Compare Reviews for Medicare Supplemental Insurance Plans Best Rated Best Rated Most Reviewed Highest Rated

| Compare | AUTHORIZED PARTNER | United American Insurance | Read 296 Reviews | |

| State Farm Medicare Supplemental Insuran ... | Read 9 Reviews | Chat with a ConsumerAffairs decision gui ... | ||

| Mutual of Omaha Medicare Supplemental In ... | Read 103 Reviews | Shop Now on Health Network Call Now Toll ... | ||

| Compare | AUTHORIZED PARTNER | United Medicare Advisors | Read 163 Reviews | Shop Now Call Now Toll Free (855) 534-71 ... |

Full Answer

What are the top 5 Medicare supplement plans?

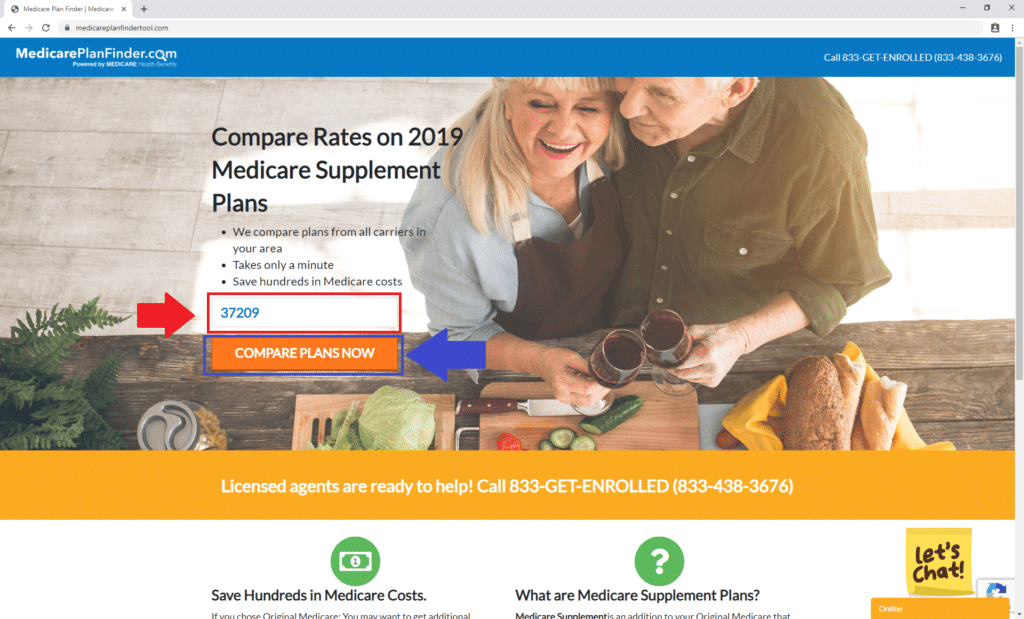

Apr 23, 2022 · Medicare Supplement Comparison Rates All Medicare supplement plans come with different monthly premiums. You can compare 15+ different insurance companies instantly for free by filling out our quoter. Keep in mind Medicare supplement rates are not locked in for life like other types of insurance.

What are the best Medicare plans?

10 rows · Jan 19, 2021 · We submitted a quote for a 68-year-old female living in Tulsa, Oklahoma, and received quotes ranging ...

What is the best Medicare supplement insurance plan?

Feb 03, 2022 · You can compare Medigap insurance companies – such as Aetna – by reviewing the reports provided by independent rating agencies. There are several rating agencies including: A.M. Best Company Fitch Ratings Kroll Bond Rating Agency Moody's Investor Services Standard & Poor's Insurance Rating Services

Do new Medicare plans have star ratings?

Jun 08, 2021 · Here’s a Medicare Supplement Plan comparison chart to help you see the differences between plans [3]. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits ...

Is there a site that compares Medicare plans?

The new Medicare Plan Finder is now available to help you compare 2020 coverage options and shop for plans. The Plan Finder is now mobile-friendly, so you can use it on your smart phone, tablet, and desktop! It will guide you step-by-step through the process of comparing plans.Oct 15, 2019

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

What are the top 3 Medicare Supplement plans?

Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold). Here's an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.Sep 25, 2021

Do Medicare Supplement plans have star ratings?

Medicare plans eligible for star ratings include Medicare Advantage, Medicare Cost, and Medicare Part D prescription drug plans. Medicare Supplement (Medigap) plans aren't eligible for star ratings.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

What are CMS star ratings based on?

Plans are rated on a one-to-five scale, with one star representing poor performance and five stars representing excellent performance. Star Ratings are released annually and reflect the experiences of people enrolled in Medicare Advantage and Part D prescription drug plans.Oct 8, 2021

What determines star ratings Medicare?

A Medicare Advantage plan's overall rating is determined by 5 categories – staying healthy, managing chronic (long-term) conditions, member experience with the health plan, member complaints and changes in the health plan's performance, and health plan customer service.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is Plan M?

Plan M covers additional days in the hospital after Medicare benefits are exceeded, Part B copayments and coinsurance, hospice care coinsurance and copayments, skilled nursing facility care coinsurance and up to three pints of blood. It also covers 50% of the Part A deductible and 80% of charges for care abroad.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

How old do you have to be to get Medicare Supplemental?

To purchase Medicare supplemental health insurance coverage, you must be at least 65, have Medicare Part A and B and purchase coverage during your Medigap open enrollment period. Medigap open enrollment starts on the first day of the month you are 65 or older and enrolled in Medicare Part B and lasts six months.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

What is bundle discount?

Bundle discounts: Some companies offer discounts for individuals who have multiple policies with them, so you may want to choose a company that sells several types of policies that interest you. Many companies that sell Medicare Supplement Insurance also offer life insurance policies.

What is the deductible for United American insurance?

1, 2020. High-deductible versions of plan F and G are also available with a deductible of $2,340.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also known as Medigap ) are sold by private insurance companies to cover some of Original Medicare's out-of-pocket costs. These costs can include Medicare deductibles, coinsurance, copayments and more.

What are the benefits of Medigap?

All 10 standardized Medigap plans provide at least partial coverage for: 1 Medicare Part A coinsurance for hospital care (and an additional 365 days for hospital stays) 2 Medicare Part A coinsurance or copayment for hospice care 3 Medicare Part B coinsurance or copayment 4 The first three pints of blood

How long does Medicare cover hospice care?

Medicare Part A coinsurance for hospital care (and an additional 365 days for hospital stays) Medicare Part A coinsurance or copayment for hospice care. Medicare Part B coinsurance or copayment. The first three pints of blood.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Medicare stop covering Part B?

Recent legislation has forced Medigap plans to stop covering the Part B deductible for anyone who became eligible for Medicare after Jan. 1, 2020.

Can you combine Medicare Part D and Original Medicare?

That allows for a high degree of cost predictability, making it easier to budget and plan for health care spending. You can combine Original Medicare, a Medigap plan and a Medicare Part D prescription drug plan.

How does Medicare Supplement Plan work?

Understanding how Medicare Supplement Plans work can take some time. Here are the basics [2]: Medigap plans cover one person. If your spouse or partner also wants a Medicare Supplement Plan, they must buy a policy of their own. Medigap plans can’t cancel you for health issues.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that aren’t covered in Original Medicare. A Medicare Supplement Plan might (for instance) cover copayments, coinsurance or deductibles you owe under Original Medicare. Medicare Supplement Plans operate as ...

How long does Medicare Supplement last?

This starts the month you turn 65 and enroll in Medicare Part B, and it lasts six months. It also never repeats, so don’t miss it.

What is issue age rated?

Issue-age-rated: Premiums are based on the age you are when you purchase them. Generally, younger people pay lower premiums than older people. This may also be called “entry age-rated.”. Attained-age-rated: Premiums are based on your current age, meaning costs will go up as you get older.

Does Medicare Supplement Plan G cover Ohio?

Medicare Supplement Plans operate as additional — not primary — insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio [1].

Does Medicare cover vision?

They don’t cover everything. Generally, Medicare Supplement Insurance doesn’t cover dental care, vision care, hearing aids, long-term care, eyeglasses or private-duty nursing. Some plans are no longer available. You can no longer purchase Plans E, H, I and J, but if you purchased one of those plans before June 1, 2010, you can continue with it.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

What is a SHIP program?

13 Also known as SHIP, they provide free local health coverage counseling to people with Medicare.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

When did Medicare stop allowing Part B deductible?

When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

Does Cigna offer a discount for spouses?

Rates may vary by age, smoking status, and location. Not only does Cigna offer competitive rates, it offers discounts of 7% if someone in your household is also on a Cigna Medicare Supplement Plan. In Washington, the discount is only available for spouses.

Does BCBS offer dental insurance?

Not only does BCBS offer dental coverage, but it also offers vision and hearing aid benefits. To round out your healthcare needs, BCBS offers 4- to 5-Star Medicare Part D prescription drug plans, available for purchase with your Medicare Supplement Plan G. As a bonus, a nurse line is available 24/7.

Does BCBS offer a discount on Medicare?

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your state’s plan for details about BCBS discount programs. BCBS prices Medicare Supplement Plan G according to attained-age in most states.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

How to know if you are enrolled in Medicare Supplement?

If you've already shopped for Medicare Supplement Plans, you know the drill when using the Medicare-Plans site: enter your zip code, birth date, gender, indicate if you're already enrolled in Medicare Part A and/or B, and then your name and email address. On the final page, you're asked for your street address and phone number - and then there's the disclaimer that you're consenting to texts, calls, emails, and postal mail from their "marketing and remarketing network, and up to eight insurance companies or their affiliates". Worthy to note.

Is Medicare a service?

Medicare-Plans is a service of QuoteWizard Insurance, which is a division of well-known financial company LendingTree. At the time of our review, QuoteWizard's profile with the Better Business Bureau was being updated, so there was no way to see a rating or any customer complaints (if any exist). LendingTree enjoys an "A+" rating and accreditation with the BBB, however.