What are the rules for meeting with a Medicare agent?

Independent agents and brokers selling plans must be licensed by the state, and the plan must tell the state which agents are selling their plans. If you're going to meet with an agent, the agent must follow all the rules for Medicare plans and some specific rules for meeting with you.

How do I report an attorney hired by Medicare?

In situations where an attorney has been hired, one of the first steps should be to report the case by accessing the Medicare Secondary Payer Recovery Portal (MSPRP) Report a Case link, or by contacting the Benefits Coordination & Recovery Center (BCRC).

How to join a Medicare plan if you are a member?

If you’re a member, the agent who helped you join can call you. Require you to speak to a sales agent to get information about the plan. Offer you cash (or gifts worth more than $15) to join their plan or give you free meals during a sales pitch for a Medicare health or drug plan.

Who is eligible for Medicare and how does it work?

Who is eligible for Medicare? Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

How is Medicare collected?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7). Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue).

How is Medicare distributed?

Medicare is financed by general revenues (41% in 2017), payroll tax contributions (37%), beneficiary premiums (14%), and other sources (Figure 8). Part A is funded mainly by a 2.9 percent payroll tax on earnings paid by employers and employees (1.45% each) deposited into the Hospital Insurance Trust Fund.

Who is Medicare designed to serve?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Who handles billing for Medicare?

Medicare Administrative Contractor (MAC)Billing for Medicare When a claim is sent to Medicare, it's processed by a Medicare Administrative Contractor (MAC). The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days.

Where do Medicare cards come from?

Your card will come in a white envelope from the Department of Health and Human Services (see example on the right). The back of the envelope will say, “Official information from Medicare.” Medicare will mail new Medicare cards with new Medicare numbers from April 2018 through April 2019.

How does Medicare get funded?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

How does Medicare work in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.

What is the main purpose of Medicare?

Medicare provides health insurance coverage to individuals who are age 65 and over, under age 65 with certain disabilities, and individuals of all ages with ESRD. Medicaid provides medical benefits to groups of low-income people, some who may have no medical insurance or inadequate medical insurance.

How is Medicare regulated?

The Social Security Administration (SSA) oversees Medicare eligibility and enrollment.

How do you submit a bill to Medicare?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Can a Medicare patient be billed?

Balance billing is prohibited for Medicare-covered services in the Medicare Advantage program, except in the case of private fee-for-service plans. In traditional Medicare, the maximum that non-participating providers may charge for a Medicare-covered service is 115 percent of the discounted fee-schedule amount.

Can providers call Medicare?

CMS also relies on providers and suppliers to ask their Medicare patients about the presence of other primary health care coverage, and to report this information when filing claims with the Medicare program.

Can you use direct messaging on PDP?

You cannot use direct messaging, including direct messaging in social media, to contact prospective enrollees. You cannot use door-to-door solicitation for any MA/MAPD/PDP products.

Can you use email to contact prospective enrollees?

You can use conventional mail and print media to contact prospective enrollees. You cannot use direct messaging, including direct messaging in social media, to contact prospective enrollees.

Can you ask for referrals?

You can ask for referrals, but do not ask for or accept phone numbers. Calling a prospective enrollee, even one who is referred by a friend, is considered an unsolicited telephonic communication and is prohibited under the marketing guidelines. If a client would like to make a referral, CMS recommends that you provide a business card ...

What is a demand letter for Medicare?

This letter includes: 1) a summary of conditional payments made by Medicare; 2) the total demand amount; 3) information on applicable waiver and administrative appeal rights. For additional information about the demand process and repaying Medicare, please click the Reimbursing Medicare link.

What is conditional payment information?

Conditional Payment Information. Once the BCRC is aware of the existence of a case, the BCRC begins identifying payments that Medicare has made conditionally that are related to the case. The BCRC will issue a conditional payment letter with detailed claim information to the beneficiary.

Is Medicare a lien or a recovery claim?

Please note that CMS’ Medicare Secondary Payer (MSP) recovery claim (under its direct right of recovery as well as its subrogation right) has sometimes been referred to as a Medicare “lien”, but the proper term is Medicare or MSP “recovery claim.”.

Can Medicare pay conditionally?

If the item or service is reimbursable under Medicare rules, Medicare may pay conditionally, subject to later recovery if there is a subsequent settlement, judgment, award, or other payment. In situations such as this, the beneficiary may choose to hire an attorney to help them recover damages.

Does Medicare require a copy of recovery correspondence?

Note: If Medicare is pursuing recovery from the insurer/workers’ compensation entity, the beneficiary and his attorney or other representative will receive a copy of recovery correspondence sent to the insurer/workers’ compensation entity. The beneficiary does not need to take any action on this correspondence.

How many credits do you need to get Medicare?

Individuals must be at least 65 years old and have 40 quarters of work credits to qualify for certain parts of Medicare without paying a monthly premium. People earn work credits when they work in a job and pay Social Security taxes.7 Individuals can earn up to four credits each year. The amount needed for a work credit changes from year to year.8

What is Medicare for HIV?

Medicare is the federal health coverage program for people who are 65 or older and certain younger people with disabilities.1 Medicare is now the single largest source of federal funding for HIV/AIDS care in the U.S. Approximately one quarter of people with HIV who are in care get their health coverage through Medicare.2

What is the role of a RWHAP case manager?

Ensuring continuous access to HIV medications and medical care is essential for people with HIV. Before enrolling in Original Medicare or a Medicare Advantage plan, RWHAP case managers can help clients to:

Does Medicare cover copays?

While Original Medicare pays for most of the cost of covered services and supplies, supplemental insurance, or “Medigap” policies, can help cover the remaining costs of Medicare Parts A and B coverage, such as copays and deductibles.

Can HIV patients get Medicare?

The majority of Medicare beneficiaries with HIV are eligible for both Medicare and Medicaid. This is known as dual eligibility . Most people who are enrolled in ADAP and Medicaid eventually transition into Medicare, either by aging in at age 65 or qualifying before age 65 due to disability or End-Stage Renal Disease status.

How many people are in Medicare Advantage?

In October 2018, KFF reported that 34 percent of Medicare beneficiaries, or 20.4 million people, were enrolled in Medicare Advantage plans in 2018 – a major increase from 2017.

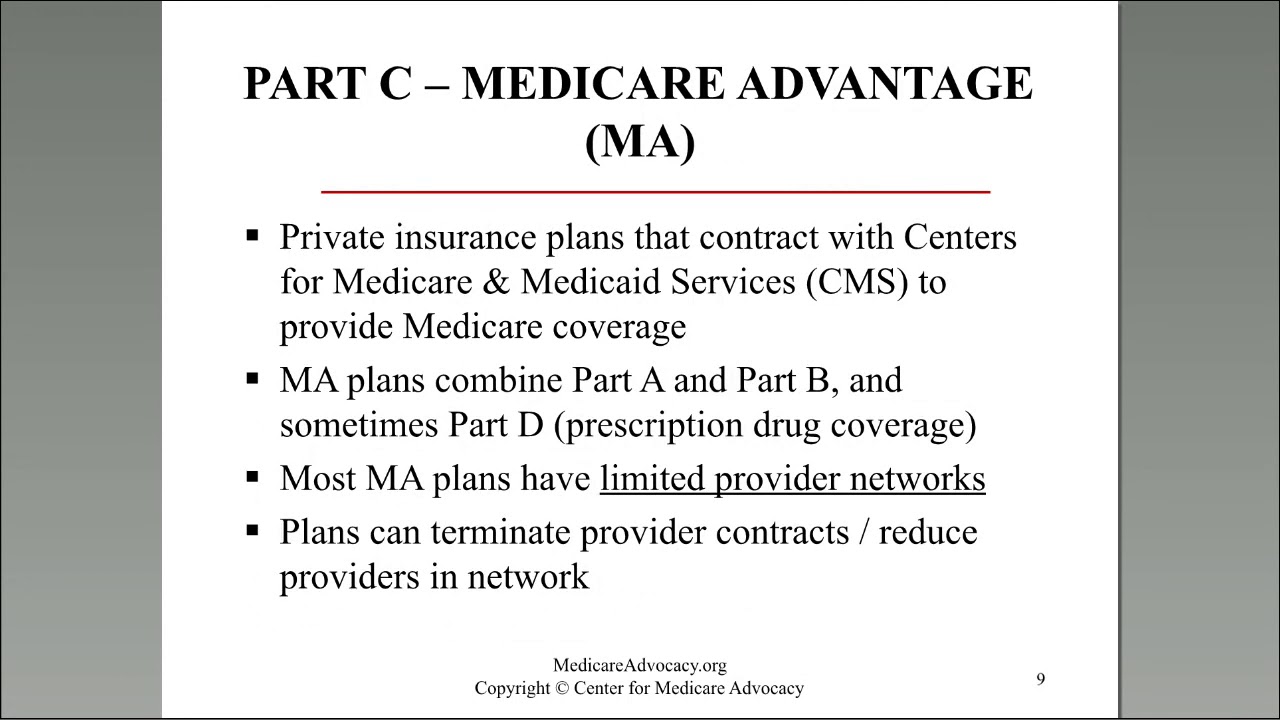

What is Medicare Advantage?

Medicare Advantage is one of the most popular ways for consumers to round out their healthcare coverage as they age. Traditional Medicare has consistently played a critical role in ...

How much did Medicare Advantage score drop?

While the Medicare Advantage market has grown considerably in recent years, research has suggested that these plans can leave consumers feeling less than pleased. In 2018, JD Power found that Medicare Advantage consumer satisfaction scores dropped from 799 in 2017 to 794 in 2018.

How often does Medicare Advantage change?

The amount members pay for premiums, deductibles, and services may change only once a year, on January 1.

What percentage of Medicare Advantage plans offer prescription drug coverage?

KFF previously reported that 88 percent of Medicare Advantage plans offered prescription drug coverage in 2017. Medicare Advantage plans also provide out-of-pocket spending caps, and some offer dental and vision coverage, while traditional Medicare plans do not.

How many Medicare Advantage plans are there in 2019?

KFF added that there are more Medicare Advantage plans available in 2019 than in any other year since 2009. “Nationwide, 2,734 Medicare Advantage plans will be available for individual enrollment in 2019 – an increase of 417 plans since 2018.

Which health insurance plans have the highest CMS ratings?

Kaiser Permanente, Blue Cross Blue Shield (BCBS) of Minnesota, and Anthem Blue Cross were among the top rated and highest performing Medicare Advantage health plans in 2018. Cigna, Humana, Aetna, and UnitedHealthcare have also recently received quality CMS ratings.