You can pay your Medicare Part A, Part B, Part C, and Part D premiums out of your HSA account. However, you cannot use your HSA to pay for your Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

- Sign up for Part B on time. ...

- Defer income to avoid a premium surcharge. ...

- Pay your premiums directly from your Social Security benefits. ...

- Get help from a Medicare Savings Program.

How can I reduce my Medicare Part B premium?

If your situation changes, you might be able to reduce your Part B premium. Certain situations give you grounds to appeal, including getting married, divorced or being widowed. If you or your spouse stop working or cut work hours, you also can question the excess Part B premium.

How much does Medicare Part A and B cost?

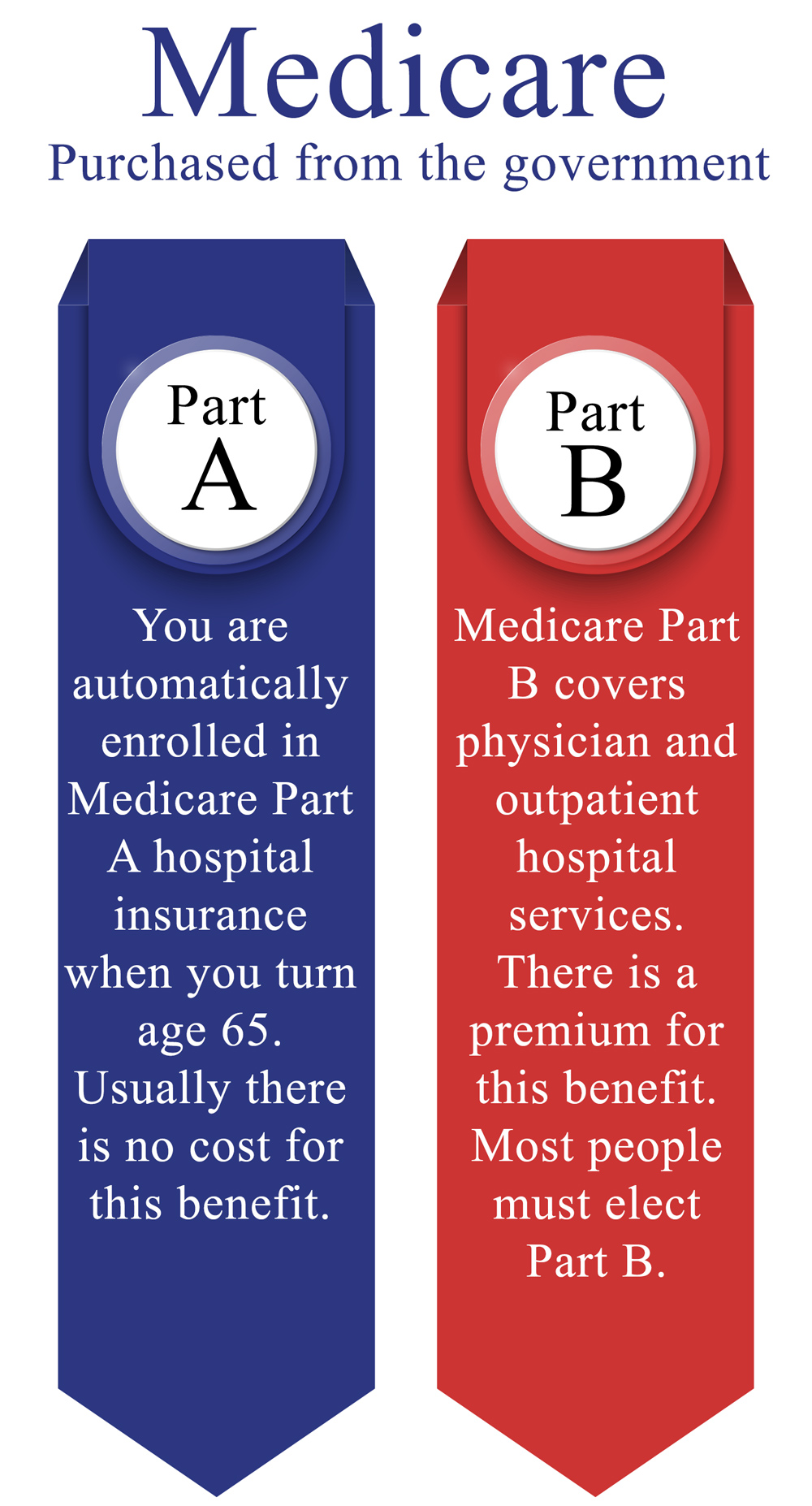

Together, parts A and B are often referred to as “ original Medicare .” Your costs for original Medicare can vary depending on your income and circumstances. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits.

How does income affect Medicare Part B premiums?

Higher-income Medicare beneficiaries (individuals who earn more than $85,000) pay higher Part B and prescription drug benefit premiums than lower-income Medicare beneficiaries. The extra amount the beneficiary owes increases as the beneficiary's income increases.

Can I reverse my Medicare Part B surcharges?

If your circumstances change, you can reverse those surcharges. Higher-income Medicare beneficiaries (individuals who earn more than $85,000) pay higher Part B and prescription drug benefit premiums than lower-income Medicare beneficiaries.

How can I get my Medicare payments lowered?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Can I get Medicare Part B for free?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Will Medicare premiums go down in 2022?

Medicare's highest-ever price increase in 2022 was driven by estimated costs for the controversial Alzheimer's drug Aduhelm.

Will my Medicare premiums go down if my income goes down?

If your income has dropped since 2017 because of certain life-changing events, such as marriage, divorce, death of a spouse or retirement, you can ask to have your Medicare premiums based on your more recent income, which could reduce or eliminate the surcharge.

Does everyone pay the same for Medicare Part B?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is Medicare Part B give back?

The Medicare Part B give back is a benefit specific to some Medicare Advantage Plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

What is the give back benefit for Social Security?

The giveback rebate can be used by people in either scenario: If you're receiving Social Security retirement benefits and you enroll in an Advantage plan with a giveback rebate, the amount that's deducted from your check to cover the cost of Part B will be lower.

What income is used for Medicare Part B premiums?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Does Medicare Advantage have a zero premium?

In some states though, particularly in Florida, there are some Medicare Advantage plans that not only have a zero-premium, but also offer you a Part B premium reduction. The way this works is that the Advantage plan pays for a portion of your Part B premiums.

Do Medicare premiums go toward Part B?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years. And yes, these deductions go toward funding your future Part A Medicare ...

How much is Medicare Part B 2021?

The standard premium for Medicare Part B is $148.50 per month in 2021 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

How long can you go without Medicare?

But for each 12-month period you go without Medicare coverage despite being eligible, you’ll be hit with a penalty that raises your Part B premium cost by 10 percent.

Can you defer income to future taxes?

If you’re able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns.

Is Medicare Part A free for 2021?

July 13, 2021. facebook2. twitter2. While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here’s how you can pay less for them. 1.

How much is MAGI for Part B?

MAGI here includes tax-exempt interest as well as your regular AGI. If you're just over those thresholds, you'll pay $146.90 a month for Part B. Premiums step up three more times at various higher levels of MAGI. The highest premium is $335.70 a month.

What is the standard Part B premium for 2014?

In 2014, the standard Part B premium will be the same as now: $104.90 a month . The threshold for paying the higher premiums is modified adjusted gross income of $85,000, or $170,000 for married couples filing joint tax returns.

What to do if you stop working and cut your Part B?

If you or your spouse stop working or cut work hours, you also can question the excess Part B premium. In such circumstances, contact Social Security, which handles Medicare applications. Be ready to provide documentation to support your appeal.

Will Medicare Part B premiums stay the same?

Premiums will stay the same in 2014 for Medicare Part B, stepping up by the same amounts as before for higher-income retirees and other participants in the government health care plan.

Can you convert a traditional IRA to a Roth IRA?

Another idea is to convert your traditional IRA to a Roth IRA each year. You can start a conversion at any age. This increases your MAGI in the current tax year, but lowers it in future years as withdrawals from Roth IRAs are tax-free in most cases.

Can you carry over excess losses?

Any excess losses can be carried over to future years. There's no time limit for using them. So you may be able to create a large bank of losses over time. Those losses can offset large gains you take in the future. By avoiding reported gains, you'll hold down your AGI and MAGI.

Why Could the Premium Change?

According to the Washington Post, this is the first time that Medicare has considered a change to its premiums after announcing its annual figures. But this year’s Part B premium rise – the largest dollar amount increase in program history – has been an unusual situation.

How Much Will the New Part B Premium Be?

It is currently unclear how much beneficiaries could see their Part B premium decrease if Medicare does opt to make a change to this year’s amounts. But the updated premium could be significantly lower.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.