What are the best Medicare plans?

These plans have no premium, and the government actually deposits money into a savings account for you every year. For the purposes of this theoretical example, let’s call that dollar amount $2,500. You’re allowed to use that $2,500 for any medical expenses you want, including your deductible. Your account also accumulates every year with ...

What is the cheapest Medicare supplement plan?

Sep 07, 2019 · By doing so, Medicare Advantage providers are able to keep costs down by negotiating with a small network of doctors and hospitals AND limit your out of pocket costs to as high as $7,550, while Original Medicare does not put a limit on what you can spend year.

What is the best insurance company for Medicare?

Oct 17, 2019 · Aetna is also among the top picks in J.D. Power and Associate’s annual Medicare Advantage study. The study rates plans for overall satisfaction, billing and payment, communication, cost ...

Is Medicare Advantage free?

Apr 06, 2022 · Medicare Advantage covers some of the gaps of Original Medicare (Part A and Part B) and usually offers a $0 premium through a private company. It can be an affordable option for patients who are...

Why are Medicare Advantage plans so much cheaper?

A main reason why Medicare Advantage carriers can offer low to zero-dollar monthly premium plans is because Medicare pays the private companies offering the plans to take on your health risk.

How can a Medicare Advantage plan have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

Are Medicare Advantage plans less expensive than Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.Jan 28, 2016

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.Nov 8, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

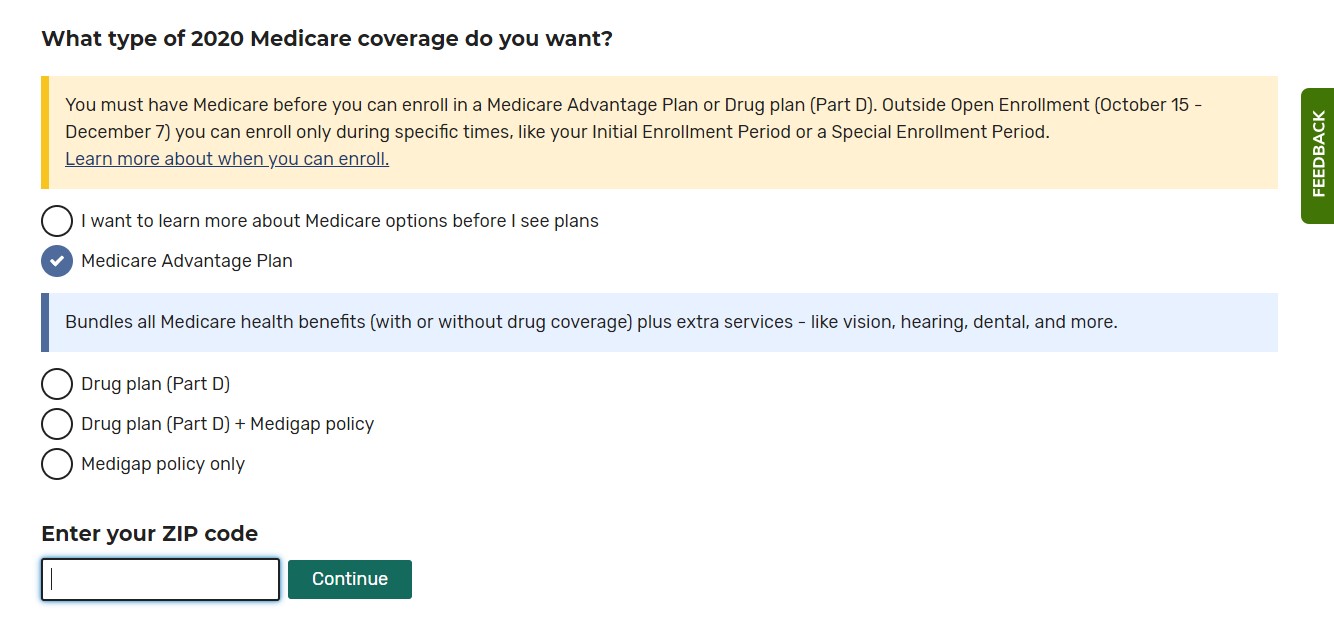

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.May 10, 2007

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

How much does Medicare Part B cost?

But you still have to pay your Medicare Part B premium ($148.50). Plans with a $0 premium may recoup those costs through higher deductibles, coinsurance, copays, and possibly less coverage. You want to weigh all costs before choosing a plan.

Is Medicare Advantage free?

Medicare Advantage Plans are NOT Free. Though Medicare Advantage can have a $0 premium, they can, like we said above, charge you copays, coinsurance, and sometimes deductibles. Remember $0 premium doesn’t mean it’s a $0 plan.

What is a Medicare Advantage Plan?

A Medicare Advantage plan is an extension of Original Medicare coverage offered by private insurers. Here are some key points to know about Medicare Advantage plans.

Medicare Overview: What is Medicare?

Medicare is a federally-funded health insurance plan created for seniors 65 and older. You’re eligible to sign up 3 months before and 3 months after your 65th birthday. You could pay a late penalty if you don’t sign up during this time.

Who is Eligible for Medicare?

You qualify to enroll in Medicare if you’re a U.S. citizen who has paid Medicare taxes throughout your working years — you won’t be eligible if you’ve never paid in. Medicare is divided into 4 parts:

Average Medicare Insurance Costs for Seniors

There are many variables to Medicare plans, depending on what you choose, so it’s hard to come up with an average Medicare plan cost. Here are some examples from Medicare.gov:

Comparing Medicare Advantage Plans

Consider cost as well as plan features when you compare Medicare Advantage plans. Do you need a prescription drug plan? How about dental, vision or hearing coverage? Is a fitness plan important to you? Your answers will help you narrow down your plan options.

What Impacts Medicare Rates for Seniors

Income: You’ll be subject to a surcharge called the income-related monthly adjustment amount (IRMAA) if your gross income increases significantly. Your monthly premiums could go up to $100–$300 a month, depending on your income.

Research Before You Enroll

You don’t have to wait until you turn 65 to research Original Medicare and Medicare Advantage plans. Use resources like Medicare.gov, J.D. Power and Associates and CMS to compare plans and choose the one that meets your health care and budget needs.

What is Medicare Advantage Plan?

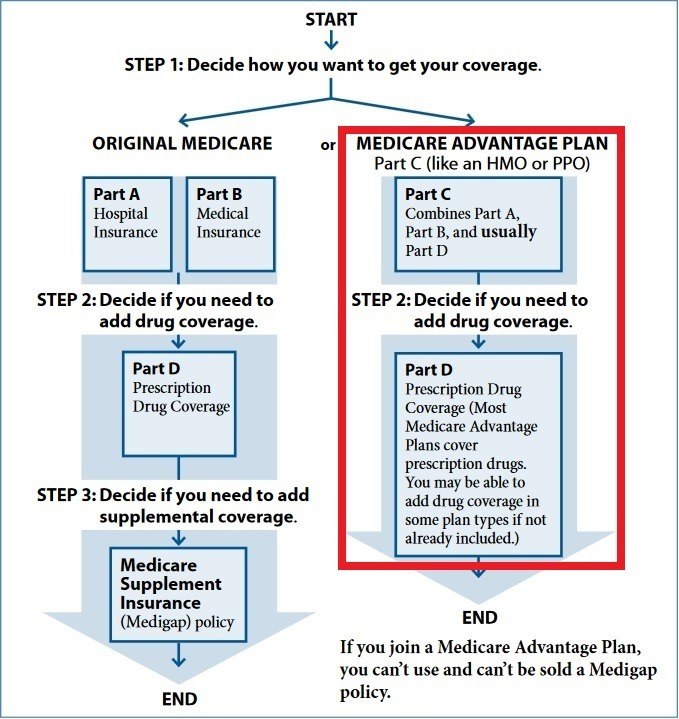

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Do I need Part D if I don't have Medicare?

Be aware that with Original Medicare and Medigap, you will still need Part D prescription drug coverage, and that if you don't buy it when you first become eligible for it—and are not covered by a drug plan through work or a spouse—you will be charged a lifetime penalty if you try to buy it later. 5.

The big what-if of Medicare Advantage

If you are lucky enough to be healthy when ready to enroll in Medicare — for most folks it’s at age 65 — the vital “what-if” you should consider: what plan you want if you are diagnosed with cancer or another serious illness that requires lengthy and costly medical care.

Two types of Medicare

Original Medicare allows you to see any doctor and use any facility in the U.S. that accepts Medicare. Most do. But to get blanket protection with Original Medicare, it’s vital to also purchase a supplemental policy — referred to as Medigap — that picks up the portion of certain bills that Medicare doesn’t pay directly.

The high cost to actually use Medicare Advantage

And once you start to use your Advantage insurance, you will likely run into coinsurance that will typically require you to pay 20% of your bills. With a serious illness, that can easily be a six-figure treatment that charges coinsurance.

Original Medicare: cost and coverage

Now let’s return to Original Medicare. It definitely costs more upfront, as it’s imperative to add a Medigap policy to cover the coinsurance costs that are embedded in all Medicare.

Making a clear-eyed Medicare choice

There is no clear-cut right or wrong choice. The key is to make an informed choice.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ( Medicare Part A and Medicare Part B).... ?

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... will make up the majority of their annual costs. For unhealthy people, deductibles.

What is MOOP in Medicare?

One of the most important costs to compare is a plan’s MOOP (maximum out-of-pocket). This is an annual cap on copay and coinsurance costs. It does not include any costs you pay for medications through a prescription drug plan ( Medicare Part D. Medicare Part D is Medicare's prescription drug plan program.

How many people will be on Medicare in 2021?

As of 2021, there are just over 60-million people on Medicare and over 24-million of them are enrolled in a Medicare Advantage plan. By 2032 there will be approximately 80-million people on Medicare. The stakes are high for both the Medicare program, insurers, and network providers.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share. ... , copayments. A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service.... , and coinsurance.

Can Medicare supplement insurance be used with other insurance?

Medicare supplement insurance plans work with Original Medicare coverage and cannot be used in conjunction with other private insurance. These plans offer flexibility in choosing healthcare providers, but they do not offer additional benefits. Also, unlike Advantage plans, there are no enrollment period restrictions.

Is MA insurance cheap?

By no means are MA plans cheap. They are funded by the federal government through the Medicare program. Medicare payments to Advantage plans to fund Part A. Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc....

Why is Medicare Advantage Plan lower?

In sum, a Medicare Advantage plan premium is lower based upon the fact that its expenses are lower because the plan is usually either an HMO or a PPO. Physicians, specialists and medical facilities have agreed to accept lower fees for their services, which reduces the overall expenses paid by the insurance company for the Medicare beneficiary’s health care. Payment of reduced fees combined with cost-sharing and Medicare funding allows an MA plan to offer coverage for a lower monthly premium.

What happens when a Medicare beneficiary enrolls in a Medicare Advantage Plan?

When a Medicare beneficiary enrolls in a Medicare Advantage plan, the plan takes over for Medicare Part A and Medicare Part B. To support the Medicare Advantage plan’s ability to do this Medicare pays the plan to cover your Part A and Part B benefits. Medicare pays the Medicare Advantage Plan for each beneficiary who enrolls a monthly amount based ...

Why is PFFS more expensive than HMO?

A PFFS plan typically carries a higher monthly premium as well as cost-sharing because it allows more flexibility. A HMO plan restricts or controls the availability of physicians the Medicare beneficiary can see and be covered under the plan.

What is the out of pocket limit for Medicare?

An out-of-pocket limit is defined as the maximum amount the Medicare beneficiary will pay out of their pocket before the plan is required to pay 100% of Medicare approved medical and drug expenses. Therefore, it is important to consider all plan costs and not just the premium, when considering a Medicare Advantage plan.

Does Medicare Advantage have a higher premium?

In the alternative, Medicare Advantage plans have more “cost sharing” which requires the Medicare beneficiary to pay a portion of the costs of their medical coverage. Cost sharing includes co-payments, co-insurance, and deductibles associated with doctor’s visits, hospital stays and other healthcare services. ...

Is Medicare Advantage a supplement?

Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.” Some Medicare Supplements cover 100% of the cost sharing left by Medicare on Medicare approved expenses. Therefore, they carry a higher premium. In the alternative, Medicare Advantage plans have more “cost sharing” which requires the Medicare beneficiary to pay a portion of the costs of their medical coverage. Cost sharing includes co-payments, co-insurance, and deductibles associated with doctor’s visits, hospital stays and other healthcare services.

Does Medicare Supplement Plan require cost sharing?

A Medicare Supplement plan requires no cost sharing and there is no network of physicians which results in the insurance company paying higher costs for the Medicare beneficiary’s care. Medicare Supplements also do not receive any Federal funding. As a result of this flexibility of coverage and care Medicare Supplement’s monthly premiums are higher ...

Why are Medicare Advantage plans free?

Certain Advantage plans are called free because they offer a $0 monthly premium to be enrolled in the plan. This makes zero premium Medicare Advantage plans an attractive offer for those looking to save money on monthly Medicare costs.

What is free Medicare Advantage?

Free Medicare Advantage plans are private Medicare insurance plans that offer a $0 monthly premium. While these plans are advertised as free, you’ll still have to pay the standard out-of-pocket costs for other premiums, deductibles, and copayments. If you qualify for Medicare and are enrolled in parts A and B, you can use ...

What is a yearly deductible for Medicare?

There are two types of yearly deductibles associated with most Medicare Advantage plans: The plan itself may have a yearly deductible, which is the out-of-pocket amount you pay before your insurance pays out. The plan may also charge you a drug deductible as well.

How much is Medicare Part B?

Medicare Part B. Medicare Part B charges a standard monthly premium of $135.50 or more , depending on your gross yearly income. You’ll owe this Part B premium as part of your free Medicare Advantage plan unless it’s covered by the plan.

Does Medicare Advantage charge yearly?

Compared to other Medicare plans, these zero premium Medicare Advantage plans don’t charge a yearly amount to be enrolled in the plan. There’s generally no difference in coverage between a free plan and a paid plan.

Do you owe Medicare Supplements a monthly premium?

If you choose to enroll in a Medicare supplement plan like Medicare Part D or Medigap as an alternative to Medicare Advantage, you’ll owe a monthly premium and other costs associated with these plans.

Does Medicare Advantage have different copayments?

Type of plan. Medicare Advantage plans can also differ in costs based on their structures. For example, PPO plans charge different copayment amounts based on whether your provider is in-network or out-of-network. These costs may even vary from year to year.

Does Medicare pay for lunch?

Medicare Pays the Part C Company. There is no such thing as a free lunch, and Medicare Advantage plans are no exception. When you enroll in a Medicare Advantage plan, you must first be enrolled in both Medicare Part A and B. Part B has a monthly premium, and you must continue to pay that to the government while you are enrolled in your Advantage ...

Is Medicare Advantage free?

The bottom line: Medicare Advantage plans are not free, even if they have a $0 premium. They are private Medicare health plans that often have lower premiums, but in exchange for that lower premium, you have to play by the plan’s rules. It requires more effort on your part, and you must be an advocate for yourself.

Does Medicare Advantage work in certain counties?

You must also understand that your Medicare Advantage plan often operates only in certain counties. You must choose providers in the network if you want to have the lowest copays. There are also sometimes restrictions which you have to work with.

Do Medicare Advantage plans require copays?

We assure you, they ’re not. Medicare Advantage plans, on the other hand, require a bit more effort on the part of the client. Yes, a $0 premium or even a $25 or $50 monthly premium is attractive. However, you will pay copays for your services as you go along. Sometimes those copays are more than you anticipate.

Do you have to pay copays for surgery?

Also, even though the premium might be low, you are responsible for paying plan copays and coinsurance, and sometimes those costs are not cheap. You might have a hospital stay for a surgery, and in most cases, you will pay the copay for the hospital AND a separate copay to the surgeon for performing the surgery.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.