How to Appeal a Higher Medicare Part B Premium

- Modified Adjusted Gross Income. Your MAGI amount is made up of your total adjusted gross income plus any tax-exempt interest income.

- Part D Income Adjustments. IRMAA also affects your Part D premium. ...

- Plan the timing of your Medicare enrollment. Social Security automatically adjusts your premium at the start of each new year. ...

- Plans that Save You Money. ...

Full Answer

How to appeal your high income Medicare premiums?

Apr 11, 2019 · How Do You Appeal Your Medicare Premium? To appeal your Medicare Part B or Part D premiums, complete the following form: Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event . Choose the appropriate life-changing event and your new adjusted gross income and the applicable tax year.

How to appeal a higher Medicare Part B monthly premium?

Dec 19, 2019 · Complete a request to Social Security for “reconsideration”. Contact the SSA at 800-772-1213 to learn how to file this request. If the reconsideration is successful, then the Medicare Part B enrollee’s Part B premium amount will be corrected.

What is Medicare Part B premium appeal?

Appeals in a Medicare health plan. If you have a Medicare health plan, start the appeal process through your plan. Follow the directions in the plan's initial denial notice and plan materials. You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination. If you miss the deadline, you must provide a reason for …

How are Medicare premium increases calculated?

You must submit any new evidence within 10 days of filing your OMHA level appeal. Contact OMHA for further instructions on submitting. You can ask OMHA for an extension if you are unable to submit new evidence within 10 days. If your OMHA level appeal is successful, your premium amount will be corrected. If your appeal is denied, you can choose to appeal to the …

Can Medicare premiums be appealed?

Appealing Your Part B Premium As a beneficiary, you have the right to appeal if you believe that an Income Related Monthly Adjustment Amount (IRMAA) is incorrect for one of the qualifying reasons.

How do I adjust Medicare premiums after retirement?

To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person.Mar 30, 2022

How do I challenge Medicare Irmaa?

To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website. Even if you haven't experienced a life-changing event, you can still appeal an IRMAA. Request an appeal in writing by completing a request for reconsideration form.

At what income level does Medicare premium increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.Nov 16, 2021

What is modified AGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the income related monthly adjustment amount?

An income-related monthly adjustment amount, or IRMAA, is an extra Medicare cost added to your Part B and Part D premiums. The Social Security Administration determines whether you're required to pay an IRMAA based on the modified adjusted gross income reported on your IRS tax return from two years prior.

What if I overpaid my Medicare premium?

When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

Is Irmaa based on adjusted gross income?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it's specific to Medicare.

Does Social Security income count towards Irmaa?

The tax-exempt Social Security isn't included in the MAGI calculation for the IRMAA.Dec 18, 2018

Does Social Security count as income for Medicare premiums?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Modified Adjusted Gross Income

Your MAGI amount is made up of your total adjusted gross income plus any tax-exempt interest income. These are line items 37 and 8b, respectively,...

Qualifying Reasons For A Medicare Part B Premium Appeal

There are a number of reasons that you might qualify for a lower premium. Social Security calls these Life-Changing Events.The most common reason i...

How to File Your Medicare Reconsideration Request

If you wish to appeal your IRMAA, you should visit the Social Security website. Find the form called Request for Reconsideration. This form gives y...

Part D Income Adjustments

IRMAA also affects your Part D premium. Unlike Medicare Part B, your Part D premium varies based on which Part D drug plan you have chosen to enrol...

Plan The Timing of Your Medicare Enrollment

Social Security automatically adjusts your premium at the start of each new year. You will receive a letter December or January notifying you of yo...

Plans That Save You Money

Plan G is a very popular plan among our higher income clients. In return for covering a small, once annual Part B deductible (currently $166 in 201...

How to request reconsideration of Social Security?

A request for reconsideration can be done orally by calling the SSA 1-800 number (800.772.1213) as well as by writing to SSA .

What are the life changing events?

There are 7 qualifying life-changing events: 1 Death of spouse 2 Marriage 3 Divorce or annulment 4 Work reduction 5 Work stoppage 6 Loss of income from income producing property 7 Loss or reduction of certain kinds of pension income

What is a work stoppage?

Work stoppage. Loss of income from income producing property. Loss or reduction of certain kinds of pension income. Events that result in the loss of dividend income or affect a beneficiary's expenses, but do not affect the beneficiary's modified adjusted gross income are not considered qualifying life-changing events.

How to appeal Medicare Part B?

To appeal your Medicare Part B or Part D premiums, complete the following form: . Choose the appropriate life-changing event and your new adjusted gross income and the applicable tax year. It also includes a section where you can estimate your new adjusted gross income.

How to contact Medicare Solutions?

The licensed agents at Medicare Solutions can help you compare plan options and answer your Medicare questions. Call us toll-free at 855-350-8101 to get started. Share on facebook. Facebook.

What to do if you are retiring soon?

If you plan to retire soon, talk to your financial adviser about how distribution of retirement funds might affect monthly Medicare premiums. If you’re still working when you sign up for Medicare, don’t forget to talk to your company’s health plan representative to determine coverage options and limitation.

How much is Medicare Part B premium?

If you do not receive SSI yet, Social Security sends you a bill for the extra amount. Medicare Part B has a base premium of $135.50 in 2019 (the amount changes most years).

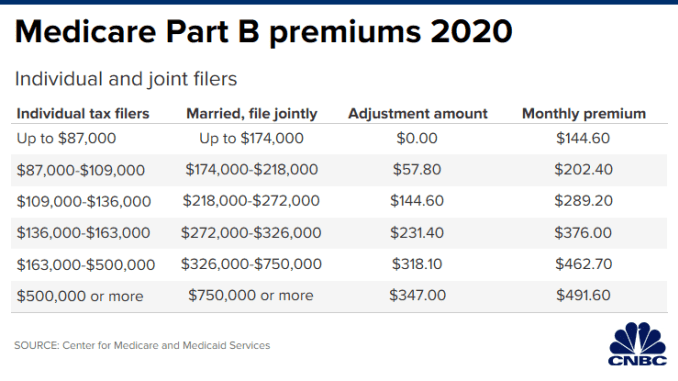

What is the difference between option 1 and option 2?

Option 2 is married filing jointly and option 3 is married filing separately. Once you know your filing status and your MAGI, find your premium on the following table.

Can you appeal Social Security?

While Social Security considers your appeal, you must continue paying the additional premiums. If your appeal is approved, the correction follows automatically. If, however, Social Security denies the appeal, they send instructions on appealing that decision.

Is Medicare a federal program?

Although Medicare is a federally-funded program, beneficiaries share some of the costs. This includes monthly premiums for Medicare Part B (medical insurance) and Part D (prescription drug plans). Although most enrollees pay the standard amount for Part B (Part D varies according to the plan and provider you choose), ...

How much will Medicare Part B cost in 2021?

In 2021, Medicare Part B costs $148.50 for new enrollees. This is the rate that most people pay. Those in the highest income bracket can pay more considerably more than that. Social Security determines what you will pay based on your modified adjusted gross income (MAGI) as reported to the IRS. If you owe a higher premium, Social Security calls ...

How much is IRMAA 2021?

Right now in 2021, Part D premiums range from around $7 to over $180/month, depending on where you live. (For more on finding the right Part D plan, visit our pages about Part D .)

What is MAGI on SSA-44?

Your MAGI amount is made up of your total adjusted gross income plus any tax-exempt interest income. (The Form SSA-44 has instructions which explain which line numbers from your IRS Tax return that you will use to calculate this number).

How much is Part B deductible in 2021?

In return for covering a small, once annual Part B deductible ($203 in 2021) you can sometimes find premiums as much as $250 lower than a Plan F. That keeps money in your pocket. Medigap plans L, M, N and High Deductible F are also great solutions for high income individuals.

How much is Medicare Part B premium for 2020?

For 2020, the Medicare Part B monthly premiums are shown in the following table: Note the following: (1) the standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019; and. (2) Medicare Part B enrollees whose modified adjusted income above a certain level must pay an income-related ...

When will Medicare Part B be released?

For 2020, in late November or early December 2019 Medicare Part B enrollees received notification about their 2020 Medicare Part B monthly premiums, as well as whether they will have to pay an IRMAA.

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, durable medical equipment and certain other medical and home health care services not covered by Medicare Part A. By being enrolled in a Federal Employees Health Benefits (FEHB) program health insurance plan and in Medicare Parts A and B, a federal annuitant will minimize, ...

Does Medicare cover inpatient hospital expenses?

Medicare Part A covers inpatient hospital expenses, skilled nursing facility inpatient expenses, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium because they have at least 40 quarters of Medicare hospital insurance-covered employment. This means these individuals have been paying ...

What is an appeal in Medicare?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: • A request for a health care service, supply, item, or drug you think Medicare should cover. • A request for payment of a health care service, supply, item, ...

What to do if you decide to appeal a health insurance plan?

If you decide to appeal, ask your doctor, health care provider, or supplier for any information that may help your case. See your plan materials, or contact your plan for details about your appeal rights.

How long does it take to get a decision from Medicare?

Any other information that may help your case. You’ll generally get a decision from the Medicare Administrative Contractor within 60 days after they get your request. If Medicare will cover the item (s) or service (s), it will be listed on your next MSN. Learn more about appeals in Original Medicare.

How long does it take to appeal a Medicare denial?

You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination. If you miss the deadline, you must provide ...

How many levels of appeals are there?

The appeals process has 5 levels. If you disagree with the decision made at any level of the process, you can generally go to the next level. At each level, you'll get instructions in the decision letter on how to move to the next level of appeal.

How much will Medicare premiums go up in 2021?

Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $148.50 a month in 2021, start with incomes above $88,000 for an individual and $176,000 for a couple who file taxes jointly. Updated May 13, 2021.

What is Social Security tax?

Social Security uses tax information from the year before last — typically the most recent data it has from the IRS — to determine if you are a “higher-income beneficiary.”. If so, you will be charged more than the “standard,” or base, premium for Medicare Part B (health insurance) and, if you have it, Part D (prescription drug coverage).