That decline occurred despite changes in the structure of the Medicare payroll tax, which increased revenues from that source. In 1986, for example, the payroll tax rate for Medicare increased the contribution rates for both employers and employees from 0.6 percent to 1.45 percent of wages.

Full Answer

What caused the Medicare payroll tax to decline?

Efforts to stimulate the economy could include a big payroll tax cut to help stimulate spending. Such a move could hurt the programs that rely on those …

What is the impact of Medicare on the economy?

Dec 11, 2012 · There’s a second reason raising the Medicare tax is a bad idea. At the margin, each new federal tax dollar shrinks the economy by at least 40 percent.

Could Trump's payroll tax cut hurt Medicare and Social Security?

Oct 11, 2005 · In the estimates presented in this report, raising payroll and personal income taxes to finance Medicare over just the next 10 years could reduce total employment by an average of nearly 816,000...

How much of Medicare spending is funded by payroll taxes?

Sep 27, 2018 · Payroll tax collections, which finance both the Social Security and Medicare HI trust funds, increase when taxable wages are rising and more people have jobs. CBO found that TCJA will improve both wages and employment, and CBO now projects $300 billion more in payroll tax collections over 2018-2027 than it did before TCJA became law.

What is Medicare tax Who benefits from this tax?

What is the money received by the government from Medicare taxes used for?

Income taxes paid on Social Security benefits. Interest earned on the trust fund investments.

How much Medicare tax has been deducted from his current pay?

How much money did the US collect in Social Security and Medicare taxes?

Where does my Medicare tax go?

Which tax is the largest source of government revenue?

What age do you stop paying taxes on Social Security?

Why are no federal taxes taken from paycheck 2021?

You Didn't Earn Enough. You Are Exempt from Federal Taxes. You Live and Work in Different States. There's No Income Tax in Your State.Mar 24, 2022

Can I opt out of Medicare tax?

What president took money from the Social Security fund?

| 1. | STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 1964 |

|---|---|

| 7. | STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 1965 |

Why is Social Security running out?

What is the yearly cost to the American taxpayer for Social Security?

Is Medicare a threat to Social Security?

However, Medicare, the other major program intended to ensure the well-being of older Americans, represents an equal if not greater threat to the long-term fiscal health of the federal government.

What is a HI trust fund?

Today, the HI trust fund (aside from small cash balances) consists almost entirely of special public-debt obligations purchased using trust fund surplus dollars. Those special obligations are credited to the trust fund by the federal government and represent a claim on future tax revenues.

The Blahous Brouhaha

The Centers for Medicare and Medicaid Services (CMS) forecasts that under current law, America’s total healthcare spending (by individuals, businesses, and governments) in 2022 will be around $4.6 trillion.

Public Finance 101

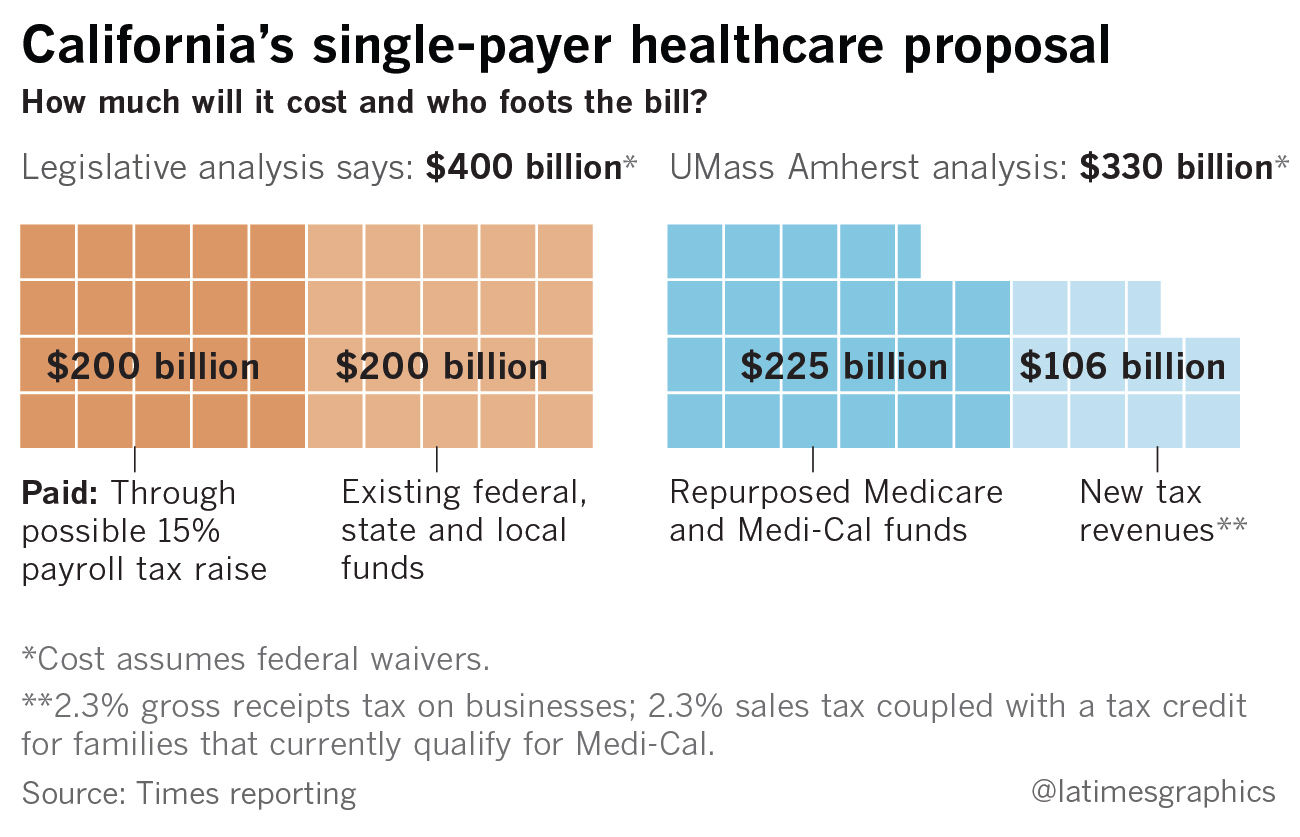

For simplicity, let’s pretend M4A would leave overall healthcare spending unchanged, merely shifting all the spending by individuals, businesses, and states to federal taxpayers. In this scenario, there’s no $2.1 trillion in savings (as Senator Sanders anticipates), but no spending increase (as Blahous and others) anticipate.

The Agony of Tradeoffs

The core argument made by M4A supporters—that trillions in new federal healthcare spending would merely offset the trillions currently spent from other sources—sounds appealing. As Marc Goldwein of the Committee for a Responsible Federal Budget noted in a series of tweets, however, that argument ignores some real costs.

Afterthought: A Better Path

Antipathy over M4A does not mean satisfaction with the status quo in US healthcare, however.

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much of Medicare is funded by the government?

They financed 15 percent of Medicare’s overall costs in 2019, about the same share as in 1970. The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

When was Medicare signed into law?

Budget Basics: Medicare. Jul 29, 2020. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve ...

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

When was Medicare first introduced?

The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How many people are on Medicare in 2019?

The number of people enrolled in Medicare has tripled since 1970, climbing from 20 million in 1970 to 61 million in 2019, and it is projected to reach about 88 million in 30 years.

Is Medicare spending going up?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis. According to CBO’s most recent long-term projections, net Medicare spending will grow from 3.0 percent of GDP in 2019 to 6.0 percent in 2049.

How much did Medicare pay in 2018?

In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 50 percent to 41 percent, spending on Part B benefits (mainly physician services and hospital outpatient services) increased from 39 percent to 46 percent, and spending on Part D prescription drug benefits increased from 11 percent to 13 percent.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Does Medicare Advantage cover Part A?

Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium.

Is the payroll tax cut a threat to Social Security?

President Donald Trump’s proposed payroll tax cut is a threat to Social Security no matter how he casts it. President Donald Trump speaks at a news conference in the James Brady Press Briefing Room at the White House, Wednesday, Aug. 12, 2020, in Washington. (AP Photo/Andrew Harnik)

When will payroll tax be eliminated?

The president added that the tax would be eliminated after the “beginning of the new year,” while the deferral only applies to the closing months of 2020.

What is the general fund?

Trump campaign officials stressed that the general fund consists of assets and liabilities that finance government operations and could do so for Social Security . The general fund is nicknamed “America's Checkbook” on the Treasury Department's website.