/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

How do I report Social Security and Medicare on my taxes?

A. issue the check, withholding only social security and Medicare taxes, and report all amounts on Form W-2. B. issue the check as usual. C. withhold only social security and Medicare taxes and report all amounts on both Form W-2 and 1099-MISC.

Is Social Security taxable income subject to Medicare tax?

Social Security taxable wages are capped at a maximum each year. First, wages from employment are considered, then self-employment income, until the annual maximum taxable income level is reached. There is no maximum on Medicare taxes, so all employment and self-employment income is subject to Medicare tax. 2

What form do I use to report uncollected Social Security and Medicare?

INFORMATION FOR... Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. None at this time.

Who is responsible for additional Medicare tax?

Additional Medicare Tax Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status.

What form is used to report the amount of federal Social Security and Medicare taxes withheld and paid for each employee?

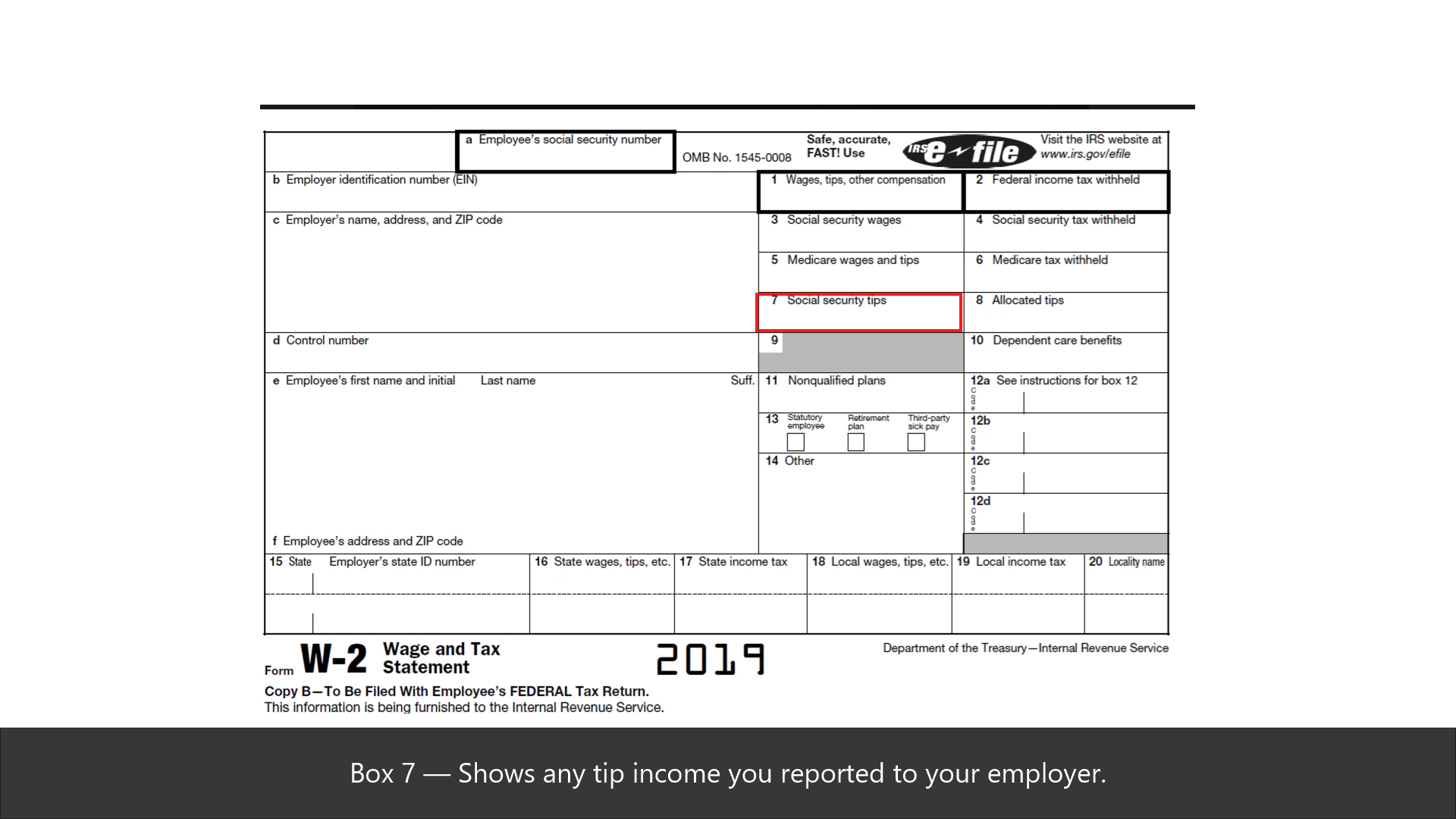

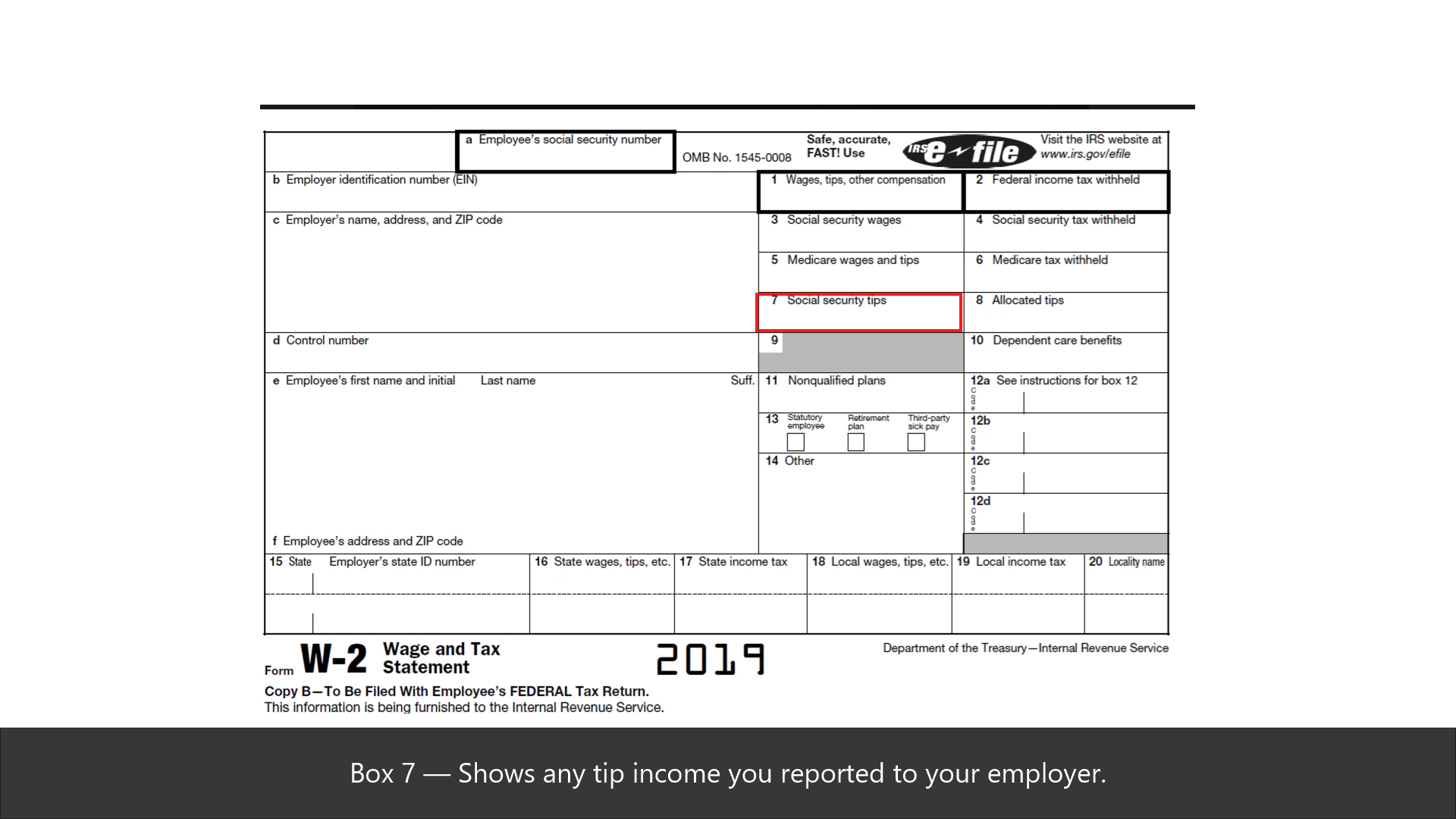

Forms W-2 are sent to Social Security along with a Form W-3 (Transmittal of Income and Tax Statements). Employers are required to file a Form W-2 for wages paid to each employee from whom: Income, Social Security, or Medicare taxes were withheld, or.

Where Do Social Security and Medicare taxes go on 1040?

Report the total on line 33. This amount represents your total tax payments throughout the year.

Does 1040 ES include Social Security and Medicare?

In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040 or 1040-SR ), Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year.

What is a 940 form?

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FUTA tax.

What is a 941 form?

More In Forms and Instructions Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

Where does federal income tax withheld go on 1040?

Include the amount from line 24 on the following line of your tax return. If you file Form 1040, 1040-SR, or 1040-NR, include this amount on line 25c combined with your federal income tax withholding. on line 12 of Part I.

What is the 1040-ES form?

More In Forms and Instructions Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What is a 1040-SR?

If you are 65 or older you have the option of using Form 1040-SR: U.S. Tax Return for Seniors rather than the standard Form 1040 when you file your taxes. It is virtually identical to Form 1040 except that it has larger type and gives greater prominence to the senior-specific tax benefits.

Why do I have a 1040-ES form?

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

What is a form 940 and 941?

IRS Form 940 is filed annually and it reports an employer's Federal Unemployment (FUTA) tax liability, which is an employer-only tax. IRS Form 941 reports federal income tax withholding and Federal Insurance (FICA) taxes, and it is filed every quarter.

What is a form 720?

Businesses that are subject to excise tax generally must file a Form 720, Quarterly Federal Excise Tax Return to report the tax to the IRS. Excise taxes are imposed on a wide variety of goods, services and activities. The tax may be imposed at the time of. Import. Sale by the manufacturer.

How do I know if I file a 941 or 944?

Most employers use Form 941 for reporting. Again, this is the form employers use to report wage and tax information quarterly. File Form 941 if you have employees and the IRS does not tell you to file Form 944. Send Form 941 to the IRS even if you don't have taxes to report (simply enter 0 on the lines).

When to report Social Security and Medicare taxes?

How and when you’re going to report FICA taxes all depends on where you report them. The Internal Revenue Service requires employers to report these taxes along with other payroll-related tax withholdings using Form 941 every quarter. Hence the name of Form 941 – Employer’s Quarterly Tax Return.

How to file tax forms associated with Social Security and Medicare tax?

As mentioned above, you’ll need to file two tax forms, the 941 for every quarter and W2 at the end of the tax year when payroll is processed for the full tax year.

What line do you report 1040?

Add up all the amounts that appear on Form 1040 lines 16 through 32. Report the total on line 33. This amount represents your total tax payments throughout the year.

What is the tax withheld from 1099?

Withholding on 1099 Income. Income tax isn't withheld from 1099 income in most cases, but some income sources from which it might be include: 1099-G, box 4: Withholding on unemployment income. 1099-R, box 4: Withholding on retirement income. SSA-1099, box 6: Withholding on Social Security benefits.

What line is the 1040 for 2021?

Updated March 01, 2021. Completing IRS Form 1040 isn't just about tallying up all the sources of income you earned during the year. It records your tax payments as well on lines 25 through 32 of your 2020 tax return. They're totaled on line 33 and applied to your total tax due.

How many times has the 1040 been redesigned?

The 2020 Form 1040 is significantly different from the ones that were used for tax years 2017 and earlier. The IRS has redesigned three times beginning in 2018. 1 All lines and boxes cited here refer to the 2020 version of the form.

How much is Social Security tax in 2020?

The maximum Social Security tax was $8,537.40 per year in 2020, which represents 6.2% of taxable wages up to that year's Social Security wage base: $137,700. Your employer would match this and pay another 6.2%. 6 . You don't have to pay Social Security tax on wages over the wage base, at least for the current year.

Do you have to pay Social Security taxes on wages?

You don't have to pay Social Security tax on wages over the wage base, at least for the current year. Withholding begins again on January 1 of the new year, however. This maximum limit can increase annually, so make sure you get the right number for the year for which you're filing a tax return.

What form to use for self employment?

CAUTIONcontractor. Instead, use Schedule C (Form 1040), Profit or Loss From Business, to report the income. And use Schedule SE (Form 1040), Self-Employment Tax, to figure the tax on net earnings from self-employment.

What is the purpose of Form 8919?

Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. By filing this form, your social security earnings will be credited to your social security record. See https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee for more information.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

How is personal income tax determined?

Your personal income taxes are determined by your total adjusted gross income. If your business is a partnership, multiple-member LLC, or corporation, your 1099 income is reported as part of your business income tax return.

Why is there no tax withholding on 1099?

You may be wondering why there was no tax withholding on your 1099-NEC form. That's because the payer didn't withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances.

What is backup withholding?

Sometimes the IRS requires withholding from payments to non-employees. This is called backup withholding, and it happens in specific cases, mostly when the payee's tax ID is missing or incorrect. In these cases, the payer receives a notice from the IRS requiring them to begin backup withholding.#N##N#

What is self employment tax?

For self-employed individuals, these taxes are called self-employment taxes. Self-employment taxes are calculated on the individual's federal income tax return based on the net income from the business, including 1099 income. .

What is the 1099-NEC used for?

For 2020 taxes and beyond, Form 1099-NEC now must be used to report payments to non-employees, including independent contractors. Form 1099-MISC is now bused to report other types of payments.

When do non-employees get 1099?

Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was $600 or more.

Do you report 1099 income on Schedule C?

If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business. When you complete Schedule C, you report all business income and expenses.

What is the IRS 944?

Annual Deposit Rule. Employers using the annual deposit rule have been notified by the IRS to file the annual Form 944, Employer's Annual Federal Tax Return, instead of Form 941, Employer's Quarterly Federal Tax Return. The IRS designates employers whose filing history shows $1,000 or less in employment taxes each year as Form 944 filers.

How often do you file Form 944?

Form 944 filers file and pay employment taxes once a year (by January 31 for the prior year). Deposit Schedule. Semiweekly depositors with a tax liability of less than $100,000.00 deposit employment taxes according to the following schedule: Payday.

When must semi weekly depositors deposit taxes?

Semiweekly depositors with a tax liability of $100,000.00 or more must deposit employment taxes by the close of business on the next business day. When a monthly depositor's liability from a pay day exceeds $100,000.00, it must deposit taxes by the: next business day and follow the semiweekly schedule thereafter.

Is an employer a semi weekly depositor?

If the total liability exceeds $50,000, the employer is a "semiweekly depositor.". If an employer's accumulated employment tax liability reaches $100,000 on any day during a monthly or semiweekly deposit period, the taxes must be deposited by the close of the next business day.