Shop around for prescription drug coverage The Centers for Medicare and Medicaid

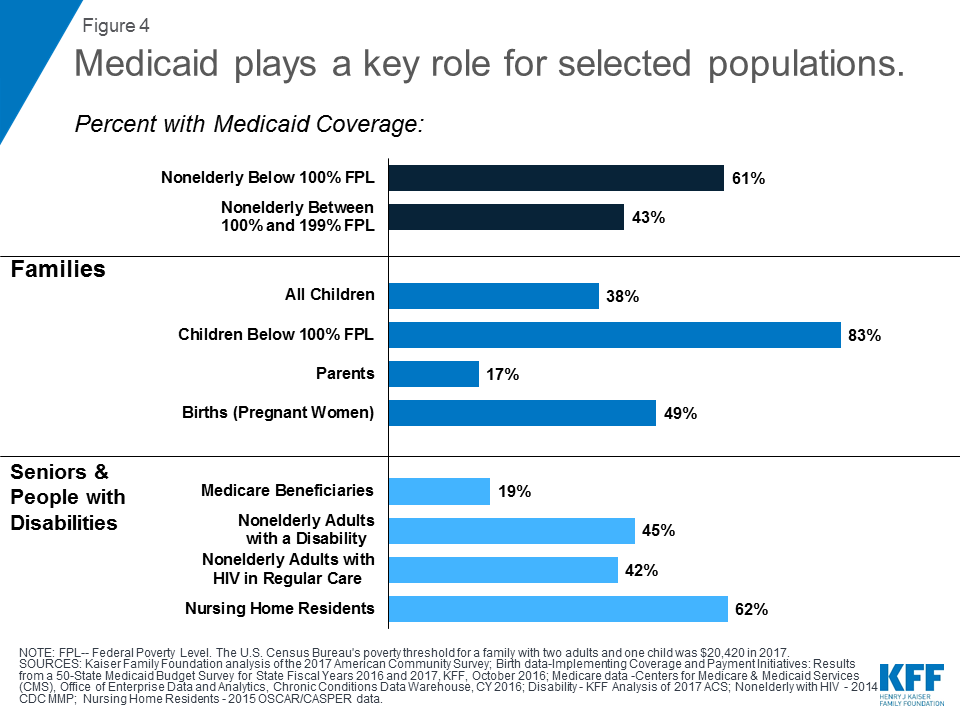

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How can I lower my Medicare costs?

· If your income is not low enough to qualify for one of the Medicaid/Medicare Savings programs, you may still be able to qualify for the chance to reduce Medicare Part D premiums via the low-income subsidy program. This program helps to pay for your Part D premiums, deductibles, coverage, copays and coinsurance.

How can we reduce the costs of health care?

· People with Medicaid automatically qualify for the Extra Help subsidy. However, you can obtain Extra Help, even if you don’t qualify for Medicaid. When your income is low, a subsidy can help reduce Medicare premiums and other costs. Can I Deduct Medicare Premiums from My Taxes? You can deduct certain medical expenses from your tax return.

How does an advantage plan reduce Medicare premiums?

Nationally, over two-thirds of Medicaid beneficiaries received most or all covered benefits through managed care in 2017. About 45 percent of Medicaid spending goes to managed care plans. What Federal Medicaid Funds Do States Receive? The federal government contributes at least $1 in matching funds for every $1 a state spends on Medicaid.

Why is Medicare so expensive?

· 5 Simple Ways to Effectively Lower Your Medicare Costs 1. Shop around for prescription drug coverage. The Centers for Medicare and Medicaid Services' top recommendation for... 2. Consider a supplemental insurance plan. Sometimes the best way to save money in Medicare is to spend more. 3. Consider a ...

How can healthcare costs be reduced?

Eight ways to cut your health care costsSave Money on Medicines. ... Use Your Benefits. ... Plan Ahead for Urgent and Emergency Care. ... Ask About Outpatient Facilities. ... Choose In-Network Health Care Providers. ... Take Care of Your Health. ... Choose a Health Plan That is Right for You.More items...•

How does Medicare and Medicaid affect the economy?

In short, Medicaid adds billions of dollars in economic activity. The federal government boosts this activity by matching state Medicaid spending at least dollar for dollar, bringing new money into states.

How does Medicaid impact the economy?

Medicaid spending generates economic activity, including jobs, income and state tax revenues, at the state level. Medicaid is the second largest line item in state budgets. Money injected into a state from outside the state is critical to generating economic activity.

What is the best way to control the costs of the attributed Medicaid patients?

Strategies to Reduce Medicaid Acute Care SpendingPremiums, Cost Sharing, and Enrollee Wellness Incentives.Complex Care Management.Patient-Centered Medical Homes.Alternative Payment Models.Tightening Financial Eligibility Rules for Long-Term Care Services.Private Long-Term Care Insurance.More items...•

How does Medicare affect the economy?

Providing nearly universal health insurance to the elderly as well as many disabled, Medicare accounts for about 17 percent of U.S. health expenditures, one-eighth of the federal budget, and 2 percent of gross domestic production.

What are the pros and cons of Medicaid expansion?

List of Medicaid Expansion ProsNot every low-income individual actually qualifies for Medicaid. ... Expansion would support local economies. ... It offers people a level of financial protection. ... Medicaid expansion drops the uninsured rate. ... The cost of expansion is minimal for the states.More items...•

What are the advantages of Medicaid expansion?

Medicaid expansion means longer windows of care coverage for low-income mothers before and after their pregnancy. Medicaid covers nearly half of all births and infants who receive prenatal care are less likely to have a low birth weight and go on to live healthy lives.

What are the disadvantages of Medicaid?

Disadvantages of Medicaid They will have a decreased financial ability to opt for elective treatments, and they may not be able to pay for top brand drugs or other medical aids. Another financial concern is that medical practices cannot charge a fee when Medicaid patients miss appointments.

Why have Medicaid expenditures increased and what can states do to contain Medicaid costs?

In general terms, Medicaid expenditure increases can be caused by: (1) cost increases for current enrollees resulting from changes in health care prices or health care utilization, (2) cost increases caused by enrollment growth, and (3) increases in "other" costs, such as those for DSH or UPL payments or administrative ...

What are your suggestions to help reduce the cost of health care without compromising patients health and safety?

Optimize Scheduling, Staffing, and Patient Flow Optimization offers another way to reduce the cost of healthcare without compromising patients' health and safety. Hospitals can examine how patients move throughout their facilities to create a standardized flow.

Why should we lower healthcare costs?

Excessive spending on healthcare places significant burdens on American businesses and family budgets and endangers the funding of vital programs such as Medicare and Medicaid.

How can nurses reduce healthcare costs?

Saving Money While Maintaining Quality Patient Care Ensuring nursing departments stay on budget. Reducing waste. Creating adequate staff schedules that avoid overtime hours. Seeking out lower-cost employee benefits.

Can you deduct Medicare premiums?

Deductible medical expenses include premiums you paid for Parts B, D, and Medicare Advantage. However, there are limits to this deduction. First, you must have enough total deductions to itemize your deductions rather than taking the standard deduction.Second, you cannot deduct all your medical charges.

How long do you have to wait to sign up for Medicare?

You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. There’s a financial motive to enroll during that time. In general, if you wait and sign up for Part B later, you will pay a late enrollment penalty.

What are some examples of life changing events?

Examples of life-changing events include retirement, divorce, and the death of your spouse.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Do you pay taxes on a Roth IRA?

If you contribute money to a Roth IRA or 401K, you pay taxes on the money when you put it in. But the income you earn is tax-free. In some cases, you can convert a traditional IRA or 401K to a Roth. If you contribute to a health savings account, your contributions AND the income from them aren’t taxed as long as you use them for healthcare.

How much does the federal government contribute to Medicaid?

The federal government contributes at least $1 in matching funds for every $1 a state spends on Medicaid. The fixed percentage the federal government pays a state, known as the federal medical assistance percentage (FMAP), depends on state income levels and ranges from 50 percent to 78 percent.

What is MLR in health insurance?

One way states can do this is to require managed care plans to repay the state if they don’t meet a “medical loss ratio” (MLR) — a certain percentage of premium revenue that insurers must spend on health care services rather than administrative costs and profits.

What is a capitation payment?

Nearly all states contract with managed care plans to provide some or all covered benefits to some or all enrollees, with the state paying the plan a set monthly amount per enrollee (called a capitation payment) to cover the cost of those benefits plus the plan’s administrative costs .

With healthcare costs rising, these simple solutions can help keep you from spending more on Medicare than you need to

A Fool since 2010, and a graduate from UC San Diego with a B.A. in Economics, Sean specializes in the healthcare sector and investment planning. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Follow @AMCScam

Medicare's age-old problem

The U.S. Census Bureau estimates that the elderly population will nearly double between 2010 and 2050 from 39.4 million to 78.9 million. What's more, the number of "oldest old," defined as persons aged 85 and up, is projected to more than triple to 18.2 million by 2050 from 5.7 million in 2010.

Five ways to effectively lower your Medicare costs

And beneficiaries aren't necessarily in a much better situation. Even though Medicare covers approximately 80% of eligible costs, that remaining 20% can be a heavy burden, given the rising costs for surgical procedures, prescription drugs, and basically anything having to do with maintaining or improving your health.

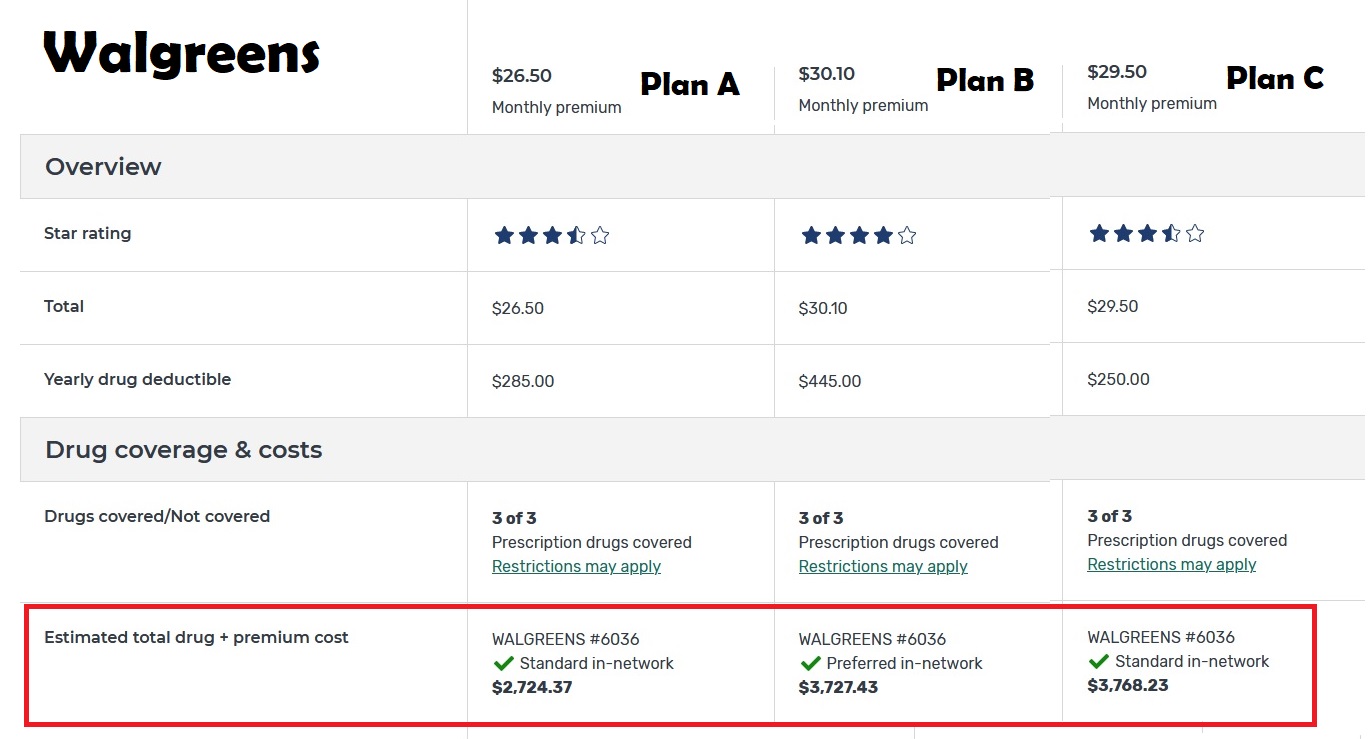

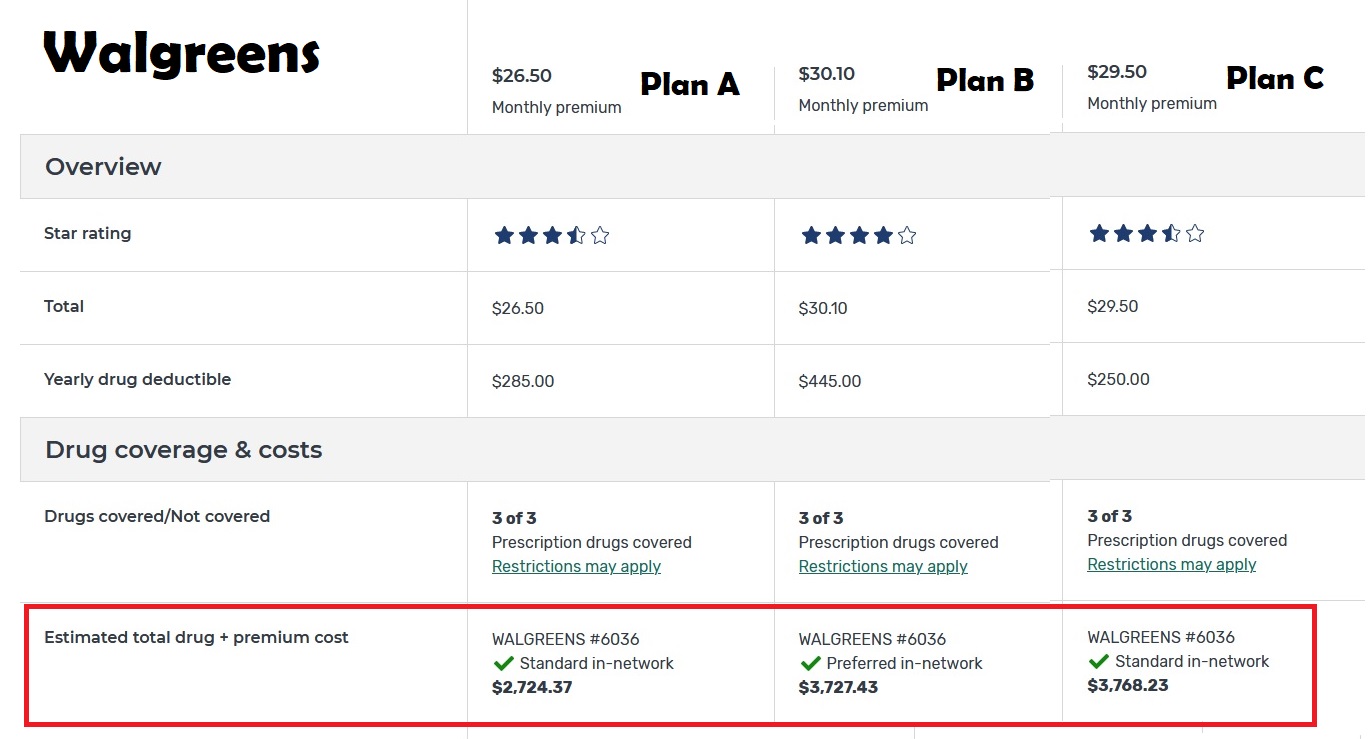

1. Shop around for prescription drug coverage

The Centers for Medicare and Medicaid Services' top recommendation for lowering your Medicare costs is to consider shopping around for a Part D prescription drug plan that best suits your needs, keeping in mind that the cheapest plan may not offer you the best value.

2. Consider a supplemental insurance plan

Sometimes the best way to save money in Medicare is to spend more. Supplemental insurance plans, also known as Part F or Medigap, help Medicare-eligible patients cover that aforementioned 20% of costs they might owe under Medicare.

3. Consider a Medicare Advantage plan

Another smart idea that could save you money is to consider the alternative to original Medicare, a Medicare Advantage plan (also known as Part C).

4. Fund a Roth IRA

A genius way to reduce your Medicare costs is to invest in a Roth IRA early and often.

How much will the AHCA reduce in 2026?

The Congressional Budget Office (CBO) estimates that the AHCA’s Medicaid financing changes, along with its repeal of enhanced federal matching funds for the Affordable Care Act’s Medicaid expansion, would reduce federal Medicaid spending by $834 billion from 2017 to 2026, resulting in a 24% reduction in federal Medicaid funds in 2026.

What is the AHCA?

Congress is considering fundamental changes to Medicaid’s financing structure that seek to make federal funding for Medicaid more predictable and achieve substantial federal budgetary savings. The American Health Care Act (AHCA) as passed by the House of Representatives converts federal Medicaid matching funds, ...

How much will Medicare spend in 2025?

Medicare spending per enrollee will grow at an annual rate of 3.9 percent between 2014 and 2025, CMS projects, while private health insurance will grow by 4.6 percent. The Affordable Care Act (ACA) envisions that Medicare will continue to lead the way in efforts to slow health care costs.

What is the ACA?

The Affordable Care Act (ACA) envisions that Medicare will continue to lead the way in efforts to slow health care costs. It authorizes the Center for Medicare & Medicaid Innovation to test new models to reduce program spending while preserving or enhancing the quality of care.

What is EHR in healthcare?

• Electronic Health Records (EHRs). Adoption of electronic health records continues to increase among physicians, hospitals, and others serving Medicare and Medicaid beneficiaries helping to evaluate patients’ medical status, coordinate care, eliminate redundant procedures, and provide high-quality care. More than 62 percent of health care professionals, and over 86 percent of hospitals, have already qualified for EHR incentive payments for using certified EHR technology to meet the objectives and measures established by the program, known as meaningful use. Electronic health records will help speed the adoption of many other delivery system reforms, by making it easier for hospitals and doctors to better coordinate care and achieve improvements in quality.

Why is electronic health records important?

Electronic health records will help speed the adoption of many other delivery system reforms, by making it easier for hospitals and doctors to better coordinate care and achieve improvements in quality. • Partnership for Patients.

What is the state innovation model?

• Providing states with additional flexibility and resources to enhance care. The State Innovation Models Initiative aims to help states deliver high-quality health care, lower costs, and improve their health system performance. Nearly $300 million has been awarded to six states (Arkansas, Massachusetts, Maine, Minnesota, Vermont and Oregon) that are ready to implement their health care delivery system reforms and nineteen states to either develop or continue to work on their plans for delivery system reform.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How does Medicare affect healthcare?

How Medicare Impacts U.S. Healthcare Costs. A recent study suggests that Medicare does much more than provide health insurance for 48 million Americans. It also plays a significant role in determining the pricing for most medical treatments and services provided in the U.S. For almost every procedure – from routine checkups to heart transplants – ...

How many Americans have Medicare?

A recent study suggests that Medicare does much more than provide health insurance for 48 million Americans. It also plays a significant role in determining the pricing for most medical treatments and services provided in the U.S.

How does drug pricing affect Medicare?

As proposed in H.R. 3, drug pricing negotiation would reduce federal spending by $456 billion and increase revenues by $45 billion over 10 years. This would include: 1 direct savings to the Medicare Part D program 2 a reduction in spending related to the Affordable Care Act’s subsidies for commercial health plans 3 a reduction in spending for the Federal Employees Health Benefits Program 4 an increase in government revenue from employers using savings from reduced premiums to fund taxable wage increases for their workers.

Can Medicare negotiate drug prices?

In a nutshell, it would allow the Medicare program to directly negotiate pharmaceutical prices with drugmakers. Negotiations could apply to either all Medicare-covered drugs or just the costliest ones.