- Medicare’s Easy Pay system lets you pay your Part A or Part B premium electronically. ...

- You can pay with a debit card or credit card by writing your card number directly on your bill and mailing it in.

- You can pay with a check or money order.

Full Answer

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How do I pay my monthly Medicare Part B premium?

- automatic deduction from your Social Security monthly benefit payment (if you receive one)

- mailing a monthly check to the plan

- arranging an electronic transfer from a bank account

- charging the payment to your credit or debit card (though not all plans offer this option)

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

How are Medicare Part B premiums paid?

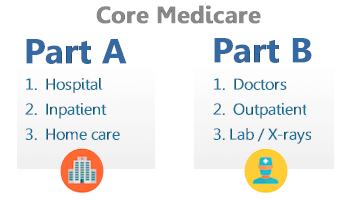

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

Can I pay my Medicare Part B premium monthly?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Are Medicare Part B premiums deducted from Social Security payments?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How do I get reimbursed for Part B premium?

2. What document do I need to submit to receive my correct Part B reimbursement amount? You must submit a copy of your Social Security benefits verification statement (your “New Benefit Amount”) or a copy of a 2022 Centers for Medicare and Medicaid Services (CMS) billing statement.

Can you pay Medicare premiums with a credit card?

Medicare allows you to pay your premiums by charging the payment to your debit or credit card, automatic deduction from your Social Security benefit, arranging an electronic bank transfer, or mailing a monthly check.

Is Medicare Part B billed monthly or quarterly?

Medicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank's bill payment service.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is the $16 728 Social Security secret?

1:266:46My Review: Motley Fool's $16,728 Social Security Bonus - YouTubeYouTubeStart of suggested clipEnd of suggested clipIf you've read any of their articles you've probably seen this it says the sixteen thousand sevenMoreIf you've read any of their articles you've probably seen this it says the sixteen thousand seven hundred and twenty eight dollar social security bonus most retirees completely overlook.

How much does Social Security take out of your check for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How do I get $800 Medicare reimbursement?

All you have to do is provide proof that you pay Medicare Part B premiums. Each eligible active or retired member on a contract with Medicare Part A and Part B, including covered spouses, can get their own $800 reimbursement.

How does the Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

Who is eligible for Medicare reimbursement account?

Reimbursement Account for Basic Option Members Enrolled in Medicare Part A and Part B. Basic Option members enrolled in Medicare Part A and Part B are eligible to be reimbursed up to $800 per calendar year for their Medicare Part B premium payments. The account is used to reimburse member-paid Medicare Part B premiums.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Where to mail Medicare premium payment?

Mail your payment to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 3. Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

HSA fast facts

Health savings accounts (HSAs) were created as part of the Medicare Prescription Drug, Improvement, and Modernization Act, or MMA, signed into law by President George W. Bush on December 8, 2003. The MMA was the largest overhaul to Medicare in the program's history.

What about FSA and HRA eligibility?

The same HSA eligibility status for Medicare Part B premiums applies to flexible spending accounts (FSAs) and health reimbursement arrangements (HRAs) as well.

Disclaimer

This page is intended to be an educational reference only. Please check with your HSA administrator or health insurance provider to confirm if you can pay for Medicare Part B premiums with your HSA card before making any purchases.

How much is Medicare Part B 2021?

Medicare Part B costs. Most people pay the standard Part B premium. In 2021, that amount is $148.50. If the modified adjusted gross income you reported on your taxes from 2 years ago is higher than a certain limit, though, you may need to pay a monthly IRMAA in addition to your premium.

How long does it take to pay Medicare premiums?

If you enroll in Medicare before you begin collecting Social Security benef it s, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins. This bill will typically be for 3 months’ worth of Part B premiums. So, it’s known as a quarterly bill.

What happens to Medicare premiums once you start?

Once your benefits begin, your premiums will be taken directly out of your monthly payments. You’ll also receive bills directly from your plan’s provider if you have any of the following types of plans: Medicare Part C, also known as Medicare Advantage. Medicare Part D, which is prescription drug coverage.

What is Medicare Part D?

Medicare Part D, which is prescription drug coverage. Medigap, also called Medicare supplement insurance. The structure of these bills and their payment period may vary from insurer to insurer. Social Security and RRB benefits are paid in arrears. This means that the benefit check you receive is for the previous month.

How often do you get Medicare payments?

If you have original Medicare and aren’t yet collecting Social Security, you’ll receive a bill from Medicare either monthly or once every 3 months in these cases: If you don’t have premium-free Part A, you’ll receive a monthly bill for your Part A premium.

Do Medicare payments go into advance?

These bills are paid in advance for the coming month or months, depending on the parts of Medicare you’re paying for. If you’re already receiving retirement benefits, your premiums may be automatically deducted from your check. Part C, Part D, and Medigap bills are sent directly from the insurance company that provides your plan.

Does Medicare Advantage pay quarterly?

Other insurers may give you the option of paying quarterly. Medicare Advantage (Part C) plans may or may not have a monthly premium. This is determined by the plan you choose. Medicare Part D and Medigap plans typically do have monthly premiums. Once you start receiving Social Security benefits, the monthly premiums for your Part C, Part D, ...

How does Medicare reimbursement work?

A Medicare premium reimbursement is a fantastic way for active employees to get refunds of their premiums. Often, premiums may cost less than group insurance at your workplace. If you prefer Medicare to your group coverage, you may be eligible to get premium reimbursements.

Who is responsible for paying your insurance premiums?

As a beneficiary, YOU are responsible for paying your premiums. Employers can reimburse any Part B and Part D premiums for employees who are actively working. This requires the company’s payment plan to integrate with the group insurance plan.

What is a health reimbursement arrangement?

A Health Reimbursement Arrangement is a system covered by Section 105. This arrangement allows your employer to reimburse you for your premiums. Some HRAs at employers that provide group coverage require that your employer’s payment plan ties in with the group health plan. Contact a human resources representative at your organization ...

What does MEC mean for Medicare?

This type of arrangement can help reimburse employees for their Medicare premiums. If an employee holds minimum essential coverage (MEC), they can get assistance in paying for virtually all Medicare costs, including Medigap premiums.

Can my employer pay my Medicare premiums in 2021?

Updated on July 13, 2021. While your employer can’t pay your Medicare premiums in the true sense, you’ll be glad to know that they may reimburse you for your premium costs! To compensate you, your employer will need to create a Section 105 Medical Reimbursement Plan. We’re here to help you understand your options for reimbursement ...

Is a Section 105 reimbursement taxable?

Some Section 105 plans may only permit refunds on healthcare costs and premiums. This compensation isn’t taxable. If the Section 105 plan reimburses with cash for any remaining benefits, both the money and reimbursements are taxable.answer.

Does Part B count as MEC?

To take part in a QSEHRA, you must have minimum essential coverage (MEC), which means enrolling in Part A. Enrolling in only Part B doesn’t count as MEC, but enrolling in Part C does because it includes Part A benefits. If you have MEC, a QSEHRA will reimburse almost all Medicare premiums; including Part D, Medigap, and Advantage.

Is group health insurance primary or secondary?

In this situation, the group health plan is primary and Medicare is secondary, so the government really doesn’t want employers to incentivize employees to cancel the group health coverage; doing so would be a violation of the MSP provisions.

Is a retiree only HRA allowed?

The answer is…it depends. We already know that a retiree-only HRA is allowed. Per IRS guidance in 2013, a retiree-only HRA is considered a “group of one” and therefore is not subject to the rules applicable to group health plans under the Affordable Care Act. In other words, it would be allowed even if QSEHRAs were not.

Can an employer pay for Medicare Part B?

However, an employer payment plan that pays for or reimburses Medicare Part B or Part D premiums is integrated with another group health plan offered by the employer for purposes ...

Is Medicare Part B a group plan?

An arrangement under which an employer reimburses (or pays directly) some or all of Medicare Part B or Part D premiums for employees constitutes an employer payment plan, as described in Notice 2013-54, and if such an arrangement covers two or more active employees, is a group health plan subject to the market reforms.

Can a company pay Medicare premiums for retired employees?

This is known as a Medicare Premium Reimbursement Arrangement. However, this is not an option for companies with 20 or more workers that are subject to the Medicare Secondary Payer provisions. All companies, regardless of size, can pay the health insurance or Medicare premiums for their retired employees, but no company can pay for individual ...