No, Medicare Supplements are not free. However, they can free you from paying out of pocket costs when you use your Part A and Part B benefits. Since Original Medicare leaves you responsible for deductibles and coinsurance, Medigap

Medigap

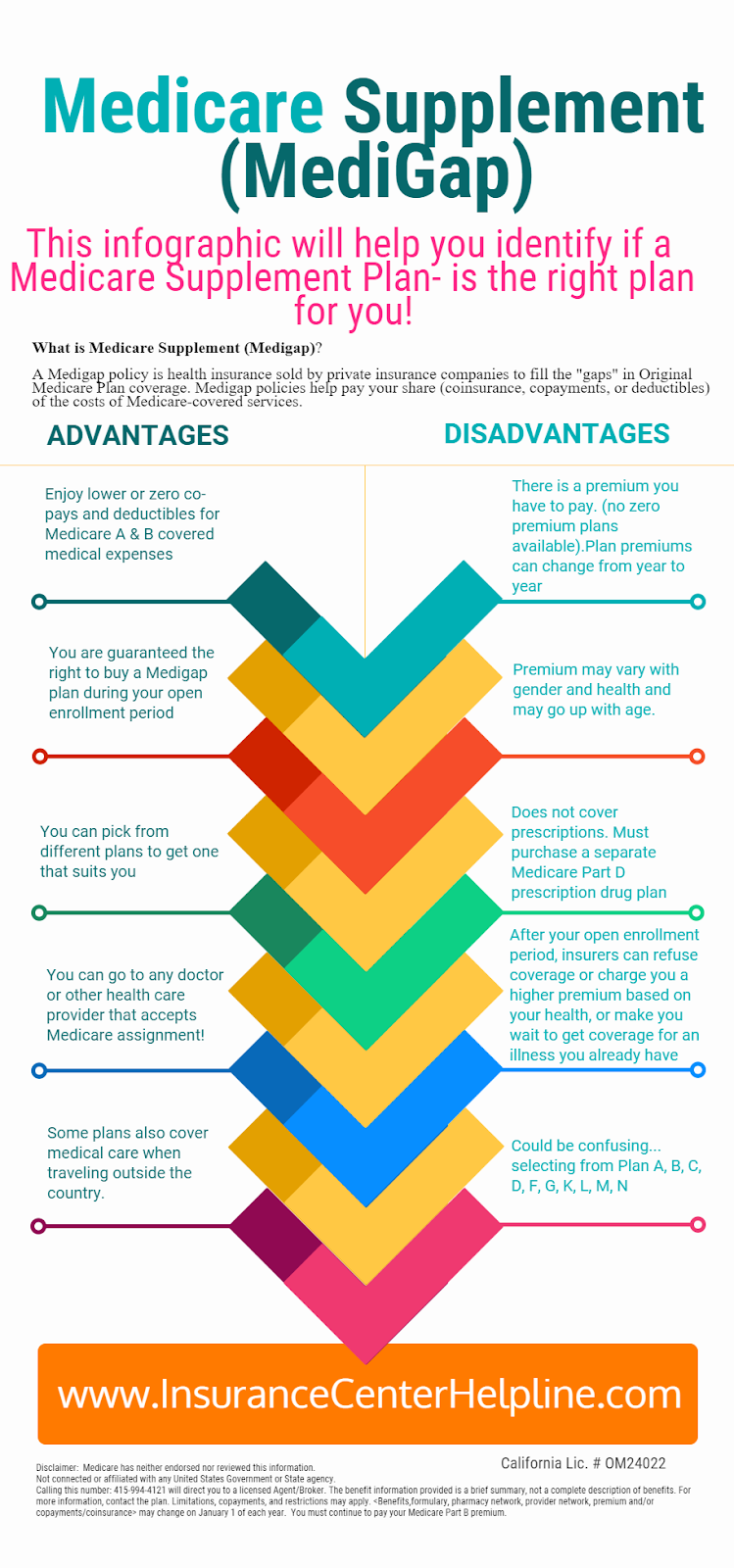

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

- Private insurers offer $0 premium Medicare Advantage plans. ...

- Medicare Advantage plans cover your Medicare Part A and Part B. ...

- Medicare Part A (hospital insurance) is free if you or your spouse paid Medicare taxes for a certain amount of time while working.

- Medicare Advantage plans aren't totally free.

Are there free Medicare supplement plans?

You might have been searching for Medicare Advantage plans available in your zip code and found a plan with a $0 monthly premium. This plan may appear to be “free” in the way that you don’t have to pay an additional monthly amount to be covered by the plan. You generally still have to pay your Medicare Part B premium, however.

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

Which is the best Medicare supplement?

Medicare Supplement Plan G is identical to Plan F except you pay the Part B deductible once per year on Plan G. It’s definitely one of the best Medicare supplement Plans. Whereas Plan F pays that amount for you (with the extra money you give them in the higher monthly premium for Plan F).

What Medicare benefits are free?

- These benefits appear to be more common in health maintenance organization (HMO) plans . ...

- The plan likely will require prior approval or authorization. ...

- There are limits on these benefits. ...

- And, most important, the plans we researched require members to select only one benefit per calendar year.

How are Medicare Supplement plans funded?

The plans receive some funding through monthly plan premiums, but most of the money comes from Medicare. The private insurance companies that offer the plans receive a payment each month from Medicare. This covers the costs of Medicare parts A and B for each beneficiary.

What are $0 premium plans?

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don't pay anything to the insurance company each month for your coverage. That's in comparison with the average Medicare Advantage premium of $23/month in 2020.

Does Medicare Supplement go by income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the cost of supplemental insurance for Medicare?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

Why are Medigap policies so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Do Medicare Supplement premiums increase with age?

The way they set the price affects how much you pay now and in the future. Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is free Medicare Advantage?

Free Medicare Advantage plans are private Medicare insurance plans that offer a $0 monthly premium. While these plans are advertised as free, you’ll still have to pay the standard out-of-pocket costs for other premiums, deductibles, and copayments. If you qualify for Medicare and are enrolled in parts A and B, you can use ...

Why are Medicare Advantage plans free?

Certain Advantage plans are called free because they offer a $0 monthly premium to be enrolled in the plan. This makes zero premium Medicare Advantage plans an attractive offer for those looking to save money on monthly Medicare costs.

What is a yearly deductible for Medicare?

There are two types of yearly deductibles associated with most Medicare Advantage plans: The plan itself may have a yearly deductible, which is the out-of-pocket amount you pay before your insurance pays out. The plan may also charge you a drug deductible as well.

How much is Medicare Part B?

Medicare Part B. Medicare Part B charges a standard monthly premium of $135.50 or more , depending on your gross yearly income. You’ll owe this Part B premium as part of your free Medicare Advantage plan unless it’s covered by the plan.

Does Medicare Advantage charge yearly?

Compared to other Medicare plans, these zero premium Medicare Advantage plans don’t charge a yearly amount to be enrolled in the plan. There’s generally no difference in coverage between a free plan and a paid plan.

Does Medicare Advantage have different copayments?

Type of plan. Medicare Advantage plans can also differ in costs based on their structures. For example, PPO plans charge different copayment amounts based on whether your provider is in-network or out-of-network. These costs may even vary from year to year.

Is Medicare free?

Medicare isn’t free health insurance. There are many different costs that are associated with Medicare coverage. Before you can enroll in a Medicare Advantage plan, you must have Medicare parts and B coverage. Below you’ll find the costs associated with those plans.

How much is Medicare Part B deductible?

The most common monthly Part B premium is $148.50. If you have a high income, you'll pay more. In 2021, the Medicare Part B deductible is $203.

What is the Medicare Part B deductible for 2021?

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

Is Medicare free?

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums. However, it's possible to receive assistance for your Medicare Part A and Part B premiums, copays, ...

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

Does Medicare pay for lunch?

Medicare Pays the Part C Company. There is no such thing as a free lunch, and Medicare Advantage plans are no exception. When you enroll in a Medicare Advantage plan, you must first be enrolled in both Medicare Part A and B. Part B has a monthly premium, and you must continue to pay that to the government while you are enrolled in your Advantage ...

Is Medicare Advantage free?

The bottom line: Medicare Advantage plans are not free, even if they have a $0 premium. They are private Medicare health plans that often have lower premiums, but in exchange for that lower premium, you have to play by the plan’s rules. It requires more effort on your part, and you must be an advocate for yourself.

Does Medicare Advantage work in certain counties?

You must also understand that your Medicare Advantage plan often operates only in certain counties. You must choose providers in the network if you want to have the lowest copays. There are also sometimes restrictions which you have to work with.

Do Medicare Advantage plans require copays?

We assure you, they ’re not. Medicare Advantage plans, on the other hand, require a bit more effort on the part of the client. Yes, a $0 premium or even a $25 or $50 monthly premium is attractive. However, you will pay copays for your services as you go along. Sometimes those copays are more than you anticipate.

Do you have to pay copays for surgery?

Also, even though the premium might be low, you are responsible for paying plan copays and coinsurance, and sometimes those costs are not cheap. You might have a hospital stay for a surgery, and in most cases, you will pay the copay for the hospital AND a separate copay to the surgeon for performing the surgery.

How much is the premium for a 30-39 quarter?

Beneficiaries that only contributed 30-39 quarters; your premium would be $252. Those with fewer than 30 quarters of contributions would pay the full premium, which is $458.

What is the Social Security premium for 2021?

For 2021, the standard monthly premium is $148.50. Premiums reflect income. Therefore, if you’re in a higher income bracket, you will pay more for coverage. Social Security determines Part B premium cost on AGI from the last two years before enrolling.

Is Medicare free in 2021?

Updated on April 5, 2021. Many people believe Medicare is free once they age in at 65. Some people are under the impression their payroll taxes will ultimately pay for Medicare costs in full. This is not entirely true, and for some, this news can be very stressful and worrisome. If Medicare is in your near future, ...

Is Part D free?

As you could imagine, this could get very costly. Part D isn’t free; but, with a policy, some generics are $0. You can think of your Part D plan as a pharmacy card that allows you to get your prescription medications by only paying a co-payment instead of the full retail price.

Do you have to pay Part C premiums?

Yes, some Part C plans don’t require a monthly premium, but that doesn’t make them entirely free. You will still need to pay your Part B premium. These plans are tricky. They may offset the zero-dollar premiums by requiring higher copayments and coinsurance.

Do supplement plans come with a monthly premium?

Each supplement plan will come with a monthly premium; consider this while planning and looking for what option is best for you and your wallet. Proper planning can help you cover the costs of your future. The last thing we want once we retire is to find out were unable to pay for Medicare.

Is Medicare a pay as you go policy?

Once you’re on Medicare, some costs may be a “pay as you go.” Just like many other health insurance policies, Medicare has deductibles and coinsurances. Medicare isn’t free, and Part B only pays 80% of outpatient expenses; so, you’re responsible for the remaining 20%.

Many Medicare Advantage plans have no monthly premium - but what's the tradeoff?

Many people are surprised to learn that some Medicare Advantage medical insurance plans seem to be free. These plans aren’t actually free, but come close enough for many: they have no monthly premiums. And, there isn’t some secret catch here, these plans truly have a $0 premium.

What Is Medicare Advantage?

Before getting into the details, it’s important to understand what Medicare Advantage is. Medicare Advantage plans, also known as MA plans or Medicare Part C plans, are health insurance plans that are offered by private insurance companies, but available only to Medicare beneficiaries.

Part C Eligibility

Eligibility for Medicare Advantage is the same as for Original Medicare. If you already receive Social Security benefits, and are turning 65, you will be able to enroll in a Part C plan. If you have End-Stage Renal Disease (ESRD) you will be able to enroll in Medicare Advantage during your Open Enrollment Period.

How Is Medicare Advantage Priced?

Unlike Original Medicare, Medicare Advantage can vary a lot in price. Essentially, Part C plans will vary in price as much as regular insurance plans, although there are some limits on how expensive they may be.

What Plan Options Are There?

More options and flexibility are the main draws of Medicare Advantage for many people. There are many types of plan options available if you’re looking for a Part C plan, and you’ll be familiar with many of these if you’ve had private insurance in the past.

SNP and PFFS Plans

In addition to these two popular plan types, there are two additional ones that you may not be as familiar with. These are PFFS (Private Fee-for-Service) and SNP (Special Needs Plan).

So, How Are Some Plans Free?

As you can see, Medicare Advantage plans mostly function as private health insurance plans. If you’ve had private health insurance in the past, you know it’s far from free. So, how can it be that some Medicare Advantage plans are free?

Understanding Your Medicare Costs: Can Medicare Advantage Plans Be Free

While Medicare is designed to make health care more affordable, you must still pay out-of-pocket costs including monthly premiums, deductibles and co-pays. These costs can add up quickly, leading some people to opt for Medicare Advantage Part C plans without monthly premiums. On the surface, these private insurance plans seem to be free.

Why Are Some Medicare Advantage Plans Free

Why are some Medicare Advantage plans free? And are they actually free? Our Medicare plan review gives you the full scoop on $0 premium Medicare Advantage plans and whether one might be a good deal for you.

Medicare Advantage Open Enrollment Period

If you decide that you are not happy with your MA plan, you have a few options.

Can A Medicare Advantage Plan Be Free

In some respects, yes. There are Medicare Advantage plans available that have premiums that are $0. However, it is important to know that it does not mean that all of your care is free. You may not have a plan premium to pay, but you will still have to pay your Medicare Part B premium.

Why Consider A Medicare Advantage Plan

Medicare Advantage plans may offer lower out-of-pocket expenses than Original Medicare. This is because they set a limit on what you must pay out of pocket each year for covered prescription medications.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.