News about Health Care Plan That Cover What Medicare Doesn't …bing.com/news

Medicare doesn't cover everything. Even if Medicare covers a service or item, you generally have to pay your Deductible , Coinsurance, and Copayment . Find out if Medicare covers a test, item, or service you need.

Videos of Health Care plan That Cover What Medicare doesn't paybing.com/videos

"Many people assume Medicare will cover all your health care costs in retirement, but it doesn't," said Steve Feinschreiber, a Fidelity senior vice president. "We estimate that about 15% of the average retiree's annual expenses will be used for health care-related expenses, including Medicare premiums and out-of-pocket expenses."

What doesn't Medicare cover?

Medicare doesn't pay for: 1 24-hour-a-day care at home 2 Meals delivered to your home 3 Homemaker services (like shopping, cleaning, and laundry), when this is the only care you need 4 Custodial or personal care (like bathing, dressing, or using the bathroom), when this is the only care you need More ...

Does Medicare cover all of your health care costs in retirement?

Typically, you will be responsible for paying for most services that aren’t considered necessary for your health. If the service you need is covered by Medicare, it’s likely you will still have to pay something for it in the form of a deductible, coinsurance or copayment.

What services does Medicare not pay for?

Do you have to pay for Medicare?

Who does not pay Medicare premiums?

Who doesn't have to pay a premium for Medicare Part A? A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

Is there a Medicare plan that covers everything?

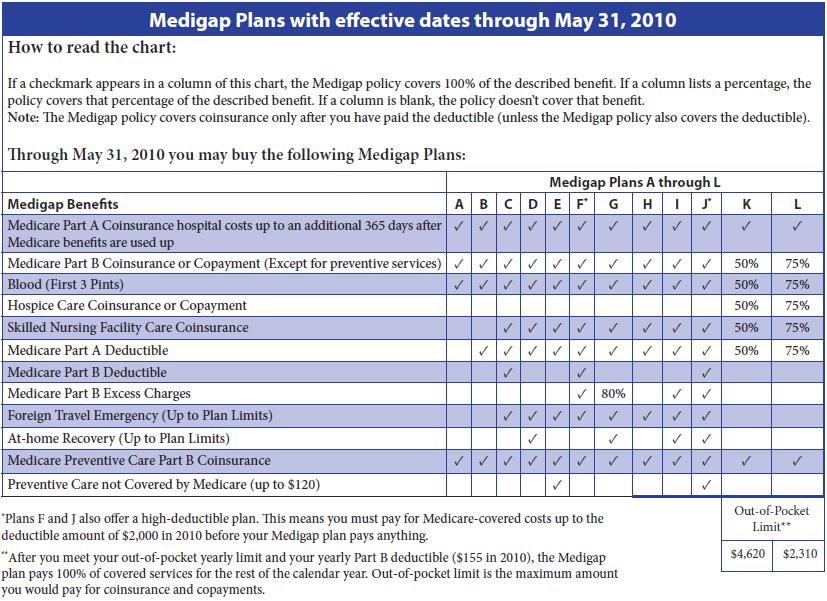

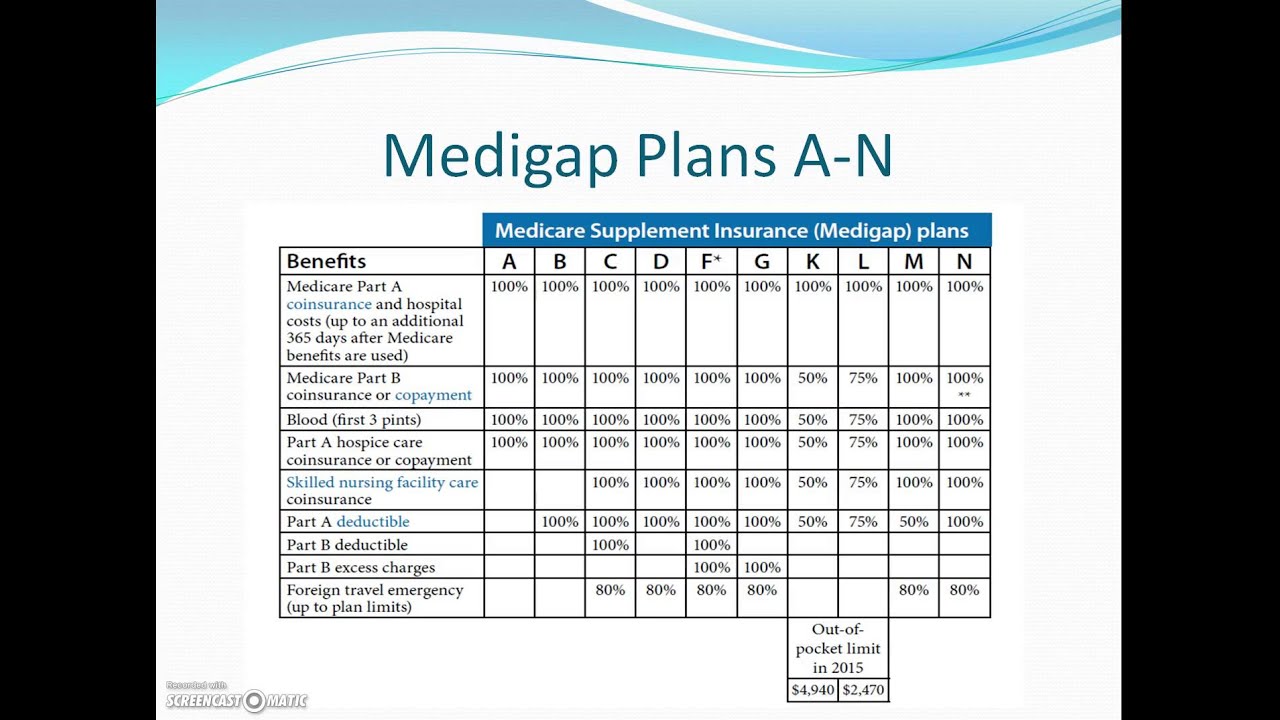

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Do you still pay Medicare if you have an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.

What is not covered by Medicare Advantage plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Which service is not covered by Part B Medicare?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Can Medicare Advantage deny coverage?

When Can a Medicare Plan Deny Coverage? Coverage can be denied under a Medicare Advantage plan when: Plan rules are not followed, like failing to seek prior approval for a particular treatment if required. Treatments provided were not deemed to be medically necessary.