Are capital gains considered income for Medicare premiums?

Unfortunately, the answer is yes, as they, amongst many other forms of income do, affect IRMAA. In fact, the definition of income, when it comes to IRMAA is extremely broad. The Centers for Medicare/Medicaid Services (CMS) defines income as: “adjusted gross income plus any tax-exempt interest”.

Does Medicare apply to capital gains?

The Medicare surtax applies to the following gross investment income types: Interest. Dividends. Capital gains.Dec 14, 2020

What type of income affects Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Are capital gains taxed for Social Security and Medicare?

Regardless of whether or not you receive Social Security benefits, the IRS levies taxes on capital gains. If your capital gains are short-term – meaning that you held the asset for less than a year before you sold it – they're taxed at ordinary income tax rates.

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

Will capital gains change in 2021?

Takeaways: In 2020, the more income you make, the higher capital gains tax rate you pay as well. While the way capital gains taxes are treated may change in 2021, those who had previously been in either the 0% or 15% categories will likely see no change.

Does inheritance affect Medicare premiums?

If you're set to inherit money from aging parents or anyone else, you may be wondering if your inheritance will affect your Medicare benefits. The short answer is no, but receiving a financial windfall could affect what you pay for coverage.Feb 8, 2022

What is the Magi for Medicare for 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.Nov 10, 2020

What is modified adjusted gross income for Medicare?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

Is capital gains added to your total income and puts you in higher tax bracket?

And now, the good news: long-term capital gains are taxed separately from your ordinary income, and your ordinary income is taxed FIRST. In other words, long-term capital gains and dividends which are taxed at the lower rates WILL NOT push your ordinary income into a higher tax bracket.Jul 15, 2020

What is the 2022 capital gains tax rate?

2022 Capital Gains Tax Rate ThresholdsCapital Gains Tax RateTaxable Income (Single)Taxable Income (Head of Household)0%Up to $41,675Up to $55,80015%$41,675 to $459,750$55,800 to $488,50020%Over $459,750Over $488,500

What is the capital gains tax rate for 2021?

2021 Long-Term Capital Gains Tax RatesTax Rate0%15%SingleUp to $40,400$40,401 to $445,850Head of householdUp to $54,100$54,101 to $473,750Married filing jointlyUp to $80,800$80,801 to $501,600Married filing separatelyUp to $40,400$40,401 to $250,8001 more row•Feb 17, 2022

Selling your home could lead to higher Medicare premiums if your taxable income sees a boost

Although your Medicare benefits shouldn't change when you sell your home, your monthly premiums may. It depends on whether the sale of your home affects your taxable income.

What Is the High-Earner Threshold?

Medicare considers you a high earner if your modified adjusted gross income (MAGI) exceeds $91,000 per year if you file your taxes as a single, or $182,000 for married couples filing jointly.

How Does Selling Your Home Affect Medicare Premiums?

The capital gains tax may apply when you make a profit on an investment, which includes the sale of real estate. Luckily, the IRS does allow you to exclude a portion of your capital gains on real estate.

When Can't You Take Advantage of Capital Gains Exclusions?

It wouldn't be the U.S. tax code if there weren't limits to the real estate exclusion. If any of the following apply, you will have to pay tax on the whole gain, meaning it will count toward your MAGI:

Appealing the Income-Related Monthly Adjustment Amount

Although Medicare premiums are determined by the Centers for Medicare & Medicaid Services (CMS), the " Initial IRMAA Determination Notice " comes from the Social Security Administration. This notice describes how SSA determined you owe IRMAA and provides information on filing an appeal.

How Long Does IRMAA Apply?

The good news is that an IRMAA determination doesn't mean you owe the high-earner surcharge forever. If your adjusted gross income dropped below the IRMAA threshold, you'll pay the standard Medicare premiums next year.

If I Sell My House, Will I Lose My Medicare Benefits?

Selling your home will not cause you to lose your Medicare benefits. However, if you have a Medicare plan and move to a new address, you may need to change your plan.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

2 Ripple Effects a Large Capital Gain Can Trigger in Your Financial Plan

For investors who make a savvy move and wind up with a sizeable capital gain, there can be few things that are more satisfying. Perhaps the only downside is the tax bill you may face from the gain.

Net Investment Income Tax

One possible tax you may trigger, in addition to the capital gains tax, is the Net Investment Income Tax (NIIT). The NIIT has been in effect since 2013 and is a flat, 3.8% surtax that is assessed if you exceed certain modified adjust gross income (MAGI) thresholds ($200,000 if filing single and $250,000 if filing jointly).

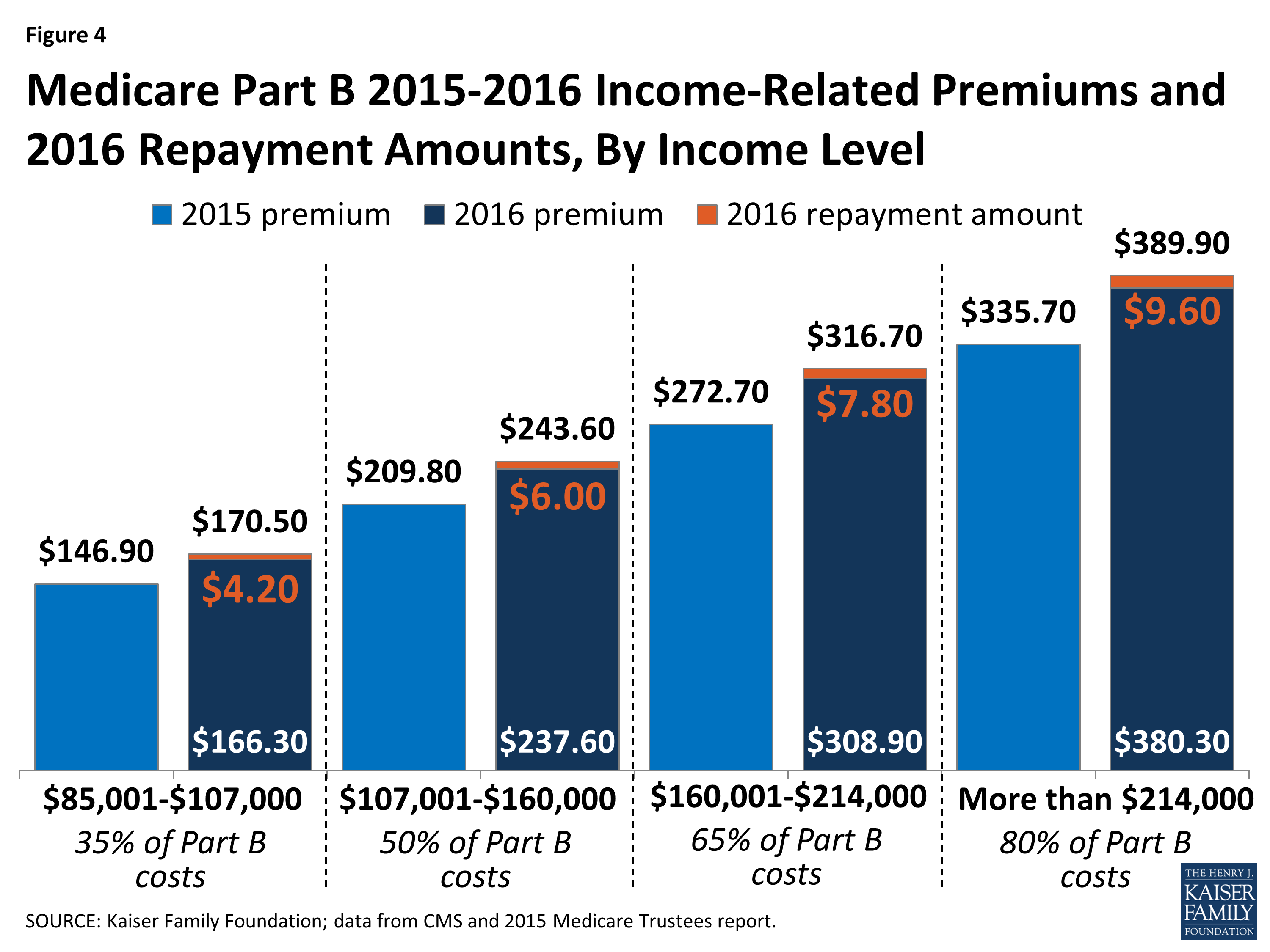

Medicare Premiums

The premiums you pay for Medicare Parts B and D are affected by your MAGI, and a large increase in your MAGI can lead to a large increase in your premiums.

Peg Webb

Peg was attracted to the financial services industry early in her career. She feels fortunate to be able to use her 30 years of in-depth knowledge working alongside Preston, the Roundtable™ and their staff to prepare clients for retirement.

Can you get penalized for claiming a tax deduction in 2016?

While you could face an IRS penalty for improperly claiming the tax benefits in the first place, my experience is that if you take care of this within a tax year and have no improper tax deductions on your 2016 tax return, you will escape a penalty.

Does Medicare have a surcharge?

Phil Moeller: Regardless of changes in your future taxable income, nothing would happen to your Medicare benefit. However, it could be another matter when it comes to how much you pay for that benefit. People who must pay Medicare’s premiums for Part B and Part D — and nearly everyone on Medicare does — face high-income surcharges ...

How much is taxable after a conversion?

After a conversion of $40,000, $34,000 of their Social Security benefit is taxable, resulting in a taxable income of a little over $71,000, or approximately $8,000 of federal tax.

When creating a long-term tax plan, should the focus be on minimizing one year's tax liability?

When creating a long-term tax plan, the focus should not be on minimizing one year’s tax liability, but rather on minimizing a family’s lifetime liability. This often takes the form of evaluating a person’s current marginal tax rate and comparing it to their expected future marginal rate.

What should the focus of tax planning be on?

The focus of tax planning should be on minimizing a family’s lifetime liability. Retirement tax planning is tricky when it involves Social Security, Medicare and RMDs. Capital gains taxes can be affected by Roth conversions. When creating a long-term tax plan, the focus should not be on minimizing one year’s tax liability, ...

Is realizing income a simple arithmetic equation?

But realizing income isn’t always a simple arithmetic equation of adding just enough to stay in a lower tax bracket. Without careful thought, added income could end up being effectively taxed at a higher rate due to how the added income affects other aspects of one’s taxes.

Does Medicare Part B go up?

The premium for the Medicare Part B program goes up at different income levels. Even adding $1 of income around these thresholds can move a person from one premium level to another. It is important to be aware of these thresholds when developing a tax plan.

What line does CMS look at for Medicare 2021?

For those on Medicare in 2021, CMS may look at your past 3 years’ tax returns. If CMS does look at your tax return from 2020 it will look specifically at lines 2b and 11 of the IRS form 1040. Keep in mind that every 1 to 3 years CMS will make a determination of IRMAA.

Does capital gains count towards IRMAA?

For individuals the first $250,000 capital gain and for couples the first $500,000 capital gain does not count towards IRMAA. All gains above those amounts do, though.

Does income affect IRMAA?

Unfortunately, the answer is yes, as they, amongst many other forms of income do, affect IRMAA. In fact, the definition of income, when it comes to IRMAA is extremely broad.

Does capital gain affect IRMAA?

IRMAA, which is short for the Income Related Monthly Adjustment Amount of Medicare is a surcharge on Part B and D premiums for those who earn too much income in a year and the question retirees often ask is do Capital Gains Affect IRMAA? Unfortunately, the answer is yes, as they, amongst many other forms of income do, affect IRMAA.

What is Medicare Part B based on?

Your Medicare Part B premium amount (and the Part D premium) is based on the Modified Adjusted Gross Income ( MAGI) on your tax return from two years ago — the most recent federal tax return the IRS provides to Social Security.

What are the life changing events that can be appealed to Social Security?

You can appeal to Social Security for any of the following life-changing events: the death of a spouse. marriage, divorce, or annulment. retirement, reduced work income, or loss of job for one or both spouses. loss of income-producing property due to event beyond your control. loss or decrease in a pension.

Can you appeal Medicare premium?

Besides the shock of Part B premiums to Medicare newcomers, the jump in your Part B premium after a one-time financial transaction can also cause distress. You can appeal your increased Medicare premium if you experienced a life-changing event that caused your income to decrease.

How much is the capital gains surcharge for 2009?

According to circumstances and income levels, the surcharge adds between $38.50 and $211.90 a month to the regular Part B premium in 2009.

What happens when Social Security changes your records?

When Social Security has revised its records, you’ll receive a refund of any money due to you.

Is Part B premium based on 2008?

That’s because the amount of your 2009 Part B premium is based on the tax return you filed in 2008 reporting your income for 2007. (In cases where a 2008 tax return is unavailable, it would be based on your 2007 return, which reflects your income in 2006.)

Will Social Security pay Part B premium in 2009?

If Social Security accepts that your 2008 income has been reduced as a result of one of those events, you will not be required to pay the higher Part B premium in 2009, even if this was based on a windfall income you received in 2007. In other words, reduced income due to a life-changing event trumps the sale of a house ...