How to Compare Medicare Advantage Plans

- Compare Medicare Advantage Plan benefits. Medicare Advantage, also known as Medicare Part C, is delivered through private insurance companies under contract with Medicare.

- Consider Medicare Advantage Plan costs. ...

- Understand Medicare Advantage Plan types. ...

Full Answer

How do I choose the best Medicare Advantage plan?

2 rows · Original Medicare: Medicare Advantage: For Part B-covered services, you usually pay 20% of the ...

How do you find top rated Medicare Advantage plans?

· How to compare Medicare Advantage plan costs Premiums: this is the amount you pay monthly for coverage. Typical premium amounts can range from as low as $0 to over... Copayments/coinsurance: this is an amount you pay when you receive a service, for example, $10 for a visit to a primary... ...

How much cheaper is Medicare Advantage compared to Medicare?

· The best place to start shopping for Medicare Advantage plans (or a Part D or Medigap policy) is on the Medicare.gov comparison tool. After answering a few questions about your location and any...

What to consider when comparing Medicare plans?

· If you wish to compare some of the Medicare plans where you live, use the Compare Plans button on this page. Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year. The Formulary, and/or provider network may change at any time. You will receive notice when necessary.

What is the best way to compare Medicare Advantage plans?

The Medicare Plan Finder on Medicare.gov is currently the most comprehensive tool for comparing Medicare Advantage plan benefits, prescription drug coverage and costs.

Is there a website to compare Medicare Advantage plans?

Compare plans online with MedicareAdvantage.com If you want to compare plans online and have one-on-one support from a licensed insurance agent, then you can use MedicareAdvantage.com. MedicareAdvantage.com offers an online plan comparison tool where you can review Medicare Advantage plans side by side.

What Medicare Advantage plan has the highest rating?

What Does a Five Star Medicare Advantage Plan Mean? Medicare Advantage plans are rated from 1 to 5 stars, with five stars being an “excellent” rating. This means a five-star plan has the highest overall score for how well it offers members access to healthcare and a positive customer service experience.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Who Has the Best Medicare Advantage Plan for 2022?

For 2022, Kaiser Permanente ranks as the best-rated provider of Medicare Advantage plans, scoring an average of 5 out of 5 stars. Plans are only available in seven states and the District of Columbia.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is Humana a good Medicare Advantage plan?

Medicare rating: 4 stars Humana has a 4-star rating from the Centers for Medicare & Medicaid Services (CMS) for nearly all of its Medicare Advantage Plan contracts.

What states have 5-star Medicare Advantage plans?

States where 5-star Medicare Advantage plans are available:Alabama.Arizona.California.Colorado.Florida.Georgia.Hawaii.Idaho.More items...•

Is it better to have Medicare Advantage or Medigap?

Is Medicare Advantage or Medigap Coverage Your Best Choice? Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Can I drop my Medicare Advantage plan and go back to original Medicare?

You can leave your Medicare Advantage plan and return to traditional Medicare Part A (hospital insurance) and Part B (medical insurance) at any time. Just give your managed care plan 30 days written notice, and they will notify Medicare.

Do Medicare Advantage plans have deductibles?

Some Medicare Advantage plans have separate deductibles for medical care and prescription drugs. If your Medicare Advantage plan has a network, only in-network care may apply towards the deductible. Some Medicare Advantage plans have $0 medical deductibles, $0 prescription drug deductibles, and $0 premiums.

How do you shop for Medicare plans?

You can find and compare Medicare Advantage and Medicare Prescription Drug Plans available in your area by inputting your zip code on the Plan Finder tool at Medicare.gov. Counselors are also available, free of charge, to provide you with personalized assistance through State Health Insurance Assistance Programs.

What are the types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

How can I save my drug list on Medicare gov?

Click the “Update/print my drugs” box on the MyMedicare.gov dashboard page. Click the “Find Your Saved Drug Lists” box in new Plan Finder. In the new Plan Finder, your client can choose to skip logging into an account and still enter their prescription drugs, compare plans, and even complete an enrollment.

What are the best Medicare Advantage plans in PA?

The Best Medicare Advantage Plans In PennsylvaniaComplete Blue PPO Distinct (PPO) - Score: 76.76.Community Blue Medicare PPO Signature (PPO) - Score: 76.76.Community Blue Medicare PPO Distinct (PPO) - Score: 76.76.Community Blue Medicare Plus PPO Signature (PPO) - Score: 76.76.More items...

How to compare Medicare Advantage plans?

How to compare Medicare Advantage plan costs 1 Premiums: this is the amount you pay monthly for coverage. Typical premium amounts can range from as low as $0 to over $100 a month. According to the Centers for Medicare and Medicaid Services (CMS), the average Medicare Advantage premium in 2021 was estimated at $21/month. Regardless of how much or little you pay for Medicare Advantage premium, you still must pay your Medicare Part B premium. The first cost you may consider when you compare Medicare Advantage plans is the premium. However, keep in mind that plans with the lowest premium may not necessarily be the cheapest plan. 2 Copayments/coinsurance: this is an amount you pay when you receive a service, for example, $10 for a visit to a primary care physician or $100 to fill a prescription for a brand-name drug. Copayments and coinsurance may vary from plan to plan. As you compare Medicare Advantage plans, look at the copayments for the services you receive the most. For example if you have arthritis and regularly see a rheumatologist, look at what different plans charge to see a specialist. 3 Deductible: this is the amount you pay before your plan begins to pay. You usually have separate deductibles for medical care and prescription drugs. Some Medicare Advantage plans have deductibles as low as $0, meaning the plan will help you pay starting with the first spend on covered services.

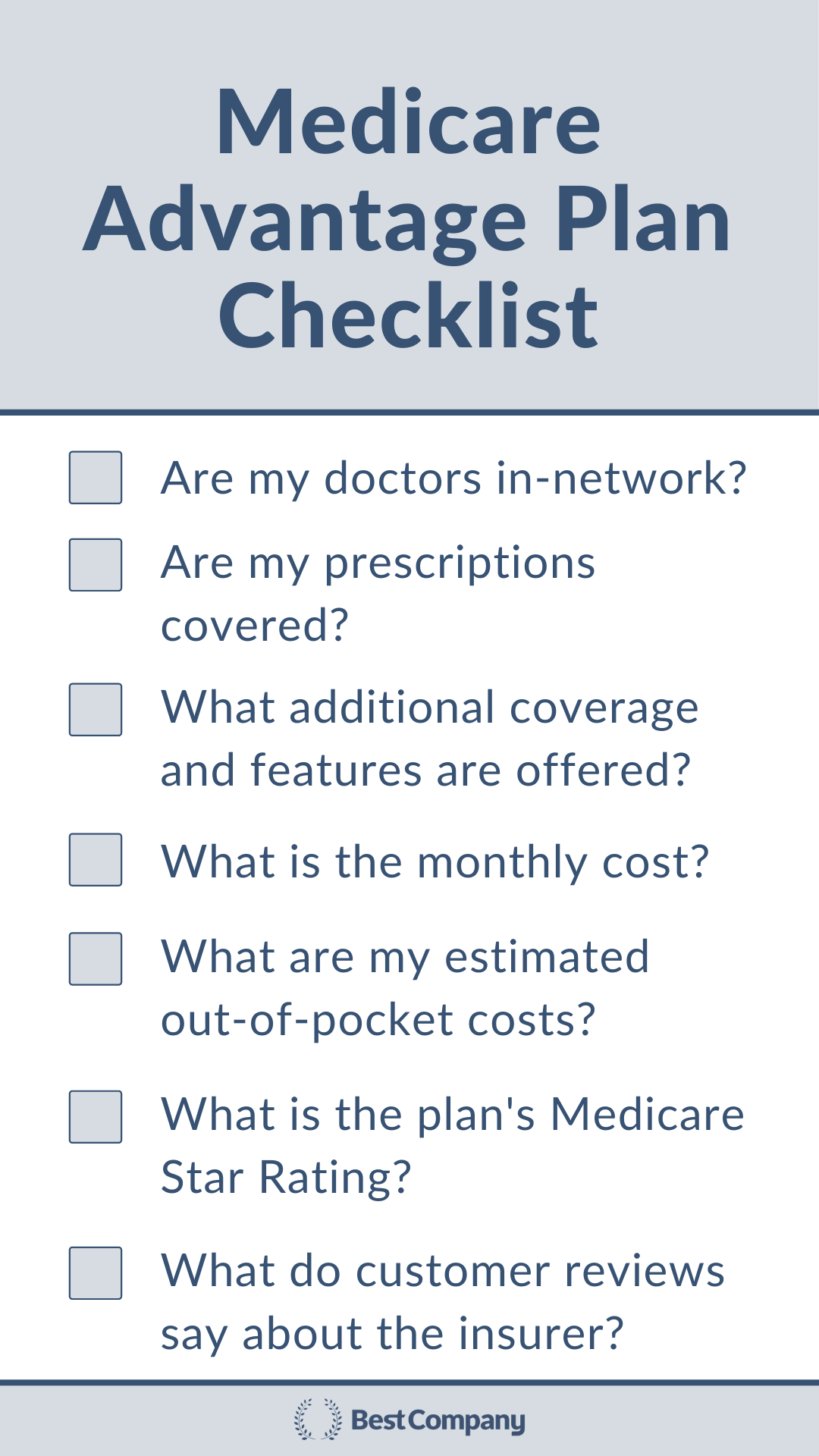

What are the things to consider when choosing a Medicare Advantage plan?

You will want to take note of the three main things to compare about Medicare Advantage plans: costs, benefits, and plan types.

What is coinsurance in Medicare?

Copayments/coinsurance: this is an amount you pay when you receive a service, for example, $10 for a visit to a primary care physician or $100 to fill a prescription for a brand-name drug. Copayments and coinsurance may vary from plan to plan. As you compare Medicare Advantage plans, look at the copayments for the services you receive the most.

How much will Medicare cost in 2021?

According to the Centers for Medicare and Medicaid Services (CMS), the average Medicare Advantage premium in 2021 was estimated at $21/month. Regardless of how much or little you pay for Medicare Advantage premium, you still must pay your Medicare Part B premium.

What are the different types of Medicare Advantage plans?

How to compare Medicare Advantage plan types. Common Medicare Advantage plan types include HMOs, PPOs, PFFS, and SNPs. The plan type indicates the rules about having a primary care doctor and seeing providers in network. A network is made up of medical professionals who have agreed to work with your plan. Health Maintenance Organization (HMO) ...

What are the extra benefits of Medicare Advantage?

Extra benefits may include: Prescription drug coverage for medications you take at home. Routine hearing coverage for exams and hearing aids. Routine vision coverage for eye exams, contacts, and glasses. Fitness benefits for gym memberships and exercise classes.

How many stars does Medicare Advantage have?

As you are shopping for Medicare Advantage plans, you may notice that all plans have a star rating, which goes up to five stars. The star rating indicates how happy beneficiaries are with the plan. that influence the rating are:

What are the different types of Medicare Advantage plans?

There are five types of Medicare Advantage Plans: 1 Health maintenance organization, or HMO, plans: Require you to see an in-network provider unless it’s an emergency situation, and most require a referral to see a specialist. 2 Preferred provider organization, or PPO, plans: Allow you to see both in-network and out-of-network health care providers, although it’s usually more expensive to go out of network. 3 Private fee-for-service, or PFFS, plans: Allow you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you. You may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more. 4 Special needs plans, or SNPs: Provide benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. These plans also provide benefits to people with a limited income. 5 Medical savings account, or MSA, plans: Combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

How does Medicare give a star rating?

Find the star rating. Medicare collects data on Medicare Advantage Plans from member surveys, the plans themselves and health care providers, then assigns a star rating based on its findings. “It’s based on performance on a range of different things to do with quality, including things like, ‘How responsive is the plan to any complaints or questions?’” says Anne Tumlinson, CEO of health care research and consulting firm ATI Advisory. The star rating goes from 1 to 5 stars, with 5 stars being excellent.

What are the pros and cons of Medicare Advantage?

The pros of Medicare Advantage Plans include potentially lower premiums for coverage, limits on out-of-pocket costs, and additional benefits such as hearing, dental and vision care.

Where to start shopping for Medicare Advantage Plans?

The best place to start shopping for Medicare Advantage Plans (or a Part D or Medigap policy) is Medicare’s Plan Finder tool. After answering a few questions about your location and any financial help you might be receiving — from Medicaid, for instance — the tool will show you all available plans that meet your criteria.

What is MA plan?

Also known as Medicare Part C or MA Plans, they’re offered by private insurers that have been approved by Medicare. Most plans offer additional benefits that aren’t covered under Original Medicare, which may include dental, hearing and vision coverage.

Which is better, a PPO or an HMO?

Think about your preferences. If you see specialists frequently and you don’t want to request a referral for every office visit, a PPO plan will be a better option than an HMO. If you’re a light health care user and see mostly your primary care physician, an HMO might be more affordable.

What are the two primary cost considerations?

Check the numbers. The two primary cost considerations are a plan’s premium and the maximum out-of-pocket cost , which is the most you’ll pay in a year for covered health care. “That’s usually something people care a lot about,” Ali says.

What are the extra benefits Medicare Advantage plans may provide?

Although Medicare Advantage plans aren’t required to offer extra benefits, many plans do offer one or more extra benefits.

Are you looking for more information about Medicare Advantage plans that offer extra benefits?

Would you like help comparing benefits between MA plans available where you live? Please feel free to contact me by using the links below. If you wish to compare some of the Medicare plans where you live, use the Compare Plans button on this page.

What is the difference between Medicare Advantage and Original?

One of the biggest differences in the two types of Medicare is your plan’s administrator. Original Medicare is administered by the government, while Medicare Advantage plans are administered by private insurance companies (although they must be approved by the federal government). Because Medicare Advantage plans are provided by private insurers, ...

What is Medicare Advantage?

All Medicare Advantage plans are required by law to provide you with all the benefits that you would have with Original Medicare. This includes Part A (hospital and skilled nursing care, hospice, and home health care) and Part B (many outpatient services, as well as ambulance, clinical research, and mental health costs).

What is an HMO plan?

A Health Maintenance Organization, or HMO, is one of the most common types of Medicare Advantage plan. These plans require you to choose a primary care provider (PCP), who will be in charge of your medical needs. Your PCP will give you recommendations to specialists if needed, and those specialists will need to be part of the company’s network of preferred providers. If you deviate from this network, you may have to pay the full costs of your medical care. HMOs usually include drug coverage.

How many stars does Medicare have?

How is this plan rated? (The Medicare site gives each plan a rating, with five stars being the highest. A plan with four or four and a half stars is considered good.)

What is covered by Advantage Plan?

Depending on the plan, you may also find coverage with your Advantage plan for the following: Routine dental and vision care. Routine hearing care, as well as some of the costs associated with hearing aids. Gym memberships, including Silver Sneakers coverage. Coverage for your prescription drugs.

Do you need to compare Medicare Advantage plans?

Because Medicare Advantage plans are provided by private insurers, you’ll need to compare them to see which one offers you the most benefits for the least cost.

Do you have to choose a PCP for a private fee for service plan?

Private Fee-for-Service plans, or PFFSs, are less common. With these plans, you do not have to choose a PCP, nor do you need to get referrals for specialists. The flip side is that many companies don’t offer this type of plan. PFFS plans may or may not cover drug costs.

How to compare Medicare plans online?

One way to compare plans online is using the Medicare.gov “ Medicare Plan Finder ” tool. Medicare.gov is the official U.S. Government site for the Medicare program.

How to find affordable Medicare plans?

Compar ing plans online with Medicare.gov or MedicareAdvantage.com or over the phone with a licensed insurance agent can help you find an affordable plan quickly.

What is Medicare Advantage Special Needs Plan?

A Medicare Advantage Special Needs Plan (SNP) is a type of specialized Medicare Advantage plan that is designed to provide customized services and coverage to people with specific health conditions or financial needs.#N#All Medicare Advantage SNPs include prescription drug coverage.

How much is Medicare Part B deductible for 2021?

Medicare Part B requires an annual deductible of $203 for the year in 2021.

How many stars does Medicare have?

These Medicare Star Ratings can change each year. 2. Each plan is rated from one to five stars on a variety of criteria, with one star being “poor” and five stars being “excellent”. Plans that are rated with 4 stars or higher are considered "top-rated" Medicare Advantage plans.

What is Medicare Advantage PPO?

A Medicare Advantage preferred provider organization (PPO) plan is a type of health plan that may offer you the ability to receive approved health care outside of your plan network. Your plan costs will typically be lower, however, if you see providers within your PPO plan network.

What is Medicare Advantage Health Maintenance Organization?

A Medicare Advantage health maintenance organization (HMO) plan is a type of health plan that typically utilizes a local network of doctors, health care providers and hospitals. With an HMO plan, you are typically limited to a local network of providers for care that will be covered by your plan.

How does MA differ from other plans?

Individual MA plans can differ greatly based on elements like how much the plan costs, which doctors you can see and whether the plan includes special benefits like gym memberships or help paying for your over-the-counter medicines. Using a tool that helps you compare the different MA plans available is a great way to ensure the coverage you choose will help you achieve your health goals.

What is the number to call Medicare?

Call us at 1-833-329-0412 (TTY: 711) to chat about any Medicare questions you have.

Who is Caremark for Aetna?

Aetna has selected Caremark as the prescription management and mail delivery service for our members. If you do not intend to leave our site, close this message.

Does Aetna use Payer Express?

Aetna handles premium payments through Payer Express, a trusted payment service. Your Payer Express log-in may be different from your Aetna secure member site log-in.