What is Centers for Medicare and Medicaid Services (CMS)?

Centers for Medicare and Medicaid Services. The Centers for Medicare and Medicaid Services (CMS) provides health coverage to more than 100 million people through Medicare, Medicaid, the Children’s Health Insurance Program, and the Health Insurance Marketplace. The CMS seeks to strengthen and modernize the Nation’s health care system,...

How is Medicare and Medicaid funded?

Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis. Medicare is administered by the Centers for Medicare & Medicaid Services (CMS), a component of the Department of Health and Human Services.

How do I find drug spending information for Medicare?

CMS Drug Spending CMS has released several information products that provide greater transparency on spending for drugs in the Medicare and Medicaid programs. The CMS Drug Spending Dashboards are interactive, web-based tools that provide spending information for drugs in the Medicare Part B and D programs as well as Medicaid.

What percentage of the federal budget goes to Medicaid?

Medicare spending often plays a major role in federal health policy and budget discussions, since it accounts for 21% of national health care spending and 12% of the federal budget. 18 How Does Medicaid Expansion Affect State Budgets?

What is the role of the Centers for Medicare and Medicaid Services in health care?

The Centers for Medicare and Medicaid Services (CMS) is the U.S. federal agency that works with state governments to manage the Medicare program, and administer Medicaid and the Children's Health Insurance program. CMS offers many great resources for researchers who are looking for health data.

How are healthcare organizations reimbursed for Medicare?

Traditional Medicare reimbursements When an individual has traditional Medicare, they will generally never see a bill from a healthcare provider. Instead, the law states that providers must send the claim directly to Medicare. Medicare then reimburses the medical costs directly to the service provider.

How much money does CMS get?

CMS has outlays of approximately $1,236 billion (net of offsetting receipts and payments of the Health Care Trust Funds) in fiscal year (FY) 2021, approximately 18 percent of total Federal outlays.

What is the largest component of healthcare expenditures?

The main categories of personal health care spending include spending on hospital care ($1,082.5 billion or 32.4 percent of total health spending), physician services ($521.7 billion or 15.6 percent), clinical services ($143.2 billion or 4.3 percent), and prescription drugs ($328.6 billion or 9.8 percent).

How do I bill Medicare services?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

How is Medicare reimbursement calculated?

Calculating 95 percent of 115 percent of an amount is equivalent to multiplying the amount by a factor of 1.0925 (or 109.25 percent). Therefore, to calculate the Medicare limiting charge for a physician service for a locality, multiply the fee schedule amount by a factor of 1.0925.

How much does Medicare cost the government?

How Much Does Medicare Cost and What Does It Cover? Medicare accounts for a significant portion of federal spending. In fiscal year 2022, the Medicare program cost $767 billion — about 13 percent of total federal government spending.

How is Medicare Part A funded?

While Part A is funded primarily by payroll taxes, benefits for Part B physician and other outpatient services and Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance, or SMI, trust fund.

What is CMS cost reporting?

The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. CMS maintains the cost report data in the Healthcare Provider Cost Reporting Information System (HCRIS).

What are the main areas of healthcare expenditures?

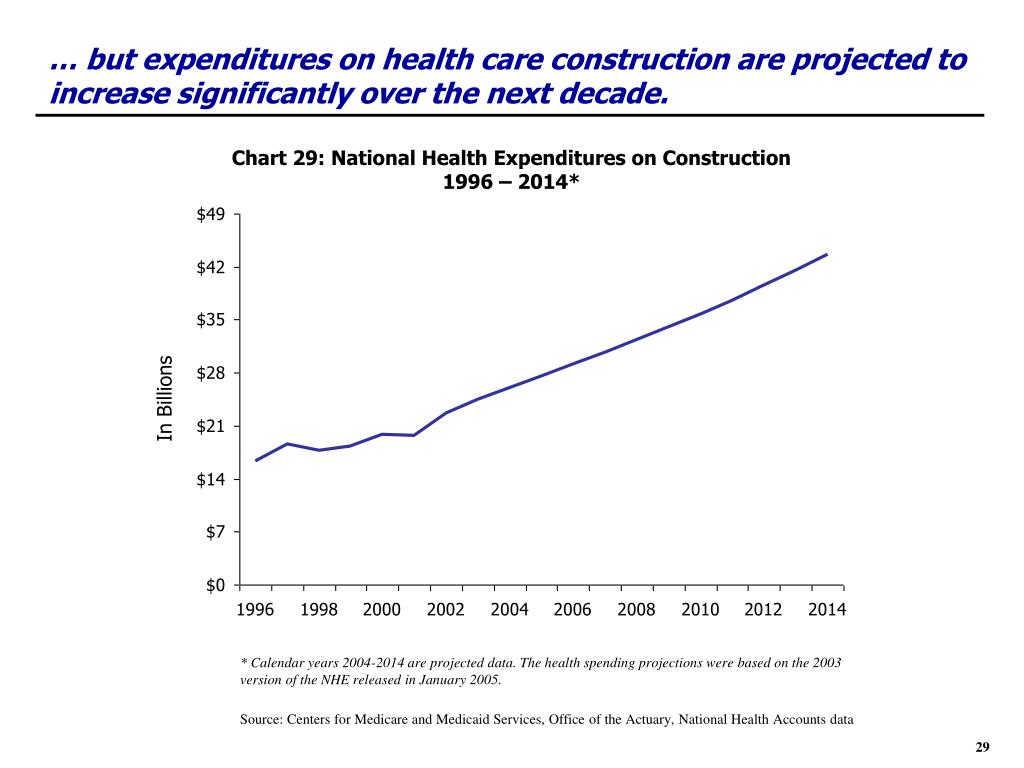

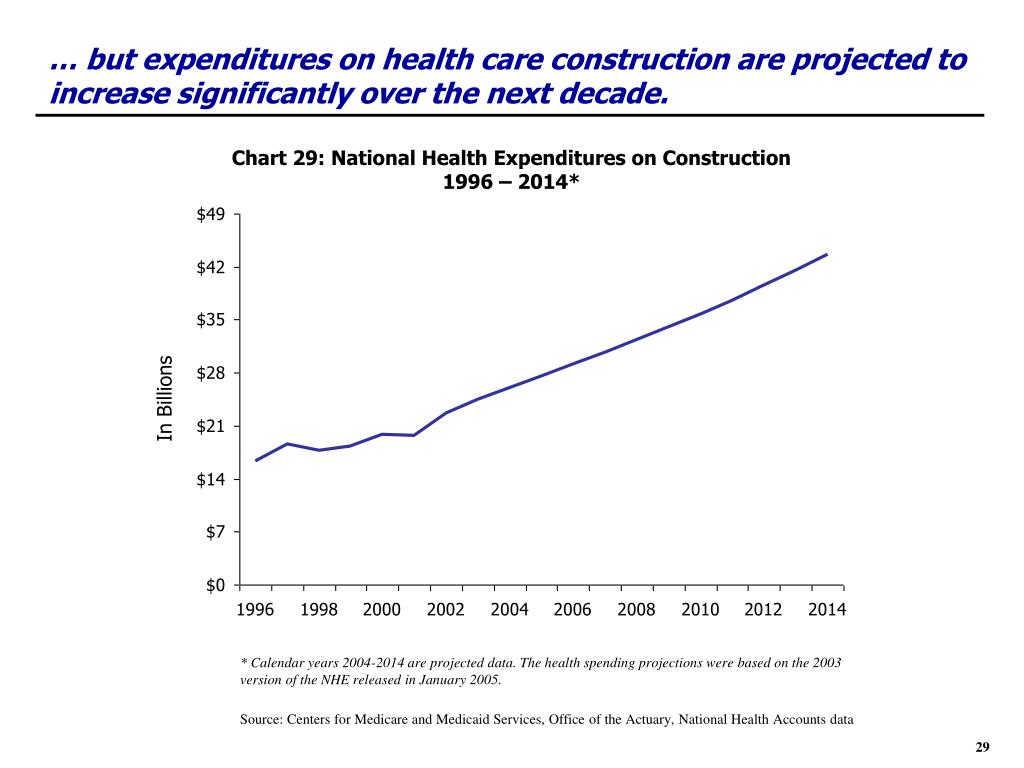

In 2019, 96 percent of health and hospital expenditures were for operational costs, such as public health administration, community health programs, public hospital operations, and regulatory services. The remaining 4 percent went to capital outlays such as hospital construction.

What are health care expenditures?

Total health expenditures represent the amount spent on health care and related activities (such as administration of insurance, health research, and public health), including expenditures from both public and private funds.

What accounts for the majority of healthcare costs?

Medicare and Medicaid together made up 76 percent of home health spending in 2017. reached $96.6 billion in 2017 and increased 4.6 percent, a slower rate of growth compared to the increase of 5.1 percent in 2016.

How Does Medicaid Expansion Affect State Budgets?

That’s because the federal government pays the vast majority of the cost of expansion coverage , while expansion generates offsetting savings and , in many states, raises more revenue from the taxes that some states impose on health plans and providers. 19

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much will healthcare cost in 2028?

The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028. This means healthcare will cost an estimated $6.2 trillion by 2028. Projections indicate that health spending will grow 1.1% faster than GDP each year from 2019 to 2028.

How much did the Affordable Care Act increase in 2019?

1 2 . According to the most recent data available from the CMS, national healthcare expenditure (NHE) grew 4.6% to $3.8 trillion in 2019.

What is a Medicare cost report?

Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data.

How many zipped files are there in CMHC?

For the Hospice, Renal, Health Clinic and CMHC cost reports, there is one zipped file each that contains all data for all the fiscal years. The links to these can be found on their section pages.

Can a hospital cost report be loaded into Excel?

The Hospital and Skilled Nursing Facility cost report data cannot be loaded into Microsoft Excel. The numeric data file for these cost reports is too large for the application.

Is CMS accurate?

These reports are a true and accurate representation of the data on file at CMS. Authenticated information is only accurate as of the point in time of validation and verification. CMS is not responsible for data that is misrepresented, misinterpreted or altered in any way. Derived conclusions and analysis generated from this data are not to be considered attributable to CMS or HCRIS.

How much did CMS make in Medicare?

CMS Made an Estimated $93.6 Million in Incorrect Medicare Electronic Health Record Incentive Payments to Acute-Care Hospitals, or Less Than 1 Percent of $10.8 Billion in Total Incentive Payments A-09-18-03020

What is CMS monitoring activities?

CMS's Monitoring Activities for Ensuring That Medicare Accountable Care Organizations Report Complete and Accurate Data on Quality Measures Were Generally Effective, but There Were Weaknesses That Could Be Improved A-09-18-03033

How much money would Medicare have saved?

Medicare Could Have Saved up to $20 Million Over 5 Years if CMS Oversight Had Been Adequate To Prevent Payments for Medically Unnecessary Cholesterol Blood Tests A-09-19-03027

How many home health agencies have infection control policies?

Six of Eight Home Health Agency Providers Had Infection Control Policies and Procedures That Complied With CMS Requirements and Followed CMS COVID-19 Guidance To Safeguard Medicare Beneficiaries, Caregivers, and Staff During the COVID-19 Pandemic A-01-20-00508

When was Medicare segment pension updated?

United Government Services, LLC, Properly Updated the Medicare Segment Pension Assets as of January 1, 2015 (A-07-18-00538)

Does Medicare and Medicaid improve the wage index?

The Centers for Medicare & Medicaid Services Could Improve Its Wage Index Adjustment for Hospitals in Areas With the Lowest Wages

Did Colorado determine Medicaid eligibility?

Colorado Did Not Correctly Determine Medicaid Eligibility for Some Newly Enrolled Beneficiaries (A-07-16-04228)

HCRIS Data Disclaimer

General Information

- Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. ...

New Cost Report Data Available

- * Due to being replaced by newer forms and an absence of updates, the HOSPICE-1999, SNF-1996 and RNL-1994 data files will no longer be updated.

Frequently Asked Questions

- There is a document available at the bottom of this page, the HCRIS FAQ, which answers some questions about HCRIS, the data files, and the cost reporting process.

Technical Assistance

- Free assistance to academic, government and non-profit researchers interested in using HCRIS data is available at : ResDAC, the Research Data Assistance Center.

Freedom of Information Act

- Individual cost reports may be requested from the Medicare Administrative contractors via the Freedom of Information Act (FOIA). For more information on this process, visit the FOIApage. Organization of data files: For the Hospital Form 2552-1996, Hospital Form 2552-2010 , SNF Form 2540-1996, SNF Form 2540-2010, HHA Form 1728-1994 and HHA Form 1728-2020 cost reports…