Is FICA the same as Medicaid tax?

Feb 16, 2022 · The Federal Insurance Contributions Act (FICA) implemented a tax that employers have to withhold from employee pay. This law came about in 1935, and it has helped fund programs such as Social Security. Throughout your career, you pay into Social Security, and you’ll enjoy benefits after you retire.

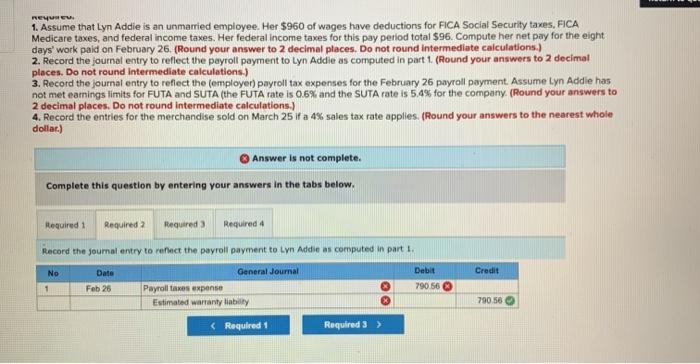

Who pays FICA employer or employee?

How are FICA and Medicare tax calculated? FICA is 6.2% of Taxable Gross for employees and 6.2% for employers. Medicare is 1.45% of Taxable Gross up to $200,000 and 2.35% on wages …

What does FICA stand for in health care?

Introduced in the 1930s, FICA, or the Federal Insurance Contribution Act, is a U.S. law that requires employers and their employees to make contributions to fund Medicare and Social …

What is FICA tax and how is it calculated?

What is FICA? FICA is a U.S. federal payroll tax. It stands for the . Federal Insurance Contributions Act. and is deducted from each paycheck. Your nine-digit number helps Social Security …

What is the difference between FICA and Medicare tax?

Does everyone pay FICA Medicare?

Do you get FICA tax back?

Why did I get a FICA Refund?

Why do I pay FICA and Medicare?

Is FICA Social Security?

Do I have to pay Medicare tax if I am on Medicare?

What does FICA mean on my paycheck?

What is FICA also known as?

What happens if I overpay FICA?

How can I reduce my FICA tax?

Is FICA tax the same as Social Security?

Since Social Security is a part of the FICA tax, the money from your FICA contribution goes toward Social Security programs, including retirement,...

How much is the FICA tax rate for 2020?

The current FICA tax rate is 7.65% of your employees’ incomes, plus an employer match of 7.65%. This tax is broken up into 6.2% for Social Security...

What tax forms do employers need to file for FICA taxes?

You need to submit the IRS Form 941 (The Employer’s Quarterly Federal Tax Return) to report your business’ contributions to Medicare and Social Sec...

What is Medicare?

Medicare is a federal health insurance program for people who qualify, including: People 65 years and older People with certain disabilities People...

What happens if employees overpay FICA taxes?

If your employees overpay on FICA taxes, they’ll get a refund once they file their taxes. Employees who have a second job on the side or who recent...

What is FICA payroll tax?

What Is FICA? What Employers Should Know About FICA Taxes. Most employers and their employees are required to pay FICA taxes, a type of payroll tax , to the Internal Revenue Service (IRS). The payment amount for these taxes varies based on how much your employees make. Learn more about what these taxes entail, including how much to withhold ...

What is the current FICA tax rate?

The current FICA tax rate is 7.65% of your employees’ incomes, plus an employer match of 7.65%. This tax is broken up into 6.2% for Social Security and 1.45% for Medicare. The combined contribution, including the tax on your employees’ incomes and the amount you have to match, is 15.3%.

How to calculate FICA taxes?

Calculate how much your employees owe in FICA taxes by multiplying their gross pay by the Social Security and Medicare tax rates. Once you calculate this total, match how much your employee pays. Follow these general equations: 1 Social Security calculation: Gross pay x 6.2% = Social Security contribution 2 Medicare calculation: Gross pay x 1.45% = Medicare contribution 3 Total FICA taxes calculation: Social Security contribution + Medicare contribution = Total FICA taxes

What are the requirements for Medicare?

Medicare is a federal health insurance program for people who qualify, including: 1 People 65 years and older 2 People with certain disabilities 3 People suffering from end-stage renal disease

When did FICA start?

Introduced in the 1930s, FICA, or the Federal Insurance Contribution Act, is a U.S. law that requires employers and their employees to make contributions to fund Medicare and Social Security programs. FICA taxes come out of your employee’s paychecks, and as an employer, you typically must match what your employees contribute.

Why is Social Security important?

The government designed Social Security as a way for current employees to support current retirees’ and other beneficiaries’ benefits. When employees and employers pay into this system, they eventually get to reap the benefits later on in life. It’s a way for the workforce to provide retirement funds for all employees.

Does Medicare cover end stage renal disease?

Since most people get their health insurance through their employer, Medicare is a solution for people who are retired or unable to work. The different parts of Medicare cover various medical expenses.

Is FICA a Medicare deduction?

The FICA Medicare deduction is just for Medicare tax. Similar to Social Security taxes, you pay half from your wages and your employer pays the rest. Taxes collected for Medicare taxes fund the health care program for retired and elderly citizens. This paycheck deduction is also mandatory, even if you don't anticipate getting Medicare yourself.

What is FICA tax?

By Alia Nikolakopulos Updated March 15, 2018. The Federal Insurance Contribution Act, or FICA, is a federal program funded through tax payments. Your contribution pays for benefits other citizens receive from the fund. You also earn credits from the taxes you pay in, which helps make you or your dependents eligible for future program payments.

What is FICA contribution?

FICA is divided into two categories, Social Security and Medicare.

What is FICA deduction?

The FICA Medicare deduction is just for Medicare tax. Similar to Social Security taxes, you pay half from your wages and your employer pays the rest. Taxes collected for Medicare taxes fund the health care program for retired and elderly citizens.

What does FICA mean in tax?

FICA stands for the Federal Insurance Contributions Act. It's the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees. FICA mandates that three separate taxes be withheld from an employee's gross earnings:

What is a tax withholding?

A tax withholding is the amount an employer takes out of an employee's wages or paycheck to pay to the government. In addition to the FICA withholdings listed above, other employer tax withholdings often include: Federal income taxes. State income taxes (in most states)

What is the Social Security tax rate for 2020?

12.4% Social Security tax: This amount is withheld from the first $137,700 an employee makes in 2020. 2.9% Medicare tax. 0.9% Medicare surtax: For single filers earning more than $200,000 per calendar year or joint filers earning more than $250,000 per calendar year.

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Do self employed people pay taxes?

Self-employed workers will pay self-employment tax (SECA) based on the net income from their business, which is calculated using form Schedule SE. The Social Security Administration uses your historical Social Security earnings record to determine your benefits under the social security program.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio