The Part B Giveback– also referred to as the Part B premium reduction– is a benefit provided by certain Medicare Advantage plans that “gives back” some of the Part B premium by reducing the amount deducted every month from your social security check.

What is a Medicare Advantage plan with Part B give back?

The give-back benefit is another term for Part B premium reduction. This is when a Medicare Advantage plan reduces the amount you pay towards your Part B monthly premium. Are Medicare Advantage Plans with Part B Give Back Popular? These plans are becoming more widely available.

Do I have to pay for Medicare Part B buy back?

By default, everyone has to pay for Medicare Part B unless they get some kind of financial assistance. While Medicare Part B is a part of original Medicare, Medicare Advantage plans are privately owned and offer additional benefits beyond original Medicare. In particular, Part B buy back is an additional benefit offered by some plans.

How do Medicare Part A and Part B work?

Here’s what you need to know about how this works: Most Medicare beneficiaries qualify for premium-free Medicare Part A, based on their work history or their spouse’s work history. But Medicare Part B has a monthly premium, which is $170.10/month for most beneficiaries in 2022.

How much do I get back with a part B plan?

How Much Do I Get Back with a Part B Give Back Plan? The amount you get back can range from $0.10 in some counties up to $148.50. Also, the amount you get back will depend on the options in your area. Further, sometimes the same plan name will have a different premium buy-down in different counties.

How do I qualify for Medicare $144 back?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I get my Part B premium back?

To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium.

Do I still pay Medicare Part B with a Medicare Advantage plan?

Medicare Advantage (MA) plans cover the benefits associated with both Medicare Part A and Part B (except for hospice care, which Part A covers) and may come with a monthly premium for coverage; however, you must also continue to pay your Part B premium.

What is Medicare Part B give back?

With Medicare Part B premiums jumping to $170.10 in 2022, you may be looking for ways to lower your premiums and save money on your Medicare costs. The new Medicare Advantage giveback plans that provide the give back benefit may be a way to do just that by 'giving back' a portion of your Part B premium.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the give back program?

Give Something Back (Give Back) provides academic assistance, long-term coaching, and support services to students who have experienced barriers to success.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do you pay Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.

Are Medicare Advantage premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

What is the Medicare Part B Giveback Benefit?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans.

How do I receive the Medicare Giveback Benefit?

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

Is the Medicare Giveback Benefit a type of Medicare Savings Program?

No. The Medicare Giveback Benefit is only available to people enrolled in certain Medicare Advantage plans. Medicare Savings Programs (MSPs) are available to people enrolled in Original Medicare who have limited income and resources.

Learn more about Medicare

For more helpful information on Medicare, check out these 10 frequently asked questions about Medicare plans.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B premium will be $148.50. Your premium may be a bit higher if you have a higher income. . The reason you have to keep paying this premium is because Medicare Part B is a paid program, unlike Medicare Part A which you earned during your working years by paying social security taxes.

How long after you sign up for Part B will you get your money back?

You’ll have to continue paying your A and B premiums, even if you do get some of that money back. Additionally, it may be a few months after you sign up for your premium give back plan before you receive your first Part B reimbursement.

How to contact Part B buy back?

If you’re interested, call us at 800-691-1832. Let us know that you’re interested in Part B buy back plans, and we’ll do all we can to help!

Does Part B buy back have higher copayments?

Remember, all plans are different, but it is possible that a plan with a Part B buy back option will have higher copayments and deductibles – which may not matter to you if you don’t spend a lot of time in the doctor’s office! The devil is in the details.

Does Medicare Advantage have a low premium?

They can vary greatly in coverage amounts and premium prices. Some Medicare Advantage plans can come with a $0 premium or a low premium in addition to a Part B buy back (or give back, as some plans call it). If you pay your Part B premium automatically out of your Social Security check, this could feel like a bonus added to your monthly checks!

Do you have to pay for Medicare Part B?

By default, everyone has to pay for Medicare Part B unless they get some kind of financial assistance. While Medicare Part B is a part of original Medicare, Medicare Advantage plans are privately owned and offer additional benefits beyond original Medicare. In particular, Part B buy back is an additional benefit offered by some plans.

Is there a catch with Medicare Advantage?

What’s the Catch? You’re probably skeptical about the idea of an insurance company wanting to give YOU money. However, there’s not really a catch. According to Quality Health Plans of New York, Medicare Advantage plans “may choose to use some of the funding it receives” to “reduce its members Medicare Part B premium.”.

What Are Medicare Part B Give Back Plans?

Medicare Part B Give Back plans are special Medicare Advantage plans that return some or all Part B premiums to beneficiaries.

How Do Medicare Part B Give Back Plans Work?

Medicare Part B Give Back plans are health plans offered by private insurance companies rather than Medicare.

How Do You Get Medicare Money Back?

You don’t get Medicare money back in the traditional sense with a Medicare Part B Give Back plan.

How Common Are Medicare Part B Give Back Plans?

Medicare Part B Give Back plans are becoming more common as time goes on. In 2021, these plans are available in 48 states. Many major insurance carriers offer this benefit to make their plans more appealing.

Are Medicare Part B Give Back Plans Cheaper Than Other Medicare Plans?

Since providers waive all or part of the Part B premium, they may be cheaper than other Medicare Advantage plans.

What Are the Qualifications for Medicare Give Back Benefits?

Medicare Give Back plans aren’t open to everyone, so make sure you meet the criteria before applying.

Should You Consider a Medicare Give Back Plan?

Medicare Part B Give Back plans offer immediate plan benefits, but they could be more expensive than some other Medicare plan options in the long run. Furthermore, these plans aren’t available in every zip code or with all insurance providers.

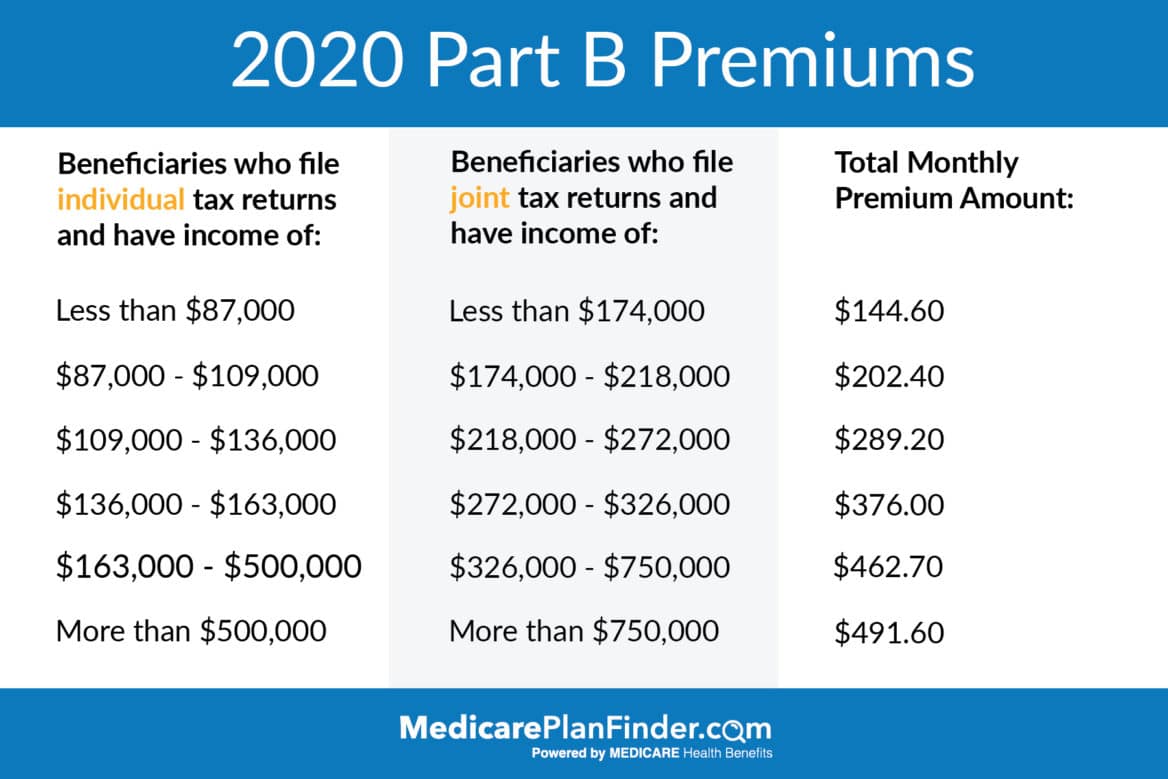

Detailed Medicare Advantage GiveBack Answer

You are still obligated to pay for your Medicare Part A and B premium when you select a Medicare Advantage plan. Fortunately for most people who have worked in the United States, there is no cost for Medicare Part A. Medicare Part B, however, typically costs $170.10 per month, although some higher-income individuals may pay more.

How Does Medicare Advantage Give Back Work?

Whatever the name, here is what you need to know. Your insurance provider works directly with social security to lower the amount you are charged for your Medicare Part B premium when you select a MA plan that features a GiveBack option.

Is the Part B Give Back a reimbursement?

No! You will never receive a Part B GiveBack reimbursement check from the carrier. Even if you are not receiving Social Security and you are currently required to pay for Medicare Part B directly, you will not get a reimbursement check.

How Much is the MA Give Back Each Month?

Currently, the few plans that include this Part B reduction usually offer $50 a month but technically they could pay your entire Part B monthly premium. We are not aware of a plan that offers that…yet. We have also seen lower amounts with MA Buy down plans such as $25 a month.

How Do I Qualify for a Medicare Advantage with a Part B Give Back?

You must be Medicare eligible. This means you enrolled in both Medicare Part A and Part B.

Where can I purchase an MA Plan that offers Medicare Part B Giveback ?

Contact a licensed Independent Agent who can help you review plans that include this feature. Members of our team at Senior65.com are licensed to help you with this process right over the phone.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

What is the Medicare Part B giveback?

If you choose to enroll in a Medicare Advantage plan, you pay the premium for Part B plus the premium for the Advantage plan. Well over half of all Advantage plans have $0 premiums, which means their enrollees just pay the Part B premium.

How does a Part B giveback rebate work?

The specifics of the giveback rebate rules are outlined in federal regulations that have been applicable since Medicare+Choice plans were rebranded as Medicare Advantage. Medicare Advantage plans receive payments from the federal government (which cost the government more per-person than it spends on Original Medicare).

How large are the Part B givebacks?

For plans that take this option, the Part B premium reduction can be as little as 10 cents, or as much as the full Part B premium. The Part B premium reduction has to be provided uniformly to a plan’s enrollees, so everyone in the plan gets the same Part B premium reduction.

How do you receive the Part B giveback?

For most Medicare beneficiaries, the cost of Part B is deducted from their Social Security checks. Beneficiaries who don’t receive Social Security retirement benefits are invoiced directly for their Part B premiums.

Where is the Part B giveback offered?

The commercials for Medicare Advantage giveback rebates are aired nationwide, but plans that offer this benefit are not available in all areas. And even if you’re in an area where this benefit is offered by at least one Advantage plan, it’s likely that the majority of the available plans will not offer it.

How can I find Medicare Advantage plans with a Part B giveback

When you’re comparing plans on the Medicare Plan Finder tool, you can click on “plan details” to see more information about each plan. An overview page will appear, and the section at the top is all about premiums.

What factors – other than premium – should I consider when choosing a Medicare Advantage plan?

The total monthly premium is just one aspect of your coverage, and there are numerous other features that you’re going to want to take into consideration when you’re making a plan selection. For example:

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.