Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”)

- Buy Generic Prescriptions. Many common brand-name medications have generic alternatives available, and they are often...

- Order your Medications by Mail and in Advance. Many Medicare Part D prescription drug plans offer medications at a...

- Ask for Drug Manufacturer’s Discounts. Some pharmaceutical...

How does the coverage gap work with Medicare?

The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,020 on covered drugs in 2020 ($4,130 in 2021), you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

Will I enter the coverage gap for my drug plan?

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $3,820 on covered drugs in 2019 ($4,020 in 2020), you're in the coverage gap. This amount may change each year.

How do I get Out of the coverage gap for 2020?

Once you've spent $6,350 out-of-pocket in 2020, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage." It assures you only pay a small Coinsurance amount or Copayment for covered drugs for the rest of the year.

What is the coverage gap in Mrs Anderson's Medicare drug plan?

Mrs. Anderson reaches the coverage gap in her Medicare drug plan. She goes to her pharmacy to fill a prescription for a covered brand-name drug. The price for the drug is $60, and there's a $2 dispensing fee that gets added to the cost, making the total price $62.

Is there a way to avoid the Medicare donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

How do I avoid Medicare gap?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

How do you get out of the donut hole?

How to get out of the donut hole. In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

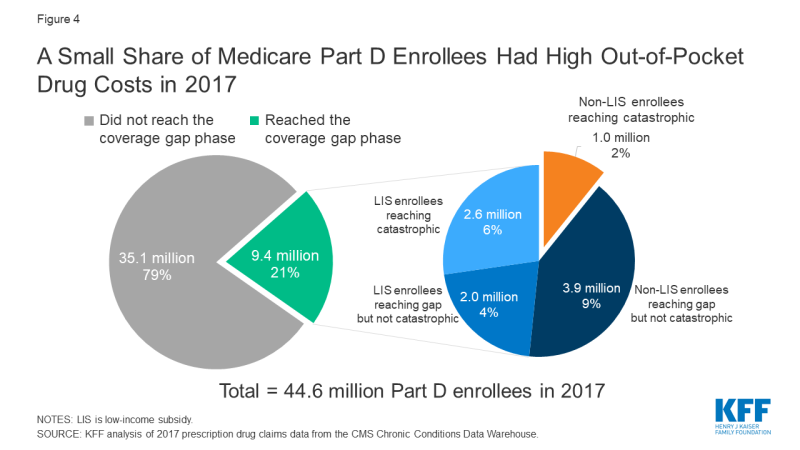

Do all Medicare members reach the coverage gap?

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022, you're in the coverage gap. This amount may change each year.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How much is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What is the Medicare donut hole 2022?

In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

How big is the Medicare donut hole?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What is Silverscript donut hole?

Coverage phases for Medicare Part D After you've reached the initial coverage limit, you move into the coverage gap, also known as the donut hole. Different plans will charge you set copay amounts for your medications during this gap phase.

What is the Medicare Coverage Gap Discount Program?

The Medicare Coverage Gap Discount Program (Discount Program) makes manufacturer discounts available to eligible Medicare beneficiaries receiving applicable, covered Part D drugs, while in the coverage gap.

Do all Medicare Part D plans have a donut hole?

All Medicare Part D plans follow the same drug phases. Every prescription coverage plan involves the gap known as the donut hole. Will I enter the donut hole if I receive Extra Help? Those who get Extra Help pay reduced amounts for their prescriptions throughout the year, so they are unlikely to reach the donut hole.

How long do you stay in the donut hole?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Do Medicare Advantage plans cover the donut hole?

Some people ask: Do Medicare Advantage plans cover the donut hole? If you choose to include Medicare prescription drug coverage in your Medicare Advantage plan, it will still have a donut hole just like a regular Part D plan. Medicare Advantage does not cover any additional Part D costs during the coverage gap.

How long does the donut hole last?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Which helped Medicare subscribers fill the gaps in Medicare coverage?

Supplemental insurance (Medigap): A Medigap policy provides insurance through a private insurance company and helps fill the cost-sharing gaps in Original Medicare, for instance by helping pay for Medicare deductibles, coinsurances, and copayments.

What is the Medicare donut hole for 2022?

$4,430You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What are My Costs in the Coverage Gap?

Once you reach $4,430 in total spending on your covered drugs, you’re responsible for a certain percentage of the costs. When you enter the coverage gap, you’ll pay no more than 25% of the actual drug cost.

What Plans Provide Gap Coverage?

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans aren’t available everywhere and may have a higher premium. Plans are available by location, if you don’t live in the service area, you’re not eligible for that policy.

Is the Medicare Coverage Gap Going Away?

While the coverage gap has closed, it doesn’t mean that it goes away. After the Initial Coverage Period, people with Medicare will pay a higher portion of their drug costs.

Which Plan Covers My Medications at the Lowest Cost?

There is not one specific plan that suits everyone’s needs. Most of the time spouses will find they have different plan needs. Perhaps you have a brand-name medication that fewer plans cover, or maybe there is a plan option that allows you to avoid the donut hole.

Avoiding the Medicare coverage gap starts with finding the right plan

Every year hundreds of thousands of people on Medicare reach the Part D donut hole. Although reaching the Medicare coverage gap can hurt financially, there are things you can do to either avoid or delay the coverage gap.

Do this to avoid the Part D donut hole

1. Compare plans every year, even if you don’t reach the coverage gap there’s no guarantee that your plan will perform the same next year. Part D plans are effective for one year and benefits, costs and covered drugs may change year to year.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

Does a catastrophic plan pay for out of pocket drugs?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits.

What is catastrophic coverage in 2021?

Catastrophic coverage. Once you've spent $6,550 out-of-pocket in 2021, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage.". It assures you only pay a small. An amount you may be required to pay as your share of the cost for services ...

What happens if you spend $6,550 in 2021?

Once you've spent $6,550 out-of-pocket in 2021, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage." It assures you only pay a small Coinsurance percentage or Copayment for covered drugs for the rest of the year.

What is the Medicare Coverage Gap?

The Medicare coverage gap is a hole in Part D prescription plans. During this phase of coverage, the cost of medicine can be higher than during other phases of Part D coverage.

How Does the Medicare Part D Donut Hole Work?

After the deductible, you’ll enter the Initial Coverage phase. During the Initial Coverage phase, you pay copays for your prescriptions until the total cost of your medications reaches the threshold that puts you in the donut hole.

Which Part D Plans Will Save Me the Most Money During the Coverage Gap?

Insurance policies change annually and the best policy for your neighbor isn’t always the best policy for you. Also, comparing your options will give you Peace of Mind.

What is the Donut Hole in Medicare?

The donut hole is the coverage gap in Medicare prescription drug plans. During this period; the beneficiary has a temporary limit on their Part D coverage. This means that after spending a specific amount on a drug plan, you’re responsible for copayments for prescriptions. Then, you’re responsible for costs up to a specific limit.

How Does the Medicare Donut Hole Work?

Prescription drug coverage consists of multiple stages. The first stage starts when the year begins and involves reaching your deductible, which can be up to $480. You are responsible for paying 100% of this cost. Then, you reach the initial coverage stage, when you’re only responsible for copayments.

How Do I Get Out of the Donut Hole?

You’ll get out of the gap when your costs for prescriptions during the gap period reach $7,050. You’re fully responsible for reaching this amount, but your drugs are also discounted while in the donut hole.

Do Medicare Advantage Plans Cover the Donut Hole?

Private insurance companies manage Part C plans, which often include prescription drug benefits. These plans work similarly to standard Part D plans. Thus, they still involve coverage gaps. An Advantage plan might cover some generic medications in the donut hole, but these don’t serve to close the gap faster due to their lower prices.

What is Donut Hole Prescription Assistance?

Ask your doctor if any other medicine on your plan’s formulary would be as effective for your condition as the ones you’re currently using. Using lower-cost drugs, like generics or similar drugs, will substantially lower your costs.

How to Get Help with the Donut Hole

We understand that the donut hole is a confusing topic and we hope we helped you make sense of it. Many people with or without current prescription drug coverage have questions. Luckily, we're not only a Medicare education resource center – we can also help find the best coverage for you.