What would happen if the ACA was repealed?

How will repealing the ACA affect the economy?

How many people will be uninsured by the ACA repeal?

When did the Affordable Care Act become law?

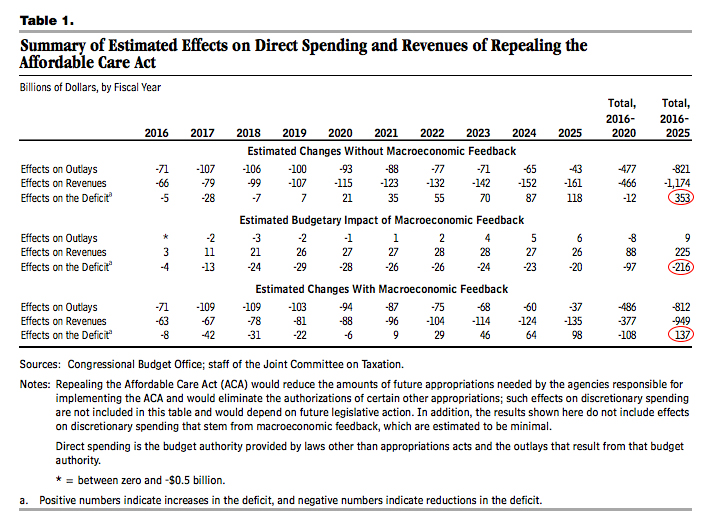

Will the repeal of the Affordable Care Act increase the deficit?

Will the ACA repeal reduce deficits?

See more

About this website

How will the repeal of Obamacare affect Medicare?

Repealing the payroll tax increases would reduce revenues to the Medicare Hospital Insurance Trust Fund, which covers the costs of beneficiaries' hospital visits and is currently projected to become insolvent in 2024. Repealing these provisions also would make preventive care more expensive.

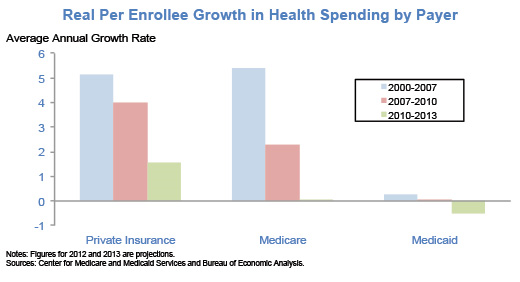

How did the Affordable Care Act affect Medicare?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare.

What does the CBO say about Medicare for All?

“Medicare for All” means higher taxes and disruption in care for the majority of Americans. The CBO analysis is clear that cost savings are achieved ONLY IF provider reimbursement is cut or utilization is reduced.

Does the Affordable Care Act affect Medicare Advantage plans?

The ACA reduced payments to Medicare Advantage plans over six years, which brought these payments closer to the average costs of care under the traditional Medicare program. In 2016, federal payments to plans were 2 percent higher than traditional Medicare spending (including quality-based bonus payments to plans).

What are the benefits of repealing the Affordable Care Act?

The Congressional Budget Office (CBO) has estimated that full repeal of the ACA would increase Medicare spending by $802 billion from 2016 to 2025. 1 Full repeal would increase spending primarily by restoring higher payments to health care providers and Medicare Advantage plans.

What would happen if the Affordable Care Act is repealed 2020?

The health insurance industry would be upended by the elimination of A.C.A. requirements. Insurers in many markets could again deny coverage or charge higher premiums to people with pre-existing medical conditions, and they could charge women higher rates.

What are the pros and cons of Medicare for All?

In theory, universal healthcare leads to a healthier society and workforce. But, the biggest downside is that healthy people pay for the medical care of less healthy people....Pros of Medicare for All:Coverage for all.Doctors get equal pay.Spending leverage for lower rates.Medicare and Medicaid are single-payer systems.

What is the difference between universal health care and single-payer health care?

Answer: "Universal coverage" refers to a health care system where every individual has health coverage. On the other hand, a "single-payer system" is one in which there is one entity—usually the government— responsible for paying health care claims.

What is CBO healthcare?

Community Based Organizations (CBOs) have a key role in improving the healthcare delivery system. CBOs and healthcare providers must partner effectively to advance health equity and drive successful and sustainable system transformation.

How does the Affordable Care Act affect the elderly?

"The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes."Under the ACA, older adults' uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they're now protected from ...

Can I keep Obamacare instead of Medicare?

A: The law allows you to keep your plan if you want, instead of signing up for Medicare, but there are good reasons why you shouldn't. If you bought a Marketplace plan, the chances are very high that you do not have employer-based health care coverage.

What is the difference between Obamacare and Medicare?

What Is the Difference Between Medicare and Obamacare? Medicare is insurance provided by the federal government for people over the age of 65 and the disabled, and Obamacare is a set of laws governing people's access to health insurance.

Repeal of Affordable Care Act Would Devastate Health Care for Millions ...

Contact: APHA Media Relations, 202-777-3913 For GWU: Kathy Fackleman, 202-994-8354; Mina Radman, 202-486-2529 Washington, D.C., May 13, 2020 – The Affordable Care Act has been essential to American public health over the past decade and its loss in the midst of a global pandemic would be a calamity, according to an amicus brief filed in the United States Supreme Court.

Repeal and Replace of Affordable Care: A Complex, but Not an Impossible ...

The Affordable Care Act (ACA), signature legislation of President Obama, was arguably the most consequential and comprehensive health care reform since Medicare was introduced as part of President Lyndon B. Johnson's great society. It has been claimed that many of the law's reforms are now so integr …

What is a CBO?

A. The CBO is an independent, nonpartisan office that analyzes the budgetary impact of proposed legislation. It was created by Congress in 1974 and operates by rules and regulations set by the House and Senate Budget committees.

What is a CBO analyst?

A. The CBO’s analysts are experts in the tax code and consult a wide range of outside experts on various subject matters. The staff is vetted to assure members have no conflicts of interest, and the office limits its employees’ political activity. Experts offering opinions are asked to disclose potential financial interests and political perspectives that might reasonably be seen as influencing their views.

How much did the ACA cost?

In March 2010, CBO and JCT projected that the provisions of the ACA related to health insurance coverage would cost the federal government $759 billion during fiscal years 2014 through 2019 (which was the last year in the 10-year budget window being used at that time). The newest projections indicate that those provisions will cost $710 billion ...

How many people will not get health insurance in 2023?

In our current projections for 2023, the ACA reduces the number of people without health insurance by 25 million, leaving 31 million uninsured (compared with 30 million in our February estimate). Also as a result of those regulations, penalties collected from individuals for being uninsured are now projected to be $7 billion less over the 2014–2023 period than previously estimated.

How many people will be enrolled in Medicaid in 2023?

CBO and JCT now project that the ACA will increase the number of people enrolled in Medicaid and the Children’s Health Insurance Program (CHIP) by more than estimated previously—for example, by 13 million in 2023 rather than 12 million. That increase in projected enrollment stems primarily from our expectation that more potentially newly eligible Medicaid beneficiaries will be residents of states that fully extend Medicaid coverage under the ACA (encompassing people with income up to 138 percent of the federal poverty level). Because of the higher projected enrollment, the costs for Medicaid and CHIP are now expected to be $74 billion greater over the 2014–2023 period than previously estimated.#N#CBO and JCT now project that fewer people will be enrolled in health insurance exchanges than estimated previously—for example, 24 million in 2023 rather than 25 million. That reduction in projected enrollment is the net effect of several factors, the largest of which is the estimated increase in the share of the potentially eligible population that will reside in states that fully extend Medicaid coverage. Because of the lower projected enrollment in the exchanges and some small modeling changes, the costs for exchange subsidies and related spending are now expected to be $137 billion lower over the 2014–2023 period than previously estimated. In addition, we adjusted our estimates of the share of exchange subsidies that reduces recipients’ tax liability, reducing the share recorded as a revenue loss and increasing the share recorded as outlays. As a result of that shift and other factors, our estimate of the revenues lost through exchange subsidies over the 10-year period is now $138 billion lower, and our estimate of outlays for exchange subsidies and related spending is now less than $1 billion higher, than in the February estimate.#N#CBO and JCT also now project that the cost of small business tax credits over the 2014–2023 period will be $10 billion lower than previously estimated, reflecting preliminary tax data showing that small businesses continue to be slow in taking advantage of those credits.

What would happen if the ACA was repealed?

Repealing the ACA would cause federal budget deficits to increase by growing amounts after 2025, whether or not the budgetary effects of macroeconomic feedback are included.

How will repealing the ACA affect the economy?

Repeal of the ACA would raise economic output , mainly by boosting the supply of labor; the resulting increase in GDP is projected to average about 0.7 percent over the 2021–2025 period. Alone, those effects would reduce federal deficits by $216 billion over the 2016–2025 period, CBO and JCT estimate, mostly because of increased federal revenues.

How many people will be uninsured by the ACA repeal?

Repealing the ACA also would affect the number of people with health insurance and their sources of coverage. CBO and JCT estimate that the number of nonelderly people who are uninsured would increase by about 19 million in 2016; by 22 million or 23 million in 2017, 2018, and 2019; and by about 24 million in all subsequent years through 2025, ...

When did the Affordable Care Act become law?

Over the past several years, a number of proposals have been advanced for repealing the Affordable Care Act (ACA), which became law in March 2010. In this report, CBO and the staff of the Joint Committee on Taxation (JCT) analyze the main budgetary and economic consequences that would arise from repealing that law.

Will the repeal of the Affordable Care Act increase the deficit?

CBO and the staff of the Joint Committee on Taxation estimate that, over the next decade, a repeal of the Affordable Care Act would probably increase budget deficits with or without considering the effects of macroeconomic feedback.

Will the ACA repeal reduce deficits?

The estimated effects on deficits of repealing the ACA are so large in the decade after 2025 as to make it unlikely that a repeal would reduce deficits during that period , even after considering the great uncertainties involved.