There is no mention of Medicare spending cuts in the GOP tax cut bill. However, experts say the reductions in tax revenues under the bill would trigger a 2010 law that requires spending cuts in some federal programs if Congress passes legislation that creates a deficit.

Full Answer

What does the tax cuts and Jobs Act mean for Medicare?

Editor’s Note: This article was originally published on April 09, 2018. While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals.

How would a payroll tax cut affect social security and Medicare?

Full details on how the Trump administration could implement a payroll tax cut are still not known. Particularly, it’s unclear how that cut would affect levies for Social Security or Medicare or both. Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare.

How did tax reform affect Medicare tax treatment?

While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals. The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform.

What does the tax cut bill mean for You?

One of the key things the tax cut bill is keeping is the medical expense deduction. This provision allows families to deduct extraordinary medical expenses that eat up more than 10 percent of their income. The original House bill proposed eliminating this deduction.

How much did the employee contribute to Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Why do employees pay Medicare tax?

Find Cheap Medicare Plans in Your Area Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.

Do employers have to pay the additional Medicare tax?

Employer Responsibilities An employer must begin withholding Additional Medicare Tax in the pay period in which the wages or railroad retirement (RRTA) compensation paid to an employee for the year exceeds $200,000. The employer then continues to withhold it each pay period until the end of the calendar year.

How do employers pay Medicare tax?

Employers must withhold FICA taxes from employees' wages, pay employer FICA taxes and report both the employee and employer shares to the IRS. For the 2019 tax year, FICA tax rates are 12.4% for social security, 2.9% for Medicare and a 0.9% Medicare surtax on highly paid employees.

Can I opt out of paying Medicare tax?

To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Who pays for Medicare tax?

Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

Who pays additional Medicare tax employer or employee?

employerAn employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee.

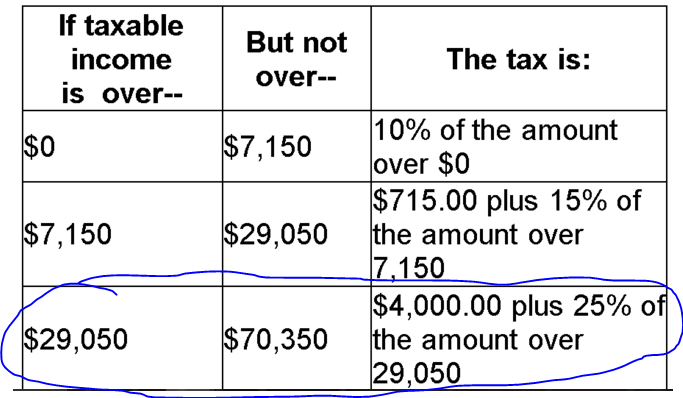

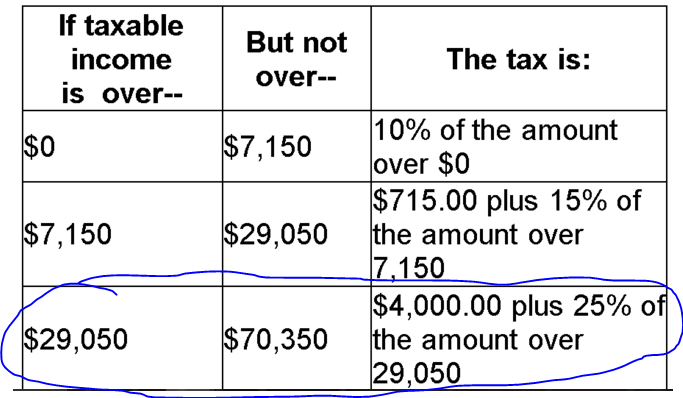

How Medicare tax is calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

Is Medicare included in federal income tax?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

When will Medicare run out of money?

The Medicare Part A trust fund is projected to run out of money in 2026. Meanwhile, the latest estimate projects Social Security’s trust funds will be insolvent in 2035.

Why is payroll tax cut important?

A payroll tax cut is one idea President Donald Trump is considering in response to the negative effects of coronavirus on the U.S. economy. Experts say such a move would not necessarily be a magic bullet. One reason why: It could impair funding to Medicare and Social Security, which rely on payroll taxes for funding and are already facing looming ...

How much tax do you pay on Social Security?

Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare. Self-employed individuals, meanwhile, make the full contributions on their own, 12.4% for Social Security and 2.9% for Medicare. In addition, if you earn over $200,000 individually, or $250,000 if you’re married and file jointly, ...

When was the last time there was a payroll tax cut?

That could be accomplished as it was the last time there was a payroll tax cut, in 2011, when money was moved from the general fund to the trust funds. However, halting payroll taxes for up to a year, which has been mentioned as a potential strategy, would be very expensive.

Will people who lose their jobs get a payroll tax cut?

Those who lose their jobs because of the negative impacts of the coronavirus will not benefit from a payroll tax cut. “They’re the ones who are going to have the biggest drops in income, and yet they’re not going to get anything from a payroll tax holiday,” Greszler said.

Does the pullback in consumer spending affect Social Security?

Plus, because the pullback in consumer spending is related to health concerns, not financial worries, it might not result in increased spending, experts say.

Is payroll tax regressive?

The other problem is that payroll taxes are regressive, so it’s a bigger chunk for people with low or moderate incomes than high income workers. And big earners are unlikely to spend that extra cash. “We know when high -income people get a tax cut, they don’t spend as much as low-income people do,” Gleckman said.

How is Medicare funded?

Medicare is funded by a payroll tax, premiums and surtaxes from beneficiaries, and general revenue.

What does Medicare Part B cover?

Medicare Part B helps cover: services from doctors and other health care providers; outpatient care; home health care; durable medical equipment; and some preventive services. Part B is optional and may be deferred if the beneficiary or their spouse is still working and has health coverage through their employer.

What is the TCJA repeal?

While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals. The takeaway here is that there were no changes to ...

Who does the Social Security Administration provide health insurance to?

It provides health insurance for Americans aged 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration.

Did Medicare change tax form?

The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform. While there are no changes to Medicare rules because of tax form, understanding how Medicare works can be helpful in understanding your overall financial picture.

What percentage of medical expenses are deducted in the tax cut?

This provision allows families to deduct extraordinary medical expenses that eat up more than 10 percent of their income. The original House bill proposed eliminating this deduction.

How much will Medicare be reduced?

It’s estimated that would create an annual reduction of $25 billion in Medicare spending, starting next year.

Why is the ACA mandate necessary?

Experts have told Healthline that the mandate is necessary because it forces healthier consumers into the insurance pool overseen by ACA marketplaces.

What are the provisions that will have the biggest impact on the healthcare industry?

Without a doubt, the provisions that will have the biggest impact on the healthcare industry are the repeal of the individual mandate and the potential cuts in Medicare spending. The individual mandate is a key component of the Affordable Care Act (ACA). It requires everyone to have health insurance.

What is the deduction for 2017?

During those tax years, the deduction will kick in at 7.5 percent of a household’s annual income. After that, it returns to the 10 percent threshold.

Why is the American Hospital Association opposing the tax waiver?

The bill keeps the tax waiver for reduced tuition for graduate students. Medical schools had pushed to preserve this break because it helps make graduate medical studies more affordable.

What programs are exempt from the 2010 tax cuts?

Programs such as Social Security and unemployment benefits are exempt from the cuts.

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status.

Wage Base Limits

Only the social security tax has a wage base limit. The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

How much will Medicare be cut in 2018?

The Congressional Budget Office (CBO) projects that the enormous cost of the tax bill would prompt immediate, automatic, and ongoing spending cuts to Medicare – $25 billion in 2018 alone. That is not the only worrisome news.

How many Americans are under the Affordable Care Act?

As the House and Senate rush to make changes to their versions of the bill, it keeps getting worse and worse, posing an immediate threat to the Medicare program and health care coverage for 13 million Americans under the Affordable Care Act (ACA).

What is Medicare Rights Center?

The Medicare Rights Center ( www.medicarerights.org) is a national, nonprofit consumer service organization that works to ensure access to affordable health care for older adults and people with disabilities through counseling and advocacy, educational programs, and public policy initiatives.

Is Congress pushing for a tax cut?

Congress is engaged in a rushed effort to push through a massive tax cut for corporations and the wealthy, presenting a clear and present danger to health coverage, other vital programs, and families throughout the country.

How does Medicare reimbursement work?

A Medicare premium reimbursement is a fantastic way for active employees to get refunds of their premiums. Often, premiums may cost less than group insurance at your workplace. If you prefer Medicare to your group coverage, you may be eligible to get premium reimbursements.

What does MEC mean for Medicare?

This type of arrangement can help reimburse employees for their Medicare premiums. If an employee holds minimum essential coverage (MEC), they can get assistance in paying for virtually all Medicare costs, including Medigap premiums.

What is a health reimbursement arrangement?

A Health Reimbursement Arrangement is a system covered by Section 105. This arrangement allows your employer to reimburse you for your premiums. Some HRAs at employers that provide group coverage require that your employer’s payment plan ties in with the group health plan. Contact a human resources representative at your organization ...

Can my employer pay my Medicare premiums in 2021?

Updated on July 13, 2021. While your employer can’t pay your Medicare premiums in the true sense, you’ll be glad to know that they may reimburse you for your premium costs! To compensate you, your employer will need to create a Section 105 Medical Reimbursement Plan. We’re here to help you understand your options for reimbursement ...

Is a Section 105 reimbursement taxable?

Some Section 105 plans may only permit refunds on healthcare costs and premiums. This compensation isn’t taxable. If the Section 105 plan reimburses with cash for any remaining benefits, both the money and reimbursements are taxable.answer.

Does Part B count as MEC?

To take part in a QSEHRA, you must have minimum essential coverage (MEC), which means enrolling in Part A. Enrolling in only Part B doesn’t count as MEC, but enrolling in Part C does because it includes Part A benefits. If you have MEC, a QSEHRA will reimburse almost all Medicare premiums; including Part D, Medigap, and Advantage.

Who is responsible for paying your insurance premiums?

As a beneficiary, YOU are responsible for paying your premiums. Employers can reimburse any Part B and Part D premiums for employees who are actively working. This requires the company’s payment plan to integrate with the group insurance plan.