The majority of changes addressed Medicare’s conditions of participation for health care providers (55) and hospital regulation and financing (60). About two-thirds of the policies were implemented under 1135 waiver authority (137), and most are expected to expire in the future (203).

Full Answer

What are the proposed changes to Medicare?

Apr 02, 2018 · CMS Finalizes Policy Changes and Updates for Medicare Advantage and the Prescription Drug Benefit Program for Contract Year 2019 (CMS-4182-F) On April 2, 2018, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that updates Medicare Advantage (MA) and the prescription drug benefit program (Part D) by promoting innovation …

When can I make changes to my Medicare coverage?

May 09, 2022 · These requirements, along with clarifications to existing regulations, were codified in the “Medicare and Medicaid Programs; Policy and Technical Changes to the Medicare Advantage, Medicare Prescription Drug Benefit, Programs of All-Inclusive Care for the Elderly (PACE), Medicaid Fee-For-Service, and Medicaid Managed Care Programs for Years ...

How new changes to Medicare may affect your healthcare?

Changes in Centers for Medicare & Medicaid Services policies appear to be associated with increases in measured severity of illness; these increases do not appear to reflect substantive changes in true patient severity. ... The change in predictive accuracy of measured severity of illness on 30-day readmissions after the implementation of both ...

How do you change Medicare plans?

Feb 28, 2022 · Although in part these changes continued the pattern of program expansions started in the 1967 modifications, they marked an important shift to some policy modifications that were intended specifically to help control the growing costs of the Medicare program. Among the most important of the 1972 modifications was the establishment of professional standards …

What is the mission of the Commonwealth Fund?

The mission of the Commonwealth Fund is to promote a high-performing health care system that achieves better access, improved quality, and greater efficiency, particularly for society’s most vulnerable , including low-income people, the uninsured, and people of color. Support for this research was provided by the Commonwealth Fund.

What is Section 1135?

Section 1135 of the Social Security Act (SSA) is the foundation of the Department of Health and Human Services’ (HHS’s) legal authority for responding to public health emergencies. 1 Section 1135 waivers require both a declaration of national emergency or disaster by the president and a public health emergency determination by the HHS secretary. 2 President Trump declared a national emergency on March 13, 2020, effective March 1, 2020. 3 HHS Secretary Azar declared a public health emergency on January 31, 2020, effective January 27, 2020. 4

What is the role of CMS in Medicare?

CMS's role in overseeing the Medicare program includes ensuring that payments are made correctly and that fraud, waste, and abuse are prevented and detected. Failure to do so endangers the Trust Funds and may result in harm Start Printed Page 5903 to beneficiaries. CMS has established various regulations over the years to address potentially fraudulent and abusive behavior in Medicare Parts C and D. For instance, 42 CFR 424.535 (a) (14) (i) addresses improper prescribing practices and permits CMS to revoke a physician's or other eligible professional's enrollment if he or she has a pattern or practice of prescribing Part B or D drugs that is abusive or represents a threat to the health and safety of Medicare beneficiaries, or both.

What are the two measures of the Medicare Health Outcomes Survey?

In accordance with § 422.164 (d) (2), we proposed substantive updates to two measures from the Medicare Health Outcomes Survey (HOS): The Improving or Maintaining Physical Health measure and Improving or Maintaining Mental Health measure.

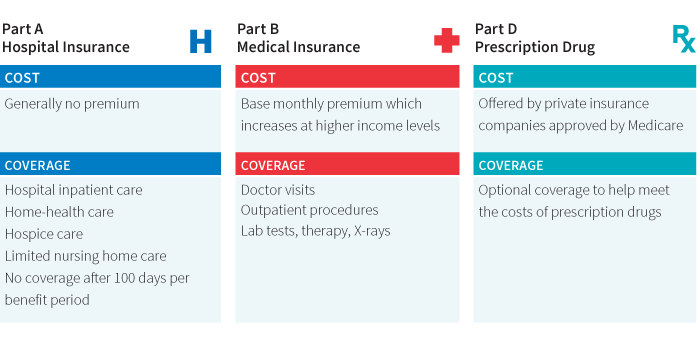

What is Medicare Part D?

Section 3308 of the Affordable Care Act amended section 1860D-13 (a) of the Act and established an income-related monthly adjustment amount for Medicare Part D (hereinafter referred to as Part D-IRMAA) for beneficiaries whose modified adjusted gross income (MAGI) exceeds the same income threshold amount tiers established under section 1839 (i) of the Act with respect to the Medicare Part B income-related monthly adjustment amount (Part B-IRMAA). The Part D-IRMAA is an amount that a beneficiary pays in addition to the monthly plan premium for Medicare prescription drug coverage under the Part D plan in which the beneficiary is enrolled when the beneficiary's MAGI is above the specified threshold.

What is eRx in Medicare?

Section 101 of the MMA requires the adoption of Part D e-prescribing (eRx) standards. Prescription Drug Plan (PDP) sponsors and Medicare Advantage (MA) organizations offering Medicare Advantage Prescription Drug Plans (MA-PD) are required to establish electronic prescription drug programs that comply with the e-prescribing standards that are adopted under this authority. Prescribers and dispensers who electronically transmit and receive prescription and certain other information for Part D-covered drugs prescribed for Medicare Part D-eligible individuals, directly or through an intermediary, are required to comply with any applicable standards that are in effect.

What is the purpose of the final rule?

The primary purpose of this final rule is to implement certain sections of the following federal laws related to the Medicare Advantage (MA or Part C) and Prescription Drug Benefit (Part D) programs:

What is a past overdose?

A past overdose is the risk factor most predictive for another overdose or suicide-related event. [ 1] In light of this fact, in section 2006 of the SUPPORT Act, Congress required CMS to include Part D beneficiaries with a history of opioid-related overdose (as defined by the Secretary) as PARBs under a Part D plan's DMP. CMS is also required under this section to notify the sponsor of such identifications. In line with this requirement, in lieu of modifying the definition of “potential at-risk beneficiary” at § 423.100 as proposed, CMS is finalizing the clinical guideline criteria at new paragraph § 423.153 (f) (16) (ii) (2) to include a Part D eligible individual who is identified as having a history of opioid-related overdose, beginning January 1, 2022. Inclusion of beneficiaries with a history of opioid-related overdose as PARBs in DMPs will allow Part D plan sponsors and providers to work together to closely assess these beneficiaries' opioid use and determine whether any additional action is warranted. The clinical guideline criteria CMS is finalizing at § 423.153 (f) (16) (ii) (2) specify that both a principal diagnosis of opioid-related overdose and a recent Part D opioid prescription are required components to meet the definition of a PARB based on the history of opioid-related overdose. Additionally, CMS is making some revisions to the terminology used in the clinical Start Printed Page 5866 guideline criteria at § 423.153 (f) (16) (ii) (2) from what was initially proposed in the definition at § 423.100 to better characterize the data sources and opioid prescription criteria to be used to identify beneficiaries meeting the definition of a PARB based on a history of opioid-related overdose. The clinical guideline criteria mirror the definition of “potential at-risk beneficiary” that was initially proposed but relocated to § 423.153 (f) (16) (ii) (2) to improve clarity of the regulation text.

What information must a sponsor of a Part D plan disclose?

Sponsors of Part D prescription drug plans, including MA-PDs and standalone PDPs, must disclose certain information about their Part D plans to each enrollee in a clear, accurate, and standardized form at the time of enrollment and at least annually thereafter under section 1860D-4 (a) (1) (a) of the Act. Section 6102 of the SUPPORT Act amended section 1860D-4 (a) (1) (B) of the Act to require that Part D sponsors also must disclose to each enrollee information about the risks of prolonged opioid use. In addition to this information, with respect to the treatment of pain, MA-PD sponsors must disclose coverage of non-pharmacological therapies, devices, and non-opioid medications under their plans. Sponsors of standalone PDPs must disclose coverage of non-pharmacological therapies, devices, and non-opioid medications under their plans and under Medicare Parts A and B. Section 6102 also amended section 1860D-4 (a) (1) (C) to permit Part D sponsors to disclose this opioid risk and alternative treatment coverage information to only a subset of plan enrollees rather than disclosing the information to each plan enrollee. We are finalizing our proposal with only one modification to make the requirement applicable beginning January 1, 2022, rather than January 1, 2021 as proposed.

Why are federal and state workforce policies implemented?

Various federal and state workforce policies have been implemented over the past decades with the intent of increasing production of health professionals determined to be in short supply, to support clinical training —especially in locations serving underserved populations—and to encourage professionals to practice in underserved areas . The availability of evidence to determine the effectiveness of these programs varies greatly by program, from none to numerous studies.

Does Medicare pay for NP services?

In addition to payment for physician services, Medicare also pays for NP or PA services. These payments are paid at the same rate paid to physicians only if the services are deemed to be “incident to” physician services. This means that the service cannot be billed to Medicare by the NP unless a physician has seen the patient previously for the particular diagnosis being addressed at the visit (i.e., so the NP service is considered to be “incident to” the physician’s management). In practice, this means an NP may not see a new patient or an existing patient with a new diagnosis if billing “incident to” a physician. In settings where these practitioners are salaried employees paid by the supervising physicians, the payment benefits accrue to the physicians as employers, and in settings where NPs are paid by hospitals, any payment benefits accrue to hospitals.

What is the NHSC?

10 This legislation authorized the U.S. Public Health Service to assign commissioned officers and federal civil service personnel to practice in shortage areas. In 1972, Congress passed the Emergency Health Personnel Amendments authorizing scholarships to support health professions education in return for a minimum of 2 years of service in shortage areas designated by the agency. During the 1980s, the NHSC implemented the Loan Repayment Program, which substantially increased the number of NHSC field personnel.

What is an ACO in Medicare?

ACOs are defined by CMS as “groups of physicians, hospitals, and other health care providers who come together voluntarily to give high-quality coordinated care to the Medicare patients they serve” ( CMS, 2012c ). The goal of ACOs is to improve quality of care for Medicare beneficiaries by coordinating care among practice settings (e.g., hospitals, physician groups, and skilled nursing facilities), which helps ensure that patients get the appropriate level of care and that unnecessary duplication of services, medical errors, and hospital readmissions are reduced ( CMS, 2012c ). CMS has established two ACO payment programs to provide financial incentives for Medicare-enrolled providers who come together to form an ACO: the Medicare Shared Savings Program and the Advance Payment Model.

How does shared savings improve health care?

Shared savings is an approach to improving the value of health care by promoting accountability, requiring coordinated care, and encouraging infrastructure investments such as electronic health records and broadband to enable the secure exchange of clinical information across settings in real time ( CMS, 2012d ). Other investments may include hiring new nurse care managers and other personnel to provide better continuity of care across clinical settings. Participants agree to lower the cost of health care while meeting identified performance standards by sharing resources and care in a coordinated manner.

What is pioneer ACO?

The pioneer ACO model is designed to support organizations that already have experience operating as ACOs or in similar arrangements providing coordinated care to Medicare beneficiaries at a lower cost to Medicare. It is designed to allow them to move more rapidly from a shared savings payment model to a population-based payment model and to work in coordination with private payers to provide better care for beneficiaries ( CMS, 2012e ).