- Revenue and contributions. Medicare for All would be funded through income tax increases, tax premiums, and contributions.

- Eligible population. All residents of the United States, regardless of age or health status, would be eligible for health coverage under Medicare for All.

- Provider payment. Services administered by Medicare for All providers would be paid for on a fee-for-service basis using a fee schedule.

- Covered benefits. Medicare for All would cover comprehensive health benefits, including any services medically necessary to diagnose, treat, or maintain a condition.

- Eligible providers. All providers under Medicare for All must follow national minimum standards and the rules and regulations set by the Act.

Is Medicare going to run out of money?

Medicare trustees announced on Tuesday that the Medicare hospital insurance trust fund will run out of money by 2026, three years earlier than reported in 2017. This is due to: Spending in 2017 that was higher than estimated; Legislation that increases hospital spending; Higher payments to private Medicare Advantage plans; As for Social Security, it will become insolvent by 2034.

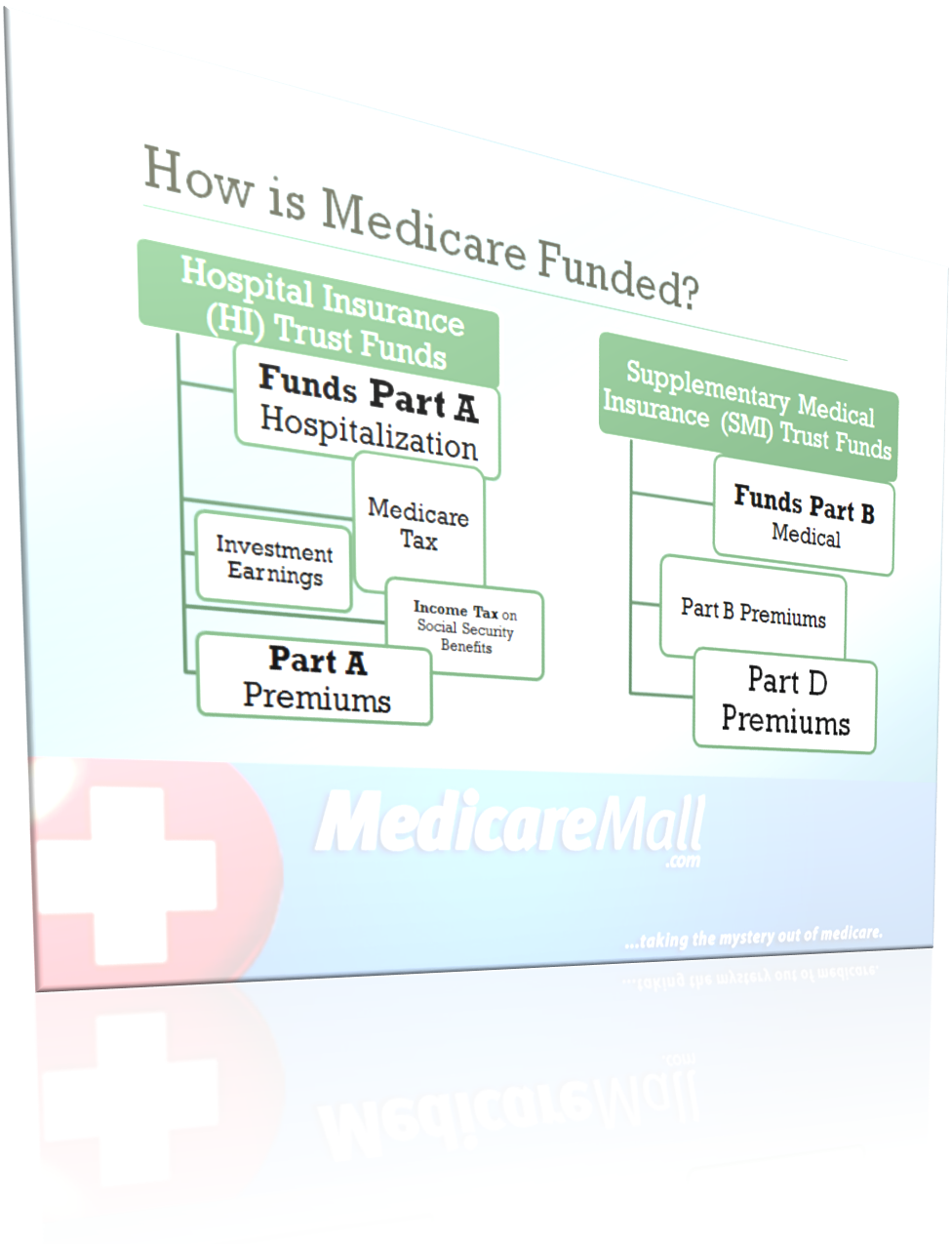

Is Medicare funded by taxes?

Medicare is funded through a combination of taxes deposited into trust funds, beneficiary monthly premiums, and additional funds approved through Congress. According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

How does the federal government funds Medicaid?

The federal government guarantees matching funds to states for qualifying Medicaid expenditures; states are guaranteed at least $1 in federal funds for every $1 in state spending on the program.

Does a retire pay for Medicare?

Retirees HAVE to pay for part B Medicare monthly. The amount you pay is based on your 2018 taxes. If you earn $87,000 a year or less you will pay the standard rate of $144.60 monthly.

How can the US finance Medicare for All?

Options for Financing Medicare for All Though most of the federal cost of Medicare for All would come from replacing private spending with public spending, these costs would nonetheless need to be financed through higher taxes, lower spending, more borrowing, or some combination of the three.

How is Medicare being funded?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Who sponsored Medicare for All?

The Medicare for All of 2022 has also been endorsed by more than 60 major organizations, including National Nurses United, American Medical Student Association, Nation Union of Health Care Workers, Service Employees International Union (SEIU), Association of Flight Attendants-CWA (AFA-CWA), Indivisible, Public Citizen, ...

Is Medicare fully funded?

Medicare is funded through multiple sources: 46% comes from general federal revenue such as income taxes, 34% comes from Medicare payroll taxes and 15% comes from the monthly premiums paid by Medicare enrollees. Other sources of funding included taxation of Social Security benefits and earned interest.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Is Medicare funded by income tax?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare.

Who invented Medicare for All?

Representative John ConyersThe Expanded and Improved Medicare for All Act, also known as Medicare for All or United States National Health Care Act, is a bill first introduced in the United States House of Representatives by Representative John Conyers (D-MI) in 2003, with 38 co-sponsors.

Can states make universal healthcare?

California could become first US state to offer universal healthcare to residents. California is considering creating the first government-funded, universal healthcare system in the US for state residents.

Which political party brought in Medicare?

The first iteration of Medicare was called Medibank, and it was introduced by the Whitlam government in 1975, early in its second term. The federal opposition under Malcolm Fraser had rejected Bills relating to its financing, which is why it took the government so long to get it established.

Can Medicare run out?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

Who funds Medicare in Australia?

The Australian governmentThe Australian government pays for Medicare through the Medicare levy. Working Australians pay the Medicare levy as part of their income tax. High income earners who don't have an appropriate level of private hospital insurance also pay a Medicare levy surcharge. To find out more, read about Medicare and tax.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How would Medicare for All be financed?

Though most of the federal cost of Medicare for All would come from replacing private spending with public spending, these costs would nonetheless need to be financed through higher taxes, lower spending, more borrowing, or some combination of the three.

How much money does Medicare for All require?

resident for nearly all medical services and eliminates premiums and cost sharing would require the federal government to identify between $25 trillion and $35 trillion of financing.

How much will Medicare reduce GDP in 2030?

PWBM estimates that financing expanded traditional Medicare with a payroll tax would reduce GDP by 5.3 percent in 2030, deficit financing it would reduce GDP by 4.4 percent, and financing it entirely with premiums would actually increase GDP by 1 percent. 16.

How much would Medicare need to be financed?

Assuming no changes in projected interest rates or economic growth, deficit-financing Medicare for All over the next decade would require nearly $34 trillion of new borrowing including interest, which is the equivalent of 105 percent of GDP by 2030.

How much will Medicare cost in 10 years?

Medicare for All is likely to increase federal costs by between $25 trillion and $35 trillion over ten years, depending both on estimating assumptions and on important design choices and policy details. To finance $30 trillion – a rough midpoint – policymakers would likely adopt a combination of approaches that are equivalent to a 32 percent ...

How much payroll tax is needed to finance a $13 trillion program?

Financing a $13 trillion program would require a 13 percent payroll tax, for example, compared to the 32 percent payroll tax required to fund $30 trillion and 39 percent required to fund $35 trillion.

How would universal health care help the economy?

PWBM found that universal health care itself would grow the economy through a healthier and more productive workforce, longer lifespans, and higher wages. However, the analysis found that options to finance Medicare for All would reduce the incentive to work, save, and invest and reduce economic output.

What is the idea of Medicare for All?

Ask someone what they think about the idea of “Medicare for All” — that is, one national health insurance plan for all Americans — and you’ll likely hear one of two opinions: One , that it sounds great and could potentially fix the country’s broken healthcare system.

What percentage of Americans support Medicare for All?

A Kaiser Family Foundation tracking poll published in November 2019 shows public perception of Medicare for All shifts depending on what detail they hear. For instance 53 percent of adults overall support Medicare for All and 65 percent support a public option. Among Democrats, specifically, 88 percent support a public option while 77 percent want ...

What would happen if we eliminated all private insurance and gave everyone a Medicare card?

“If we literally eliminate all private insurance and give everyone a Medicare card, it would probably be implemented by age groups ,” Weil said.

What is single payer healthcare?

Single-payer is an umbrella term for multiple approaches.

How many people in the US are without health insurance?

The number of Americans without health insurance also increased in 2018 to 27.5 million people, according to a report issued in September by the U.S. Census Bureau. This is the first increase in uninsured people since the ACA took effect in 2013.

Is Medicare Advantage open enrollment?

While it covers basic costs, many people still pay extra for Medicare Advantage, which is similar to a private health insurance plan. If legislators decide to keep that around, open enrollment will be necessary. “You’re not just being mailed a card, but you could also have a choice of five plans,” said Weil.

Is Medicare for All a fact?

A succinct, fact-based explanation of what Medicare for All would actually entail and how it could affect you. It’s a topic that is especially relevant right now. In the midst of the 2020 U.S. presidential election, Medicare for All has become a key point of contention in the Democratic Party primary.

What is Medicare for All?

Medicare for All is a proposed new healthcare system for the United States where instead of people getting health insurance from an insurance company, often provided through their workplace, everyone in America would be on a program provided through the federal government. It has become a favorite of progressives, ...

Who introduced the Medicare at 50 Act?

Lawmakers have introduced other Medicare expansion options, which would be much more limited than Medicare for All. Senators Debbie Stabenow (D- Michigan), Sherrod Brown (D-Ohio) and Tammy Baldwin (D-Wisconsin) introduced the Medicare at 50 Act in February of 2019.

Why is universal healthcare important?

Pros. Universal healthcare lowers health care costs for the economy overall, since the government controls the price of medication and medical services through regulation and negotiation.

Is Medicare for All single payer?

Medicare for All is effectively single-payer healthcare. Single-payer health care is where the government pays for people’s health care. The new name just makes the concept more popular. A Kaiser Family Foundation poll found that 48% of people approved of single-payer healthcare, while 62% of people approved of Medicare for All.

Is Medicare for All the same as Obamacare?

The Affordable Care Act, commonly referred to as Obamacare, would also be replaced by Medicare for All. Medicare for All is actually more genero us than your current Medicare program. Right now, Medicareis for Americans 65 and older. They receive care, but they’re also responsible for some of the cost.

Does Sanders tax Medicare?

If you make more than $250,000 a year, or are in the top 0.1 % of household, Sanders’ tax to pay for Medicare for All would be a con for you. In addition, universal health care requires healthy people to pay for medical care for the sick. However, that is how all health insurance programs work.

Is HSA good for health?

Tips for Keeping Your Finances Healthy. A health savings account (HSA) may be a good option for younger people who are worried about potential healthcare costs. HSAs can greatly reduce monthly premiums. Whatever the outcome on Medicare for All, it is important to keep yourself physically and financially healthy.

How many cosponsors did the Medicare bill have?

The bill, which has 16 Democratic cosponsors, would expand Medicare into a universal health insurance program, phased in over four years. (The bill hasn’t gone anywhere in a Republican-controlled Senate.)

Who funded the Mercatus Center?

The Mercatus Center gets some of its funding from the libertarian Koch brothers, but more about that later.

Will Medicare have negative margins in 2040?

The Centers for Medicare and Medicaid Services (CMS) Office of the Actuary has projected that even upholding current-law reimbursement rates for treat ing Medicare beneficiaries alone would cause nearly half of all hospitals to have negative total facility margins by 2040. The same study found that by 2019, over 80 percent ...

What is Medicare for All?

The Medicare for All proposal would be an expansion of Medicare, the health insurance program that covers Americans age 65 and older. Medicare is currently broken into different parts: Part A, Part B, Part C, and Part D. There is also Medicare supplement insurance, also known as Medigap.

What is Medicare coverage?

providing coverage for all individuals, regardless of age or health status. offering original Medicare coverage, including inpatient and outpatient medical insurance. adding additional coverage, such as reproductive, maternity, and pediatric care.

What services would be affected by switching to single payer healthcare?

rehabilitation and substance abuse services. Switching to a single-payer healthcare system would likely affect the current government-funded healthcare options, such as Medicare and Medicaid.

What is single payer healthcare?

Single-payer healthcare systems refer to health insurance programs that are governed by one organization. These single-payer systems, which can be found worldwide, may vary by how they are funded, who is eligible, what benefits they offer, and more.

What is the allocation of funds?

Allocation of funds, or provider payment, could be population-based, fee-for-service, or global budget. Generally, when it comes to covered benefits, all single-payer healthcare systems aim to provide coverage for essential health benefits. These benefits include: inpatient and outpatient medical services.

Do you have to pay yearly deductibles for Medicare?

You must pay these fees to stay enrolled in your Medicare plan and receive coverage. Under Medicare for All, there would be no monthly premiums or yearly deductibles. You would owe nothing at the time of your services. Instead, your healthcare plan would be prepaid through taxes and contributions.

Is Medicare for All a single payer system?

Medicare for All is only one type of single-payer system. There are a variety of single-payer healthcare systems that are currently in place in countries all around the world, such as Canada, Australia, Sweden, and others.