Average unweighted monthly plan premiums in 2014 are $49, down from $51 in 2013. Most beneficiaries (84%) will have access to a Medicare Advantage plan offered in their area for no additional premium. Enrollees who stay with their current plan (if available) will find that, on average, their premiums will increase by almost $5, from $35 to $39.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Are Medicare Part B premiums indexed for inflation?

Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm. Medicare Part B premiums are indexed for inflation. They're adjusted periodically to keep pace with the falling value of the dollar.

Will Medicare recipients get a premium reduction for Alzheimer's drug?

WASHINGTON -- Medicare recipients will get a premium reduction-but not until next year-reflecting what Health and Human Services Secretary Xavier Becerra said Friday was an overestimate in costs of covering an expensive and controversial new Alzheimer's drug.

Who pays the most for Medicare Part B premiums?

Taxpayers with higher incomes paid more. 2011 Medicare Part B Premiums Medicare Part B premiums were $115.40 per month in 2011. Single taxpayers with modified adjusted gross incomes over $85,000 and married tax filers with MAGIs over $170,000 paid more.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

How much did Medicare premiums go up?

The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month. The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021.

Why is my Medicare premium increasing?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

What were Medicare premiums in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.

Why did my Medicare premium double?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Why did Medicare Part B go up so much?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

Do Medicare premiums change each year based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why is Medicare going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

Did Medicare premiums go up in 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

Are Medicare premiums indexed to inflation?

Medicare Part B premiums are indexed for inflation. They're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you'll pay next year. Premiums are also means-tested, so they're somewhat dependent upon your income.

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What were Medicare premiums in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the Medicare premium for 2014?

2014 Medicare Part A Premium: The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate.

How much did Medicare pay in 2014?

For a hospital stay of 91-150 days, the per-day Medicare Part A co-payment in 2014 is $608, a $16 increase from 2013.

What is the Medicare Part B 2014 deductible?

The Medicare Part B 2014 deductible will remain unchanged at $147.

How much did Medicare pay for skilled nursing in 2014?

2014 Medicare Part A Skilled Nursing: After 20 days in a skilled nursing facility, the per-day Medicare Part A skilled nursing co-payment in 2014 will be $152, or $4 more than in 2013.

When did Medicare Part B and Part A change?

The Medicare administration has announced Medicare Part A and Part B rates for 2014, with changes taking effect Jan. 1, 2014.

Does Plan F cover Medicare Part A?

With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without ...

How much is Part B premium in 2014?

In fact, the 2014 Part B premium will be $104.90 a month — the same amount as in 2013. A mass email claiming that the premium will rise to $247 a month by 2014 has been circulating since before the 2010 elections — and it still is. But it's just another attempt to scare older Americans and has never had any basis in fact.

What to email Medicare?

Check out the Q&As featured in the Ask Ms. Medicare Archive. If the information you’re looking for isn’t there, email your query to msmed@aarp.org. Be sure to include your name, age, state and ZIP code. Your name will not be published

What percentage of older Americans will be liable for the surcharge?

The law froze the income brackets at 2010 levels through 2019, which means that more older Americans will become liable for the surcharge — up from 5 percent now to 14 percent by 2019, according to an estimate from the Kaiser Family Foundation.

Will my name be published in the Affordable Care Act?

Your name will not be published. This process is in no way affected by the new health care law, the Affordable Care Act (ACA), also known as "Obamacare.". The law does, however, contain provisions to reduce the rate of Medicare costs over time — without reducing guaranteed benefits.

What was the average Medicare premium in 2014?

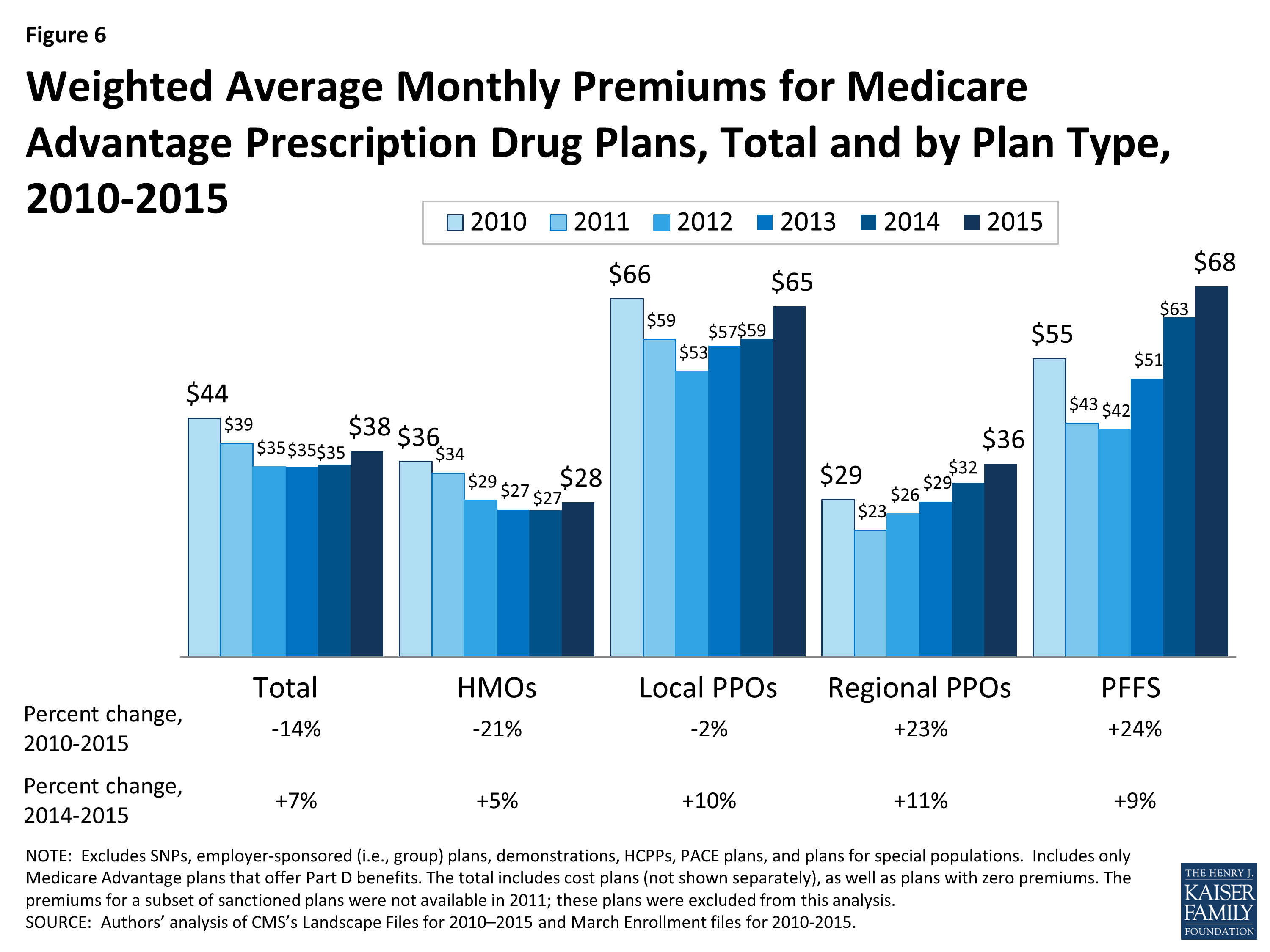

In 2014, the average unweighted monthly premium for Medicare Advantage Prescription Drug plans (MA-PDs) will be $49 —a $2 decrease from 2013 and lower than the premium in 2011 or 2012 ( Exhibit 6 ).

How many Medicare Advantage plans were available in 2014?

A total of 2014 Medicare Advantage plans will be available nationwide for general enrollment in 2014, down 60 plans from 2013, taking into account new entrants, consolidations, and departures. 5 On average, Medicare beneficiaries will be able to choose from among 18 plans in 2014, two fewer than in 2013. As in prior years, choice will be more extensive in metro than non-metro areas (on average 20 versus 11 plans, respectively). About 526,000 of current 2013 Medicare Advantage enrollees (5%) will have to make some change because their plan is not available in 2014. However, almost all of these enrollees (91%) will still be able to choose a plan of the same type, and often a plan that is offered by the same company. Virtually all (99%) beneficiaries in plans that are withdrawing from their area will continue to have access to one or more Medicare Advantage plans.

How much did HMOs cost in 2014?

Premiums for HMOs will average $35 per month in 2014, up $1 from 2013 but still lower than the average monthly premium for regional PPOs ($38), and substantially lower than the average monthly premiums for local PPOs ($70) and PFFS plans ($70). In 2014, the only plan type with large changes in premiums is PFFS plans, where average premiums of $70 are down $13 from $83 in 2013.

How many SNPs were there in 2014?

In 2014, 560 SNPs in total will be available nationwide to those eligible for enrollment, down from 644 plans in 2013 ( Exhibit 4; Table A3 ). Most of the decline between 2013 and 2014 reflects a drop in chronic care SNPs, from 214 plans in 2013 to 152 plans in 2014. Institutional SNPs, always limited in number, will decline from 68 plans in 2013 to 61 plans in 2014. SNPs for dually eligible beneficiaries will continue to be the most common type of SNP, though the number will decline from 362 plans in 2013 to 347 plans in 2014.

What is the Medicare coverage gap?

The initial design of the Medicare drug benefit included a coverage gap, or “doughnut hole” that required beneficiaries with relatively high drug costs to pay 100 percent of their expenses in the gap until they qualified for catastrophic protection . The ACA phases in coverage in the gap, and eliminates the gap altogether by 2020. In 2014, beneficiaries will be responsible for no more than 47.5 percent of the cost of brand-name drugs and 72 percent of the cost of generic drugs in the gap.

What is Medicare Advantage?

Medicare Advantage plans receive funds from the federal government (Medicare) to provide Medicare-covered benefits to enrollees. As of September 2013, 15 million Medicare beneficiaries (29%) were enrolled in a Medicare Advantage plan. The Affordable Care Act of 2010 (ACA) enacted reductions in payments to Medicare Advantage plans with the goal of creating greater parity in payments between the traditional Medicare program and Medicare Advantage. 1

What was the average out of pocket limit in 2014?

Average out-of-pocket limits in 2014 will be higher than in 2013, providing less protection to enrollees with relatively high out-of-pocket costs ($4,797 versus $4,333). In 2014, about one-third (37%) of plans set limits at or below CMS’s recommended limit of $3,400, a decline from almost half in 2013 (48%), 2012 (50%) and 2011 (51%). Conversely, the share of plans with a limit exceeding $5,000 is higher in 2014 than in 2013 (41% versus 25%, respectively; Exhibit 9 ).

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.

Medicare Part A and Part B Changes from 2013 to 2014

Medicare Part A in 2014

- 2014 Medicare Part A Premium:

The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate. - 2014 Medicare Part A Deductible:

The 2014 Medicare Part A deductible will be $1,216per benefit period, up from $1,184 per benefit period in 2013.

Medicare Part B in 2014

- 2014 Medicare Part B Premium:

The standard 2014 Medicare Part B premium will remain at $104.90per month, the same rate as in 2013. Higher Part B premium rates for people with higher incomes will also remain at 2013 levels. - 2014 Medicare Part B Deductible:

The Medicare Part B 2014 deductible will remain unchanged at $147.

Medigap Protection Against Deductibles, Co-Pays, and Coinsurance

- Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next. An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all …

Summary of Findings

Change in Overall Plan Availability in 2014

- In total, there will be 2014 Medicare Advantage plans nationwide available for individual enrollment in 2014 (Exhibit 1). In aggregate, 60 fewer plans will be available in 2014 than in 2013, a relatively small change that reflects offsets of plan expansion and contraction (discussed below). The average Medicare beneficiary will have 18 plans availa...

2014 Plan Choices and Geographic Variation

- In 2014, as in recent years, virtually all Medicare beneficiaries will have access to a Medicare Advantage plan as an alternative to traditional Medicare (Exhibit 3). Nationwide 99 percent of all beneficiaries (100 percent in metro areas and 98 percent in non-metro areas) have one or more Medicare Advantage choices, and most have a wide range of plans available to them. The larges…

Availability by Level of Traditional Medicare Spending

- Historically, beneficiaries in counties with the highest per capita spending for traditional Medicare (top quartile) have had more Medicare Advantage plans available to them than have beneficiaries in lower cost counties (Table A1). In 2012, the first year of Medicare Advantage payment reform under the ACA (See Box on Recent Legislative and Regulatory Changes), the number of plans av…

Market Dynamics and Turnover

- While many organizations offer Medicare Advantage plans, a few – particularly Humana, United Healthcare, and the Blue Cross and Blue Shield (BCBS) affiliates – have particularly large geographic spread and these organizations historically account for a disproportionate share of enrollment. In 2014, 44 percent of available plans are being offered by one of these three firms o…

Premiums and Benefits in 2014

- Premiums, benefits, cost sharing requirements and provider networks are important plan characteristics for beneficiaries to consider when choosing among Medicare Advantage plans, because of the potential effect on beneficiaries’ out-of-pocket costs and their access to preferred health care providers. This analysis focuses on national trends in premiums, out-of-pocket spen…

Limits on Out-Of-Pocket Spending

- The traditional fee-for-service Medicare program does not include a limit on out-of-pocket spending for services covered under Parts A and B, which is one reason most beneficiaries have supplemental coverage to limit their financial liability. When HMOs were first offered under the risk contracting program in the mid-1980s, they covered most of Medicare’s cost sharing require…

Prescription Drug Coverage

- Prior to 2006, traditional Medicare did not offer an outpatient prescription drug benefit, and Medicare Advantage plans were an important source of prescription drug coverage for people on Medicare. Many plans offered some coverage for prescription drugs, which they often financed in part with the net difference between Medicare Advantage payments for Part A and B benefits an…

Discussion

- In 2014, Medicare beneficiaries will continue to be able to choose from among many Medicare Advantage plans, offered by many firms, in virtually all parts of the country. HMOs continue to be more numerous than other plan types, but the availability of local PPOs is growing. Regional PPOs also remain available to many Medicare beneficiaries, although a relatively small number of firm…