make Medicare primary by dropping the other coverage. Short of this, though, there's no action you can take to change Medicare from secondary to primary payer.

Can I drop my employer health insurance and go on Medicare?

You can keep your employer plan and sign up for Medicare Part A. You can keep your employer plan and sign up for Medicare Part A, and decide if you want to pick up B, D, and/or a Medigap Plan. Most people don't sign up for Parts B and D, because they have a monthly premium.

How do I update my Medicare Coordination of benefits?

Call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627. TTY users can call 1-855-797-2627. Contact your employer or union benefits administrator. These situations and more are available at Medicare.gov/supple- ments-other-insurance/how-medicare-works-with-other-insurance.

When Can Medicare be a secondary payer?

Medicare may be the secondary payer when: a person has a GHP through their own or a spouse's employment, and the employer has more than 20 employees. a person is disabled and covered by a GHP through an employer with more than 100 employees.

How do you make Medicare primary?

Making Medicare Primary. If you're in a situation where you have Medicare and some other health coverage, you can make Medicare primary by dropping the other coverage. Short of this, though, there's no action you can take to change Medicare from secondary to primary payer.

Is Medicare always considered primary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

When Can Medicare be a secondary payer?

Medicare may be the secondary payer when: a person has a GHP through their own or a spouse's employment, and the employer has more than 20 employees. a person is disabled and covered by a GHP through an employer with more than 100 employees.

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

Can I have Medicare and Employer Health Insurance Together?

Yes, you can have both Medicare and employer health insurance together. When you have Medicare and other health insurance or coverage, you have mor...

Does Medicare Cover Deductibles and Copays as Secondary Insurance?

The downside of having two insurance plans (group and Medicare) is that you pay two sets of premiums and deductibles. Your secondary insurance will...

Can I still use my Part A coverage even when I don't have Part B?

Yes, you can use Medicare Part A coverage even if you delay enrollment in Part B. However, unless you have other creditable coverage (like employer...

Who is responsible for what with the coordination of benefits?

Coordination of benefits (COB) is relevant for individuals with more than one primary payer. It is used to determine which insurance plan has the p...

What should I consider when deciding whether to stay on my employer’s health plan or switch to Medic...

Employees working for larger companies can either stay on their group plan and delay Medicare enrollment or drop their employer plan for Medicare....

Do I need Medicare if I have health insurance?

Employers and unions often offer health insurance to employees or retirees. If you already have Medicare and are offered group coverage through you...

How does Medicare work with Medicaid?

If you are dual enrolled in both Medicare and Medicaid, Medicare will always pay first on any health care claim. In rare cases where you might have...

Who pays first between Medicare and VA benefits?

If you qualify for both Medicare and Veterans’ benefits, you can receive treatment through either federal program. But each time you receive health...

Where can I find more information?

Visit Medicare.gov to view or print out publications such as “Who Pays First?” that explains more about coordination of benefits. You can also call...