How can we fix Medicare?

1. Raise Medicare taxes The easiest, and probably least liked, method of fixing Medicare would be to dramatically... 2. Institute means-testing Another popular solution would be to institute means testing. Image source: Flickr user Day... 3. Use the federal government's might to negotiate A third ...

How can I get help Paying my Medicare costs?

Those with limited income can get help paying costs for original Medicare and Part D. Medicare savings programs are available to help pay premiums, deductibles, coinsurance, and other costs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections.

How much does Medicare Part a cost?

Your costs for original Medicare can vary depending on your income and circumstances. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits.

Is Medicare Part A Really Free?

Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet. So, if you’re 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

How can Medicare problems be solved?

Call 1-800-MEDICARE (1-800-633-4227) You can call 1-800-MEDICARE and speak with a representative to ask questions about Medicare or get help resolving problems with Medicare. We made a test call to this number and were greeted by a polite Medicare representative after being on hold for about 90 seconds.

How does the government pay for Medicare?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7). Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue).

How does Medicare get reimbursed?

Since Medicare Advantage is a private plan, you never file for reimbursement from Medicare for any outstanding amount. You will file a claim with the private insurance company to reimburse you if you have been billed directly for covered expenses.

Where does the money for Medicare go?

How is it funded? Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

Who paid for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare have to be repaid?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

Why is Medicare not paying on claims?

If the claim is denied because the medical service/procedure was “not medically necessary,” there were “too many or too frequent” services or treatments, or due to a local coverage determination, the beneficiary/caregiver may want to file an appeal of the denial decision. Appeal the denial of payment.

Do you pay Medicare back?

Medicare makes this conditional payment so you will not have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare when a settlement, judgment, award, or other payment is made.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Is Medicare about to collapse?

At its current pace, Medicare will go bankrupt in 2026 (the same as last year's projection) and the Social Security Trust Funds for old-aged benefits and disability benefits will become exhausted by 2034.

Can Medicare run out?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

How much is Medicare taxed?

Medicare is currently taken out as part of your payroll taxes along with Social Security at a rate of 2.9% of your modified adjusted gross income. Like Social Security, this tax is typically split down the middle between you and your employer, with each side paying 1.45%.

How much did Medicare spend in 2014?

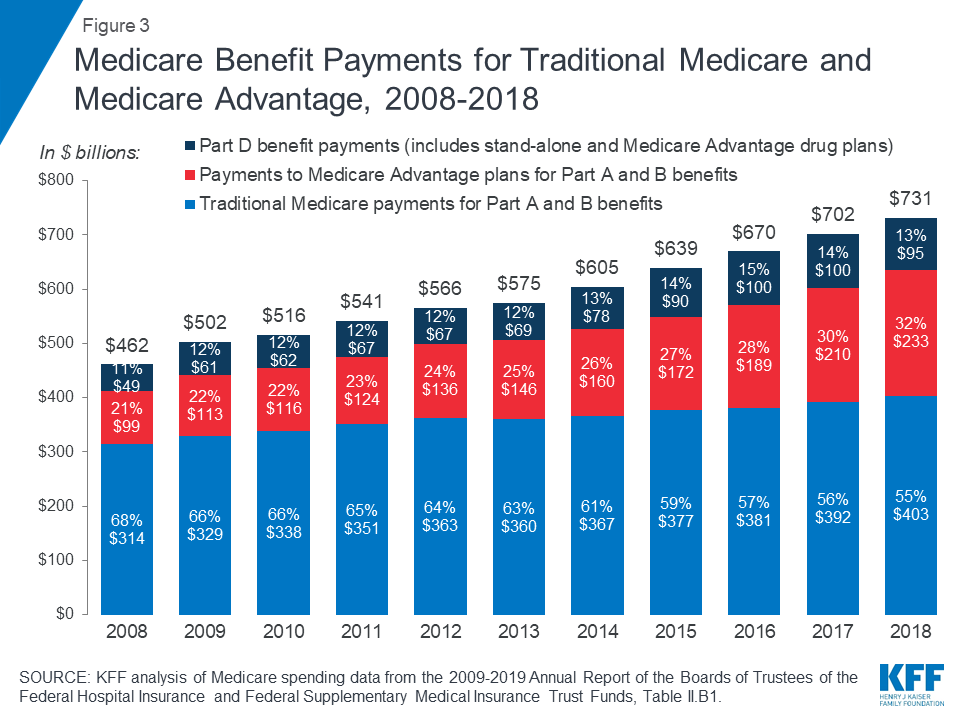

First, Medicare Part D (drug plans) spending was "only" $78 billion in 2014, meaning even with staunch negotiations the program might only save between 2% and 5% of its total annual expenditures, by my estimate. That's not going to give the Medicare program much of an extension beyond 2030. The other issue is simply innovation.

How much Medicare did the average person pay in 2010?

As of 2010 (but based on 2012 dollars), the average man and woman were paying $61,000 in Medicare taxes over their lifetimes. Yet, men and women were receiving $180,000 and $207,000, respectively, worth of lifetime benefits (women have a longer life expectancy than men). This gap between taxes paid and benefits received is only expected ...

What is Bernie Sanders' plan?

Democratic Party candidate Bernie Sanders has suggested creating a universal health plan for Americans of all ages, which would require a 2.2% healthcare premium tax on all individuals and a 6.2% tax on employers. 2. Institute means-testing. Another popular solution would be to institute means testing.

Is it tougher for Medicare to police claims?

The problem is in convincing lawmakers that a model beyond the institutional hospital setting should be reimbursed. It may also be tougher for Medicare officials to police claims if they aren't made within the traditional settings of a hospital.

Is there a cap on Medicare?

There is no earnings cap on the Medicare tax, so raising the earnings cap isn't an option here . If taxes are going to rise, they're likely going to rise for everyone. While increasing taxes could indeed stem a cash shortfall, it also could strain the pocketbooks of tens of millions of working Americans.

Is Social Security going to burn through?

Image source: National Cancer Institute. For years, Social Security has been the entitlement program that's been highlighted as being in dire straits. Expected to burn through its cash reserves by 2035, and providing income to more than 40 million retirees each month, seniors and pre-retirees consider a fix to Social Security to be ...

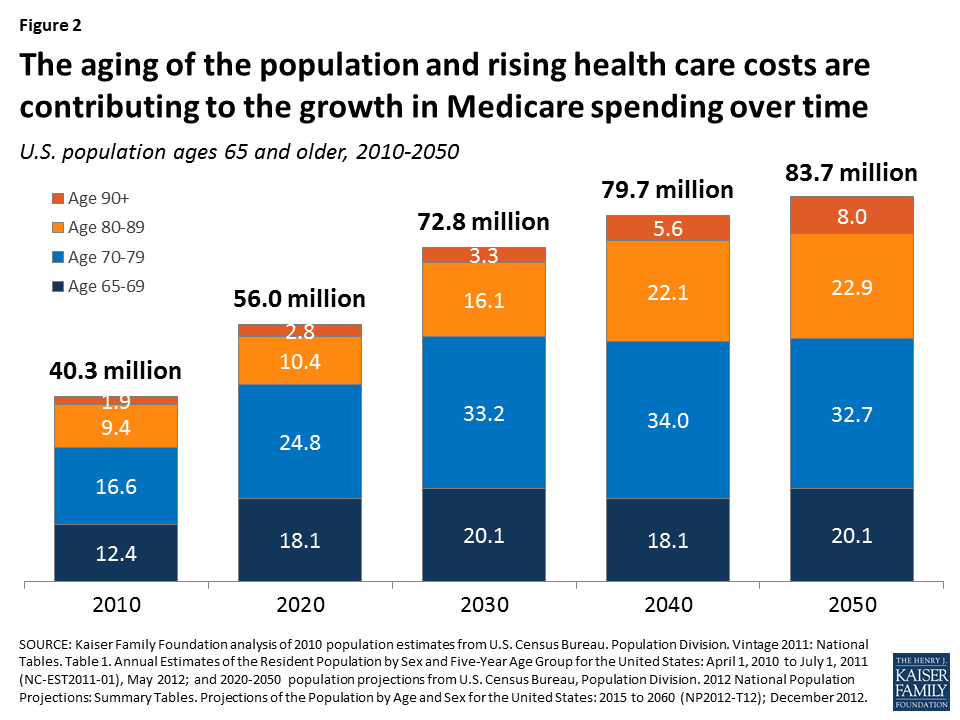

How many people are covered by Medicare?

In particular, Medicare — our socialized health-insurance scheme for the elderly and disabled — covers 55 million people. That's 17% of the American population, or roughly the population of England. The program accounts for 15% of the federal budget and 3% of our economy.

Why is Medicare reform important?

There are two broad reasons for reforming Medicare. The first is to reduce costs in the program. This saves money for taxpayers and extends the program's solvency. Typically, this points to changes in benefit structures and payment schedules or to increases in revenue. The second reason for reform is to deliver better value to beneficiaries. Doing so might involve some benefit changes, but it also can include the various experiments being conducted to incentivize higher-value care.

Why was the retrospective reimbursement system a problem?

The program's retrospective reimbursement system (which essentially amounted to asking hospitals after the fact what their costs were) was a particular problem since it allowed hospitals to raise costs at the taxpayer's expense without much pushback.

Is Medicare a premium support system?

Implementing a premium-support system in Medicare would be challenging in practice, since it would require some major design and funding decisions that would affect costs to taxpayers and beneficiaries. But the overall approach is theoretically simple.

When did socialized health insurance start?

The Progressive Party platform in 1912 endorsed socialized health insurance, and the Bull Moose himself lobbied for sickness benefits as a state program.

When will Medicare's trust fund be exhausted?

According to the 2016 annual report of the Medicare trustees, Medicare's Hospital Insurance (HI) trust fund, used to pay for inpatient expenditures, will exhaust its funds by 2028.

Do enrollees pay premiums?

Enrollees, however, pay a premium that factors in the difference between the plan's bid and the nationwide average bid. While enrollees in MA plans pay a higher premium for plans that bid above the benchmark, that is the only instance where enrollees are held accountable for selecting higher-cost plans.

How much money does Washington spend on Medicare?

According to the Congressional Budget Office, the national debt has roughly tripled since 2007 and is projected to rise such that, by the end of the coming decade, Washington will spend nearly $1 trillion per year just to pay the interest on our bills. Medicare itself has been effectively insolvent for several years.

When did Medicare Part A become a condition of Social Security?

In 1993, an administrative ruling by the Clinton administration—one that did not even go through notice-and-comment rulemaking—forced all individuals to enroll in Medicare Part A as a condition of applying for Social Security. This policy makes little sense, for several reasons.

How long does it take for Medicare to become insolvent?

But now even those gimmicks have run their course. Estimates suggest the Medicare trust fund will become officially insolvent within five years —and could face a cash flow crunch even sooner.

What does it mean when seniors pay to Medigap?

Every dollar seniors pay to a Medigap insurer allows an organization like AARP to take their share of the cut (a.k.a. “ kickbacks ”) in the process. Fewer dollars running through insurance companies means less overhead and profits for the insurers—and more dollars back in seniors’ pockets.

When will seniors' per capita income increase?

Projections from the Kaiser Family Foundation demonstrate the rationale for expanding means testing further. According to Kaiser, between 2016 and 2035, per capita income for seniors will rise the greatest for those in the top quartile of income.

Does Medicare have a cap on out of pocket costs?

Because the traditional Medicare benefits provided by law do not include a cap on out-of-pocket costs, roughly nine in 10 seniors have some type of “insurance” to provide such a catastrophic cap. Otherwise they could face medical bills totaling tens of thousands of dollars (or more) in the case of a medical emergency.

Can Republicans reform Medicare?

To be clear: Republicans can—and should—explore more comprehensive Medicare reforms, including a premium support program that would place private plans and traditional Medicare on a level playing field to attract and enroll seniors.

Why don't people sign up for Medicare?

However, Congress failed to address the real problem: Many people don’t enroll in Medicare because they don’t know they are eligible or that they will be penalized for failing to sign up on time. And they don’t know because the government doesn’t tell them.

When will Medicare begin to cover people who don't sign up?

First, it eliminated long coverage gaps by requiring Medicare to begin coverage one month after enrollment, starting in 2023. It also expanded Medicare’s authority to grant relief to people who don’t sign up in time due to natural disasters such as hurricanes.

What is the Medicare Advantage plan for 65?

The basic rule is this: When you turn 65, you are eligible to enroll in Medicare Part A hospital insurance, Part B insurance for doctor visits and other benefits, Part D drug benefits, or Part C Medicare Advantage managed care. There is no premium for Part A. But if you do not enroll in Part B or Part D just before or after you turn 65, ...

Why are older people delaying Social Security?

But increasingly older adults are delaying Social Security benefits, largely because Congress increased the full benefit age. In 2016, only about 60 percent of 65-year olds were claiming Social Security. If you are not among them, the government tells you nothing about Medicare. And that creates double-trouble.

Is there a penalty for declining health insurance?

There is nothing wrong with imposing a penalty on consumers who decline health insurance, including Medicare. Such a tool can prevent people from gaming the system by waiting to buy insurance until they are sick, which raises premiums for everyone else. But long coverage delays make little sense.

Raise the Eligibility Age

Some Democrats are currently pushing to lower the Medicare eligibility age from 65 to 60, but from a financial perspective, it's the opposite that needs to happen.

Earmark Revenue From an Existing Tax

Policymakers could take an existing tax, the unearned income Medicare contribution tax, also known as the net investment income tax, and use it to fund Medicare directly. The Health Care and Education Reconciliation Act established the tax in 2010 to help pay for the Affordable Care Act, but the money currently goes into a general revenue fund.

Modify Advantage Payments

One way to cut Medicare spending is to lower what the program pays to private Medicare Advantage insurers and medical providers. Medicare Advantage, or Part C, is not separately funded and instead is supported by money from Parts A, B and D.

Negotiate Drug Prices

Under current law, Medicare is prohibited from negotiating drug prices, but this might change if Democrats are able to pass the Build Back Better Act. In the version that the House passed, a provision was included for Medicare to negotiate prices for a small number of high-cost drugs, starting in 2025 for Part D and in 2027 for Part B.

Shift to a Defined Contribution Program

One of the more controversial fixes calls for transforming Medicare into a defined contribution program, similar to the one for federal employee health benefits.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.