Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because: To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

Are there any Medicare Advantage plans that have no monthly premium?

Want to sign up for a Medicare Advantage plan? Call us at 217-423-8000 today or download our free Annual Enrollment Period To-Do List! These plans have no premium, and the government actually deposits money into a savings account for you every year. For the purposes of this theoretical example, let’s call that dollar amount $2,500.

Do I have to pay my Medicare Part B premiums for advantage?

Oct 31, 2019 · Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These expenses may include copayments, coinsurance, and deductibles. A deductible is the amount you have to pay before your Medicare Advantage plan pays its share of covered services.

Do Medicare Advantage plans have a deductible?

Dec 07, 2021 · Some Medicare Advantage plans in the Star Alliance and United Healthcare networks don't charge premiums. In addition, Medicare Advantage plans may cover your out-of-pocket spending in the Medicare Part D drug program. This means that Medicare Advantage plan members can enroll in the plan and use Medicare Part D to buy their medications and then …

What does $0-premium Medicare Advantage cost?

Nov 08, 2021 · Although you may enroll in a no-premium Medicare Advantage plan*, the coverage isn’t free. You are still responsible for paying your monthly Part B premium (estimated to be $158.50 in 2022). 1 That’s because you will still have Part B medical coverage even if you enroll in a Medicare Advantage plan. There are also other out-of-pocket expenses, which vary among …

What is a $0 premium?

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don't pay anything to the insurance company each month for your coverage.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Which Medicare plans does not require any premium payment?

Medicare Part C, the Medicare Advantage program, lets Medicare-approved private insurance companies offer plans that provide your Medicare Part A and Part B benefits. A $0 premium Medicare Advantage plan, like other Medicare Advantage plans, might include prescription drug coverage.

Do Medicare Advantage plans pay 100 %?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.Jan 7, 2022

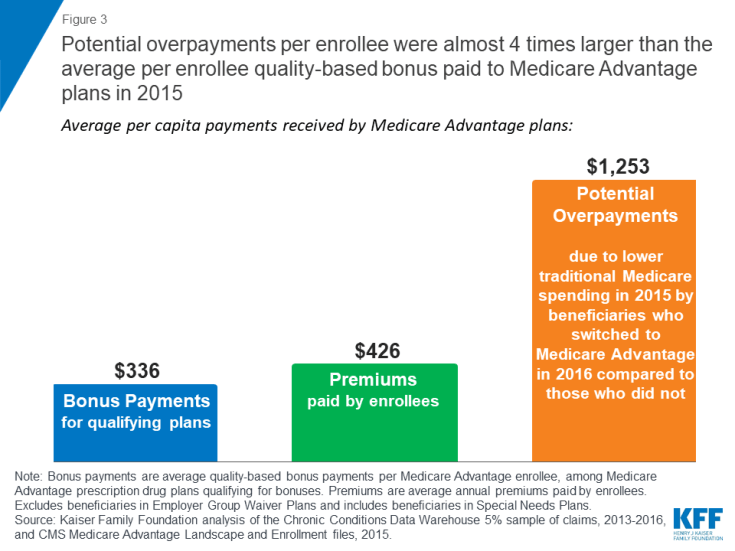

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Do Medicare Advantage plans have an out-of-pocket maximum?

Unlike Original Medicare, all Medicare Advantage plans have out-of-pocket maximums. An out-of-pocket maximum can be a reassuring thing because this means you only have to pay up to known amount before all your covered medical costs are paid for.

What is max out-of-pocket for Medicare?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

What Are $0-Premium Medicare Advantage Plans?

No matter whether they have a $0 premium or not, Medicare Advantage plans give you an opportunity to receive your Medicare benefits through a priva...

What Out-Of-Pocket Costs Might $0-Premium Medicare Advantage Plans have?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These exp...

What Else Do I Need to Know About $0-Premium Medicare Advantage Plans?

Whether or not it’s a zero-premium Medicare Advantage plan that you sign up for, you still need to continue paying your Medicare Part B premium, in...

What is Medicare Advantage Plan?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These expenses may include copayments, coinsurance, and deductibles. A deductible is the amount you have to pay before your Medicare Advantage plan pays its share of covered services.

What is a deductible in Medicare?

A deductible is the amount you have to pay before your Medicare Advantage plan pays its share of covered services. Not every plan might have a deductible amount, and they may vary among plans. A copayment is generally a set dollar amount you may have to pay for a covered service (for example, $15). A coinsurance amount is a percentage ...

What is coinsurance amount?

A coinsurance amount is a percentage of the total cost that you may have to pay for a covered service (for example, 20%). Insurance companies offering Medicare Advantage plans have some flexibility in setting their rates. Plan premiums, deductibles, coinsurance amounts, and copayments may vary among plans. Another cost-related item ...

Does Medicare Advantage cover hospice?

Under the Medicare Advantage (also called Medicare Part C) program, plans must offer the same benefits as Original Medicare, Part A and Part B , but if you need hospice benefits, they’d come directly through Medicare Part A instead of through the plan.

What is Medicare Advantage Plan C?

How Are Zero-Premium Medicare Advantage Plans Possible? Medicare Advantage, also known as Medicare Part C, combines the coverage of Original Medicare (Part A and Part B) and often adds additional benefits, such as prescription drug, dental, and vision coverage.

How much can you pay out of pocket for Medicare?

Medicare Advantage plans also have a maximum out-of-pocket limit ($6,700 in 2020), which can change every year. This is the most you would have to pay out of pocket for covered Part A and Part B expenses during a calendar year. Plans that include prescriptions benefits have a separate out-of-pocket maximum for drug costs.

How much is Medicare Part B premium 2020?

You are still responsible for paying your Part B premium ($144.60 in 2020). That’s because you will still have Part B medical coverage even if you enroll in a Medicare Advantage plan. There are also other out-of-pocket expenses, which vary among Medicare Advantage plans. These include:

Can I overpay for Medicare?

Don’t overpay for your Medicare coverage. HealthMarkets searches thousands of plans from nationally known companies to find your right fit, at no cost to you. Shop for plans online to see available options, compare plans, view up-to-date pricing, and even enroll at any time of day.

Does Medicare Part C have a deductible?

The majority of Medicare Part C plans include prescription benefits. Many of these plans have a separate deductible for drug coverage, and there’s usually a copay or coinsurance each time you fill a prescription. Medicare Advantage plans also have a maximum out-of-pocket limit ($6,700 in 2020), which can change every year.

How much does Medicare Part B cost?

But you still have to pay your Medicare Part B premium ($148.50). Plans with a $0 premium may recoup those costs through higher deductibles, coinsurance, copays, and possibly less coverage. You want to weigh all costs before choosing a plan.

Is Medicare Advantage free?

Medicare Advantage Plans are NOT Free. Though Medicare Advantage can have a $0 premium, they can, like we said above, charge you copays, coinsurance, and sometimes deductibles. Remember $0 premium doesn’t mean it’s a $0 plan.

How much is Medicare Advantage monthly?

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. That's right—zero dollars per month. And that usually includes coverage for services that aren’t covered under Original Medicare.

What are the benefits of Medicare Advantage?

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because: 1 To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.#N#That means you may have to pay more money out of pocket if you see a doctor outside the plan’s network 2 Many Medicare Advantage plans offer preventive care and disease management programs to help people better manage their health, and healthy patients generally have lower healthcare costs. 3 If a particular Medicare Advantage plan ends up spending less than the flat fee it gets from the government, it can pass the savings on to members.#N#That may mean offering plans with a monthly plan premium of $0 or providing additional benefits, such as dental, vision and/or prescription coverage

Is Medicare Advantage free?

Of course, no Medicare plan is really free. You may still pay deductibles and copays for covered services and you’ll still have to pay the Part B premium. But depending on your own personal healthcare needs, a Medicare Advantage plan may be worth it for the added benefits.

Does Medicare Advantage pay out of pocket?

That means you may have to pay more money out of pocket if you see a doctor outside the plan’s network.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) is a healthcare plan that’s offered by private insurance companies. But can you really get anything for free? Let’s take a closer look at zero premium Medicare Advantage plans and whether this might be a good option for your healthcare needs. Share on Pinterest.

How to enroll in Medicare?

If you are helping your loved one enroll in Medicare, remember to: 1 gather important documents, such as a social security card and any other insurance plan documents 2 compare plans online through Medicare.gov’s plan finder tool or through your preferred insurance company’s website

Do you have to pay coinsurance after paying deductible?

After you pay your full deductible, your health plan will pay most of the cost for medical services, but you may still have to pay a copay or coinsurance. Other Medicare premiums. Even with a Medicare Advantage plan, you are responsible for paying the premiums for all other parts of Medicare (parts A, B, and D) that you may have. ...

Is zero premium Medicare good?

Zero premium Medicare Advantage plans can be a great option for people who are looking to either bundle or supplement their existing Medicare coverage. Research your plan options thoroughly before choosing one to make sure it covers everything you need at a cost that makes sense for your budget.

What is a copay?

A copayment (copay) is an amount that you pay for a service after you have met your deductible. These may be higher with plans that have a lower monthly premium, while plans with a higher monthly premium may have lower copays. Coinsurance. Coinsurance is the amount that you are responsible for paying for a covered service, ...

How much does a health plan cover?

Once that amount is met, the health plan will cover 100 percent of the cost for the healthcare services for the rest of the year.

What is coinsurance in insurance?

Coinsurance. Coinsurance is the amount that you are responsible for paying for a covered service, even after you’ve paid your deductible. For example, if your coinsurance is 20 percent, you will pay the first 20 percent of the amount due, and your health plan will cover the rest. Deductible.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

How much is Medicare Part B?

Medicare Part B. Medicare Part B charges a standard monthly premium of $135.50 or more , depending on your gross yearly income. You’ll owe this Part B premium as part of your free Medicare Advantage plan unless it’s covered by the plan.

Do you owe Medicare Supplements a monthly premium?

If you choose to enroll in a Medicare supplement plan like Medicare Part D or Medigap as an alternative to Medicare Advantage, you’ll owe a monthly premium and other costs associated with these plans.

Does Medicare Advantage charge coinsurance?

A copayment is the out-of-pocket fee you pay every time you receive medical services. Some plans may also charge a coinsurance. This is the percentage of all medical costs you’re responsible for paying.

Is Medicare free?

Medicare isn’t free health insurance. There are many different costs that are associated with Medicare coverage. Before you can enroll in a Medicare Advantage plan, you must have Medicare parts and B coverage. Below you’ll find the costs associated with those plans.

Does Medicare Advantage have a deductible?

There are two types of yearly deductibles associated with most Medicare Advantage plans: The plan itself may have a yearly deductible, which is the out-of-pocket amount you pay before your insurance pays out. The plan may also charge you a drug deductible as well.