When are Medicare premiums deducted from Social Security?

· Does Social Security pay for Medicare? Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that...

Are Medicare premiums deducted from Social Security payments?

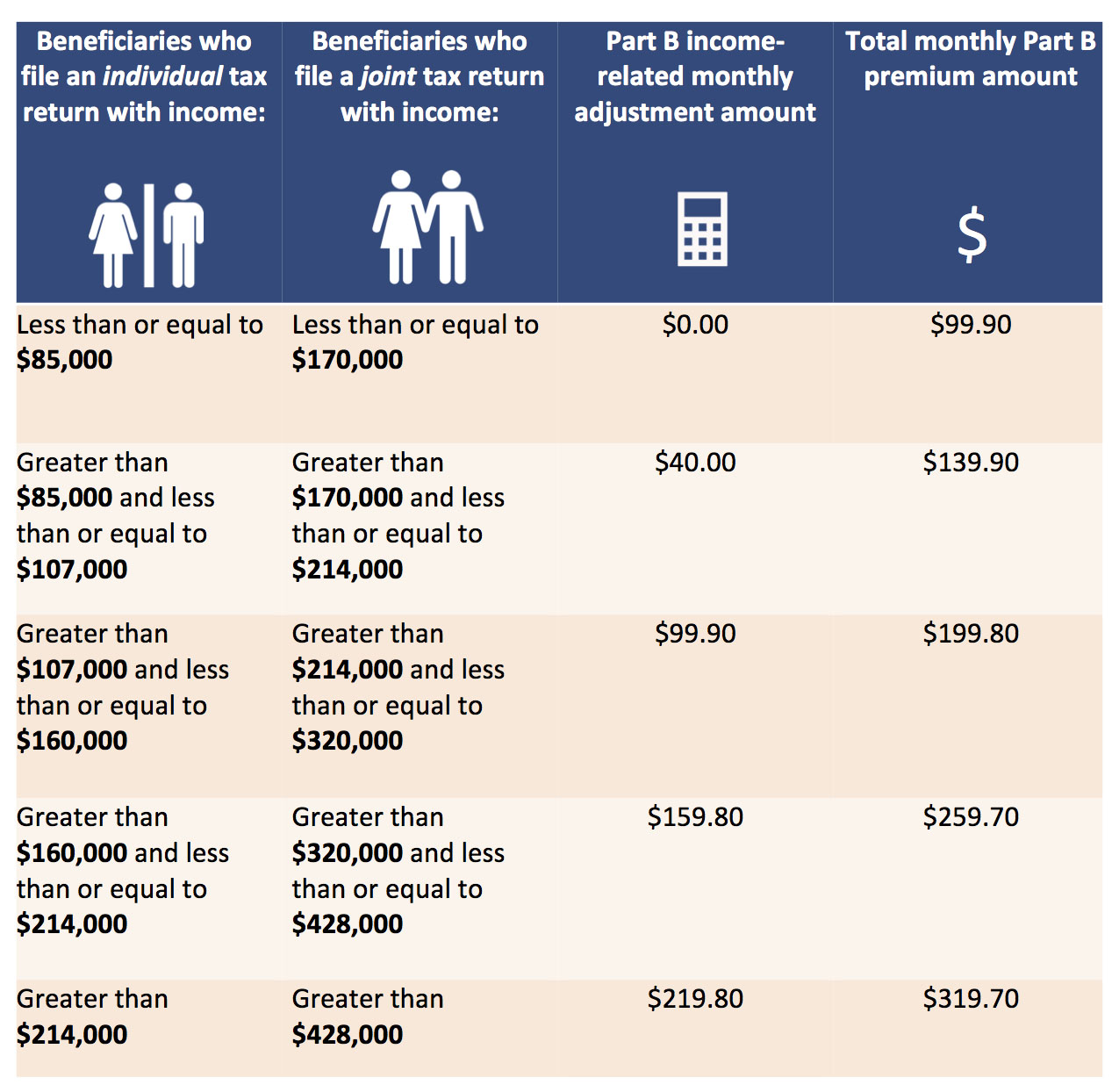

For most beneficiaries, the government pays a substantial portion — about 75% — of the Part B premium, and the beneficiary pays the remaining 25%. If we determine you’re a higher-income beneficiary, you’ll pay a larger percentage of the total cost of Part B based on the income you normally report to the Internal Revenue Service (IRS).

Is Medicare automatically deducted?

· Paying Medicare premiums. If you are drawing Social Security benefits, your Medicare Part B premiums are deducted from your monthly payments. If you're not getting …

What is the monthly premium for Medicare Part B?

· Tiếng Việt. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social …

How does Social Security and Medicare get funded?

Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent. In 2020, $1.001 trillion (89.6 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes.

Who pays for Social Security and Medicare?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

How is Medicare paid for by the government?

Q: How is Medicare funded? A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they're enrolled in Medicare. Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

How is Social Security paid?

We pay Social Security benefits monthly. The benefits are paid in the month following the month for which they are due. For example, you would receive your July benefit in August.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Does everyone pay into Social Security?

Workers and employers pay for Social Security. Workers pay 6.2 percent of their earnings up to a cap, which is $127,200 a year in 2017. (The cap on taxable earnings usually rises each year with average wages.) Employers pay a matching amount for a combined contribution of 12.4 percent of earnings.

Is Medicare funded by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

Do we pay for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

How is healthcare funded in the US?

There are three main funding sources for health care in the United States: the government, private health insurers and individuals. Between Medicaid, Medicare and the other health care programs it runs, the federal government covers just about half of all medical spending.

Where does the money for the Social Security fund come from?

Social Security benefits are paid from the reserves of the Old-Age, Survivors, and Disability Insurance ( OASDI ) trust fund. The reserves are funded from dedicated tax revenues and interest on accumulated reserve holdings, which are invested in Treasury securities.

How much will I get from Social Security if I make $30000?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

Why did my spouse receive a settlement?

You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy, or reorganization.

How to determine 2021 income adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What does Part B cover?

Part B helps pay for your doctors’ services and outpatient care. It also covers other medical services, such as physical and occupational therapy, and some home health care. For most beneficiaries, the government pays a substantial portion — about 75 percent — of the Part B premium, and the beneficiary pays the remaining 25 percent.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

How does Social Security determine if you will pay a higher premium?

Social Security determines whether you will pay a higher premium based on income information it receives from the Internal Revenue Service.

When will Medicare be sent out to Social Security?

If you're receiving Social Security retirement benefits, SSA will send you a Medicare enrollment package at the start of your initial enrollment period, which begins three months before the month you turn 65. For example, if your 65th birthday is July 15, 2021, this period begins April 1.

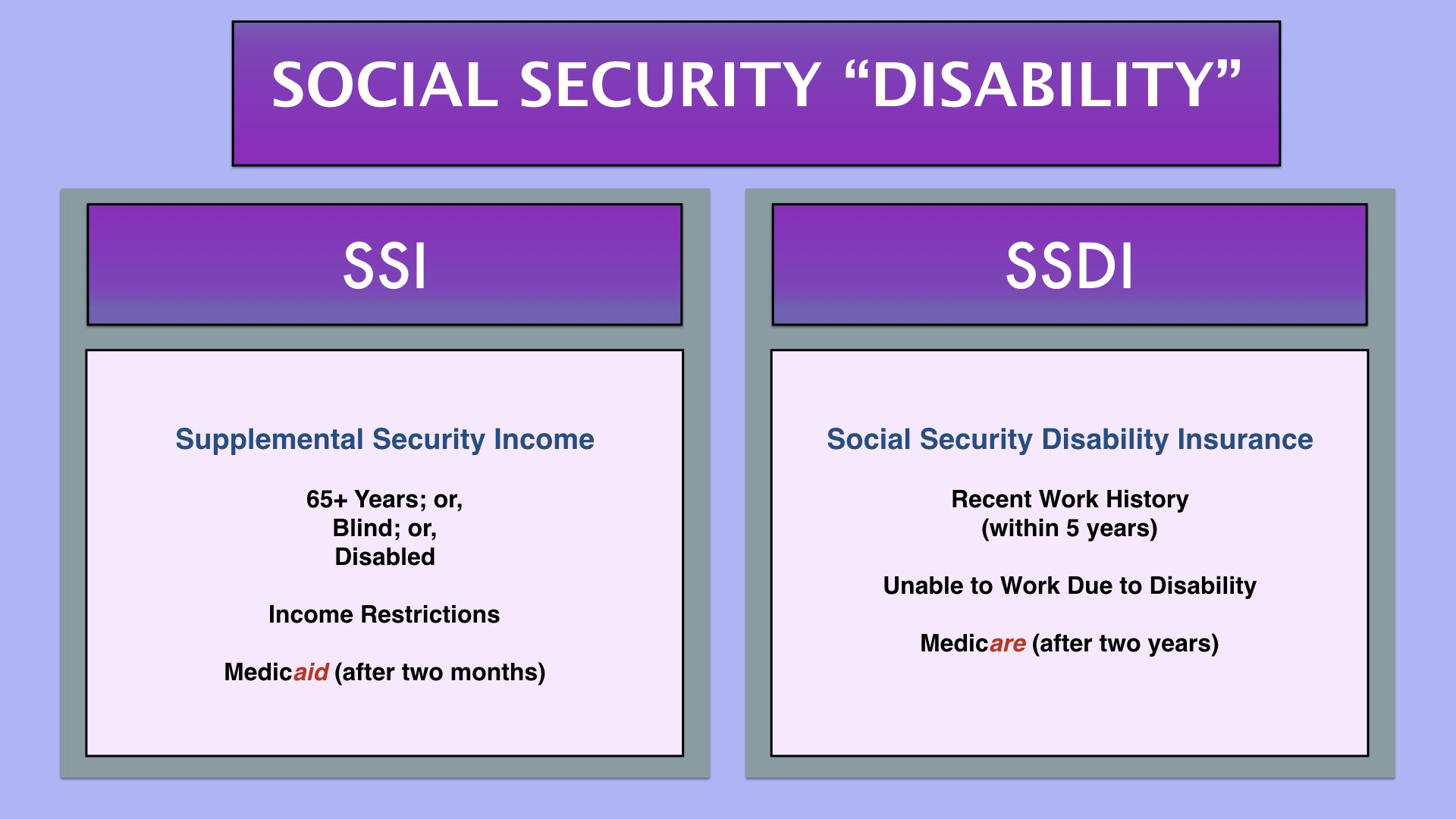

When can I get Medicare if I have a disability?

People with disabilities may qualify for Medicare before age 65. If you are receiving Social Security Disability Insurance (SSDI), Social Security will enroll you automatically in Parts A and B after you have been drawing benefits for two years.

When do you have to apply for Medicare if you have not filed for Social Security?

If you have not yet filed for Social Security benefits, you will need to apply for Medicare yourself. You can do so any time during the initial enrollment period, which lasts seven months (so, for that July 15 birthday, the sign-up window runs from April 1 through Oct. 31).

When does Medicare start?

If you're receiving Social Security retirement benefits, SSA will send you a Medicare enrollment package at the start of your initial enrollment period, which begins three months before the month you turn 65. For example, if your 65th birthday is July 15, 2021, this period begins April 1.

When will Social Security start in 2021?

For example, if your 65th birthday is July 15, 2021, this period begins April 1. On your 65th birthday, you'll automatically be enrolled in parts A and B. You have the right to opt out of Part B, but you might incur a penalty, in the form of permanently higher premiums, if you sign up for it later. If you have not yet filed for Social Security ...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

What is the purpose of Social Security and Medicare?

Social Security and Medicare provide help to people through financial support and healthcare insurance.

How does the SSA determine Medicare premium?

The premium for original Medicare Part A is a fixed amount and is calculated on how many years a person paid Medicare taxes. The premium for Medicare Part B depends on a person’s income for the previous two years.

How does Social Security work?

The amount of Social Security benefit a person gets is based on their total earnings and their age when they retire.

How old do you have to be to get Social Security?

Age is not a factor in eligibility for Social Security benefits, and a person may apply for benefits when they are 62 years old, although they may not then get their full benefit amount. In general, a total of 40 credits is needed to qualify for benefits. That amount of credits represents 10 years of work.

What is tax money for Social Security?

Tax money pays for Social Security benefits. During a person’s working life, they pay taxes into Social Security, which is then used to pay benefits. The benefits are provided for a person who meets one of the following criteria: has retired. is a survivor of a person who died.

What happens if you delay enrolling in Medicare?

If a person delays enrolling in Medicare until after their IEP they may pay a late enrollment penalty, which will last as long as they have Medicare coverage.

When does Medicare start if you get Social Security?

A person’s 7-month IEP starts 3 months before the month they turn 65, includes the birthday month, and the following 3 months.

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.