What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Are there advantages to a Medicare Advantage plan?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Do Medicare Advantage plans pay the 20 %?

With Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for common health services like office visits or outpatient surgery. Most Medicare Advantage plans use copays instead of coinsurance for these services. That means you pay a fixed cost.Oct 1, 2020

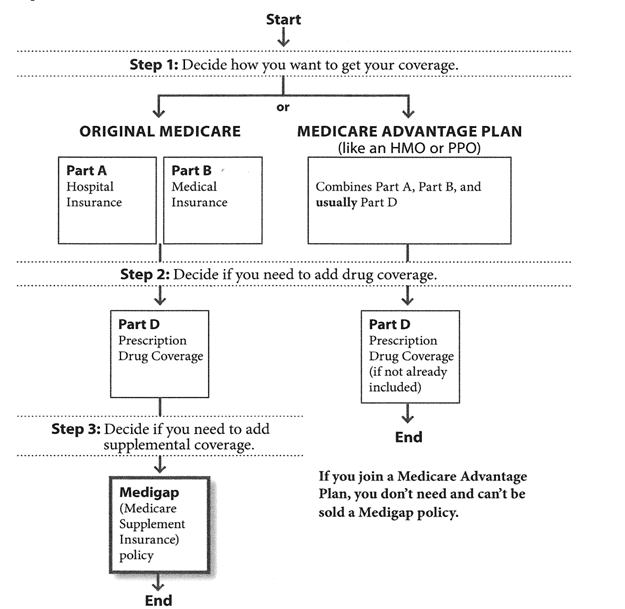

What is the difference between Medicare and Medicare Advantage plans?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the maximum out of pocket for Medicare Advantage plans?

Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.Jun 21, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

How Much Does Medicare Advantage Cost per month?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

Why are Medicare Advantage plans bad?

There are 7 common reasons that some Medicare beneficiaries, and many healthcare professionals, feel that Medicare Advantage plans are bad. They in...

Is it better to have Medicare Advantage or Original Medicare and Medigap?

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it cost...

What are the advantages and disadvantages of Medicare Advantage plans?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider net...

Is Medicare Advantage a Good Deal?

Medicare Advantage is a great deal if you are not the one paying the copays. Many people with Medicare Advantage plans, including federal, railroad...

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is Medicare Advantage Plan?

What are Medicare Advantage Plans? Medicare.gov, the government Medicare website explains that Medicare Advantage Plans are “sometimes called “Part C” or “MA Plans,” are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare.

How much does Medicare cost?

How much do Medicare Advantage plans cost? 1 Premiums: The first cost people often consider is the monthly premium. Medicare Advantage plan premiums start at $0 and can go up to around $100 a month, depending on plan benefits and location. The low or no premium is one of the most substantial benefits of Medicare Advantage plans. Remember that you will most likely have to pay your Part B premium, so figure that into your costs. 2 Copayments and Coinsurance: With Medicare Advantage plans, you will be charged a copayment or coinsurance for any service you use. These amounts differ between plans, and some plans even have a $0 copay to see your primary care doctor or a specialist. 3 Out-of-Pocket Maximum: The maximum amount you will pay out of pocket in a given year. Some costs do not count towards the out of pocket maximum, including premiums, Part D costs, services not covered by the plan, and some charges from out-of-network providers. Most people do not hit their out of pocket maximum. 4 Deductibles: Some plans have a deductible, which is what you pay for medical and/or prescription drugs before your insurance begins to pay for coverage. Many plans do not have any deductibles.

How to minimize drug costs?

To minimize your drug costs, look for a plan covering the medications you take in more favorable tiers. Additionally, the pharmacy where you purchase your medication impacts how much you will pay. Insurance companies divide pharmacies into “preferred” and “standard.”.

When does Medicare coverage end?

This coverage begins three months before the month you turn 65 and ends three months after that month. If you don’t enroll for Medicare Drug Coverage during your initial eligibility period, you may be subject to an enrollment penalty.

Does Medicare Advantage include Part D?

Some Medicare Advantage plans, known as Medicare Savings or Cost Plans, do not include Part D coverage. For these, you must also purchase a stand-alone Part D prescription drug plan (PDP) from a private insurance company. It’s important to enroll for your Medicare Drug Coverage during your initial enrollment period.

Do you have to pay Part B premium for Medicare Advantage?

The low or no premium is one of the most substantial benefits of Medicare Advantage plans. Remember that you will most likely have to pay your Part B premium, so figure that into your costs. Copayments and Coinsurance: With Medicare Advantage plans, you will be charged a copayment or coinsurance for any service you use.

Can you use an in-network provider with Medicare Advantage?

Therefore it’s important to understand that Medicare Advantage has two main plan types which differ in how you can access doctors: In a Medicare Advantage HMO, you can only use in-network providers. An in-network provider is a doctor who is contracted by an insurance company, usually found within a specified list.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medi care Part A and Medicare Part B).... work. In this MedicareWire article, we’ll explain what you need to know to stay out of trouble.

How many types of Medicare Advantage Plans are there?

Currently, there are seven types of Medicare Advantage plans: HMO — HMOs deliver care through a network of doctors, hospitals, and other medical professionals that you must use to be covered for your care. PPO — PPO plans have provider networks, like HMOs.

What is a deductible for HMO?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share. ... . Care you receive in-network through the HMO has a different deductible than the care you get out-of-network through the POS.

What is cost plan?

COST — Cost Plans are a type of Medicare health plan available in certain, limited areas of the country. Usually rural areas. Unlike other plans, you can join even if you only have Part B. If you have Part A and Part B and go to a non-network provider, Original Medicare covers the services.

What do you need to use for Medicare supplement?

It’s worth mentioning that when you have a Medicare supplement, you need to use healthcare providers that are approved by Medicare. This includes hospitals, nursing facilities, home health agencies, hospice care, and doctors. Most primary care doctors accept Medicare patients.

What is the CMS rating system?

The Centers for Medicare & Medicaid. Medicaid is a public health insurance program that provides health care coverage to low-income families and individuals in the United States.... Services (CMS) grades each plan annually with a 5-star rating system making it easier to compare Medicare Advantage plans in your area so you can find ...

What is MSA insurance?

MSA — Medicare Advantage MSA plans combine a high-deductible insurance plan with a medical savings account that you can use to pay your health care costs. SNP — Special Needs Plans are plans designed to provide health insurance to people with special health and/or financial needs.

What are the different Medicare Parts?

Medicare Parts A, B, C, and D all give you different kinds of benefits and can combine in different ways. To top it off, some plans have multiple titles. For instance, Medicare Parts A and B are collectively known as Original Medicare; Medicare Part C is commonly called Medicare Advantage.

What are the benefits of hospital visits?

The benefits associated with hospital visits could include the following. Surgical procedures. Anesthesia. Medications administered in the hospital. Inpatient mental health. Like Medicare Part B, Medicare Advantage plans work to cover major medical expenses. These could include the following important services and devices.

Does Medicare Advantage cover supplementary expenses?

Ambulance services to certain facilities. Wheelchairs and other “durable” medical equipment. Outpatient mental health. Clinical research. Medicare Advantage can also cover supplementary expenses.

Is Medicare Advantage the same as Medicare Part B?

Medicare Advantage plans are required to offer the same benefits as Medicare Part A and Medicare Part B plans.⃰ But whereas Part A and Part B offer a fixed set of benefits based on government regulations, Medicare Advantage plans can offer any additional benefits the private insurance company chooses.

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is Medicare Advantage?

Medicare Advantage plans are managed care, which means you might need prior authorization for a medication, you may need a referral to see a specialist, and you may have to try a cheaper treatment plan before your plan will approve a more expensive one. That’s how Medicare Advantage plans manage their costs.

Is Medicare Advantage a low premium?

Most Medicare Advantage plans are paid enough by the government to offer very low – sometimes even $0 premium plans – in addition to extra benefits that go above and beyond what Medicare regularly covers. For example, you might get some dental, vision, and fitness benefits.

How long do you have to be away from home for health insurance?

It’s pretty common for your health plan to require that you be away from home for a few weeks or months before the benefit kicks in.

Do you pay for travel benefits out of state?

With a travel benefit, you’ll pay almost the same for care out-of-state as you would close to home. The benefits and costs are different for every plan, so you’ll need to do your homework to figure out what’s best for you.

Does Medicare Advantage include travel?

Not all Medicare Advantage plans include a travel benefit. So if you’re like me and plan on traveling south every winter, you should look for a plan that offers one. Some are included in the price of your plan. Others are an option that you pay for only when you need it.

Does Medicare cover snowbirds?

Yes, there are special Medicare Advantage plans just for snowbirds! Make sure you’re covered before you take off. Since I live in the Midwest, where “polar vortex” is actually a thing, I’ve always dreamed of spending the winters somewhere warm. I know a lot of Medicare members are in the same boat.

Can you get emergency coverage with Medicare Advantage?

If you’re spending part of the year away from home, here are a few things to keep in mind: With the most basic Medicare Advantage plans, you get emergency coverage when traveling outside of your network, if you’re traveling within the United States.