If a particular Medicare Advantage plan ends up spending less than the flat fee it gets from the government, it can pass the savings on to members. That may mean offering plans with a monthly plan premium of $0 or providing additional benefits, such as dental, vision and/or prescription coverage So what’s the catch?

Full Answer

What are the benefits of Medicare Advantage plan?

Oct 31, 2019 · What out-of-pocket costs might $0-premium Medicare Advantage plans have? Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These expenses may include copayments, coinsurance, and deductibles. A deductible is the amount you have to pay before your …

Is it better to have Medicare Advantage or Medigap?

Mar 08, 2017 · Here’s why these plans can offer a $0 premium: 1. You’re still paying your Medicare Part B monthly premium Every month, you pay your Medicare Part B (medical coverage)... 2. Focus on preventive care = healthier you + lower costs Medicare Advantage plans partner with you to stay on top of... 3. Plans ...

What is the best Medicare plan?

Want to sign up for a Medicare Advantage plan? Call us at 217-423-8000 today or download our free Annual Enrollment Period To-Do List! These plans have no premium, and the government actually deposits money into a savings account for you every year. For the purposes of this theoretical example, let’s call that dollar amount $2,500.

What is Medicare Advantage vs supplement?

Nov 18, 2021 · $0 premium Medicare Advantage plans may feature certain cost-sharing measures such as copayments (a flat fee) or coinsurance (a percentage of the cost of services or equipment). A copayment or coinsurance is the amount that you must pay for medical services, doctor visits, medical equipment or prescription drugs after your deductible is met.

How can Medicare Advantage plans have 0 premiums?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

What does a $0 premium mean?

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don't pay anything to the insurance company each month for your coverage.

Do Medicare Advantage plans pay 100 %?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.Jan 7, 2022

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What is the least expensive Medicare Advantage plan?

Aetna Medicare Advantage plans have the cheapest overall prices, costing an average of $7 per month for 2022. Aetna's Medicare Advantage plans stand out for those who are looking for affordable coverage.Feb 16, 2022

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

Do Medicare Advantage plans have an out-of-pocket maximum?

Unlike Original Medicare, all Medicare Advantage plans have out-of-pocket maximums. An out-of-pocket maximum can be a reassuring thing because this means you only have to pay up to known amount before all your covered medical costs are paid for.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

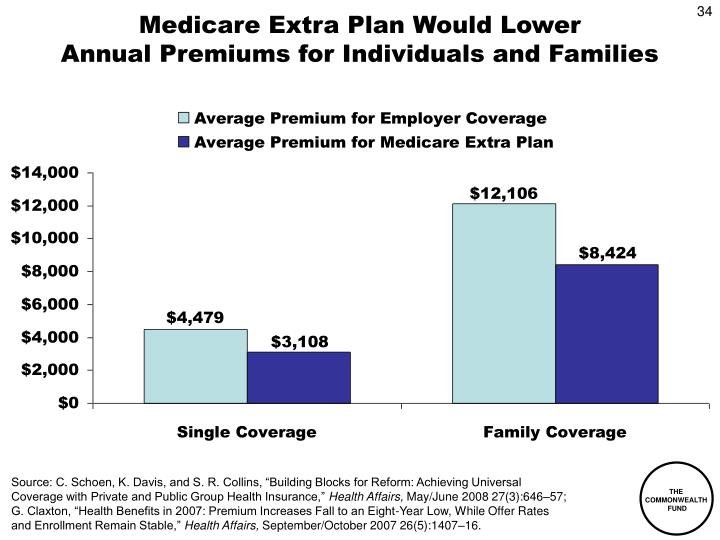

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

Which is better a Medigap policy or Medicare Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What Are $0-Premium Medicare Advantage Plans?

No matter whether they have a $0 premium or not, Medicare Advantage plans give you an opportunity to receive your Medicare benefits through a priva...

What Out-Of-Pocket Costs Might $0-Premium Medicare Advantage Plans have?

Medicare Advantage plans (whether $0-premium or not) typically come with certain out-of-pocket costs, just as most health insurance does. These exp...

What Else Do I Need to Know About $0-Premium Medicare Advantage Plans?

Whether or not it’s a zero-premium Medicare Advantage plan that you sign up for, you still need to continue paying your Medicare Part B premium, in...

How to choose a Medicare Advantage plan?

A no-premium Medicare Advantage plan might be a good idea for you if: 1 You’re healthy and are willing to take on the risk of a high deductible in exchange for low or no monthly premium. 2 You rarely go to the doctor and have enough money saved up to cover any very unexpected emergencies. 3 You’re dual eligible, meaning you’re eligible for both Medicare and Medicaid. 4 You don’t travel much and live in one state for the entire year.

What is Medicare Advantage?

In case you’re new to Medicare, Medicare Advantage is an alternative option for health coverage. Medicare Advantage, or MA, is offered by private insurance companies, and it’s approved by Medicare. MA plans cover everything traditional Medicare covers as well as emergency and urgent care. These plans often include extra perks, like dental coverage, ...

What is an HMO plan?

HMO Point-of-Service (HMO/POS) plans: HMO plans may allow you to get some services out-of-network for a higher copayment or coinsurance. Medical Savings Account (MSA) plans: These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible).

How much does Medicare Part B cost?

As of 2018, that premium is $134 per month, and it generally comes right out of your social security check.

What is the maximum out of pocket limit for Medicare Advantage?

Some of the tradeoffs of Medicare Advantage when comparing it to Original Medicare are the networks and the co-pays, which accumulate to a maximum out-of-pocket limit anywhere between a couple thousand dollars to as high as $6,000 ...

How many types of Medicare Advantage are there?

When we talk about Medicare Advantage, we often refer to these plans as a single entity, but in reality, there are actually 6 different types of MA plans. Health Maintenance Organization (HMO) plans: In most HMOs, you can only go to doctors in your network (except in an urgent or emergency situation). Preferred Provider Organization (PPO) ...

Can MSAs be used for Medicare?

Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan. The last one – Medical Savings Accounts (MSAs) – are another type ...

How much is Medicare Advantage 2021?

Most people do not pay a premium for Part A, but the standard Part B premium for 2021 is $148.50 per month. If you are enrolled in a $0 Medicare Advantage plan, ...

How many Medicare Advantage plans will be available in 2021?

There are over 3,550 Medicare Advantage plans for sale in the U.S. in 2021, and many of those have $0 premiums. 2 Here we’ll take a detailed look at these plans and help you make the most informed decision regarding your Medicare coverage.

How much can you get out of Medicare in 2021?

By law, Medicare Advantage plans had to have an out-of-pocket maximum of no more than $7,750 in 2021. Medicare Advantage plans can be structured in a number of different ways, including Medicare HMO and Medicare PPO plan types, among others.

How much does a copay of $30 cover?

Your plan will cover the remaining 80 percent of the costs. By contrast, a $30 copay requires you to pay $30 for each service you receive after your deductible is met, regardless of the total bill amount for the covered services. Out-of-pocket maximums.

What is the out of pocket maximum for Medicare?

A plan’s out-of-pocket maximum is the total amount you can expect to pay during a plan year. Medicare Advantage plans will pay 100 percent of the remaining costs for covered services for the remainder of the year once this maximum is reached.

Does Medicare Advantage cover out of network care?

With some of these plans, it may cost more money to receive approved medical care outside of the plan’s network. In some cases, out-of-net work care may not be covered at all. Part B premium.

Does Medicare Part A have a deductible?

Medicare Part A, Part B, Part C and Part D plans can each have a deductible, which is the amount you must pay out of pocket before Medicare or your plan pays its share. Deductibles typically apply on an annual basis and reset with each new plan year. (This is not the case with Medicare Part A, however.