How do providers bill Medicare?

Payment for Medicare-covered services is based on the Medicare Physicians' Fee Schedule, not the amount a provider chooses to bill for the service. Participating providers receive 100 percent of the Medicare Allowed Amount directly from Medicare.

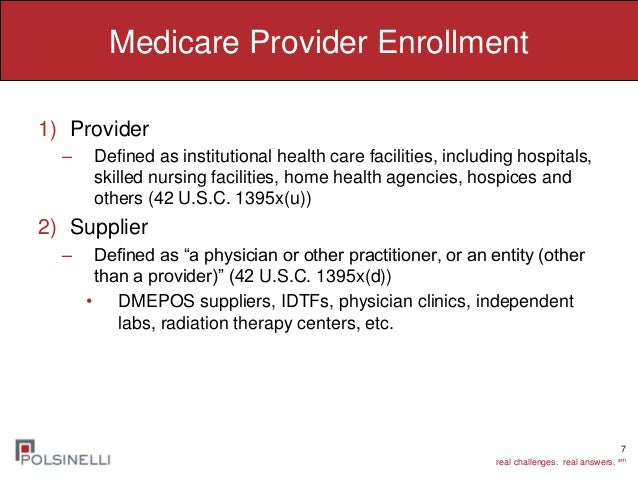

What is a Medicare provider?

A Medicare provider is a physician, health care facility or agency that accepts Medicare insurance. Providers earn certification after passing inspection by a state government agency. Make sure your doctor or health care provider is approved by Medicare before accepting services.

What is a Medicare Part B provider?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers. medically necessary.

What is an 855I Medicare form?

CMS 855I. Form Title. Medicare Enrollment Application - Physicians and Non-Physician Practitioners.

How long does it take to get a Medicare provider number?

Most Medicare provider number applications are taking up to 12 calendar days to process from the date we get your application. Some applications may take longer if they need to be assessed by the Department of Health.Jan 25, 2022

What are provider types?

Provider types include individuals, facilities, and vendors. The provider's specialty is a value indicating what field of medicine a provider has additional education in to make him/her a specialist in a certain field.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare Part B pay 80 percent?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

How do I enroll in Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

What is the difference between 855I and 855R?

CMS-855R: Individuals reassigning (entire application). CMS-855I: For employed physician assistants (sections 1, 2, 3, 13, and 15). CMS-855R: Individuals reassigning (entire application).

Where do I send my CMS 588 form?

Submit the most current CMS-588 EFT Form....CMS-588 EFT Form Instructions and Helpful Hints.Regular MailOvernight MailWPS Government Health Administrators Provider Enrollment P.O Box 8248 Madison, WI 53708-8248WPS Government Health Administrators Provider Enrollment 1717 W. Broadway Madison, WI 53713Feb 4, 2016

How do I fill out Form 855I?

2:0013:56How to Complete the CMS 855I Form to Enroll Individual Reassigning All ...YouTubeStart of suggested clipEnd of suggested clipOnce you have selected your line of business in-state. And accepted the a test station. Click on theMoreOnce you have selected your line of business in-state. And accepted the a test station. Click on the enrollment. Megaton. Then select enrollment forms and finally click on the CMS. 855.

What is Medicare enrollment?

The Medicare Enrollment Application Eligible Ordering, Certifying, and Prescribing Physicians and Other Eligible Professionals (Physicians, including dentists and other eligible NPPs), use to enroll to order items or certify Medicare patient services. This includes those physicians and other eligible NPPs who don't and won't send furnished patient services claims to a MAC.

How to change Medicare enrollment after getting an NPI?

Before applying, be sure you have the necessary enrollment information. Complete the actions using PECOS or the paper enrollment form.

What is a TIN number?

Tax Identification Number (TIN) of the provider or supplier organization. Federal, state, and local (city or county) business and professional licenses, certificates, and registrations specifically required to operate as a health care facility. A Medicare-imposed revocation of Medicare billing privileges.

How much is the Medicare application fee for 2021?

Application Fee Amount. The enrollment application fee sent January 1, 2021, through December 31, 2021, is $599. For more information, refer to the Medicare Application Fee webpage. How to Pay the Application Fee ⤵. Whether you apply for Medicare enrollment online or use the paper application, you must pay the application fee online:

What is Medicare revocation?

A Medicare-imposed revocation of Medicare billing privileges. A suspension, termination, or revocation of a license to provide health care by a state licensing authority or the Medicaid Program. A conviction of a federal or state felony within the 10 years preceding enrollment, revalidation, or re-enrollment.

How long does it take to become a Medicare provider?

You’ve 90 days after your initial enrollment approval letter is sent to decide if you want to be a participating provider or supplier.

Does Medicare require EFT?

If enrolling in Medicare, revalidating, or making certain changes to their enrollment, CMS requires E FT. The most efficient way to enroll in EFT is to complete the PECOS EFT information section. When submitting a PECOS web application:

What is the penalty for not enrolling in Medicare Part B?

The penalty you accumulate for not enrolling in Medicare Part B during your IEP is 10% of the national average premium for each year that you go without Part B. For example, if you wait to get Medicare Part B until you retire at 70 years old, you will have a 50% penalty added onto your monthly premium for Part B.

What is the worst thing about Medicare?

The worst thing about Medicare’s penalties is that they last the entire time you are enrolled in Medicare. So, you could be paying this penalty for the rest of your life. Enrolling on time during your IEP avoids both unnecessary medical expenses and unnecessary late penalties.

How long does an IEP last?

Your IEP starts three months prior to the month of your 65 th birthday, lasts during your birthday month, and then ends three months after your 65 th birthday month. In total, your initial enrollment period lasts for 7 months. The penalty you accumulate for not enrolling in Medicare Part B during your IEP is 10% of the national average premium ...

What is open enrollment in Medicare?

What is Medicare open enrollment? Open enrollment is the health care user’s chance to evaluate the plan they have, take a look at what’s on the market and update their coverage for the coming year. Open enrollment is for consumers who already have Original Medicare or Medicare Advantage.

What is Medicare Advantage?

Medicare Advantage Plans usually offer coverage for things that aren’t included under Original Medicare, such as dental, vision, hearing and wellness programs. With a Medicare Advantage Plan, you must use health care providers that are in the plan’s network, and you may need a referral to see a specialist.

What are the different types of Medicare Advantage plans?

There are five different types of Medicare Advantage Plans: 1 Health Maintenance Organization, or HMO, plans: This kind of plan requires you to see an in-network provider unless it’s an emergency situation. Most require you to get a referral to see a specialist. 2 Preferred Provider Organization, or PPO, plans: This kind of plan allows you to see both in-network and out-of-network health care providers, although it typically is more expensive to go out of network. 3 Private Fee-for-Service, or PFFS, plans: This kind of plan allows you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you, and you may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more. 4 Special Needs Plans, or SNPs: This kind of plan provides benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. It also provides benefits to people with a limited income. 5 Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

Does Medicare have a limit on out of pocket expenses?

Under Original Medicare, there is no limit on your out-of-pocket costs each year. With a Medicare Advantage Plan, once you spend a certain amount, the plan will cover 100% of the costs for the rest of the year.

What is MSA insurance?

Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs. Choosing between Medicare Advantage Plans will require you to understand your health care needs and think about what each type of plan offers.

What is a special needs plan?

Special Needs Plans, or SNPs: This kind of plan provides benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. It also provides benefits to people with a limited income.

Is Medicare Part A or B?

Comparing Original Medicare and Medicare Advantage. If you have an Original Medicare plan — you’re enrolled in Medicare Part A and Medicare Part B — open enrollment is the time when you might consider switching to a Medicare Advantage Plan. For some people, purchasing a Medicare Advantage Plan feels simpler.

What is Medicare Part B?

Medicare Part B is medical insurance and provides coverage for outpatient appointments and durable medical equipment. Part B is optional, but is required for anyone wanting to enroll in Medicare Part C, Part D or Medicare Supplement Insurance. Part A and Part B are known together as “Original ...

What are the different types of Medicare?

The basics of each type of Medicare plan is as follows: 1 Medicare Part A provides coverage for inpatient hospital stays. Every Medicare beneficiary will typically have Part A. 2 Medicare Part B is medical insurance and provides coverage for outpatient appointments and durable medical equipment. Part B is optional, but is required for anyone wanting to enroll in Medicare Part C, Part D or Medicare Supplement Insurance.#N#Part A and Part B are known together as “Original Medicare.” 3 Medicare Part C, also known as Medicare Advantage, provides all the same benefits as Medicare Part A and Part B combined into a single plan sold by a private insurance company. A Medicare Advantage plan replaces your Original Medicare coverage, although beneficiaries remain technically enrolled in Part A and Part B and continue to pay any required Original Medicare premiums.#N#Most Medicare Advantage plans offer additional benefits not covered by Original Medicare, such as dental, vision and prescription drug coverage. 4 Medicare Part D provides coverage for prescription medications, which is something not typically covered by Original Medicare. Part D beneficiaries must be enrolled in both Medicare Part A and Part B. 5 Medicare Supplement Insurance, also called Medigap, provides coverage for some of the out-of-pocket expenses faced by Original Medicare beneficiaries, such as Medicare deductibles and coinsurance or copayments.#N#There are 10 Medigap plans from which to choose (in most states), and beneficiaries must first be enrolled in both Part A and Part B.

When to review Medicare coverage?

One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period , or AEP. The Medicare AEP lasts from October 15 to December 7 every year. During this time, Medicare beneficiaries may do any of the following: Change from Original Medicare to a Medicare Advantage plan. Change from Medicare Advantage back ...

Is Medicare Part A and Part B the same?

Part A and Part B are known together as “Original Medicare.”. Medicare Part C, also known as Medicare Advantage, provides all the same benefits as Medicare Part A and Part B combined into a single plan sold by a private insurance company.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

How much does Medicare Part B cost?

As of 2018, that premium is $134 per month, and it generally comes right out of your social security check.

What is Medicare Advantage?

In case you’re new to Medicare, Medicare Advantage is an alternative option for health coverage. Medicare Advantage, or MA, is offered by private insurance companies, and it’s approved by Medicare. MA plans cover everything traditional Medicare covers as well as emergency and urgent care. These plans often include extra perks, like dental coverage, ...

What are the different types of Medicare Advantage plans?

Medical Savings Accounts – Another Type of Medicare Advantage 1 Health Maintenance Organization (HMO) plans: In most HMOs, you can only go to doctors in your network (except in an urgent or emergency situation). 2 Preferred Provider Organization (PPO) plans: In a PPO, you pay less if you use doctors in your network. You usually pay more if you go outside of your network. 3 Private Fee-for-Service (PFFS) plans: PFFS plans are similar to Original Medicare in that you can generally go to any doctor as long as they accept the plan’s payment terms. The plan determines how much it will pay and how much you must pay when you get care. 4 Special Needs Plans (SNPs): SNPs provide specialized health care for specific groups of people, like those who have both Medicare and Medicaid, live in a nursing home, or have certain chronic medical conditions. 5 HMO Point-of-Service (HMO/POS) plans: HMO plans may allow you to get some services out-of-network for a higher copayment or coinsurance. 6 Medical Savings Account (MSA) plans: These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan.

How many types of Medicare Advantage are there?

When we talk about Medicare Advantage, we often refer to these plans as a single entity, but in reality, there are actually 6 different types of MA plans. Health Maintenance Organization (HMO) plans: In most HMOs, you can only go to doctors in your network (except in an urgent or emergency situation). Preferred Provider Organization (PPO) ...

What is an HMO plan?

HMO Point-of-Service (HMO/POS) plans: HMO plans may allow you to get some services out-of-network for a higher copayment or coinsurance. Medical Savings Account (MSA) plans: These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible).

Can you have both Medicare and Medicaid?

You rarely go to the doctor and have enough money saved up to cover any very unexpected emergencies. You’re dual eligible, meaning you’re eligible for both Medicare and Medicaid.

Does Medicare pay monthly premiums?

So, Medicare (run by the government) pays a monthly premium to the insurance carrier on your behalf, and that amount can range depending on the county.

How long do you have to sign up for Medicare?

A person then has 8 months to sign up for Medicare, with or without COBRA. People who wait longer pay a penalty related to the time they have Part B. A person with a Health Savings Account (HSA) may want to defer enrolling in Medicare, as contributions to the HSA stops after they enroll.

When does Medicare start?

A person is first eligible for original Medicare in their initial enrollment period (IEP), which begins 3 months before the month they turn 65, includes their birthday month and ends 3 months after the month they turn 65. People who wait to enroll in Medicare after the IEP and do not qualify to defer may pay a lifetime late enrollment penalty.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is the Medicare premium for 2021?

The standard Medicare Part B monthly premium in 2021 is $148.50. The premium is paid to Medicare unless a person gets certain benefits, in which case the premiums may be automatically deducted. The benefits include: There are other costs to original Medicare, including deductibles, coinsurance, and copays.

How much is the penalty for late enrollment in Medicare?

A person who delays enrolling in Medicare Part B may also pay a 10% penalty if they do not qualify for a SEP. The late enrollment premium lasts for as long as a person has Medicare Part B. The penalty increases 10% for every full 12-month period a person delays enrolling.

What is Part B coinsurance?

Part B coinsurance is 20% of the medically approved charges, and Medicare pays the remaining 80%. A person can also get a Medicare supplement insurance policy called Medigap. The policies help cover additional costs such as copays, deductibles, and coinsurance and are offered by private companies.

What is the penalty for not enrolling in Part A?

If a person has to buy Part A, they may have to pay a 10% late penalty if they do not enroll during their IEP. The penalty is calculated as a percentage of the premium and is generally twice the number of years a person delayed enrolling.