Medicare Advantage plans managed by private insurers pay physicians prices that are similar to traditional Medicare rates, according to a new USC-led study. More and more Medicare beneficiaries are enrolling each year in Medicare Advantage, but experts knew little about their physician reimbursement differences or similarities.

How much cheaper is Medicare Advantage compared to Medicare?

Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.” Some Medicare Supplements cover 100% of the cost sharing left by Medicare on Medicare approved expenses.

Does Medicare Advantage offer much advantage?

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

Does Medicare Advantage cost less than traditional Medicare?

UnitedHealth Group, for example, discovered that Medicare Advantage costs beneficiaries 40 percent less than traditional Medicare does.

What do you pay in a Medicare Advantage plan?

- Complete a new Medicare enrollment (unless you are in your initial or special enrollment period)

- Switch from Original Medicare to Medicare Advantage

- Enroll in a stand-alone Part D prescription drug plan (unless you are moving to Original Medicare from Medicare Advantage)

How are Medicare Advantage plans reimbursed?

The money that the government pays to Medicare Advantage providers for capitation comes from two U.S. Treasury funds. The first one is The Hospital Insurance Trust fund, which pays for whatever is covered in Part A of Original Medicare, such as hospital, skilled nursing care, and hospice coverage.

Where does the money come from for Medicare Advantage plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

How are Medicare providers paid?

Current payment systems in traditional Medicare have evolved over the last several decades, but have maintained a fee-for-service payment structure for most types of providers. In many cases, private insurers have modeled their payment systems on traditional Medicare, including those used for hospitals and physicians.

Is Medicare Advantage profitable for insurance companies?

Medicare Advantage is the common thread. Big-name health insurers raked in $8.2 billion in profit for the fourth quarter of 2019 and $35.7 billion over the course of the year.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

What are the three main payment mechanisms used in managed care?

What are the three main payment mechanisms managed care uses? In each mechanism who bears the risk. The three main types of payment arrangements with providers are: capitation, discounted fees, and salaries.

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentUnder Part B, after the annual deductible has been met, Medicare pays 80 percent of the allowed amount for covered services and supplies; the remaining 20 percent is the coinsurance payable by the enrollee.

What is the maximum fee a Medicare participating provider can collect for services?

The limiting charge is 15% over Medicare's approved amount. The limiting charge only applies to certain services and doesn't apply to supplies or equipment. ". The provider can only charge you up to 15% over the amount that non-participating providers are paid.

Who is the largest Medicare Advantage provider?

/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.

What insurance company makes the most money?

Top 10 Most Profitable Insurance Companies in 2020Berkshire Hathaway. $81.4B.MetLife. $5.9B.State Farm. $5.6B.Allstate. $4.8B.Prudential. $4.2B.USAA. $4B.Progressive. $4B.MassMutual. $3.7B.More items...•

Medicare Advantage penetration by state, 2018

A different assessment came on the same blog early last year from Robert E. Moffit of the conservative Heritage Foundation and coauthors Rita E. Numerof and Christen M. Buseman.

An invitation to plans

Pulling back out of the weeds a bit, concerns about MA plan payment aren’t limited to the growing risk-adjustment gap between MA and FFS and all the other details. They also go to the whole benchmark-bid process and the way it works. As health economist Austin Frakt has noted, benchmarks really have nothing to do with plan costs.

2020 foresight: an MA payment timeline

As this magazine is published, the process that will determine the amounts of monthly capitated payments to Medicare Advantage (MA) plans next year, in 2020, has already begun. Here are highlights:

Who administers Medicare Advantage?

The traditional Medicare program is administered by the federal government. The Medicare Advantage program instead gives beneficiaries a choice of enrolling with a private health plan that has contracted with the government to provide health insurance benefits to Medicare beneficiaries. For the study published on July 10 in JAMA Internal Medicine, ...

How many Medicare beneficiaries are in Medicare Advantage?

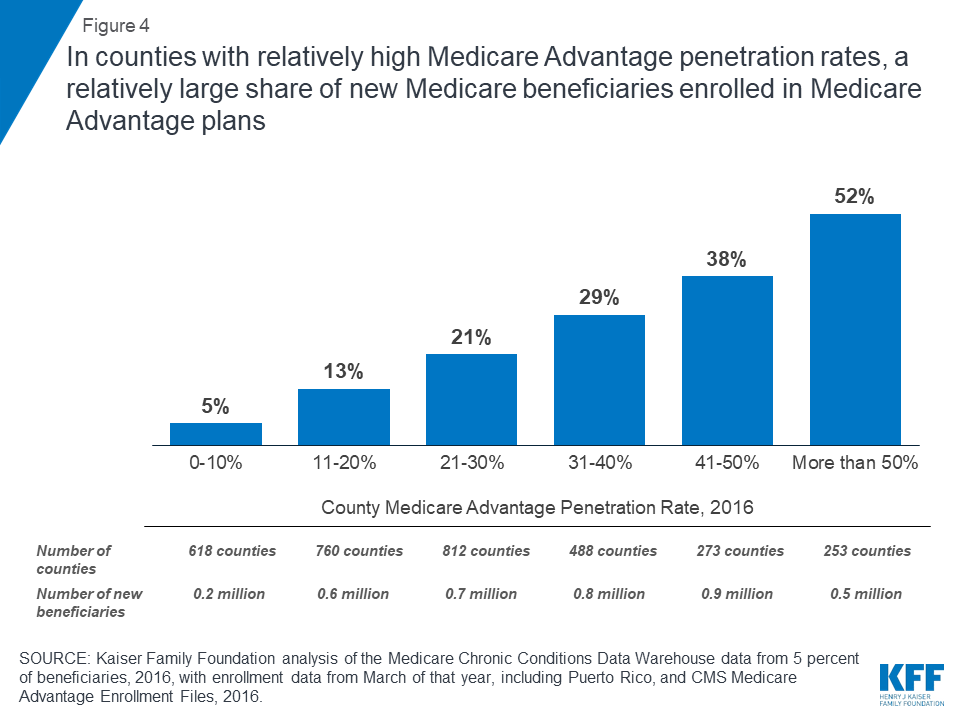

More and more Medicare beneficiaries are enrolling each year in Medicare Advantage, but experts knew little about their physician reimbursement differences or similarities. “With 1 in 3 beneficiaries enrolled in Medicare Advantage, it is important to look under the hood and get a better understanding of how these plans operate,” said Erin Trish, ...

Is Medicare Advantage the same as Medicare Advantage?

Medicare Advantage plans sit somewhere between these two ends of the spectrum. On the one hand, they operate in the context of the traditional Medicare program, but on the other hand, they are often the same private health plans ...

Is Medicare Advantage a private insurer?

The Medicare Advantage and commercial data are from a single insurer and thus, may not represent all private insurers. However, it is an insurer with large Medicare Advantage market share, they noted, so its rates may well reflect the market.

Does privatization reduce health care costs?

As recently as last fall, House Speaker Paul Ryan suggested that privatization would reduce health care costs for the federal government. The current Congress has made no formal legislative proposal, but one idea discussed in policy circles is the “premium support model,” which would provide beneficiaries with subsidies or vouchers that they could use to purchase insurance from private insurers.

Is Medicare Advantage more tied to traditional Medicare?

The researchers found that “physician reimbursement in Medicare Advantage is more strongly tied to traditional Medicare than to commercial prices, but Medicare Advantage plans take advantage of favorable commercial prices for services for which traditional Medicare overpays.”.